- Home

- »

- Animal Health

- »

-

Animal Ultrasound Market Size, Share & Growth Report 2030GVR Report cover

![Animal Ultrasound Market Size, Share & Trends Report]()

Animal Ultrasound Market Size, Share & Trends Analysis Report By Animal (Small Animals, Large Animals), By Solution (Equipment, PACS), By Type, By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-545-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Animal Ultrasound Market Size & Trends

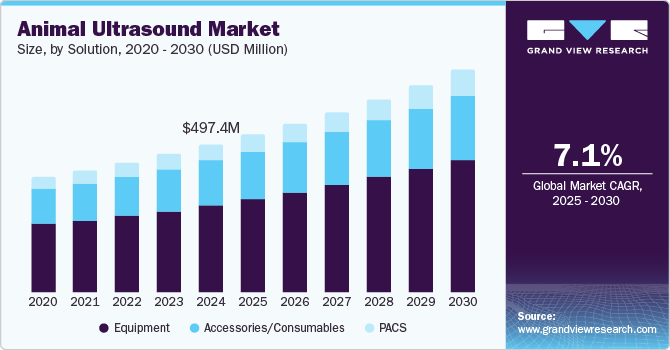

The global animal ultrasound market size was valued at USD 497.44 million in 2024 and is projected to grow at a CAGR of 7.07% from 2025 to 2030. Some of the key factors driving the market growth are growing research initiatives & breakthroughs, expanding applications of ultrasound within the veterinary sector, improving regulatory scenarios, and increasing crucial collaborations in the industry.

The market is experiencing various research initiatives as well as breakthroughs in this diagnostics sector. For instance, a July 2024 study published in the Annual Reviews Journal discussed different types of biomaterials and their applications in veterinary ultrasound. The development of biomaterials is crucial for the advancement of ultrasound technology in veterinary medicine as they can be utilized to create targeted and biocompatible ultrasound imaging agents, enhancing the quality of the images acquired. Additionally, these materials can aid in research studies in the development of tissue-engineered models of animals to assist in more accurate and humane testing of ultrasound technologies prior to clinical use. Furthermore, the integration of these biomaterials with ultrasound technology can lead to the creation of more advanced and minimally invasive ultrasound devices, improving the diagnosis and treatment of animal diseases.

Moreover, technologies like Point-of-Care Ultrasound (POCUS) have revolutionized veterinary medicine by providing a rapid and non-invasive diagnostic tool for various applications. POCUS is utilized to detect free abdominal fluid, visualize abdominal organs, and guide invasive procedures. It is also used in thoracic, musculoskeletal, neurological, reproductive, and pediatric applications, as well as vascular examinations. POCUS provides improved diagnostic accuracy and treatment outcomes in veterinary medicine, and its applications continue to expand with advancements in technology.

Furthermore, a Frontiers in Veterinary Science study published in June 2024 dove deep into researching the application of Artificial Intelligence (AI) in veterinary ultrasound. This study was designed to develop artificial intelligence (AI) models for automating point-of-care ultrasound (POCUS) predictions for military working dogs (MWDs). 3 AI architectures, namely, MobileNetV2, DarkNet-19, and ShrapML were trained on canine image datasets to identify injuries at each POCUS scan point. The study inferred that all models achieved high accuracy, with ShrapML demonstrating the strongest performance and prediction rate. The models were able to detect intra-abdominal and intrathoracic injuries with accuracy rates exceeding 80%. However, the study highlighted the need for more training data for these AI models to achieve the highest possible accuracy and rule out false data interpretation. Further research is necessary to expand the training datasets and enable real-time integration with ultrasound devices. The ultimate goal is to lower the skill threshold for medical imaging-based triage, making it more accessible for emergency veterinary medicine.

Such research initiatives and breakthroughs in the animal ultrasound market are driving the market forward. These advancements are helping improve the quality of ultrasound images, enabling more accurate and humane testing and creating more advanced and minimally invasive ultrasound devices. The use of AI models assists in enhancing diagnostic accuracy and treatment outcomes in the veterinary sector. As the technology continues to evolve, it is expected to lower the skill threshold for medical imaging-based triage, making it more accessible for emergency veterinary medicine. This, in turn, is driving the growth of the animal ultrasound market. Overall, these initiatives are revolutionizing veterinary medicine and improving animal healthcare.

