Android Set-Top Box Market Size, Share & Trends Analysis Report By Content Quality (HD & Full HD, 4K & Above), By Distribution Channel, By Application (Residential, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-932-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Android Set-Top Box Market Size & Trends

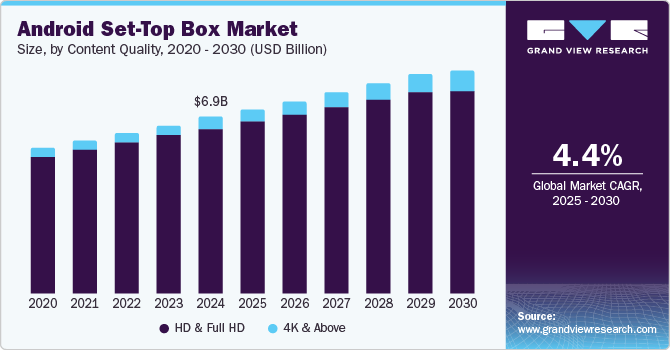

The global android set-top box market size was valued at USD 6.90 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2030. Increasing accessibility and availability of high-speed internet and unprecedented growth in the digitization of content are key growth drivers for this market. The emergence of digital content platforms, online streaming services, and on-demand video subscription services, especially in developed economies, have driven demand for the Android set-top box market in recent years.

Growing broadcasting and streaming services and advancements have led to a demand for digital or smart television solutions. This has triggered demand for accessories equipped with modern technologies such as voice recognition, in-built app ecosystems, numerous connectivity alternatives, and more. The technology and innovation industry's focus on delivering immersive consumer experiences has resulted in increased integration of OTT platforms. These aspects have been driving growth for the Android set-top box market.

Android set-top boxes are empowered with innovation and budding technologies by key companies, making them a preferred choice among customers. Their offerings, including personalized content, enhanced user experience, and uninterrupted access to an extensive range of applications related to media and entertainment, have driven their demand in multiple regions. The inclusion of numerous connectivity alternatives, such as USB ports, HDMI outputs, Wi-Fi, Bluetooth, Ethernet ports, and others, add to the benefits of this product.

New product launches and innovations by key companies in the technology-based media and entertainment industry are expected to increase demand for the Android set-top box market in the coming years. For instance, in August 2024, Reliance Jio Infocomm Ltd., one of India's prominent companies in the telecom industry, launched the JioTV+ app. The newly launched product lets users connect two TV sets with one JioFiber active connection. The new offering permitted over 800 digital TV channels across multiple genres and languages.

Content Quality Insights

Based on content quality, the HD & Full HD segment dominated the global Android set-top box market and accounted for a revenue share of 93.7% in 2024. Advancements in technology have enhanced access to improved content quality. 1280 x 720 pixels, high definition (HD), and 1920 x 1080 pixels full HD content qualities are delivered by platforms with the help of high-speed internet connections. The larger displays, easy access to high-performance broadband connections, popularity of streaming platforms for sports and other events, increasing demand for HD & full HD content quality for immersive gaming experiences, and cost-effective nature of full HD technology as compared to UHD or 4K are some of the key growth driving factors for this segment.

The 4K & above segment is expected to experience the fastest CAGR of 7.2% over the forecast period attributed to the growing availability and demand of 4K technology-enabled TVs worldwide. Improved technologies, superior quality of content, premium subscriptions offered by OTT platforms, and increasing demand from the gaming sector are anticipated to drive growth for this segment. Advancements in telecom and high-speed internet connection technologies are also contributing to the growing demand for this segment.

