Animal Sedative Market Size, Share & Trends Analysis Report By Application, By Animal Type, By Route of Administration (Parenteral, Oral), By Drug Class, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-179-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Animal Sedative Market Size & Trends

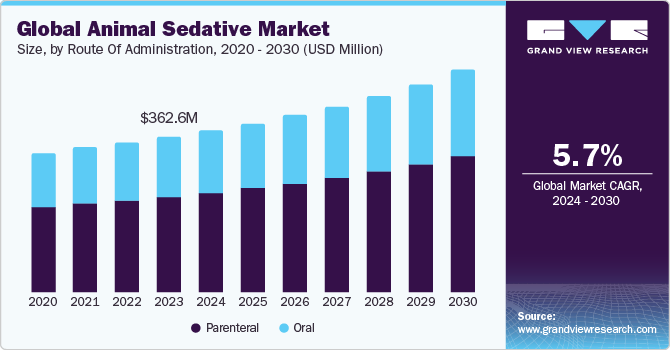

The global animal sedative market size was estimated at USD 362.6 million in 2023 and is anticipated to grow at a CAGR of 5.71% from 2024 to 2030. Key factors expected to drive the market include increasing pet ownership, rising prevalence of chronic diseases in animals, increasing surgical procedures, and a rise in animal health expenditure. More and more pet owners are realizing the value of routine veterinary care for the health and welfare of their animals. As a result of this greater awareness, more money is spent on veterinary services, including pet surgeries, which raises the need for veterinary medications.

Increased acceptance of pet insurance may result in an increase in the number of surgeries performed on animals. The expenses of veterinarian treatment, including procedures, are often partially covered by pet insurance. Knowing that their insurance will cover some of the costs, pet owners may be more willing to approve critical surgeries for their animals. This may lead to an overall increase in surgical volume. Furthermore, pet owners may be more likely to seek out sophisticated or specialized operations that might have been considered too costly if they had insurance coverage. According to the AVMA, pet owners are increasingly using pet insurance to help them budget for the medical expenses related to their animals. Spending on dog veterinary care increased significantly between 2020 and 2022, with the average yearly cost of veterinary visits rising from USD 224 in 2020 to USD 362 in 2022.

The increasing prevalence of chronic diseases in animals further propels the market growth. One of the most prevalent diseases in animals nowadays is osteoarthritis (OA). Data from 2024 released by Zoetis indicates that dogs have an over 40% prevalence of OA. Early-life structural alterations in dogs can cause hip dysplasia in large breeds and patellar luxation in small breeds, which can lead to OA. For this reason, it is advised that dogs of all sizes get screened for OA. Dogs may exhibit symptoms of OA long before the condition is widely recognized. The field of veterinary medicine has developed tremendously, and more modern techniques are now available for the detection and management of chronic illnesses in animals. These procedures often require anesthesia or sedation to ensure the animal's safety and comfort. Examples include MRI and CT scans, the advanced imaging techniques require animals to remain still, often necessitating sedation.

Market Concentration & Characteristics

The market has a moderate concentration. It is expanding at a faster rate and is currently in a medium growth stage. One major factor propelling the market growth is the increasing pet ownership. The global pet population is increasing as more people adopt pets for companionship. This rise in pet ownership boosts demand for veterinary services, including the need for sedatives during medical procedures, grooming, and travel. For example, China's pet ownership rate is predicted to rise from 19% of households in 2020 to 40% of households by 2030, according to the Elanco Animal Health survey for 2022. The number of people adopting dogs to their households is driving up the demand for specialized medical care, such as orthopedic treatments.

The market demonstrates a moderate-to-high degree of innovation, characterized by ongoing partnership and collaboration between market players, product launches, and supportive initiatives. For instance, in July 2022, Dechra launched Zenalpha. Combining an alpha-2 agonist and a peripheral antagonist can reduce the stress of sedation in dogs and keep physiological parameters stable.

Within the market, there exists a moderate-to-high level of mergers and acquisitions activity indicative of ongoing consolidation, strategic acquisitions, and partnerships among industry players. For instance, Zoetis, Inc. acquired Jurox, a private animal health company specializing in veterinary medicines for livestock and companion animals. The deal, finalized in September 2022, included Jurox’s operations in Australia, with regional offices in New Zealand, the U.S., Canada, and the UK. The financial details of the transaction remain undisclosed.

