- Home

- »

- Animal Health

- »

-

Animal Gastroesophageal Reflux Disease Market Report, 2030GVR Report cover

![Animal Gastroesophageal Reflux Disease Market Size, Share & Trends Report]()

Animal Gastroesophageal Reflux Disease Market Size, Share & Trends Analysis Report By Product, By Animal (Companion, Livestock), By Mode, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-370-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

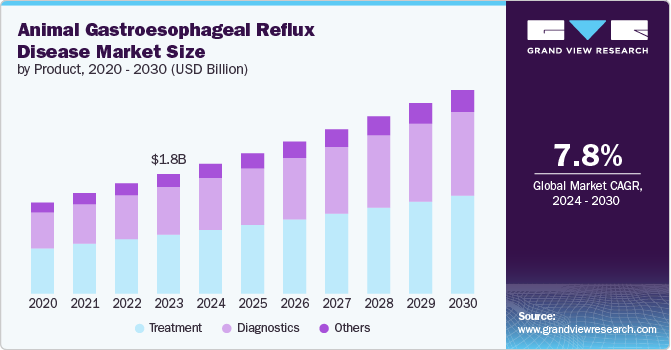

The global animal gastroesophageal reflux disease market size was valued at USD 1.82 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. The market is primarily driven by rising prevalence of gastrointestinal diseases such as GERD in animals, particularly in dogs, increasing humanization of pets, and ongoing advancements in veterinary diagnostics and treatments. Furthermore, poor diet or abrupt changes in diet are some of the factors contributing to animal gastroesophageal reflux disease (GERD) in pets.

Overweight pets are more likely to develop GERD. For instance, according to a June 2024 study by ScienceDirect, the prevalence of obesity in dogs was estimated to be 35%. Certain breeds, especially brachycephalic (short-nosed) breeds, are more susceptible to GERD. However, younger pups and brachycephalic (flat-faced) dogs are at greater risk.

In addition, the trend toward overall pet health and wellness, coupled with the development of specialized diets, is driving demand for products that manage gastrointestinal issues. Economic factors, such as rising disposable incomes and the growth of pet insurance, are also enabling pet owners to afford comprehensive veterinary care. According to a recent survey conducted by USA Today, a significant proportion of Americans are dedicating a substantial portion of their monthly income to pet care. 26% of respondents spend between USD 51 and USD 100 per month on their dogs, while an equal percentage of 26% allocate between USD 101 and USD 250 for their canine companions’ needs. In some cases, the total cost of dog ownership can reach as high as USD 5,000. Notably, two-thirds of respondents (66%) reported having to sacrifice their own needs to keep up with the rising expenses associated with pet ownership. Some individuals have resorted to taking out loans or seeking financial assistance to cover the costs of caring for their pets.

The market is further characterized by advancements in technology that have significantly improved the ability to detect and manage these conditions. Veterinarians now have access to more sophisticated imaging techniques, such as fluoroscopy and high-resolution endoscopy, which allow for real-time visualization of the esophagus and stomach during swallowing and digestion. Additionally, esophageal pH monitoring and impedance testing have been adapted for use in pets, providing valuable data on acid exposure and reflux events. Biomarker analysis, including measurement of pepsin in saliva or respiratory secretions, is emerging as a non-invasive diagnostic tool. These developments, combined with an improved understanding of breed-specific predispositions and risk factors, have enhanced early detection and treatment strategies for GERD in dogs and cats, leading to better outcomes and improved quality of life for affected animals.

Governments often fund collaborative research programs that bring together universities, research institutions, and private companies to tackle veterinary health issues, including GERD. These programs facilitate the sharing of knowledge and resources to accelerate advancements. Governments sponsor campaigns to raise awareness about GERD in animals among pet owners and veterinarians. These campaigns aim to educate the public on recognizing symptoms and seeking timely veterinary care.

