Animal Feed Additives Market Size, Share & Trends Analysis Report By Product (Antibiotics, Vitamins), By Source (Natural, Synthetic), By Form (Liquid, Dry), By Livestock, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-070-5

- Number of Report Pages: 141

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Animal Feed Additives Market Size & Trends

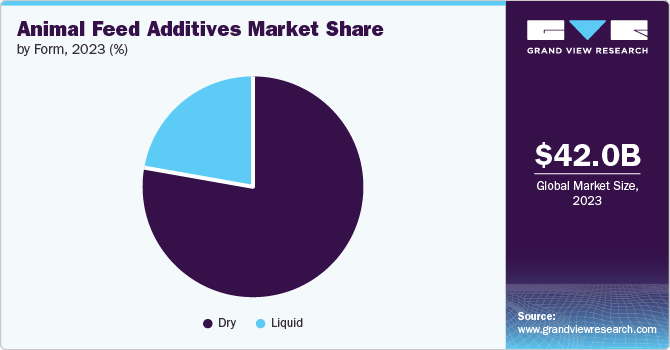

The global animal feed additives market size was estimated at USD 42.0 billion in 2023 and is projected to grow USD 55.46 billion by 2030, growing at a CAGR of 4.3% from 2024 to 2030. This is mainly attributed to surging animal feed production due to rising meat consumption worldwide, which is expected to boost product consumption. Moreover, increasing demand for sustainable feed additives will offer significant growth opportunities in the coming years.

The global consumption of meat has been experiencing an upward trend due to population growth, increasing incomes, and evolving dietary preferences, particularly in low- and middle-income countries. This rise in meat consumption is evident in the consistent increase in per capita meat consumption trends over the years. The growing demand for meat presents opportunities for the product market, as it plays a crucial role in enhancing animal health, growth, and productivity.

Drivers, Opportunities & Restraints

There is a growing awareness among consumers and industry players about the benefits of feed additives. Concerns about livestock diseases, meat quality, and safety have prompted the product usage to improve overall health and enhance meat production. Consumers are becoming more conscious of the impact of meat production on the environment and are seeking products that promote animal welfare and sustainable practices. This increased awareness has led to a greater product demand that can address these concerns.

The United Nations Food and Agriculture Organization (FAO) forecasts that by 2050, global food demand will increase by 60%, with animal protein production expected to grow at an annual rate of approximately 1.7%. Specifically, meat production is projected to rise by nearly 70%, aquaculture by 90%, and dairy by 55%. This growth is driven by rising populations and changing dietary preferences, particularly in developing countries, which are expected to account for most of the increase in demand.

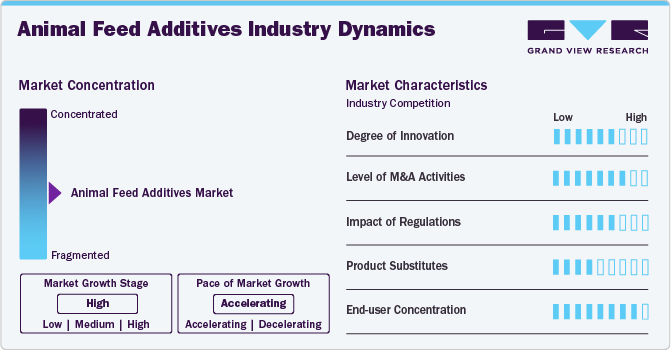

Market Concentration & Characteristics

The market is moderately consolidated with intense competition among the tier-1 and tier-2 players.

The USDA focuses on animal health and welfare, while the FDA oversees the regulation of their food products. The FDA's Center for Veterinary Medicine (CVM) explicitly regulates feed products. These regulatory bodies set requirements for using additives in animal feed, including labeling, safety, and efficacy standards.

Companies adopt mergers and acquisitions to quickly gain market share, access new technologies, or enter new markets by leveraging the established capabilities of other firms. These strategies can lead to cost efficiencies through enhanced competitive positioning and provide strategic advantages such as increased resources.

Product Categories Insights

“Amino acids segment is expected to grow at 5.2% CAGR.”

