- Home

- »

- Plastics, Polymers & Resins

- »

-

Anhydrous Hydrogen Fluoride Market, Industry Report, 2030GVR Report cover

![Anhydrous Hydrogen Fluoride Market Size, Share & Trends Report]()

Anhydrous Hydrogen Fluoride Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Fluoropolymers, Fluorogases, Pesticides), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-006-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Anhydrous Hydrogen Fluoride Market Summary

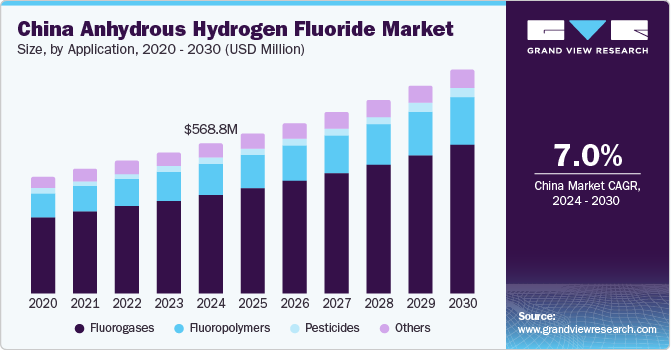

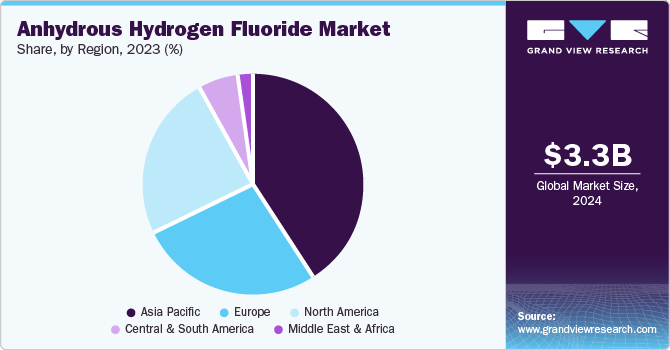

The global anhydrous hydrogen fluoride market was estimated at USD 3.33 billion in 2024 and is projected to reach USD 4.70 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The increasing demand for fluorinated products in sectors such as pharmaceuticals, agrochemicals, and electronics is a primary driver. For instance, AHF is essential in the production of fluorinated intermediates used in the synthesis of pharmaceuticals and crop protection chemicals, contributing to the growth of these markets.

Key Market Trends & Insights

- Asia Pacific was the largest revenue generating market in 2024.

- Based on application, fluorogases segment dominated the market with a revenue share of 63.7% in 2024.

- Based on application, fluoropolymers segment is expected to grow significantly at 6.0% CAGR over forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3.33 Billion

- 2030 Projected Market Size: USD 4.70 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

A growing emphasis on sustainable energy solutions is propelling the global AHF market. Anhydrous hydrogen fluoride is used in the production of refrigerants that have a lower global warming potential compared to traditional refrigerants. As governments and regulatory bodies enforce stricter environmental regulations to combat climate change, the shift towards more eco-friendly alternatives is driving increased interest in AHF. This trend not only supports environmental initiatives but also positions AHF as a more attractive option for industries seeking sustainable practices.

The adoption of anhydrous hydrogen fluoride in oil refining processes is another significant driver for the market. AHF is utilized as a catalyst in alkylation, a process that enhances the quality of gasoline by increasing its octane rating. With the global demand for cleaner and more efficient fuels rising, the oil refining sector increasingly relies on AHF to meet these standards. This growing requirement for high-quality fuels contributes to the sustained demand for anhydrous hydrogen fluoride within the energy sector, reinforcing its importance in the market

Application Insights

Fluorogases segment dominated the market with a revenue share of 63.7% in 2024 owing to the transition to environmentally friendly refrigerants, which is a significant driver for the fluorogases application segment of the AHF market. Anhydrous hydrogen fluoride is used in producing hydrofluorocarbons (HFCs) and other fluorinated refrigerants that have lower global warming potentials compared to traditional options. As countries worldwide adopt regulations to phase out high-GWP substances, the demand for low-GWP fluorinated refrigerants derived from AHF is expected to increase, boosting the market. Anhydrous hydrogen fluoride is a critical precursor for various specialty fluorinated chemicals used in diverse applications, including pharmaceuticals and agrochemicals. The growing demand for specialty chemicals, which often require fluorinated compounds for their synthesis, drives the need for AHF. As industries seek to innovate and develop new products, the demand for fluorogases derived from AHF continues to rise.

Fluoropolymers segment is expected to grow significantly at 6.0% CAGR over forecast period. The increasing demand for high-performance materials is a significant driver for the fluoropolymers segment. Fluoropolymers are known for their exceptional properties, including chemical resistance, thermal stability, and low friction, making them ideal for applications in industries such as automotive, aerospace, electronics, and healthcare. As industries seek materials that can withstand extreme conditions and provide enhanced performance, the demand for fluoropolymers continues to grow, subsequently driving the need for anhydrous hydrogen fluoride in their production.

The rapid expansion of the electronics industry is another crucial driver for the fluoropolymers segment. Fluoropolymers, such as polytetrafluoroethylene (PTFE), are widely used in the manufacturing of insulating materials, coatings, and components for electronic devices, including smartphones, computers, and circuit boards. With the continuous advancements in technology and the increasing production of electronic devices, the demand for fluoropolymers is expected to rise, thereby boosting the consumption of AHF.