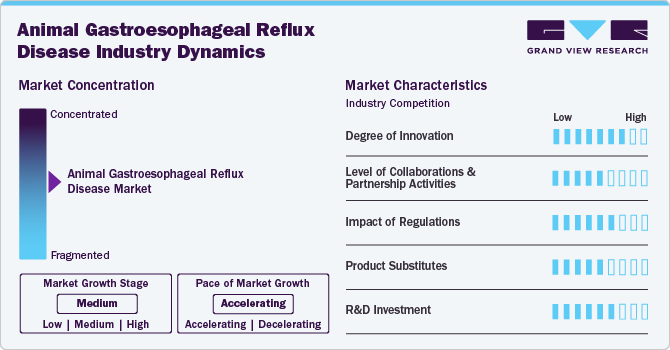

Market Concentration & Characteristics

The animal GERD market is moderately concentrated, with key players including Zoetis Inc., Elanco Animal Health, and Merck Animal Health dominating the landscape. These companies hold a significant share due to their extensive product portfolios, research investments, and established distribution networks. The market also sees contributions from smaller firms focusing on niche segments and innovative treatments. The market is at an initial growth stage, and rate of expansion is accelerating.

The market is experiencing a high degree of innovation, with advancements in diagnostic technologies, such as endoscopy and ultrasound systems, as well as the development of specialized medications and diets. This continuous innovation enhances diagnostic accuracy and treatment options, improving overall pet health outcomes.

Collaboration and partnership activities in the animal gastroesophageal reflux disease (GERD) market are essential for driving innovation and enhancing treatment options. Veterinary pharmaceutical companies often collaborate with research institutions and veterinary clinics to develop new therapies and diagnostic tools, encouraging advancements in the overall market.

Regulations in the animal gastroesophageal reflux disease (GERD) market impact product development, safety standards, and marketing practices. Compliance with veterinary regulations ensures the effectiveness and safety of treatments, ultimately increasing consumer trust and driving market growth. Furthermore, there is no FDA-approved drug specifically for animal gastroesophageal reflux disease (GERD) treatment due to limited clinical trials and research focused on this specific condition in animals. Additionally, veterinary medications often rely on off-label use of human drugs, reducing the incentive for companies to pursue the costly and rigorous approval process for animal-specific treatments.

Product substitutes include dietary modifications such as specialized pet foods designed to manage gastrointestinal health and natural remedies like herbal supplements. These alternatives offer pet owners additional options alongside traditional medications like proton pump inhibitors (PPIs) and H2 blockers. These substitutes can impact the market by providing cost-effective options, potentially reducing the demand for traditional pharmaceuticals while encouraging a diversified approach to managing GERD in pets.

Increased R&D investments in the animal gastroesophageal reflux disease (GERD) market are driving the development of advanced diagnostics and more effective treatments. This focus on innovation enhances diagnostic accuracy and therapeutic options, leading to improved pet health outcomes and stimulating market growth.

Product Insights

The treatment segment accounted for the largest revenue share of 49.31% in 2023. This high share is attributable to the rising prevalence of GERD in companion animals, increasing awareness among pet owners about the condition, and the availability of advanced and effective treatment options. Veterinary advancements have led to the development of specialized medications and therapeutic interventions that significantly improve the quality of life for affected animals. Additionally, the willingness of pet owners to invest in their pets' health and the growing number of veterinary clinics offering comprehensive treatment solutions further drive the dominance of the treatment segment in this market.

The diagnostics segment is anticipated to witness the fastest growth over the forecast period, owing to increasing awareness about early disease detection, advancements in diagnostic technologies, and a growing emphasis on preventive veterinary care. The rising incidence of GERD in pets has led to a demand for accurate and efficient diagnostic tools, enabling veterinarians to identify and address the condition rapidly. Additionally, pet owners' increasing willingness to seek comprehensive health assessments for their animals and the expansion of veterinary diagnostic laboratories contribute to the rapid growth of this segment.

