- Home

- »

- Pharmaceuticals

- »

-

Androgenetic Alopecia Market Size & Share Report, 2030GVR Report cover

![Androgenetic Alopecia Market Size, Share & Trends Report]()

Androgenetic Alopecia Market (2024 - 2030) Size, Share & Trends Analysis Report By Gender (Male, Female), By Treatment (Pharmaceuticals, Devices), By End-use (Dermatology Clinics, Homecare Settings), By Sales Channel, And Segment Forecasts

- Report ID: GVR-4-68040-197-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Androgenetic Alopecia Market Summary

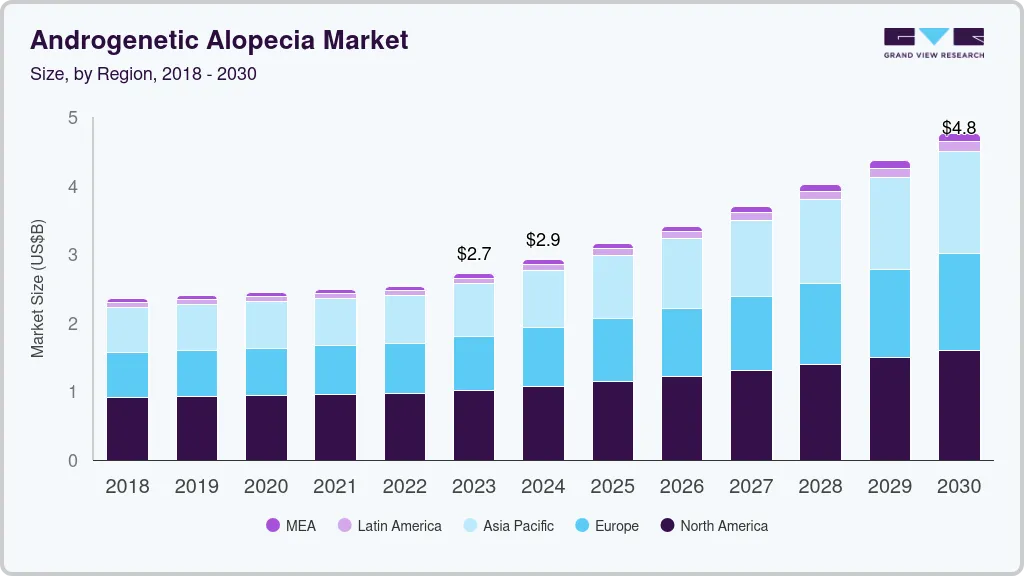

The global androgenetic alopecia market size was estimated at USD 2.7 billion in 2023 and is projected to reach 4.76 billion by 2030, growing at a CAGR of 8.45% from 2024 to 2030. The market growth is attributed to increasing demand for therapeutics due to the rising incidence of androgenic alopecia (AGA) globally.

Key Market Trends & Insights

- North America dominated the market and accounted for a share of 37.40% in 2023.

- Androgenetic alopecia market in Asia Pacific is anticipated to witness significant growth from 2024 to 2030.

- Based on gender, the male segment accounted for the largest share of 56.59% in 2023.

- Based on treatment, the pharmaceuticals segment accounted for the largest revenue share of 98.37% in 2023.

- Based on end-use, the dermatology clinics segment accounted for the largest share of 56.59% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.7 Billion

- 2030 Projected Market Size: USD 4.76 Billion

- CAGR (2024-2030): 8.45%

- North America: Largest market in 2023

For instance, according to data published by the U.S. Department of Health and Human Services in December 2023, an estimated 30 million women and 50 million men suffer due to androgenic alopecia (AA) per year. In the case of women, the disease occurrence is likely after menopause. In addition, growing research & development in therapeutics and increasing healthcare expenditure across various regions are further propelling overall market growth.The prevalence of androgenetic alopecia is increasing in most countries due to changing lifestyles, such as increased consumption of alcohol & tobacco; changing food habits, such as more intake of junk food; high levels of stress; and an increasing geriatric population. In the U.S. alone, around 50 million men and 30 million women were estimated to be affected by androgenetic alopecia, according to the National Library of Medicine. Similarly, as per a report published by the International Society of Hair Restoration Surgery, it is estimated that nearly 40% of men encounter some degree of hair loss by 35 years of age, 65% at 60 years, 70% at 80 years, and 80% at age of 85. These factors are expected to boost market growth.

