- Home

- »

- Medical Devices

- »

-

Anesthesia And Respiratory Devices Market Report, 2033GVR Report cover

![Anesthesia And Respiratory Devices Market Size, Share & Trends Report]()

Anesthesia And Respiratory Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Respiratory Devices, Anesthesia Devices), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: 978-1-68038-557-1

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Anesthesia And Respiratory Devices Market Summary

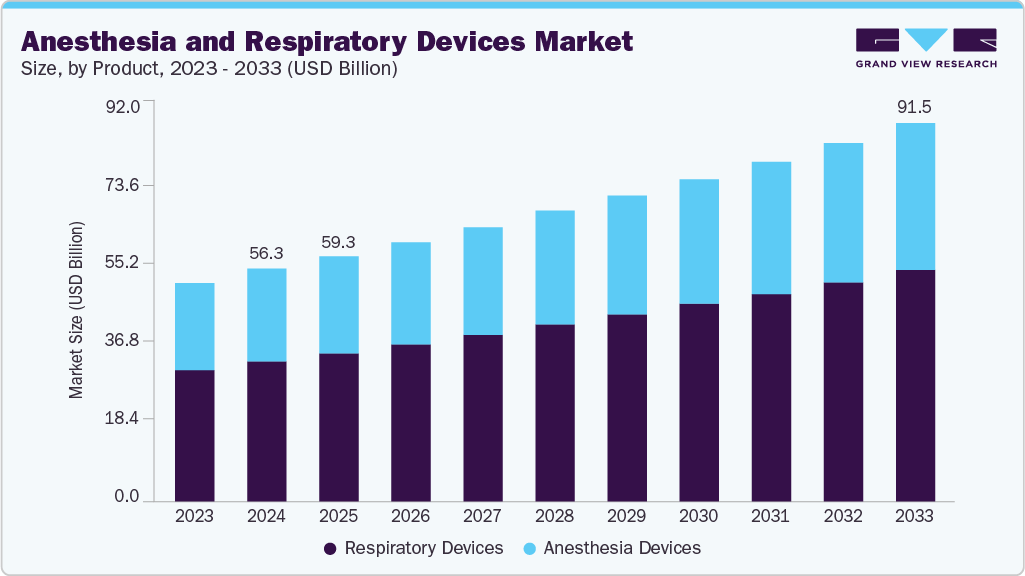

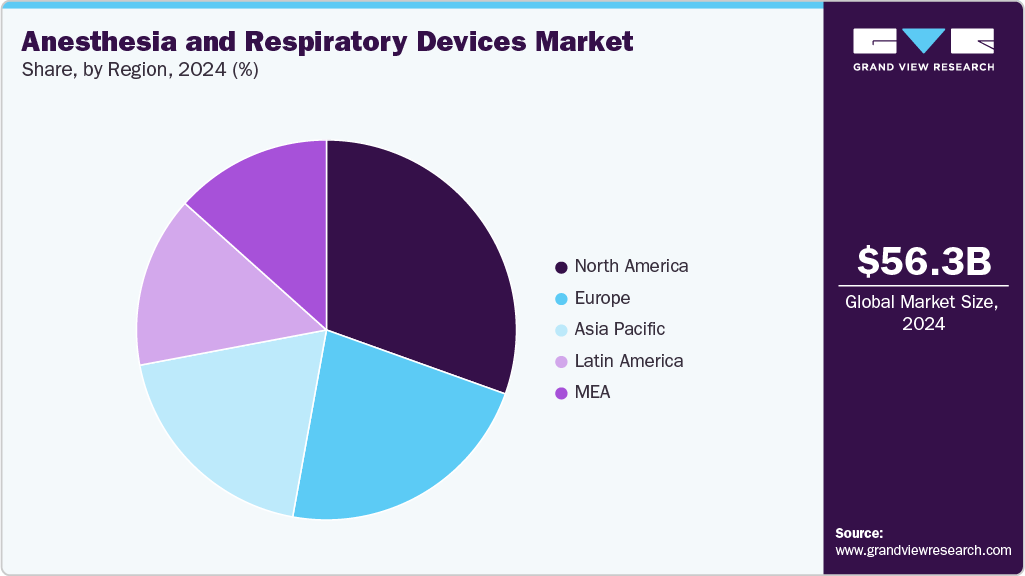

The global anesthesia and respiratory devices market size was estimated at USD 56.3 billion in 2024 and is expected to reach USD 91.5 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The industry is driven by an increased incidence of respiratory disorders such as Obstructive Sleep Apnea (OSA) and Chronic Obstructive Pulmonary Disease (COPD), fast urbanization, an increase in surgical operations, pollution levels, a geriatric population, and a smoking population.