Animal Insights

The companion animal segment dominated the market in 2023 with a share of 59.07%, and is expected to be the fastest-growing segment over the forecast period. This is due to the high prevalence of GERD in pets such as dogs and cats, which are more prone to the condition compared to livestock or wild animals. The increasing humanization of pets and the willingness of pet owners to spend on veterinary healthcare drive significant demand for diagnostic and treatment solutions. Additionally, the growing awareness of pet health issues and the availability of advanced veterinary care contribute to the dominance of the companion animals segment. The rise in pet ownership and the consequent increase in routine veterinary visits are also contributing to the segment's leading position in the market.

The dogs segment dominated among companion animals due to the rise in prevalence of GERD in dogs compared to other animals and the increased awareness and willingness of dog owners to seek veterinary care for their pets' gastrointestinal issues. This has led to a higher demand for diagnostic and treatment options specifically designed for dogs.

Mode Insights

The OTC segment dominated the market and accounted for the largest share of 56.88% in 2023. OTC medicines are widely used for Animal Gastroesophageal Reflux Disease (GERD) treatment due to their accessibility, cost-effectiveness, and ease of administration for pet owners. These medications provide a convenient initial treatment option for managing mild to moderate GERD symptoms, reducing the need for frequent veterinary visits and allowing for rapid relief of discomfort in affected animals.

The prescription segment is anticipated to grow at the fastest rate over the forecast period. The demand for prescription medicines for animal GERD treatment is increasing due to their effectiveness in managing GERD symptoms in animals. These medicines, prescribed by veterinarians, offer targeted relief and control of acid reflux and related gastrointestinal issues, thereby improving the quality of life for affected animals. Moreover, as pet owners become more aware of the availability and benefits of prescription treatments, there is a growing preference for medically approved solutions over general over-the-counter remedies, driving the rise in demand for these specialized medications.

Route of Administration Insights

The oral segment dominated the market and accounted for the largest share of 65.35% in 2023 and is expected to grow at the fastest rate of 7.9% CAGR over the forecast period. Most of the drugs used for GERD treatment in animals are commonly administered orally to ensure precise dosing and effective delivery of medication to the gastrointestinal tract, where GERD symptoms occur.

Oral administration allows for controlled release and absorption of the drug, optimizing its therapeutic effects on stomach acid production and esophageal irritation. This route of administration also facilitates ease of use for pet owners and ensures compliance with treatment protocols, enhancing overall management of GERD in veterinary patients.

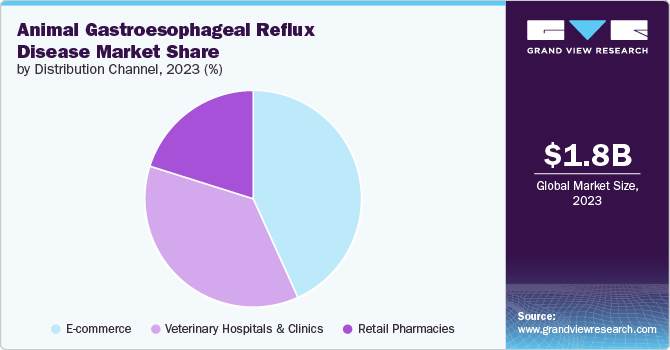

Distribution Channel Insights

The e-commerce segment dominated the market with the largest share of 43.23% in 2023 and is also anticipated to grow at the fastest CAGR over the forecast period. This is due to its convenience, wide product availability, and increasing consumer preference for online shopping. Animal GERD drugs and supplements are widely sold on e-commerce platforms due to the increasing accessibility is particularly beneficial for managing chronic conditions like GERD, allowing pet owners to quickly reorder medications, compare prices, and access a wider range of products designed for their pets' specific needs.

Additionally, e-commerce platforms often provide detailed product information and customer reviews, enhancing transparency and trust in purchasing decisions for veterinary medications online. Additionally, the ease of doorstep delivery and promotional offers often available online further incentivize pet owners to purchase veterinary medicines and products through E-commerce platforms.