Region Insights

The pharmaceutical and agrochemical sectors are also contributing to the demand for anhydrous hydrogen fluoride in North America. Anhydrous Hydrogen Fluoride (AHF) is used in synthesizing various pharmaceutical products and crop protection chemicals, making it essential for these industries. As the demand for innovative medications and agricultural solutions grows, the consumption of AHF is likely to rise.

U.S. Anhydrous Hydrogen Fluoride Market Trends

The Anhydrous Hydrogen Fluoride market in U.S. The regulatory environment in the U.S. increasingly favors the use of eco-friendly chemicals, including anhydrous hydrogen fluoride, which is used to produce refrigerants with lower global warming potential. Stricter regulations aimed at reducing greenhouse gas emissions and promoting sustainable practices are driving industries to adopt more environmentally friendly alternatives, contributing to the growth of the AHF market.

Asia Pacific Anhydrous Hydrogen Fluoride Market Trends

The expansion of the chemical processing industry in Asia Pacific is another significant driver for the anhydrous hydrogen fluoride market. Anhydrous hydrogen fluoride is widely used in producing fluorinated compounds, which find applications in pharmaceuticals, agrochemicals, and other specialty chemicals. As the chemical processing sector continues to grow, driven by increasing demand for diverse chemical products, the consumption of AHF is expected to rise.

Europe Anhydrous Hydrogen Fluoride Market Trends

The push for renewable energy technologies in Europe is also contributing to the demand for anhydrous hydrogen fluoride. AHF is used in producing materials that are essential for renewable energy applications, such as photovoltaic cells for solar panels. As the region invests in renewable energy solutions to meet sustainability goals, the demand for AHF in these applications is likely to increase.

Key Anhydrous Hydrogen Fluoride Company Insights

Some of the key players operating in the market include Honeywell International Inc.; Solvay; Linde plc.

-

Honeywell International Inc. is a multinational conglomerate headquartered in Charlotte, North Carolina, known for its diverse range of technologies and manufacturing capabilities across various sectors, including aerospace, building technologies, performance materials, and safety solutions. In the context of anhydrous hydrogen fluoride, Honeywell is a prominent player, offering high-quality AHF as a key chemical intermediate for various applications, including the production of fluorinated chemicals, refrigerants, and electronic materials.

-

Solvay offers a range of high-purity products that cater to diverse applications, such as semiconductor manufacturing, fluorinated compounds production, and specialty chemicals. Their AHF products are renowned for their exceptional quality and reliability, supporting customers in achieving advanced technological applications while adhering to stringent environmental regulations.

Key Anhydrous Hydrogen Fluoride Companies:

The following are the leading companies in the anhydrous hydrogen fluoride market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- Lanxess

- Navin Fluorine International Limited

- Fubao Group

- Foshan Nanhai Shuangfu Chemical Co., Ltd

- Foosung, Co Ltd

- Fluorchemie Dohna GmbH

- Fluorsid S.p.A.

- Derivados del Fluor SA

Recent Developments

-

In September 2023, SOJITZ has selected Buss ChemTech’s hydrogen fluoride (HF) technology for a new HF plant in Japan. This decision underscores the importance of Buss ChemTech's reliable HF technology in this strategically vital project aimed at enhancing fluorine delivery in Japan.

-

In March 2022, Nutrien, in collaboration with its partner Arkema, completed the construction of an Anhydrous Hydrogen Fluoride (AHF) plant in Aurora, North Carolina, United States. Nutrien operates two major integrated phosphate facilities and four regional product enhancement facilities in the U.S.

Anhydrous Hydrogen Fluoride Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.52 billion

Revenue forecast in 2030

USD 4.70 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Honeywell International Inc.; Solvay; Linde plc; Arkema; Lanxess; Navin Fluorine International Limited; Fubao Group; Foshan Nanhai Shuangfu Chemical Co., Ltd; Foosung Co Ltd; Fluorchemie Dohna GmbH; Fluorsid S.p.A.; Derivados del Fluor SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anhydrous Hydrogen Fluoride Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anhydrous hydrogen fluoride market report based on application and region:

-

Application Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Fluoropolymers

-

Fluorogases

-

Pesticides

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anhydrous hydrogen fluoride market size was estimated at USD 3.33 billion in 2024 and is expected to reach USD 3.52 billion in 2025.

b. The global anhydrous hydrogen fluoride market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 4.70 billion by 2030.

b. Asia Pacific dominated the global anhydrous hydrogen fluoride market with a share of 41.0% in 2024. The expansion of the chemical processing industry in Asia Pacific is a significant driver for the AHF market.

b. Some key players operating in the global anhydrous hydrogen fluoride market include Honeywell International Inc., Solvay, Linde plc,Arkema, Lanxess, Navin Fluorine International Limited, Fubao Group, Foshan Nanhai Shuangfu, Chemical Co., Ltd, Foosung,. Co Ltd, Fluorchemie, Dohna GmbH, Fluorsid S.p.A., Derivados del Fluor SA.

b. Key factors that are driving the market growth include growing utilization of anhydrous hydrogen fluoride in fluorogases and fluoropolymers as they are considered as a prominent chemical compounds in fluoride chemistry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.