Key Market Trends & Insights

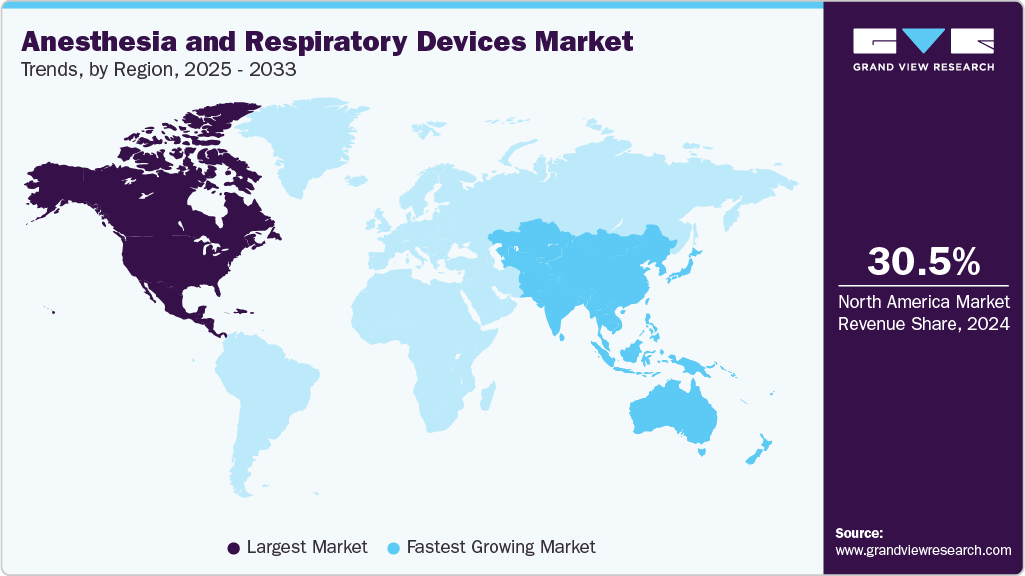

- North America dominated the market for anesthesia and respiratory devices with a share of 30.5% in 2024.

- Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- Based on product, the respiratory devices segment held the largest market share of 60.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 56.3 Billion

- 2033 Projected Market Size: USD 91.5 Billion

- CAGR (2025-2033): 5.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the Australian Institute of Health and Welfare, in 2023, COPD accounted for 50% of the total burden of disease due to respiratory conditions and 3.6% of the total disease burden. Furthermore, according to the American Lung Association, in 2022, 4.6% of adults, or 11.7 million people, reported a diagnosis of chronic bronchitis, COPD, or emphysema.

The rising population of smokers is also leading to the increasing incidence of respiratory diseases, such as emphysema, bronchitis, cancer, and other lung diseases, which is leading to the growing demand for respiratory devices, hence boosting the market growth. According to WHO data published in July 2023, tobacco use is responsible for over 8 million deaths annually worldwide. Of these, more than 7 million are attributed to direct tobacco consumption, while approximately 1.3 million are due to second-hand smoke exposure among non-smokers.

Furthermore, the demand for anesthetic and respiratory equipment is expected to rise as technology continues to advance. Manufacturers are driving market growth by innovating patient care, integrating advanced patient monitors, novel metrics, IT solutions, and cutting-edge devices. For example, in September 2023, Smartmi launched the Evaporative Humidifier 3, which enhances air quality with features designed to combat dry air issues like respiratory allergies, irritation, and germ proliferation, making it ideal for individuals with respiratory conditions and homes in dry climates or with forced air heating systems.

Recent Product Launches and Developments

Company

Launch Date

Product

Description

Inogen

April 2024

Rove 4 Portable Oxygen Concentrator

A lightweight, FAA-compliant portable oxygen concentrator designed for mobility and long battery life.