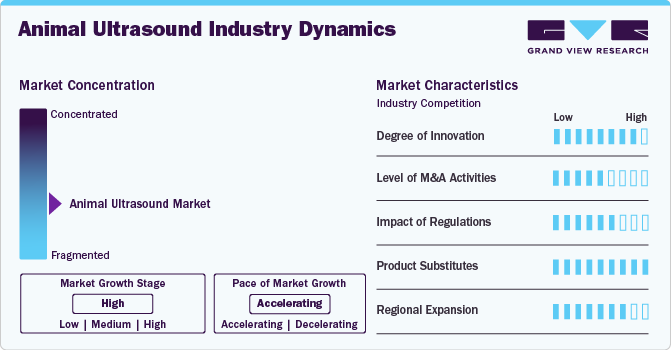

Market Concentration & Characteristics

The degree of innovation in this market is high owing to growing research studies and breakthroughs, as well as the launch of innovative products throughout the veterinary sector. For example, in May 2024, Esaote SpA launched the MyLab™ FOX veterinary ultrasound system with a cleanable interface, precision probes, adaptable design, and advanced features like AI-powered Augmented Insight™. It is designed to enhance productivity, diagnostic efficiency, and connectivity and is supported by comprehensive training and education programs for veterinarians.

The industry is experiencing a moderate level of M&A activities. Manufacturers in this industry are acquiring other market players with an aim to enhance their existing technology expertise and expand into the market. For instance, in May 2023, Probo Medical, one of the leading veterinary equipment manufacturers, acquired National Ultrasound Inc.

The impact of regulations is anticipated to grow over the forecast period owing to veterinary organizations increasingly taking steps toward providing a structure to the regulations with respect to veterinary diagnostic practices. For example, the Animal Ultrasound Association, in May 2023, introduced novel guidelines for ultrasound usage in pregnant small animals.

The industry has a large number of product substitutes. Apart from the market leaders, the industry in different countries has domestic manufacturers that dominate that country. Furthermore, companies that manufacture human-use ultrasound machines are venturing into making veterinary-specific machines, making the market competitive.

The industry is experiencing a moderate impact of regional expansion. Healthcare industry giants are expanding into the veterinary ultrasound market space by partnering with leading veterinary companies. For example, in January 2023, Sound Technologies (Mars Inc.) and GE Healthcare forged a partnership to launch Vscan Air Handheld Ultrasound across veterinary partnerships across the U.S.

Animal Insights

The small animals segment held a significant market share of around 67% in 2024 and is expected to show the fastest growth rate over the forecast period of 2025 - 2030, owing to rising pet ownership and growing demand for pet insurance. For instance, according to the American Pet Products Association's 2023-2024 National Pet Owners Survey, 66% of American homes, or about 90.5 million families, own a pet. This is an increase from 67 % in 2019.

Similarly, more than 65.1 million dogs and 46.5 million cats are owned by families in the U.S. alone. Moreover, according to a report by APPA, pet owners spent around USD 147 billion on veterinary care in 2023 in the U.S.

Solutions Insights

The equipment segment held the highest market share in 2024 because of their ease of use. These gadgets are widely used in hospitals, diagnostic centers, and veterinary clinics. Moreover, significant industry participants like IMV Imaging, Esaote SpA, Fujifilm Sonosite, etc., are anticipated to propel market expansion throughout the projection year with their technological innovations. Due to the potential of using 2-D ultrasound imaging scanners at the point of treatment, the market for handheld scanners is anticipated to grow rapidly. IMV Imaging's Duo-Scan and Clarius Mobile Health Corp.'s C3 Microconvex Vet, C3 Convex Vet, and L7 Linear Vet are two examples of handheld scanners.

The PACS segment is anticipated to grow at the highest CAGR of 8.01% over the forecast period. This software is widely used in veterinary applications as a result of the growing need for routinely exchanging diagnostic images and other storage needs in clinical settings. It makes it possible for image management systems to store, quickly retrieve, and access stored digital images either on-premises or in the cloud. These options seamlessly integrate with any veterinary environment to produce diagnostic radiographic pictures right away. They contain predesigned templates for speedy report creation, which may be customized based on the task. In addition, they have tags that are distinctive to each species & breed, making it simple to obtain patient demographic data.

Type Insights

2-D ultrasound imaging held the highest share in 2024. The widespread acceptance of such types of devices in visualizing and diagnosing complications in different parts of animals' bodies, like the abdomen and musculoskeletal system, as well as others like cardiology, etc, is responsible for the growth of this segment. Furthermore, the lower price compared to other types of ultrasounds is another factor driving the market growth. The common use of 2D ultrasounds in this market is owed to its affordability, ease of usage, and capacity to give real-time photographs, further contributing to the segment’s large market share.