Regional Insights

North America animal gastroesophageal reflux disease (GERD) market accounted for the largest share of 43.66% in 2023. This high share is attributable to rising prevalence of GERD in the region, it is a common condition, especially in dog population in the region. A study published by NIH highlighted the prevalence of GERD in non-brachycephalic dogs in North America to be 18.1 to 27.8%. GERD is also seen in cats, though less frequently than in dogs. In addition, developed veterinary care infrastructure, high pet adoption as well as presence of major market players like Zoetis, and Elanco Animal Health in the US. According to Humane Society International, the U.S. alone accounts for around 85 million pet owner families. Further, the U.S. alone accounts for 85 million Pet Dogs population and 65 million Pet Cats Population. Also, Humane Canada stated that in 2021, around 20,974 Dogs and 60,677 Cats were taken into shelters. Out of which 44% of dogs as well as 62% of cats have been adopted back into homes. Such factors are driving the need for early diagnosis and veterinary care for pet owners, driving market growth.

U.S. Animal Gastroesophageal Reflux Disease (GERD) Market Trends

The animal gastroesophageal reflux disease (GERD) market in the U.S. is anticipated to witness significant growth over the forecast period, owing to the increasing humanization of pets. Moreover, initiatives like product approval and launching new products play a significant role in driving growth within the animal gastroesophageal reflux disease (GERD) market. Furthermore, in the U.S., agencies like the National Institutes of Health (NIH) and the United States Department of Agriculture (USDA) provide grants for research into animal health, including gastrointestinal diseases like GERD. These grants support studies aimed at understanding the disease mechanisms, developing new diagnostic tools, and creating effective treatments.

Europe Animal Gastroesophageal Reflux Disease (GERD) Market Trends

The animal gastroesophageal reflux disease (GERD) market in Europe was identified as a lucrative region in GERD industry. The increasing number of pets across Europe, along with growing pet humanization trends, drive the demand for advanced diagnosis and treatments related to gastrointestinal diseases. Pets are increasingly considered as family members, leading to higher spending on their healthcare needs. Pet owners are becoming more aware of the available treatment options for their pets, coupled with growing awareness and education efforts by veterinary organizations. In addition, the EU’s Horizon Europe program allocates significant funds for research and innovation in animal health. Projects focusing on gastrointestinal diseases in animals, such as GERD, can receive substantial support. This funding helps drive the development of new diagnostic and therapeutic approaches.

Germany animal gastroesophageal reflux disease (GERD) market is leading in Europe, with the largest population of both cats and dogs. According to FEDIAF estimates, in 2023, Germany had approximately 15.2 million cats and 10.6 million dogs. From 2010 to 2022, the population of pet dogs in Germany has doubled to around 10.6 million, while cats continue to be the most popular pets, with approximately 15.2 million population in 2023. The percentage of German households with pets has remained relatively stable, with around 45% of households owning pets. As pets are increasingly viewed as family members, pet owners are more willing to invest in advanced healthcare treatments, including those for chronic conditions like GERD. This shift in perception drives demand for innovative GERD products and treatments in the German market.

Additionally, continuous innovation in medications and treatment protocols for managing GERD in pets is expected to drive Germany animal gastroesophageal reflux disease (GERD) Market. For instance, German veterinary pharmaceutical companies have reported a 10% increase in the production and sales of proton pump inhibitors (PPIs) and H2 receptor antagonists for veterinary use since 2020. This trend reflects the growing emphasis on addressing chronic gastrointestinal issues in pets through advanced pharmaceutical solutions.