Fisher & Paykel

April 2024

New Respiratory Humidifier for Home Mechanical Ventilation

Designed to provide optimal humidification therapy for patients in home ventilation settings.

Medline

May 2024 (approx.)

TurboMist Nebulizer

A fast, high-efficiency nebulizer for respiratory treatments in clinical and homecare settings.

Hans Rudolph

April 2024 (approx.)

Disposable Masks for NIV & O₂ Therapy

New disposable mask line to support non-invasive ventilation and oxygen delivery with improved comfort.

Dräger

March 2024 (approx.)

Atlan Series Anesthesia Workstations

Advanced workstations integrating safety, ventilation precision, and modular upgrades.

Mindray

June 2024

A-Series Anesthesia System Upgrades

Enhancements in user interface, safety algorithms, and workflow efficiency for the A-Series platform.

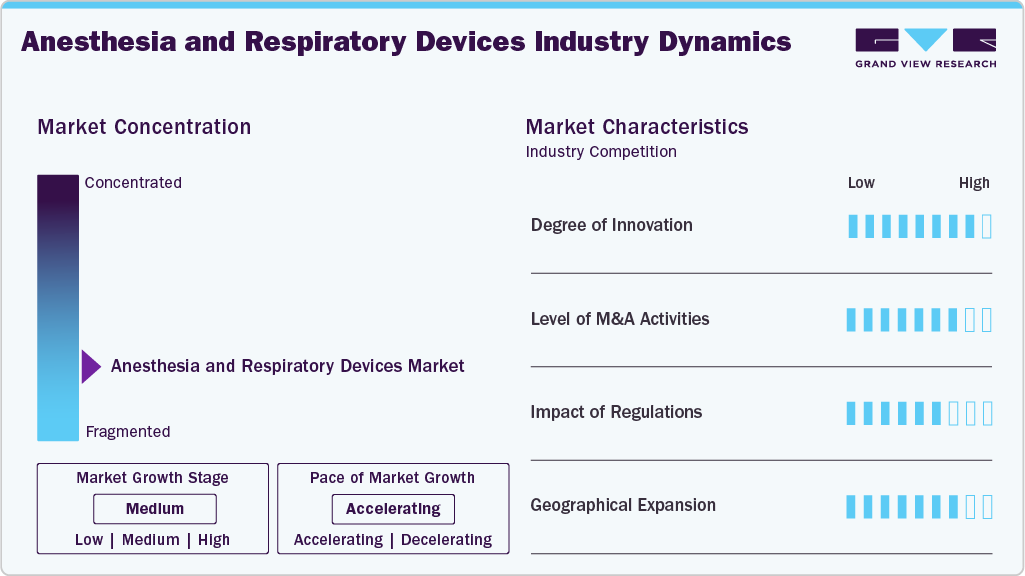

Market Concentration & Characteristics

The degree of innovation in the industry is high. Technological innovation in respiratory therapeutic devices includes advancements in portable ventilators, smart inhalers, and AI-driven respiratory systems. For instance, in November 2023, the U.S. startup Samay presented clinical findings demonstrating the efficacy of its Sylvee wearable technology in accurately diagnosing COPD and forecasting critical exacerbations before onset. The company reported that its AI-supported device successfully identified "air trapping," a key early indicator of COPD exacerbations, with an accuracy of 83%. This performance was compared to traditional hospital-based Pulmonary Function Tests (PFTs), which utilize in-person spirometry, plethysmography, or CT scans.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. In August 2024, ZOLL, a subsidiary of Asahi Kasei, acquired Vyaire Medical's ventilator business during Vyaire's Chapter 11 bankruptcy process. Once the acquisition is finalized, the company will integrate Vyaire's ventilators into ZOLL's product portfolio, expanding its capacity to support a wider range of clinicians and patients.

The impact of regulations is moderate to high in the industry. The industry involves several digital technologies, including AI and ML. It is regulated by different bodies in different countries. The U.S. FDA regulates anesthesia and respiratory devices, along with other medical devices, in the U.S. The industry players might face severe challenges if they fail to abide by the regulations. For instance, in April 2024, a federal court mandated that Philips RS North America LLC (Philips Respironics) halt the manufacturing and distribution of most respiratory and sleep devices at three Pennsylvania facilities. This order requires the company to implement specific safety measures and ensure compliance with the Federal Food, Drug, and Cosmetic Act (FDCA).