Currently, 3-D/4-D ultrasound imaging is not used on a commercial level or for clinical diagnostic purposes. However, its use has been on the rise in different research studies that are carried out in animals, leading to it’s anticipated highest growth rate over the forecast period.

Technology Insights

By technology, digital imaging dominated the animal ultrasound market in 2024 owing to technological developments offered by significant market players and growing demand for veterinary diagnostics. Additionally, these systems have a higher radiograph production, distribution efficiency, a larger viewing area and greater latitude exposure, which boosts their efficiency by lowering the need for re-scanning, propelling the market growth.

The contrast imaging segment is anticipated to grow at the fastest CAGR from 2025 to 2030 due to its increasing adoption in veterinary hospitals and clinics. This technology is used for advanced imaging tests to visualize blood flow, such as M-mode imaging and myocardial perfusion. Myocardial perfusion imaging with contrast ultrasonography is primarily employed to diagnose cardiac infarction in companion animals such as cats and dogs. This is achieved by assessing the left ventricular free wall and the septum.

Application Insights

The abdominal segment led the animal ultrasound market with a share of 27.34% in 2024 and is anticipated to grow with the highest growth rate over the forecast period. One of the most popular uses of ultrasonography in veterinary medicine is the examination of the abdominal cavity, like the liver, spleen, gynecological regions, kidneys, bladder, and gastrointestinal tract. Diagnosing diseases like organ enlargement, tumors, stones, pregnancy, and other anomalies is made easier with this non-invasive method.

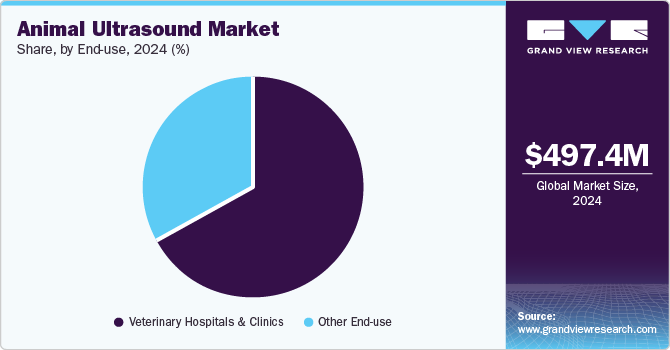

End-use Insights

Veterinary hospitals & clinics led the market in 2024 in terms of revenue share. This is owing to faster diagnosis, allowing patients to receive treatment as soon as possible at these locations. Moreover, veterinary hospitals offer a wide range of diagnostic imaging options, which is a high-impact rendering driver of this market. Additionally, technological developments such as hand-held technologies and cloud-based information management systems have boosted the abilities of these settings to increase their patient reach, which is likely to boost market growth.

Among the other end-uses are academic & research centers, Point-of-Care (PoC) facilities, diagnostic laboratories, and reference laboratories. The others segment is expected to grow at the fastest growth rate over the forecast period. Comprehensive diagnostic testing can be provided by reference laboratories, ensuring prompt results and expert consultation. The market's participants and reference laboratories are anticipated to work together with greater regularity, which could accelerate the segment's growth. End-users with a low resource availability typically outsource their imaging services to diagnostic and reference laboratories, as well as veterinary hospitals. These end-users include academic and research institutions and point-of-care facilities.

Regional Insights

North America animal ultrasound market held the largest share of 38.29% of the global market in 2024. The region is expected to grow owing to the business activities like product launches, research initiatives, etc., by the industry participants in the region. For example, in June 2023, Esaote North America launched the MyLab X90 VET system enhanced with the help of AI. Such activities help in increasing the adoption of ultrasound among the veterinary settings across the region, boosting the market growth.

U.S. Animal Ultrasound Market Trends

U.S. animal ultrasound market lucrative growth is due to the increasing penetration of ultrasound into the livestock industry. For instance, according to February 2023, the Michigan State University (MSU) Beef Team enhanced beef cattle carcass ultrasound service offerings as a fee-for-service program for Michigan and nearby states. This service provides cattle producers with valuable information on carcass traits, enabling them to make informed decisions about breeding and selection. The use of ultrasound technology in the livestock industry is becoming increasingly popular, and initiatives like this will drive the animal ultrasound market in the US by increasing adoption and demand for these services. This will also lead to advancements in technology and more accurate results.

Europe Animal Ultrasound Market Trends

Europe animal ultrasound market growth can be attributed to leading organizations of the region, like the Animal Ultrasound Association (AU), structuring the guidelines for the use of ultrasound in the region. These guidelines play a crucial role in driving the market by ensuring the safe and effective use of ultrasound technology in veterinary practice, apart from providing a framework for veterinarians to follow, promoting the adoption of ultrasound technology, and driving market growth. Compliance with these guidelines is essential for veterinary clinics, contributing to the industry's expansion. Standardization of ultrasound practices is also encouraged through these guidelines. This trend is expected to continue, driving the growth of the animal ultrasound market in Europe.