Amino acids dominated the market with a revenue share of 19.15% in 2023, owing to an increasing demand for high-quality animal proteins. Also, there is a need for enhanced feed efficiency and a strong emphasis on animal health and welfare. Amino acids play a crucial role as essential nutrients required in specific amounts to meet the nutritional needs of livestock. They are often incorporated into our product to support optimal growth, effective reproduction, and overall performance of livestock.

Preservatives is expected to grow significantly over the forecast period. They are a vital product category utilized to uphold the quality and safety of animal feed. They prevent spoilage, inhibit microbial growth, and extend the shelf life of ingredients and finished products. Preservation methods play a critical role in ensuring that the feed remains fresh, nutritious, and free from harmful contaminants.

Source Insights

“Synthetic segment is expected to witness growth at 4.5% CAGR.”

Synthetic accounted for the largest share of 65.68% in 2023. This is mainly due to advancements in synthetic chemistry contributing to the development of more effective and safer products and the higher concentration of synthetic feed additives, which result in lower inclusion rates in feeds.

The natural segment is expected to grow at the second-fastest CAGR during the forecast period. This segment covers a wide range of products, such as probiotics, prebiotics, enzymes, essential oils, and other compounds. These additives tackle important consumer concerns such as reducing antibiotic use, enhancing product safety, and improving animal health and efficiency.

Livestock Insights

“Poultry segment is expected to witness growth at 4.6% CAGR.”

The poultry segment held the largest market share of 45.79% in 2023. Poultry, especially broilers, plays a crucial role in the global market. Unlike other livestock, poultry has shorter production cycles, allowing feed additives such as antibiotics, probiotics, and growth promoters to deliver fast and noticeable results in terms of weight gain, disease prevention, and feed conversion efficiency.

Feed additives for swine include non-nutritive ingredients that, while not essential, can significantly improve their performance. The FDA regulates these additives, which encompass antibacterial agents, metabolic modifiers, probiotics/prebiotics, and enzymes, among others.

Form Insights

“Dry segment is expected to witness growth at 4.4% CAGR.”

Dry form dominated the market with a revenue share of 78.41% in 2023. It is widely used due to its ease of handling, cost-effectiveness, and convenience in storage and transportation. It offers several advantages, making it a preferred choice among feed manufacturers and livestock producers.

Liquid additives offer advantages such as ease of mixing, precise dosing, and improved palatability, making them a popular choice for product manufacturers and livestock producers.

Region Insight

“Asia Pacific segment is expected to grow at 4.8% CAGR.”

Asia Pacific dominated the market segment with a revenue share of 40.50% in 2023, owing to a large livestock population and the presence of various agricultural economies in the region. In 2023, China and Vietnam emerged as the most prominent markets in Asia Pacific. Pork and poultry are the largest livestock types in the country, owing to their suitability for the food preferences of the masses in these countries.

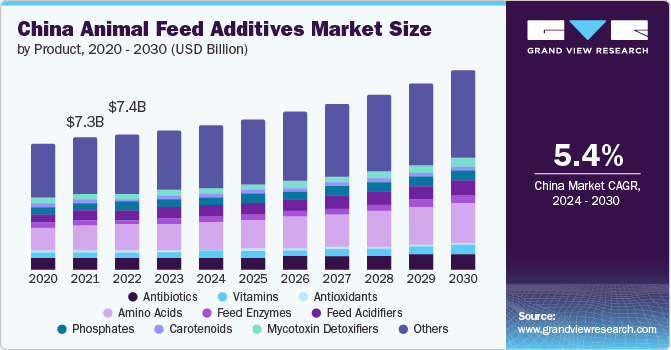

China Animal Feed Additives Market Trends

The animal feed additives in China is expected to grow significantly during the forecast period. In China, many people are moving to urban areas for higher incomes. This trend is leading to changes in lifestyle and greater disposable income for the population, which in turn is shifting their dietary habits from traditional foods to meat products. Consequently, China is now importing more meat and the raw materials needed for meat production.

Europe Animal Feed Additives Market Trends

The animal feed additives market in Europe is driven by innovation and is highly regulated. The market in the region has traditionally been highly regulated in terms of human health and, well-being and environment. This leads to frequent changes in the guidelines for feed additives through bans and restrictions. Europe is expected to continue growing steadily over the forecast period.