Geographical expansion enables companies to tap into new, underserved regions with varying healthcare needs and regulatory environments. For instance, in April 2022, CAIRE, Inc. planned to expand its oxygen portfolio with companion 5 and new Life Intensity 10 stationary oxygen concentrators in Brazil. Due to the COVID-19 pandemic, there was a shortage of oxygen across Latin America, creating an opportunity for the company to expand its oxygen therapy portfolio.

Product Insights

Respiratory devices accounted for a majority share of over 60.0% in the product segment in 2024. The key factors expected to fuel the segment's growth are the rising prevalence of respiratory diseases, the availability of advanced respiratory devices, the growing number of surgeries performed, and rising healthcare expenditure. These devices manage and treat conditions including fibrosis, asthma, chronic obstructive pulmonary disease (COPD), and acute respiratory distress syndrome. For instance, in May 2023, Drive DeVilbiss International introduced a new energy-efficient 10-liter oxygen concentrator. This device is designed to address the unique challenges of semi-urban and rural healthcare environments, making it suitable for providing oxygen therapy at primary and secondary health levels.

The anesthesia devices segment is experiencing significant growth, driven by the increasing number of surgical procedures, both elective and emergency. This rise has increased demand for advanced anesthesia workstations and delivery systems in hospitals and ambulatory surgical centers. In addition, the prevalence of chronic diseases such as cardiovascular disorders, cancer, and orthopedic conditions, particularly among the aging population, is contributing to a greater volume of surgeries, which in turn boosts the adoption of anesthesia devices.

Regional Insights

North America anesthesia and respiratory devices market accounted for the largest revenue share of 30.5% in 2024. The increasing geriatric population in the U.S. is driving a rise in surgeries, boosting market growth. According to the U.S. Census Bureau, over 54 million adults aged 65 and older were reported in the U.S. in 2021. Furthermore, the World Health Organization projects that the geriatric population will grow from 12% in 2015 to 22% by 2050.

In addition, healthcare cost containment issues and the economic crisis have compelled the government to introduce new strategies to reduce hospital stays and impose an excise tax on medical devices. These initiatives have compelled patients and physicians to opt for respiratory and anesthesia monitoring and therapeutic devices for home care. However, the excise tax is expected to negatively affect the original equipment manufacturers. The major players in the U.S. market are GE Healthcare, Koninklijke Philips N.V., Teleflex Inc., Masimo, and others.

U.S. Anesthesia and Respiratory Devices Market Trends

The anesthesia and respiratory devices market in the U.S. is driven by favorable reimbursement policies that support the adoption of these devices. A significant development occurred in March 2024, when a U.S. Congressman introduced the Supplemental Oxygen Access Reform (SOAR) Act to improve access to supplementary oxygen for Medicare beneficiaries. This legislation is expected to boost the adoption of oxygen concentrators nationwide. In addition, rising healthcare spending in the U.S. is increasing the demand for effective diagnosis and treatment of respiratory diseases, further driving the market for oxygen concentrators.

Europe Anesthesia and Respiratory Devices Market Trends

The anesthesia and respiratory devices market in Europe is projected to experience significant growth during the forecast period. The region's robust healthcare infrastructure and commitment to innovation drive the adoption of advanced mechanical ventilators. In addition, the aging population in Europe is leading to a rise in respiratory illnesses and chronic obstructive pulmonary disease (COPD), increasing the demand for ventilatory support. For instance, Eurostat projects that by 2050, Europe will have nearly half a million centenarians, with the median age expected to rise by 4.5 years to 48.2 years.

The UK anesthesia and respiratory devices market had a substantial share in 2024. The growth is attributed to the active participation of market players and other organizations in developing cost-effective respiratory devices, among other factors. For instance, in February 2022, OxVent, a rapidly scalable and deployable low-cost ventilator developed by a collaboration between the University of Oxford and King’s College London, received approval for large-scale development and adoption as a social enterprise.