Distribution Channel Insights

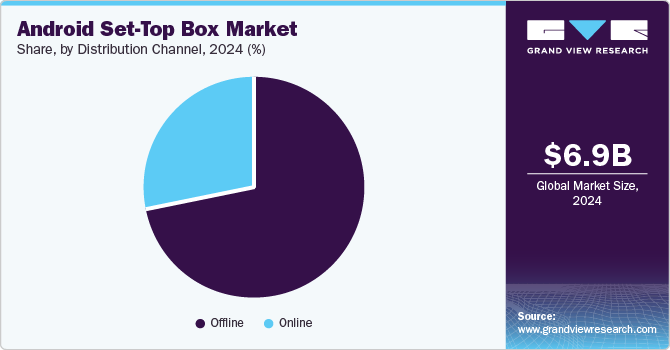

The offline distribution segment held the largest revenue share of the global android set-top box market in 2024, mainly driven by factors such as the increasing focus of manufacturers to develop effective offline distribution channels, availability of products in technology equipment stores, dedicated outlets, brand stores by companies, shopping malls, and others. Enhanced brand visibility offered by offline distribution encourages manufacturers and marketers to focus on the offline distribution aspect.

The online distribution segment is anticipated to experience the fastest CAGR from 2025 to 2030 attributed to the growing availability of Android set-top boxes through e-commerce websites, independent shopping platforms developed by manufacturing companies and marketers, value-added services offered by the online shopping experience, and more. Additional features associated with online shopping, such as doorstep delivery, refund or return policy, and detailed product review displays shared by previous buyers and others, are also fueling the growth of this segment.

Application Insights

Based on application, the residential segment dominated the global market for Android set-top boxes in 2024 largely influenced by the increasing demand from residential users, such as families and individuals who engage in home entertainment. Availability of large TV displays, affordability associated with modern technologies, and trends in customer behavior are driving demand for this segment. Unceasing growth in urbanization, the emergence of multiple online streaming platforms, on-demand video subscriptions, OTT offerings, and changing lifestyles have changed the media & entertainment industry paradigm in recent years. This has resulted in developing multiple advanced technologies, such as Android set-top boxes, that assist the ongoing digital transformation and its rapid pace.

The commercial segment is expected to experience growth during the forecast period. The commercial demand for Android set-top boxes is mainly driven by hospitality, tourism, facility management, aviation, and other industries. Large displays in high-value premium facilities also contribute to the growing demand for Android set-top boxes. Such facilities market the availability of Android set-top box-enabled systems as value-added services in premium services.

Regional Insights

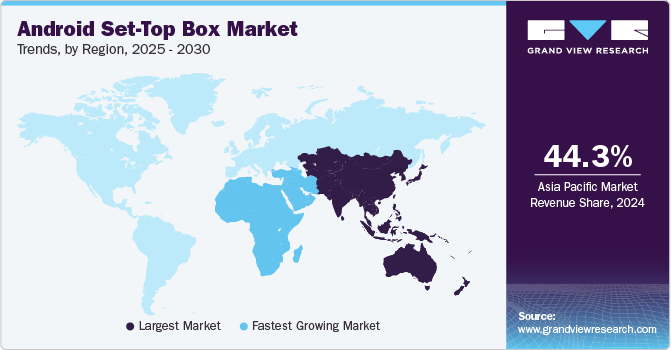

The Asia Pacific android set-top box market dominated the global industry and accounted for a revenue share of 44.3% in 2024, attributed to multiple aspects, such as the growing penetration of high-speed internet in the region, the availability of advanced TV sets offered by numerous domestic and international brands, the ever increasing number of subscriptions to OTT platforms, and the rising popularity of online streaming services. The growth in the purchasing power of the regional customers is expected to drive demand for this market in the next few years.

China Android Set-Top Box Market Trends

The growing digitization of content, the rise in demand for smart TV solutions, the increasing popularity of hybrid content and interactive entertainment alternatives among consumers, and the presence of a robust manufacturing industry focused on innovation and technology advancements are key growth driving factors for this market.

North America Android Set-Top Box Market Trends

The rapid pace of digital transformation, ongoing 5G rollouts by the telecom industry, the increasing popularity of on-demand video platforms and online streaming services, and affordable alternatives available in Android and smart TV portfolios offered by multiple market participants are driving growth for this market.

U.S. Android Set-Top Box Market Trends

The U.S. android set-top box market dominated the regional industry with a significant revenue share in 2024, attributed to ease of availability and accessibility, enhanced penetration of high-performing internet services, growing demand for online entertainment platforms, presence of multiple large enterprises in the OTT market, and continuous delivery of high-quality content by domestic content generation companies and productions.