Technological advancements in androgenetic alopecia treatment are among the key drivers of this market. There are two FDA-approved therapeutics for androgenetic alopecia, Minoxidil & finasteride. Furthermore, Lasermax Haircomb is the only device approved for the treatment of androgenetic alopecia by the FDA. The market has experienced a surge in the utilization of generic alternatives following the expiration of patents for both drugs. However, the launch of several promising pipeline candidates is expected to significantly drive market growth in the near future.

Market Concentration & Characteristics

Market growth stage is high and the pace is accelerating. The market is characterized by a high degree of innovation owing to advancements in technology, including the introduction of a low-level laser therapy, which helps stimulate hair growth. For instance, in January 2021, Lexington Intl., LLC, introduced FLIP Laser 80 Cap, the first cordless flip laser growth device. The device can be flipped to be used on both areas of the scalp and has uniquely incorporated densely concentrated 80 medical-grade lasers within half the cap.

Key market players leverage strategies, such as collaborations, partnerships, and acquisitions, to promote the reach of their offerings and increase their product capabilities globally. For instance, in December 2023, Sun Pharmaceutical Industries Ltd. entered into a strategic collaboration with Aclaris. Sun Pharma will get exclusive rights for the use of deuruxolitinib JAK inhibitor or other isotopic forms of ruxolitinib used to treat androgenetic alopecia.

These players are receiving approvals from several regulatory authorities to boost their product expansion. For instance, in September 2021, Dr. Reddy’s Laboratories Ltd., received approval for its minoxidil topical solutions, Mintop 2%, and Mintop Eva 5%, from CDSCO for treating female pattern hair loss. This initiative expanded the company’s androgenetic alopecia product offerings in India.

Moreover, rapid economic growth in developing countries and an increase in the number of initiatives being undertaken by organizations, such as the National Alopecia Areata Foundation and American Hair Loss Association, for spreading awareness about androgenetic alopecia & available treatment options are leading to an increase in healthcare expenditure, which is further propelling overall market growth.

Gender Insights

The male segment accounted for the largest share of 56.59% in 2023. Increasing prevalence is estimated to accelerate segment growth during the forecast period. For instance, according to data published by the American Hair Loss Association and the U.S. National Library of Medicine, over 95% of hair loss cases among men are androgenetic type, and about 50% of men tend to experience some degree of hair loss at an average age of 50 years. In addition, rising investments by pharmaceutical companies to develop new products are projected to impact segment growth positively. For instance, in March 2023, Kintor Pharmaceutical Limited announced the completion of enrolment for its candidate KX-826 for the treatment of androgenetic alopecia in males. The female segment is expected to witness considerable growth from 2024 to 2030.

The increasing incidence of diseases associated with AA, such as PCOS, rise in cosmetic procedures, and lifestyle changes are driving the segment's growth. Furthermore, rising awareness among women highlights segment growth. Various treatment options aim to address this condition, including topical minoxidil, an FDA-approved over-the-counter solution. Oral medications, such as finasteride, may be prescribed, although it is not FDA-approved for women of childbearing age. Low-level laser therapy and platelet-rich plasma injections are emerging as noninvasive alternatives. Hair transplant surgery remains a more invasive option for those seeking a permanent solution. Thus, the growing availability of novel treatments is likely to impel segment growth in the near future.

Treatment Insights

The pharmaceuticals segment accounted for the largest revenue share of 98.37% in 2023. Increasing product availability in the market positively impacts segment growth. Several prescription treatments, including minoxidil, betamethasone dipropionate, and fluocinolone acetonide, are available in the market for hair regrowth in androgenetic alopecia patients. In addition, an increasing number of clinical trials and product development activities are expected to boost segment growth. For instance, in March 2023, OliX Pharmaceuticals received approval from authorities to initiate its phase 1 clinical trial for the treatment of androgenetic alopecia. The company would investigate its candidate OLX72021 for its efficacy over androgenetic alopecia.