North America Animal Feed Additives Market Trends

The animal feed additives market in North America is expected to grow lucratively during the forecast period. The surging demand for meat, particularly in North America, along with rigorous standards for maintaining meat quality in the region, is projected to remain the primary driver of the regional market growth.

Key Animal Feed Additives Company Insights

Some of the key players operating in the market include ADM, Ajinomoto Co., Inc., Alltech, Inc., and Lallemand, Inc.

-

Archer Daniels Midland Co (ADM) produces, processes, transports, stores, and merchandises agricultural products, commodities, and ingredients. The company's portfolio includes food and beverage ingredients and products made from oilseeds, corn, wheat, and other agricultural commodities, such as natural flavors and colors, health and nutrition products, animal feed, and biofuels.

-

Ajinomoto Co Inc (Ajinomoto) is engaged in innovating and producing a wide range of high-quality products, including sauces, seasonings, and convenient nourishment solutions such as cup soup and coffee. In addition to these offerings, it supplies office provisions, coffee vending machines, bakery goods, frozen and processed foods, edible oils, amino acids, and animal nutrition products.

Key Animal Feed Additives Companies:

The following are the leading companies in the animal feed additives market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Ajinomoto Co., Inc.

- Alltech, Inc.

- Lallemand Inc.

- BASF SE

- BIOMIN Holding GmbH

- Cargill, Incorporated

- Centafarm SRL

- Novonesis.

- DSM

- Evonik Industries AG

- Nutreco

- Adisseo

- Kemin Industries, Inc.

- Elanco

Recent Developments

-

In May 2023, Evonik Industries AG launched the enhanced Biolys product for animal feeds, which delivers a high concentration of L-lysine for optimal animal nutrition.

-

In August 2023, Gramik launched a new range of cattle feed supplements, which include Doodh Sagar, Heifer Mix, and Urja Pashu PoshakAahar.

Animal Feed Additives Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 43.10 billion |

|

Revenue forecast in 2030 |

USD 55.46 billion |

|

Growth rate |

CAGR of 4.3% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, source, form, livestock, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; Netherlands; Belgium; Russia; China; India; Japan; South Korea; Thailand; Vietnam; Indonesia; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

ADM, Ajinomoto Co., Inc.; Alltech, Inc.; Lallemand Inc.; BASF SE; BIOMIN Holding GmbH; Cargill, Incorporated; Centafarm SRL; Novonesis.; DSM; Evonik Industries AG; Nutreco; Adisseo; Kemin Industries, Inc.; Elanco |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Animal Feed Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global animal feed additives market report based on product, source, form, livestock, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibiotics

-

Vitamins

-

Vitamin A

-

Vitamin E

-

Vitamin B

-

Vitamin C

-

Others

-

-

Antioxidants

-

Amino Acids

-

Tryptophan

-

Lysine

-

Methionine

-

Threonine

-

Others

-

-

Feed Enzymes

-

Phytase

-

Non-Starch Polysaccharides & Others

-

-

Feed Acidifiers

-

Phosphates

-

Carotenoids

-

Mycotoxin Detoxifiers

-

Flavors & Sweeteners

-

Minerals

-

Non-Protein Nitrogen

-

Phytogenics

-

Preservatives

-

Probiotics

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Livestock Outlook (Revenue, USD Million, 2018 - 2030)

-

Swine

-

Poultry

-

Cattle

-

Aquaculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Vietnam

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The poultry segment held the largest market share of 45.8% in 2023. Poultry have shorter production cycles, allowing feed additives such as antibiotics, probiotics, and growth promoters to deliver fast and noticeable results in terms of weight gain, disease prevention, and feed conversion efficiency.

b. Key players in the market include ADM, Ajinomoto Co., Inc., Alltech, Inc., BASF SE, Lallemand Inc.

b. Growing meat consumption coupled with a recent outbreak of diseases has generated the need for additives in poultry, aqua, and other animal-based products which in turn, is expected to drive the demand.

b. The global animal feed additives market size was estimated at USD 42.0 billion in 2023 and is expected to reach USD 43.10 billion in 2024.

b. The global animal feed additives market is projected to expand at a CAGR of 4.3% from 2024 to 2030 to reach USD 55.46 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."