The UK animal ultrasound market is experiencing lucrative growth due to the increasing adoption of novel technologies by veterinarians in the country. According to a September 2023 article by CVS Group, veterinarians at Bristol Vet Specialists employed a new ultrasound software to predict recovery in dogs after spinal cord injuries. This is a very valuable tool for assessing the severity of spinal cord injuries and predicting patient outcomes, and allows for more accurate diagnoses and treatment plans, leading to improved patient care and outcomes. The adoption of this technology is also contributing to the growth of the animal ultrasound industry in the UK. Additionally, the use of advanced ultrasound software is enhancing the reputation of veterinary clinics and specialists, attracting more clients and driving business growth. The development of such technology is also encouraging further research and innovation in the field.

The animal ultrasound market in Sweden is growing due to an increase in pet insurance coverage. Pet owners are more likely to take their animals to veterinary hospitals and clinics for diagnosis & treatment with insurance policies covering the cost of veterinary care, which increases the need for diagnostic imaging equipment. In Sweden, pet insurance is very popular. In fact, adoption of pet insurance services in Sweden is the highest in the world. According to a February 2024 article by The Furry Emporium, more than 80% of the pets in Sweden are insured.

Asia Pacific Animal Ultrasound Market Trends

The animal ultrasound market in Asia Pacific is anticipated to witness significant growth due to companies across the region investing in expanding the applications of diagnostic equipment beyond livestock and companion animals. For instance, in May 2024, researchers at EC Technologies utilized ultrasound technology innovatively in endangered wild animal species by enabling non-invasive assessments of reproductive health and detection of health complications. This technology is showing promising results in enhancing conservation efforts and safeguarding vulnerable species, and its use is expected to continue growing in the field of wildlife conservation.

India animal ultrasound market is primarily driven by the increasing adoption of ultrasound among veterinary hospitals and clinics across the country. Realizing its importance, hospitals and clinics across the countries are procuring dedicated diagnostic equipment for use in patients. For example, in February 2024, Guru Angad Dev Veterinary and Animal Sciences University (GADVASU) from Ludhiana, Punjab, inaugurated a new diagnostic unit dedicated specifically to ultrasound imaging services.

Latin America Animal Ultrasound Market Trends

The animal ultrasound market in Latin America is driven by factors such as the increasing adoption of pets, rising pet healthcare expenditure, and technological advancements in ultrasound systems. Additionally, the growing veterinarian population, increasing prevalence of zoonotic diseases, and humanization of pets are also contributing to the market growth. The market is expected to grow significantly in countries such as Brazil and Argentina.

Argentina veterinary imaging market is expected to exhibit steady growth during the forecast period due to increasing pet adoption and ownership. For instance, 86% of households in Argentina have at least one pet, mostly a dog or cat. In addition, advancements in veterinary technology and diagnostic imaging equipment have made diagnostic procedures more accurate, efficient, & accessible, further driving market growth. Moreover, regulatory support and favorable policies aimed at promoting animal health and welfare in Argentina contribute to the expansion of the veterinary imaging market.

MEA Animal Ultrasound Market Trends

The veterinary imaging market in the Middle East & Africa is growing at a steady pace as a result of international players entering the regional market to seek novel business opportunities. For example, in January 2024, Esaote SpA launched two new ultrasound systems, namely, MyLab A50 and MyLab A70, at the Arab Health Expo conducted at the Dubai World Trade Centre,

Key Animal Ultrasound Company Insights

Some of the key players operating in the market include IDEXX, Esaote SpA, Mars Inc. (Sound & Heska), IMV Imaging, and Shenzhen Mindray Bio-Medical Electronics, among others. The market is highly fragmented owing to the presence of a large number of notable manufacturers. This is expected to intensify the competition in the coming years. These players are adopting various research studies, and strategic initiatives, such as partnerships, sales & marketing activities, and mergers & acquisitions, but their primary focus seems to be on product as well as geographical expansion and offering innovative products to the customers to strengthen their market presence.

Key Animal Ultrasound Companies:

The following are the leading companies in the animal ultrasound market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX

- Esaote SpA

- Mars Inc. (Sound & Heska)

- FUJIFILM Holdings America Corporation

- Shenzhen Mindray Bio-Medical Electronics

- Siemens Healthcare Limited (PLH Medical Ltd.)