The devices segment is expected to register the fastest CAGR from 2024 to 2030. Increasing familiarity of the global population with technology is improving the adoption rate of devices for the treatment of androgenetic alopecia. In addition, devices based on low-level laser therapy (LLLT) offer the convenience of at-home use and minimize the need for clinical visits. Moreover, it provides a non-pharmacological and nonsurgical viable therapeutic action for hair restoration, due to which the market is expected to grow steadily. In addition, technological advancements are projected to offer lucrative growth opportunities in the segment. For instance, in October 2022, a group of researchers from the National Natural Science Foundation of China discovered a new design of microneedle patches for the treatment of AA with the help of AI.

End-use Insights

The dermatology clinics segment accounted for the largest share of 56.59% in 2023. The large share is attributed to increased consumer awareness regarding prescription medicines & modern treatments, such as laser technology, coupled with a strong product pipeline. Advanced treatment therapies and devices combined with novel haircare products help overcome hair loss problems. In April 2020, Bimini Health Tech announced topline results for the phase 2 clinical trial on Kerastem in the U.S. The single procedure therapy consists of doses of Adipose-derived Regenerative Cells (ADRCs) combined with Puregraft purified fat, depending on the severity of hair loss. The company is planning to initiate a phase 3 clinical trial, and upon successful completion of this phase in the U.S., around 40 million people might opt for this treatment. Such initiatives are driving the segment growth.

The homecare settings segment is projected to witness the highest CAGR from 2024 to 2030. Technological advancements have led to the introduction of novel devices for the treatment of androgenetic alopecia that can be used in home care settings. Patient comfort, convenience, and ease of use are considered for developing homecare devices. Companies are focusing on developing low-cost, home-grade lasers for home use, such as laser caps, helmets, laser combs, and other systems. In March 2020, LifeMD received U.S. FDA approval for its proprietary laser-based product, the Shapiro MD hair restoration device. This FDA-approved medical device was designed to promote hair growth in men & women with androgenetic alopecia and is available through direct-to-consumer platforms & telemedicine. Hence, growing FDA approval of androgenetic alopecia treatment products for homecare settings is anticipated to propel segment growth.

Sales Channel Insights

The prescription segment accounted for the largest share of 65.96% in 2023, driven by a strong product pipeline, growing disposable income, and rising adoption of unhealthy lifestyles, resulting in chronic diseases, such as cancer, PCOS, & diabetes, which can cause AGA. Moreover, a growing number of research and development activities are likely to boost the discovery of new molecules, which will eventually positively impact segment growth. For instance, in June 2022, a group of researchers from the University of California announced the discovery of a new hair stimulator, SCUBE3. This signaling molecule shows promise as a therapeutic solution for AA, a prevalent form of hair loss affecting both men and women. The discovery opens avenues for potential treatments targeting this molecular pathway.

The over-the-counter segment is expected to witness substantial growth. Patent expiries of the key FDA-approved therapeutics, such as Avodart (dutasteride), Rogaine (minoxidil), and Propecia (finasteride), led to large-scale penetration of generics into this market. Furthermore, the lack of approved drugs has driven the usage of several products, including OTC or off-label drugs. The increasing demand for affordable hair loss treatments, increased consumer awareness regarding the potential side effects of prescribed drugs, and growing accessibility of over-the-counter (OTC) medications are key factors driving the market. OTC products are particularly prevalent in developing regions, presenting multiple opportunities for industry players to address unmet medical needs through product reformulation.

Regional Insights

North America dominated the market and accounted for a share of 37.40% in 2023. Growth in the region is driven by a high disease prevalence, rising consumer awareness, proactive government measures, technological advancements, and improvements in healthcare infrastructure. Moreover, the presence of major companies involved in developing treatments for AGA, such as Concert Pharmaceuticals, Inc.; Eli Lilly & Company; RepliCel Life Sciences; & Triple Hair, is anticipated to drive market growth. In addition, the presence of non-invasive therapies with minimal side effects, such as laser therapy, is anticipated to improve the treatment rate in North America.

U.S. Androgenetic Alopecia Market Trends

The market in the U.S. held the largest share in 2023. The increasing awareness about the disease, rising R&D for novel therapeutics, and growing prevalence of androgenetic alopecia are some of the key factors propelling market growth. According to the Journal of Dermatology and Skin Science estimate, AGA affects around 50 million men and 30 million women in the U.S.