The market experiences a moderate impact of regulations. Health experts are increasingly advocating for animal sedatives to be classified as controlled substances due to their potential for misuse and abuse. Currently, these medications are not consistently regulated, making it easier for them to be diverted for recreational use. Moreover, various veterinary associations and organizations have established guidelines to ensure the safe use of sedatives in animals.

The market experiences a moderate level of product substitutes. The availability of substitutes often leads to increased competition, which can drive down prices. Veterinary clinics and pet owners might choose more cost-effective alternatives if they offer comparable efficacy and safety. Veterinarians and pet owners may switch to substitutes if they are perceived as more effective, safer, or easier to administer.

High levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For example, in November 2022,Virbac’s Carros site established a cutting-edge production facility for companion animal vaccines, employing a fast-track approach to meet global demand while adhering to stringent regulatory standards.

Drug Class Insights

Alpha-2 Adrenergic Receptor Agonists dominated the market in 2023. It is also anticipated to grow at the fastest CAGR over the forecast period. Sedation, muscular relaxation, analgesia, and anxiolysis are all provided by alpha-2 agonists. Numerous substances, such as clonidine, romifidine, medetomidine, detomidine, xylazine, and dexmedetomidine, have been created for use in both human and veterinary medicine. The primary reason for the sedative effects of α2-adrenergic agonists is their ability to decrease the activity of noradrenergic neurons in the pons and lower brainstem of Locus coeruleus, which, in turn, reduces the activity of noradrenergic activator projections that ascend towards superior cerebral structures. The presence of postsynaptic α2-adrenergic receptors in the frontal cortex can also contribute to its calming effects by mediating its activation and inhibiting cortical activity.

Route of Administration Insights

The parenteral segment dominated the market in 2023. The parenteral route of administration provides a much quicker onset of action compared to oral sedatives. This is crucial in emergencies where immediate sedation is needed, such as in acute agitation or severe anxiety. The absorption of parenteral sedatives is more predictable and reliable than oral sedatives. Oral sedatives must pass through the digestive system, where factors like gastric emptying time and the presence of food can affect drug absorption and efficacy. Furthermore, parenteral administration avoids the first-pass metabolism by the liver, which can significantly reduce the bioavailability of oral medications. This allows for more accurate dosing and control over the sedative effects.

The oral segment is anticipated to grow at the fastest CAGR over the forecast period. Oral sedatives are often easier to administer than injections, especially in animals that are difficult to handle or are fearful of needles. This can reduce stress for both the animal and the handler. Administering sedatives orally eliminates the risk of injury associated with injections, such as accidental needle sticks or tissue damage at the injection site. Moreover, oral sedatives may offer greater convenience for both veterinarians and pet owners, as they can be easily dispensed and administered at home, eliminating the need for a visit to the veterinary clinic for sedation.

Application Insights

The surgical segment dominated the market in 2023. It is also anticipated to grow at the fastest CAGR over the forecast period. The rising number of surgeries on animals indeed plays a significant role in driving the demand for animal sedatives. As more pet owners seek medical interventions for their furry companions and as veterinary medicine advances, surgeries become more common. Animal sedatives are essential for ensuring the comfort and safety of animals undergoing various procedures, ranging from routine surgeries to more complex interventions. For instance, according to an article published by TopDog Animal Health and Rehabilitation 2024, every year, around 85% of dogs get orthopedic surgery.

End-use Insights

Hospitals dominated the market with a share of over 53.00% in 2023. This can be attributed to the growing patient footfall in these hospitals to treat these diseases in animals. The need for animal sedatives is directly related to the range of treatments and operations performed at veterinary hospitals, such as surgeries, diagnostic tests, and procedures that need immobilization or pain management for the animals. In addition, a significant number of surgical procedures, from simple neutering and spaying to intricate orthopedic procedures, require the administration of sedatives. To ensure the safety of the animal and the veterinary team, these treatments require the animal to be quiet and pain-free.

The specialty centers segment is anticipated to grow at the fastest CAGR over the forecast period. Specialty centers often offer advanced surgical and diagnostic procedures that require sedatives and anesthetics. These procedures include complex surgeries, dental work, and diagnostic imaging like MRI or CT scans, which necessitate the use of sedatives to ensure the animal's safety and compliance. Furthermore,many specialty centers are involved in research, leading to the development and use of newer, more effective sedatives. This not only increases the market size but also pushes for continuous innovation.

