- Home

- »

- Animal Feed and Feed Additives

- »

-

Animal Feed Market Size And Share Analysis Report, 2030GVR Report cover

![Animal Feed Market Size, Share & Trends Report]()

Animal Feed Market (2023 - 2030) Size, Share & Trends Analysis Report By Species (Poultry, Cattle, Swine, Aqua, Pet), By Additives (Antibiotics, Vitamins), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-114-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Feed Market Summary

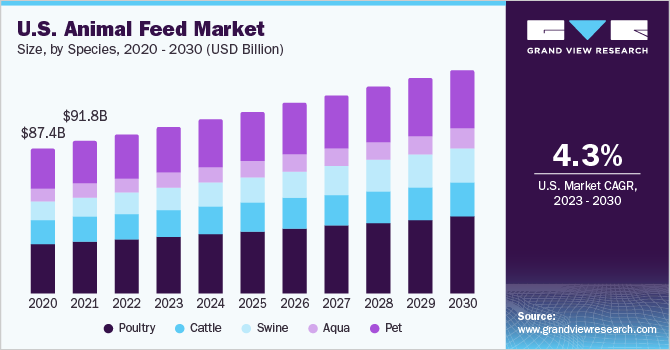

The global animal feed market size was estimated at USD 570.72 billion in 2022 and is projected to reach USD 816.78 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This growth is attributable to the increasing commercial livestock production owing to the rising demand for animal-derived protein such as milk, meat, and eggs. Moreover, the rising health awareness among people is driving the demand for poultry, cattle, swine, and aqua, which in turn is stimulating the product market growth.

Key Market Trends & Insights

- The Asia Pacific region dominated the market in 2022 with a highest revenue share of 37.6% in 2022.

- The Indian market grew over a CAGR of 3.5% over the last five years.

- In terms of species, the poultry segment dominated the market in 2022 with the highest revenue share of 36.0%.

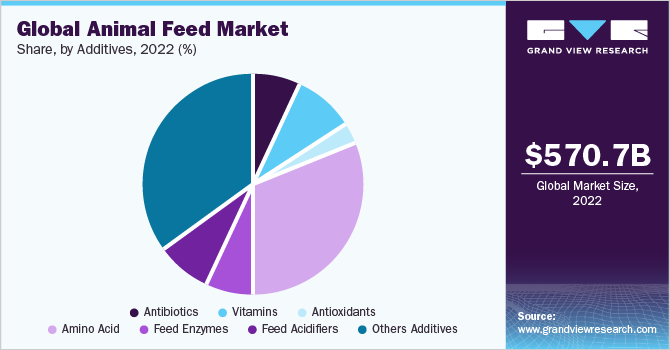

- In terms of additives, the amino acid segment dominated the market in 2022 with a highest revenue share of 30.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 570.72 billion

- 2030 Projected Market Size: USD 816.78 billion

- CAGR (2023-2030): 4.6%

- Asia Pacific: Largest market in 2022

The product market involves different types of feeds, including compounds, concentrates, and premixes. Product manufacturers use a wide range of raw materials such as grains, oilseeds, protein meals, vitamins, and minerals to formulate feeds that meet the specific nutritional requirements of different animal species and production stages. The dairy industry is projected to experience significant growth in the coming years due to the rising demand for dairy products driven by their recognized health benefits and versatile applications. There has been a notable surge in cattle farming across different regions as cattle serve as the primary source of various dairy products like milk, cream, butter, yogurt, and cheese, among others. This increased focus on cattle farming is expected to contribute to the expansion of the dairy industry during the forecast period.

The increasing global population and the growing demand to fulfill nutritional and taste preferences in developing countries have resulted in a notable surge in the industrialization of livestock production. In the past, cattle rearing in these countries was primarily done on a small scale, often as a backyard occupation. However, as the demand for livestock products has grown and awareness regarding the benefits of maintaining larger herds has increased, cattle-rearing practices in developing nations are undergoing transformation.

For instance, according to the Food and Agriculture Organization (FAO), India's cattle population has grown from 191.9 million in 2018 to 193.2 million in 2021. In addition, milk production in densely populated countries like India reached 108.3 million metric tons in 2021, reflecting a substantial 20.6% increase from the figures recorded in 2018. The regulations set by different regions for product manufacturing along with the fluctuating prices of raw materials such as soybean and corn may hinder the growth of the product market.

Species Insights

In terms of species, the poultry segment dominated the market in 2022 with the highest revenue share of 36.0%. This is attributable to continuous growth in broiler production across regions. The poultry industry is a significant component of the global agricultural sector, focused on the production of chicken, turkey, ducks, and other domesticated birds for meat, eggs, and other products. It is a vital source of animal protein, providing nutritious food to millions of people worldwide.

Poultry feed manufacturers use a combination of various ingredients, such as grains, oilseeds, protein meals, vitamins, minerals, and additives, to formulate balanced diets for different stages of poultry growth, including broilers (meat birds) and layers (egg-laying birds). The industry faces challenges such as fluctuating ingredient prices and disease outbreaks that may affect the production and supply of the product.

There are typically two types of cattle-beef and dairy. Their feeds are specifically made as beef cattle feed and dairy cattle feed. Internationally, the beef cattle sector has experienced notable growth in the last few years owing to increasing demand for high-quality beef meat worldwide, particularly in Western countries like the United States, the United Kingdom, and various Asian nations. Notably, China stands out as the largest consumer and producer of beef meat, with a growing beef cattle population contributing to this growth trend.