- Samsung Healthcare

- ASUSTeK Computer Inc.

- IMV Imaging

- CHISON Medical Technologies Co., Ltd.

- BenQ Medical Technology Corp.

- Avante Animal Health

- Contec Medical Systems Co. Ltd.

- Wuhan Zoncare Bio-medical Electronics Co., Ltd

- Butterfly Network, Inc.

View a comprehensive list of companies in the Animal Ultrasound Market

Recent Developments

-

In September 2024, zoos and aquariums across the U.S. collaborated to form a Zoo and Aquarium Radiology Database (ZARD) with an aim to create a comprehensive database of diagnostic images for zoological veterinary professionals. The database aims to address the challenge of limited reference material for non-domestic species, with over 10,000 images from 500 species expected to be featured.

-

In September 2024, UK’s CVS Group implemented a nationwide clinical improvement project to increase the use of ultrasound scans in first opinion diagnosis, with an additional 3,675 scans conducted across the small animal division within 12 months. The project's success has been recognized with RCVS Knowledge 'highly commended' status, and it is now being developed to focus on echocardiography in its second year.

-

In August 2024, Vinno's small animal ultrasound equipment was successfully installed at the Cangzhou Hospital of Integrated Traditional Chinese and Western Medicine, providing convenient and stable imaging results for researchers.

-

In April 2024, two livestock ultrasound operators, Rusty Herr, and Ethan Wentworth, were jailed for allegedly practicing veterinary medicine without a license, specifically for performing ultrasound scans on animals not owned by them. The case has raised concerns about the regulation of veterinary practice and the use of ultrasound technology in animal care.

-

In November 2023, the Animal Ultrasound Association (AUA) announced the launch of a Hybrid Course for ultrasound training beginning on January 1st, 2024. This course offers a flexible learning approach with pre-recorded material, live sessions, and lifetime access to expert sonographers and allows learners to study at their own pace and schedule live sessions with a sonographer to review material and receive a certificate upon completion.

-

In November 2022, Advanced Veterinary Ultrasound partnered with Draminski S.A. to allow the marketing, selling and servicing of veterinary ultrasound equipment of Draminski.

Animal Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 531.0 million

Revenue forecast in 2030

USD 747.31 million

Growth rate

CAGR of 7.07% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, solution, type, technology, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

US, Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

IDEXX, Esaote SpA, Mars Inc. (Sound & Heska), FUJIFILM Holdings America Corporation, Shenzhen Mindray Bio-Medical Electronics, Siemens Healthcare Limited (PLH Medical Ltd.), Samsung Healthcare, ASUSTeK Computer Inc., IMV Imaging, CHISON Medical Technologies Co., Ltd. , BenQ Medical Technology Corp., Avante Animal Health, Contec Medical Systems Co. Ltd., Wuhan Zoncare Bio-medical Electronics Co., Ltd, and Butterfly Network, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal ultrasound market report based on animal, solution, type, technology, application, end-use, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Console/Cart-Based Ultrasound

-

Portable/Handheld Ultrasound

-

-

Accessories/Consumables

-

PACS

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2-D Ultrasound Imaging

-

3-D/4-D Ultrasound Imaging

-

Doppler Imaging

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Imaging

-

Contrast Imaging

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Musculoskeletal

-

Cardiology

-

Oncology

-

Abdominal

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other End-Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global animal ultrasound market size was estimated at USD 497.44 million in 2024 and is expected to reach USD 531.00 million in 2025.

b. The global animal ultrasound market is expected to grow at a compound annual growth rate (CAGR) of 7.07% from 2025 to 2030 to reach USD 747.31 million by 2030.

b. North America animal ultrasound market held the largest share of 38.29% of the global market in 2024. The region is expected to grow owing to the business activities like product launch, research initiatives, etc. by the industry participants in the region.

b. Some key players operating in the global animal ultrasound market include IDEXX, Esaote SpA, Mars Inc. (Sound & Heska), FUJIFILM Holdings America Corporation, Shenzhen Mindray Bio-Medical Electronics, Siemens Healthcare Limited (PLH Medical Ltd.), Samsung Healthcare, ASUSTeK Computer Inc., IMV Imaging, CHISON Medical Technologies Co., Ltd. , BenQ Medical Technology Corp., Avante Animal Health, Contec Medical Systems Co. Ltd., Wuhan Zoncare Bio-medical Electronics Co., Ltd, and Butterfly Network, Inc.

b. Some of the key factors driving the market growth are growing research initiatives & breakthroughs, expanding applications of ultrasound within the veterinary sector, improving regulatory scenario and increasing crucial collaborations in the industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."