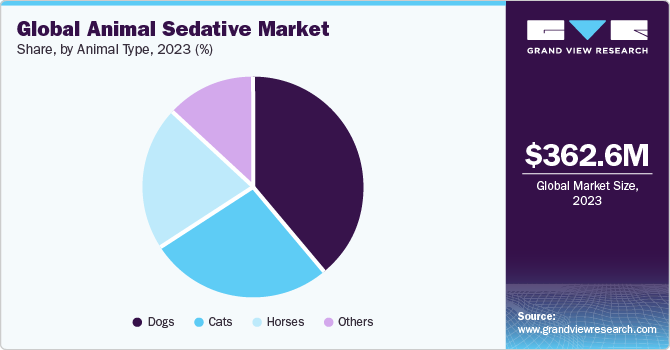

Animal Type Insights

Dogs held the dominant share of the market in 2023. Sedatives are more commonly used in dogs for several reasons. Dogs often exhibit behavioral issues such as anxiety, aggression, and hyperactivity, especially in stressful situations like vet visits, grooming, thunderstorms, or fireworks. Sedatives can help manage these behaviors effectively. Dogs are frequent patients for routine veterinary care, surgeries, dental cleanings, and diagnostic procedures. Sedatives help ensure the safety of both the dog and the veterinary staff by calming the animal, making it easier to perform necessary procedures without resistance. Moreover, dogs are more likely to travel with their owners compared to other pets. Sedatives can help reduce travel-induced anxiety, motion sickness, and stress, making trips safer and more comfortable for the dog.

The others segment is anticipated to grow at the fastest CAGR over the forecast period. The segment comprises cattle, small mammals, etc. Outbreaks of diseases in livestock can increase the demand for sedatives, as they are often used to calm animals for examination, treatment, and vaccination. Managing animal stress is crucial during these times to prevent the further spread of disease and ensure effective treatment. The expansion of livestock farming in emerging economies contributes to market growth. As these regions develop their agricultural sectors, the demand for veterinary products, including sedatives, will increase, which will result in supporting the growing livestock industry.

Regional Insights

The North America animal sedative market accounted for the largest global revenue share of 38.57% in 2023 and is expected to grow at a significant CAGR over the forecast period. The market is propelled by the existence of well-established competitors and the rising demand for services from veterinarians. North America's growing pet population is driving up demand for veterinary services, including sedatives for operations, dental work, and grooming. More and more pet owners understand the value of providing their animals with comprehensive healthcare, which may involve giving them sedatives during some medical procedures to help them feel less stressed and pained.

U.S. Animal Sedative Market Trends

The animal sedative market in the U.S. is driven by the presence of a large number of veterinary hospitals. For instance, there were 48,487 Veterinary Services businesses in the US as of 2023. With more veterinary hospitals, there is a greater focus on advanced medical procedures and treatments. This requires a variety of sedatives tailored for different species, sizes, and medical conditions, further driving the market growth. Moreover, many routine veterinary procedures, such as dental cleanings, grooming, and minor surgeries, often require sedation to ensure the safety and comfort of the animals. The prevalence of these procedures increases the demand for sedatives.

Europe Animal Sedative Market Trends

The animal sedative market in Europe is expected to grow at a significant pace due to favorable government regulations and the rising geriatric population of pets. Like humans, pets are living longer due to improved healthcare, leading to an increase in age-related conditions that may require sedatives for treatment or diagnostic procedures. Moreover, the presence of various players in the market, along with their marketing strategies and product offerings, can significantly impact market growth.

The UK animal sedative market is driven by the significant factor of the increasing adoption of sedatives by veterinarians. Veterinarians often use sedatives for various reasons, such as calming anxious or aggressive animals during examinations or procedures, facilitating handling for grooming or veterinary care, or aiding in diagnostic procedures like X-rays or ultrasounds. The UK has a large population of pets, including dogs, cats, and other companion animals, and the demand for veterinary services continues to grow. As a result, there's a steady need for sedatives in veterinary practices across the country.

Asia Pacific Animal Sedative Market Trends

The Asia Pacific animal sedative market is expected to exhibit lucrative growth over the forecast period. The region's growth can be attributed to a number of factors, including an increasing number of pets, the incidence of animal diseases, rising concerns about animal health, and the region's growing livestock population.

The animal sedative market in India is expected to grow at a CAGR of 7.26% over the forecast period due to the rising livestock production, growing dairy industry, and increasing number of veterinary healthcare facilities. India's large agricultural sector relies heavily on livestock, including cattle, goats, and poultry. The need to manage these animals for various procedures, including transport, medical treatment, and handling, drives the demand for sedatives.