Additives Insights

In terms of additives, the amino acid segment dominated the market in 2022 with a highest revenue share of 30.6% in 2022. This is attributed to the ability of additives which help build immunity and promote animal growth. Different types of animal feed additives available in the market are enzymes, antioxidants, antibiotics, vitamins, amino acids, and acidifiers, which are used to increase efficiency and add nutritional value to the product. An increase in consumption is observed in developing countries where increasing income and urbanization are making consumers add variety to their diets.

Amino acids play an important role in preventing nail and skin issues in animals, moreover, they are also essential in preventing cerebral dysfunction, which can lead to muscular incoordination. As a result, there is a high demand for amino acids in the animal feed supplement and pet food industries. In addition, antibiotics are widely used to promote growth in livestock, making them a significant factor contributing to market growth. Antibiotics also enhance meat quality by increasing protein content and reducing fat content.

The extensive use of antibiotics as growth promoters has led to the development of antibiotic-resistant bacteria. In addition, the presence of traces of antibiotics in meat can have implications for human health due to their overuse in promoting growth. While some vitamins are naturally present in livestock feed, additional vitamin supplements are mixed to ensure proper nutrition. Commonly used vitamin additives, such as vitamins A, D, E, K, and riboflavin, are incorporated into animal feed as supplements to enhance and maintain animal health. These vitamins are also administered to improve reproductive outcomes in animals. Furthermore, there is a growing consumer awareness regarding the benefits of fat-soluble vitamins, which is expected to drive the demand for these vitamins in the industry.

Regional Insights

The Asia Pacific region dominated the market in 2022 with a highest revenue share of 37.6% in 2022. This is attributed to the rapidly growing population, along with the rising middle-class income and increasing urbanization. Owing to the rising incomes and changes in dietary preferences, there is a higher demand for animal-derived products, leading to an increased need for animal feed to support livestock production. Furthermore, major industry players are expected to expand their poultry feed offerings in response to changing consumer preferences for meat consumption.

As per the National Investment Promotion Facilitation Agency (NIPFA), the Indian market grew over a CAGR of 3.5% over the last five years. The compound cattle feed segment is further expected to expand with a projected market potential of $400 - $650 million and an estimated growth rate of 16% over the next five years. This growth is driven by factors such as the untapped potential of the organic feed market. These factors are further expected to increase the demand for animal feed in the region.

The North America market, particularly the U.S., is witnessing an increase in meat consumption, and strict regulations concerning meat quality are anticipated to be significant driving forces for the industry. The presence of well-established mills and pet food manufacturing industries will also contribute to the demand for animal feed products. Furthermore, the growing health awareness among consumers, along with a rise in per capita meat consumption, will further propel industry growth. The abundant availability of raw materials, including maize and dextrose, is expected to be a driving factor for the market's expansion during the forecast period.

The United States holds a significant position in the market of North America. The domestic animal food manufacturing industry greatly benefits from the free-trade agreement with Canada and Mexico (implemented through NAFTA), which facilitates the export of feed ingredients, feed, and pet food. This trade agreement, combined with the growth of the livestock industry, is a key driver in the growth of the market in the country.

Key Companies & Market Share Insights

The market is fragmented with international & domestic players operating globally. A few of the prominent players in the product market are BASF SE, Cargill Inc.& ADM, and Archer Daniels Midland Company.

The market players adopt strategies to increase the reach of their products by serving a larger consumer base in the market and increasing the availability of their products in diverse geographical areas. For instance, in January 2023, De Heus Animal Nutrition installed a new greenfield animal feed manufacturing plant in Ivory Coast, West Africa. The facility has an initial production capacity of 120,000 metric tons of feed for various animals, including cattle. Some prominent players in the global animal feed market include:

-

Archer Daniels Midland Company

-

BASF SE

-

Land O Lakes Purina

-

Nutreco N.V. (Trouw nutrition)

-

Cargill Inc.

-

Kemin Industries, Inc.

-

ANOVA Group

-

ADM

-

Chr. Hansen Holding

-

Alltech, Inc.

Animal Feed Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 597.20 billion

Revenue forecast in 2030

USD 816.78 billion

Growth rate

CAGR of 4.6% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, additives, region

Regional scope

U.S.; Canada; Mexico; Germany; UK; Turkey; Russia; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia & South Africa

Market Players

Archer Daniels Midland Company, BASF SE, Land O Lakes Purina, Nutreco N.V. (Trouw nutrition); Cargill Inc.; BASF SE; Kemin Industries, Inc.; ANOVA Group; ADM; Chr. Hansen Holding; Alltech, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Feed Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal feed market report based on species, additives, and region:

-

Species Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Poultry

-

Cattle

-

Swine

-

Aqua

-

Pet

-

-

Additives Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Antibiotics

-

Vitamins

-

Antioxidants

-

Amino Acid

-

Feed Enzymes

-

Feed Acidifiers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Turkey

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global animal feed market size was estimated at USD 570.72 billion in 2022 and is expected to reach USD 597.20 billion in 2023.

b. The global animal feed market is expected to grow at a compound annual growth rate of 4.6% from 2023 to 2030 to reach USD 816.78 billion by 2030.

b. Asia Pacific dominated the animal feed market with a share of 37.6% in 2022. This is attributable to the rapidly growing population, along with the rising middle-class income and increasing urbanization

b. Some key players operating in the animal feed market include Archer Daniels Midland Company, BASF SE, Land O Lakes Purina, Nutreco N.V., Cargill Inc., BASF SE, Kemin Industries, Inc., ANOVA Group, ADM, Chr. Hansen Holding, Alltech, Inc.

b. Key factors that are driving the market growth include increasing commercial livestock production owing to the rising demand for animal-derived protein such as milk, meat, and eggs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.