The animal gastroesophageal reflux disease (GERD) market in the UK is driven by an increase in pet ownership and an aging pet population. Due to the increase in pet population in UK, the demand for veterinary care has increased, leading to more frequent diagnoses and treatments of chronic conditions like GERD. Additionally, older pets are more prone to gastrointestinal issues, further driving the need for specialized GERD treatments and preventative care, thereby fueling market growth. According to an article published by Pet Keen in June 2023, there are 34 million pets in the UK, with dogs & cats accounting for the highest proportion. With the growing pet adoption rate, the prevalence of illnesses and burden of GERD in dogs is growing in the country. Thus, growing adoption of pets in the country is a major factor boosting the demand for animal gastroesophageal reflux disease (GERD) medicine.

Asia Pacific Animal Gastroesophageal Reflux Disease (GERD) Market Trends

The animal gastroesophageal reflux disease (GERD) market in Asia Pacific is anticipated to witness a substantial growth of 9.04% CAGR over the forecast period. GERD in pets is increasingly recognized in Asia-Pacific countries, particularly in urban areas where pet ownership is rising. Further, the diverse dietary habits across Asia-Pacific countries can influence GERD in pets. For instance, high-carbohydrate diets common in some areas may contribute to obesity, a risk factor for GERD. However, awareness and diagnosis rates vary significantly across the region. Improved diagnostic tools such as endoscopy and imaging, along with effective pharmaceuticals, are enhancing the management of GERD in animals.

Japan animal gastroesophageal reflux disease (GERD) market growth is attributed to improvements in veterinary diagnostic technologies, particularly in endoscopy, which enhance the ability to accurately diagnose and manage GERD in pets in Japan. Furthermore, growing awareness about GERD treatment and diagnosis in animals is expected to fuel the demand for Japan's animal gastroesophageal reflux disease (GERD) market. According to the Japan Pet Food Association, there are over 20 million cats and dogs in the country and 17 million children under the age of 16 years. Government support and regulation for the welfare of animal health are anticipated to fuel the market in Japan. For instance, Japan's Act of Welfare and Management of Animals (1973) focuses on building awareness among people as part of its process of implementation.

Latin America Animal Gastroesophageal Reflux Disease (GERD) Market Trends

The animal gastroesophageal reflux disease (GERD) market in Latin America is driven by a rise in pet ownership and increasing awareness of pet health among owners. The growing aging pet population leads to higher demand for specialized veterinary care and treatments. Additionally, advancements in veterinary diagnostics and the availability of targeted medications and diets contribute to market growth, as pet owners seek effective solutions for managing chronic conditions like GERD. The expanding veterinary infrastructure and rising expenditures on pet healthcare further support the development of this market in the region.

Brazilanimal gastroesophageal reflux disease (GERD) market is experiencing significant growth due to a rise in pet ownership across the country, driven by an increasing number of middle-class households and a growing urban population. The Pet Brazil Institute (IPB) indicated a rise in the pet population from 132 million in 2013 to 150 million in 2021. However, the Brazilian Association of the Pet Products Industry (ABINPET) reports an even higher number, with pets totaling 168 million in the country. This suggests that there are nearly two pets per household in Brazil. As more Brazilians welcome pets into their families, the demand for veterinary services, including diagnostic imaging, would increase.

Middle East & Africa Animal Gastroesophageal Reflux Disease (GERD) Market Trends

The animal gastroesophageal reflux disease (GERD) market in the Middle East and Africa is driven by increasing pet ownership, rising awareness of animal health issues, and a growing aging pet population that is more susceptible to gastrointestinal disorders. Additionally, advancements in veterinary care and diagnostics, coupled with a higher demand for specialized treatments and diets, are fueling market growth. The expansion of veterinary services and the increasing willingness of pet owners to invest in their pets' health further support the development of the GERD market in the region.

Saudi Arabiaanimal gastroesophageal reflux disease (GERD) market is growing owing to increasing pet ownership across the country & increased demand for veterinary care, including diagnosis and treatment of gastrointestinal disorders like GERD. Rising awareness among pet owners about the health needs of their animals contributes to early detection and treatment. Moreover, advancements in veterinary medicine and diagnostic technologies are enhancing the capability to manage GERD effectively. The market is also supported by a growing availability of specialized veterinary services and products tailored to manage and prevent GERD in pets, reflecting a broader trend toward higher standards of pet healthcare in the region.