Middle East & Africa Set-Top Box Market Trends

The Middle East & Africa set-top box market is projected to grow at the fastest CAGR of 5.7% from 2025 to 2030. This market is primarily driven by aspects such as increasing demand for smart or android TV solutions, rising use of large TV displays, growing popularity of online video streaming services, demand from the hospitality industry, and more.

Egypt android set-top box market held the largest revenue share of the regional industry in 2024. The expansion of high-speed internet service networks, the increasing awareness regarding the benefits of Android STBs, and the growing demand for personalized viewing experiences and seamless content delivery facilitated by technological advancements are expected to drive demand for this market in the coming years.

Key Android Set-Top Box Company Insights

Some of the key companies in the global android set-top box market are

-

Microsoft Corporation offers a wide range of AI capabilities and services, including computer vision, speech recognition, and language understanding. It also offers pre-trained models, SDKs, and APIs that help build AI-based workflows for various applications.

-

IBM Corporations’ subsidiary IBM Watson Health uses AI algorithms to estimate human perception in medical data analysis. The principal goal of healthcare-related AI applications is to examine relationships between patient outcomes and prevention or treatment techniques.

Key Android Set-Top Box Companies:

The following are the leading companies in the android set-top box market. These companies collectively hold the largest market share and dictate industry trends.

- COMMSCOPE

- Coship Electronics

- Evolution Digital

- HUMAX Electronics Co., Ltd.

- Kaonmedia Co., Ltd.

- NVIDIA Corporation

- Sagemcom

- SDMC Technology Co., Ltd

- Shenzhen Skyworth Digital Technology Co. Ltd

- Vantiva

Recent Developments

-

In April 2024, Vantiva, one of the prominent companies in the technology and network services industry, announced that it has sold nearly 22 million units of set-top boxes equipped with Android TV tech to date. The company has deployed the Android TV tech with necessary upgrades and multiple OTT certifications since its emergence.

-

In March 2024, ZTE Corporation, a major market participant in the information technology and communication industry, announced that it had entered into a strategic partnership with Telecab TV + Internet. The newly established tie-up focuses on the Brazil market to introduce its newest portfolio addition, set-top box B866V2FA.

Android Set-Top Box Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.20 billion |

|

Revenue forecast in 2030 |

USD 8.94 billion |

|

Growth Rate |

CAGR of 4.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion, Volume in Thousand Units and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Content quality, distribution channel, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Benelux, Nordic Countries, Russia, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Egypt, Nigeria, South Africa |

|

Key companies profiled |

COMMSCOPE; Coship Electronics; Evolution Digital; HUMAX Electronics Co., Ltd.; Kaonmedia Co., Ltd.; NVIDIA Corporation; Sagemcom; SDMC Technology Co., Ltd; Shenzhen Skyworth Digital Technology Co. Ltd; Vantiva |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Android Set-Top Box Market Report Segmentation

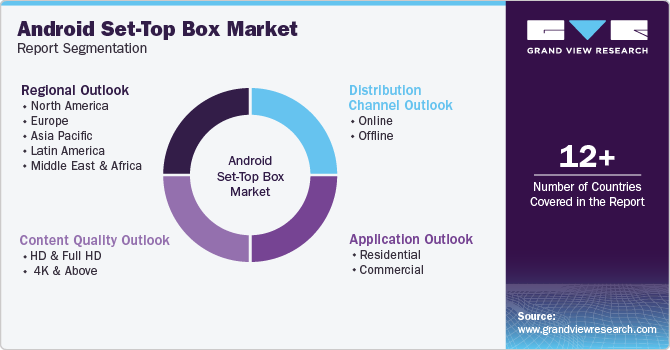

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global android set-top box market report based on content quality, distribution channel, application, and region.

-

Content Quality Outlook (Revenue, USD Billion, Volume, Thousand Units, 2018 - 2030)

-

HD & Full HD

-

4K & Above

-

-

Distribution Channel Outlook (Revenue, USD Billion, Volume, Thousand Units, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Billion, Volume, Thousand Units, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, Volume, Thousand Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Benelux

-

Nordic Countries

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Egypt

-

Nigeria

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."