The anesthesia and respiratory devices market in France is positively influenced by the increasing efforts of market players. For instance, in August 2020, ZOOOK, a French lifestyle brand, launched the Oximate Finger Tip Pulse Oximeter. This compact device is specifically designed to accurately monitor pulse rates and blood oxygen saturation levels. It features a single-button function for ease of operation and is comfortable to wear, enhancing the user experience. By expanding its health-tech product range with this device, ZOOOK strengthens its market position and contributes to the overall growth of the pulse oximeter market in France.

Asia Pacific Anesthesia and Respiratory Devices Market Trends

The anesthesia and respiratory devices market in the Asia Pacific region is expected to exhibit the highest growth over the forecast period, several key factors, including rising healthcare awareness, increasing prevalence of respiratory diseases, technological advancements, and supportive government initiatives & market interventions.

The region's experience with COVID-19 significantly heightened awareness and adoption of various anesthesia and respiratory devices. For instance, in June 2021, Temasek Foundation distributed free oximeters to every Singapore household to enable regular monitoring of blood oxygen levels. This initiative aimed to address silent pneumonia, a severe complication of COVID-19, where individuals may have damaged lungs and dangerously low oxygen levels without experiencing noticeable symptoms. Oximeters are critical in alerting users to seek medical attention promptly in such cases, thus driving increased demand and adoption of pulse oximeters in the region.

Japan anesthesia and respiratory devices market held a significant share in the region in 2023. Nebulizers, oxygen concentrators, ventilators, and other respiratory devices are experiencing high demand due to the rising prevalence of respiratory diseases. In Japan, hay fever, primarily triggered by cedar pollen, is the most common respiratory allergy, affecting approximately 40% of the population as of May 2023, according to Firstpost. Consequently, the market for anesthesia and respiratory devices in Japan is expected to grow as the incidence of respiratory conditions continues to rise.

The anesthesia and respiratory devices market in India is driven by increasing initiatives. For instance, in April 2021, Koninklijke Philips N.V. announced a 7% price reduction in its oxygen concentrators in India. This move passed the benefits of custom duty reduction by the government to customers, reducing the MRP of its products. As of April 2021, the MRP of the company’s oxygen concentrator was INR 68,120 (USD 940), decreasing from INR 73,311 (USD 1,012).

Key Anesthesia And Respiratory Devices Companies Insights

Key players operating in the anesthesia and respiratory devices market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Anesthesia And Respiratory Devices Companies:

The following are the leading companies in the anesthesia and respiratory devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Teleflex Incorporated

- Koninklijke Philips N.V.

- Drägerwerk AG & Co. KGaA

- Getinge AB.

- Smiths Group plc

- Fisher & Paykel Healthcare Limited.

- Masimo

- B. Braun Melsungen AG

- ResMed

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Inogen, Inc.

- Caire Medical (a subsidiary of NGK Spark Plug),

- DeVilbiss Healthcare (a subsidiary of Drive Medical).

- React Health (Respiratory Product Line from Invacare Corporation)

- O2 Concepts

- Nidek Medical Products, Inc.

- Omron Corporation

- GE Healthcare

- Allied Healthcare

- Vectura Group Plc.

- PARI Respiratory Equipment, Inc.

- Aerogen

- Briggs Healthcare

- Beurer GmBH

Recent Developments

-

In May 2024, Masimo partnered with Medable Inc. to integrate medical-grade wearable devices into clinical research. Medable incorporated Masimo’s MightySat Rx pulse oximeter in its evidence-generation platform for eight large-scale pharmaceutical clinical trials. These trials, involving over 3,000 patients across 25 countries, are focused on two oncology indications: breast and lung cancer.

“Masimo’s SET pulse oximetry is sensitive enough to capture key vitals on the very ill like cancer patients, plus it works on all skin tones, all ages, and is easy to use.”

- Medable’s Vice President of Digital Outcomes and TA Strategy

-

In April 2024, Royal Philips initiated the establishment of an additional R&D center within its Healthcare Innovation Center (HIC) in Maharashtra, underscoring India's increasing significance in global healthcare innovation. This new facility, set to be functional within two years, will house R&D units dedicated to Sleep & Respiratory Care, Precision Diagnosis, Image Guided Therapy, and Monitoring.