Latin America Animal Sedative Market Trends

The animal sedative market in Latin America is driven by the increasing prevalence of diseases in pets, such as osteoarthritis, due to the rising obesity in pets. In addition, the rising livestock population and the presence of animal pharmaceutical companies are expected to drive market growth over the forecast period.

The Brazil animal sedative market is influenced by several key factors such as increasing awareness of animal welfare. There is a growing emphasis on animal welfare standards, both domestically and internationally. This includes ensuring the humane handling and treatment of animals, which often necessitates the use of sedatives to reduce stress and prevent injury during various procedures.

Middle East & Africa Animal Sedative Market Trends

The animal sedative market in MEA comprises South Africa, Saudi Arabia, Kuwait, and the UAE. In the MEA, the increasing requirement for veterinary medicine is expected to drive market growth over the forecast period. The growing prevalence of chronic diseases in animals is predicted to improve the demand for veterinary surgeries, diagnosis, treatments, and medicines.

The South Africa animal sedative market growth is attributed to increased awareness and education among veterinarians and animal handlers about the benefits and proper use of sedatives. Training programs and workshops help in disseminating knowledge about new sedative products and techniques.

Key Animal Sedative Company Insights

The market is fairly competitive due to the existence of small to major market participants. Due to the existence of multiple small and large companies, the market is slightly fragmented. Thus, small players face intense competition to maintain their market position. Moreover, companies are increasingly adopting various strategies, such as mergers & acquisitions, geographic expansion, and the launch of products to grow in the market. For instance, in March 2022, Elanco expanded the shared value footprint across Sub-Saharan Africa to create sustainable development solutions for those dependent on livestock for livelihoods.

Key Animal Sedative Companies:

The following are the leading companies in the animal sedative market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Inc.

- Virbac

- Ouro Fino Saude Animal Group

- Dechra Pharmaceuticals Plc (EQT)

- Merck & Co., Inc.

- Bimeda Inc.

- vetcare. fi.

- Chanelle Pharma (Exponent)

- Randlab Australia Pty Ltd

- Troy Laboratories Pty Ltd

Recent Developments

-

In May 2023, Virbac acquired GS Partners, its long-standing distributor in the Czech Republic & Slovakia, marking its 35th subsidiary and reinforcing its presence in Central Europe. With the acquisition, Virbac aimed to enhance its ability to meet the health needs of animals in the region, particularly in the pet & ruminant sectors.

-

In August 2022, Bimeda acquired Afrivet, a leading South African animal health distributor. With Afrivet’s operations in South Africa, Zambia, and Mozambique, this acquisition would provide Bimeda with the largest footprint of any animal health company in Africa. Integration into Bimeda’s Africa, Middle East, and Asia (AMEA) division enhances the company’s product portfolio and service offerings in the region.

Animal Sedative Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 377.8 million |

|

Revenue forecast in 2030 |

USD 527.3 million |

|

Growth rate |

CAGR of 5.71% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Actual data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Animal type, drug class, route of administration, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Zoetis Inc.; Virbac; Ouro Fino Saude Animal Group; Dechra Pharmaceuticals Plc (EQT); Merck & Co. Inc.; Bimeda Inc.; vetcare. fi.; Chanelle Pharma (Exponent), Randlab Australia Pty Ltd, Troy Laboratories Pty Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Animal Sedative Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal sedative market report based on animal type, application, drug class, route of administration, end-use, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Phenothiazines

-

Benzodiazepines

-

Alpha-2 Adrenergic Receptor Agonists

-

Butyrophenones

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Diagnostic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global animal sedative market size was estimated at USD 362.6 million in 2023 and is expected to reach USD 377.8 million in 2024

b. The global animal sedative market is expected to grow at a compound annual growth rate of 5.71% from 2024 to 2030 to reach USD 527.3 million by 2030.

b. North America dominated the animal sedative market with a share of 38.57% in 2023. The market is propelled by the existence of well-established competitors and the rising demand for services from veterinarians.

b. Some key players operating in the animal sedative market include Zoetis Inc., Virbac, Ouro Fino Saude Animal Group, Dechra Pharmaceuticals Plc (EQT), Merck & Co., Inc., Bimeda Inc., vetcare.fi. , Chanelle Pharma (Exponent), Randlab Australia Pty Ltd, Troy Laboratories Pty Ltd

b. Key factors that are driving the market growth include increasing pet ownership, rising prevalence of chronic diseases in animals, rising surgical procedures, and increasing animal health expenditure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."