Key Animal Gastroesophageal Reflux Disease Company Insights

Some of the key players operating in the market include McNeil Consumer Pharmaceuticals Co., Boehringer Ingelheim International GmbH., Zoetis Inc., Merck, and others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Animal Gastroesophageal Reflux Disease Companies:

The following are the leading companies in the animal gastroesophageal reflux disease market. These companies collectively hold the largest market share and dictate industry trends.

- McNeil Consumer Pharmaceuticals Co.

- Boehringer Ingelheim International GmbH.

- Zoetis Inc.

- Merck & Co., Inc.

- Elanco

- Ceva

- BioZyme, Inc.

- Annamaet Petfoods Inc.

- Hill's Pet Nutrition, Inc.

- Blue Buffalo Co., Ltd.

Recent Developments

-

In May 2024, Esaote North America Inc. launched the MyLab FOX veterinary ultrasound system, an innovative and adaptable tool designed to enhance veterinary imaging.

-

In April 2024, Royal Canin U.S. expanded its Veterinary Gastrointestinal (GI) portfolio with five new diets tailored to support digestive health in cats and dogs. These new diets include options such as Gastrointestinal Low Fat + Hydrolyzed Protein for dogs and Gastrointestinal Hydrolyzed Protein for cats, all designed to address food sensitivities and promote long-term gastrointestinal health.

Animal Gastroesophageal Reflux Disease Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.98 billion

Revenue Forecast in 2030

USD 3.10 billion

Growth Rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, animal, mode, route of administration, distribution channel, region.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

McNeil Consumer Pharmaceuticals Co.; Boehringer Ingelheim International GmbH.; Zoetis Inc.; Merck & Co., Inc.; Elanco; Ceva; BioZyme, Inc.; Annamaet Petfoods Inc.; Hill's Pet Nutrition, Inc.; Blue Buffalo Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Gastroesophageal Reflux Disease (GERD) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal gastroesophageal reflux disease (GERD) market report based on product, animal, mode, route of administration, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Laboratory Tests

-

Veterinary Imaging

-

Others

-

-

Treatment

-

Antacids

-

H2 Receptor Blockers

-

Proton Pump Inhibitors (PPIs)

-

Pro-kinetic agents

-

Others

-

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Livestock Animal

-

Cattle

-

Poultry

-

Swine

-

Sheep & Goats

-

Others

-

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescription

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary hospitals & clinics

-

Retail Pharmacies

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the animal gastroesophageal reflux disease market with a share of 43.66% in 2023. This high share is attributable to rising prevalence of GERD in the region, it is a common condition, especially in dog population in the region. A study published by NIH highlighted the prevalence of GERD in non-brachycephalic dogs in North America to be 18.1 to 27.8%. GERD is also seen in cats, though less frequently than in dogs.

b. Some key players operating in the animal gastroesophageal reflux disease market include McNeil Consumer Pharmaceuticals Co., Boehringer Ingelheim International GmbH., Zoetis Inc., Merck & Co., Inc., Elanco, Ceva, BioZyme, Inc., Annamaet Petfoods Inc., Hill's Pet Nutrition, Inc., Blue Buffalo Co., Ltd.

b. Key factors that are driving the market growth include rising prevalence of gastrointestinal diseases such as GERD in animals, particularly in dogs, increasing humanization of pets, and ongoing advancements in veterinary diagnostics and treatments.

b. The global animal gastroesophageal reflux disease market size was estimated at USD 1.82 billion in 2023 and is expected to reach USD 1.98 billion in 2024.

b. The global animal gastroesophageal reflux disease market is expected to grow at a compound annual growth rate of 7.80% from 2024 to 2030, to reach USD 3.10 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."