-

In June 2022, Medtronic and GE Healthcare obtained FDA 510(k) clearance and CE Mark approval for integrating advanced Microstream capnography technologies and INVOS regional oximetry into the CARESCAPE precision monitoring platform. This integration enhances healthcare providers' ability to monitor respiratory compromise and predict perioperative complications more effectively than traditional peripheral measurements.

Anesthesia and Respiratory Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.3 billion

Revenue forecast in 2033

USD 91.5 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Teleflex Incorporated; Koninklijke Philips N.V.; Drägerwerk AG & Co. KGaA; Getinge AB.; Smiths Group plc; Fisher & Paykel Healthcare Limited; Masimo; B. Braun Melsungen AG; ResMed; Shenzhen Mindray Bio-Medical Electronics Co., Ltd; Inogen, Inc.; Caire Medical (a subsidiary of NGK Spark Plug); DeVilbiss Healthcare (a subsidiary of Drive Medical).; React Health (Respiratory Product Line from Invacare Corporation); O2 Concepts; Nidek Medical Products; Inc.; Omron Corporation; GE Healthcare; Allied Healthcare; Vectura Group Plc.; PARI Respiratory Equipment, Inc.; Aerogen; Briggs Healthcare; Beurer GmBH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anesthesia And Respiratory Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global anesthesia and respiratory devices market report based on product and region:

-

Product Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Respiratory Devices

-

Respiratory Equipment

-

Humidifiers

-

Heat Humidifiers

-

Heated Wire Breathing Circuits

-

Heat Exchangers

-

Pass Over Humidifiers

-

-

Nebulizers

-

Pneumatic Nebulizers

-

Mesh Nebulizers

-

Ultrasonic Nebulizers

-

-

Oxygen Concentrator

-

Fixed Oxygen Concentrators

-

Portable Oxygen Concentrators

-

-

Positive Airway Pressure Devices

-

Bilevel & automatic positive airway pressure devices

-

Continuous positive airway pressure devices

-

-

Reusable Resuscitators

-

Ventilators

-

Adult Ventilators

-

Neonatal Ventilators

-

-

Respiratory Inhalers

-

Dry Powdered Inhalers

-

Metered Dose Inhaler

-

-

-

Respiratory Disposables

-

Disposable Oxygen Masks

-

Resuscitators

-

Tracheostomy Tubes

-

Oxygen Cannula

-

-

Respiratory Measurement Devices

-

Pulse Oximetry systems

-

Capnographs

-

Spirometers

-

Peak Flowmeters

-

-

-

Anesthesia Devices

-

Anesthesia Machines

-

Anesthesia Workstation

-

Anesthesia delivery machines

-

Portable

-

Standalone

-

-

Anesthesia Ventilators

-

Anesthesia Monitors

-

-

Anesthesia Disposables

-

Anesthesia Masks

-

Anesthesia Accessories

-

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the anesthesia and respiratory devices market include General Electric Company, Medtronic, Teleflex Incorporated, Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Getinge AB., Smiths Group plc, Fisher & Paykel Healthcare Limited, Masimo, B. Braun Melsungen AG, ResMed, Shenzhen Mindray Bio-Medical Electronics Co., Ltd, Inogen, Inc., Caire Medical (a subsidiary of NGK Spark Plug), DeVilbiss Healthcare (a subsidiary of Drive Medical)., React Health (Respiratory Product Line from Invacare Corporation), O2 Concepts, Nidek Medical Products, Inc., Omron Corporation, GE Healthcare, Allied Healthcare, Vectura Group Plc., PARI Respiratory Equipment, Inc., Aerogen, DeVilbiss Healthcare LLC, Briggs Healthcare, and Beurer GmBH

b. Key factors that are driving the anesthesia and respiratory devices market growth include increasing demand for anesthesia and respiratory devices, an increase in the incidence of respiratory disorders, fast urbanization, an increase in surgical operations, an increase in pollution levels, a rise in the elderly population, and an increase in cigarette use.

b. The global anesthesia and respiratory devices market size was estimated at USD 56.3 billion in 2024 and is expected to reach USD 59.3 billion in 2025.

b. The global anesthesia and respiratory devices market is expected to grow at a compound annual growth rate of 5.6%

b. North America dominated the anesthesia and respiratory devices market with a share of 30.5% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.