Europe Androgenetic Alopecia Market Trends

Androgenetic alopecia market in Europe was the second-largest regional market in 2023. AGA is the most common hair loss disease in Europe, and it affects around 80% of men and 40% to 70% of women of Caucasian race of age 70 years & older. Moreover, the increasing prevalence of chronic diseases is indirectly driving market growth as the treatment regimens of several of these diseases result in hair loss.

The UK androgenetic alopecia market is estimated to grow at a significant CAGR from 2024 to 2030. The growing adoption of user-friendly laser devices, such as helmets and caps, for alopecia is improving the demand for laser devices. Moreover, customer-oriented policies of local companies such as CNV Hair are encouraging people to use these devices. These companies offer better return policies, product warranties, and money-back guarantees that reduce purchase risk for customers.

Androgenetic Alopecia market in France is expected to grow significantly due to research initiatives by government organizations and market players focusing on developing potential treatments and rising awareness among the target population. In addition, it was observed that Tumor Necrosis Factor (TNF) alpha antagonists, used in treating plaque psoriasis, rheumatoid arthritis, inflammatory bowel diseases, and other autoimmune disorders, may cause alopecia

Germany androgenetic alopecia market held the largest share of the Europe market in 2023 and is mainly driven by the growing prevalence of hair loss and other medical conditions causing alopecia & hair thinning. Furthermore, a rise in research initiatives and clinical studies for developing novel products is expected to contribute to market growth. For instance, in September 2023, the University Hospital of Bonn and the University of Bonn researchers identified rare genetic variants involved in AGA.

Asia Pacific Androgenetic Alopecia Market Trends

Androgenetic alopecia market in Asia Pacific is anticipated to witness significant growth from 2024 to 2030. Increasing awareness is a major factor driving the market growth in this region. The local presence of key players, such as Cipla, Dr. Reddy’s Laboratories Ltd, & Aurobindo Pharma, is expected to drive overall market growth. Increasing avenues of scientific research, untapped opportunities in the form of unmet medical needs, and economic growth are expected to be additional growth drivers.

China androgenetic alopecia market is estimated to grow at a significant CAGR over the forecast period. The changing regulatory framework will impact the industry landscape. Hair loss products are now regulated by the National Medical Products Administration (NMPA). Moreover, the increasing adoption of laser-based hair growth devices in the country is creating new avenues for market players.

Androgenetic alopecia market in Japan is expected to grow over the forecast period due to an increase in the ongoing research initiatives in the country for the development of novel technologies and products to treat hair loss. Growing interest of key players and research institutes in developing new products & treatments and advances in technologies are expected to drive market growth in Japan.

Latin America Androgenetic Alopecia Market Trends

Androgenetic alopecia market in Latin America is estimated to grow rapidly over the coming years owing to increasing government spending, the presence of skilled healthcare professionals, growing focus by multinational pharmaceutical companies on untapped markets, and rising patient awareness

Brazil androgenetic alopecia market is expected to grow at a significant growth rate over the forecast period due to positive economic growth following financial and political stability in the country. In addition, AGA is the most common type of hair loss, and the incidence of the disease increases with age.

MEA Androgenetic Alopecia Market Trends

The androgenetic alopecia market in MEA is growing due to the high economic development and improved healthcare facilities. Economic development and the presence of high unmet medical needs in emerging economies, such as South Africa, are primary factors driving market growth.

Saudi Arabia androgenetic alopecia market is expected to grow at a lucrative rate due to high unmet clinical needs, rising disposable income, and an increasing number of collaborative agreements with international organizations, such as WHO & UN.

Key Androgenetic Alopecia Company Insights

Some of the key established players operating in the market include Johnson & Johnson Services, Inc., Cipla, Inc., Sun Pharmaceutical Industries Ltd., and Merck & Co., Inc. These companies are collaborating with regional players to expand their services geographically. Lexington Intl., LLC, Freedom Laser Therapy, Inc. (iRESTORE Hair Growth System), Curallux, LLC, and Apira Science, Inc. (iGROW Laser) are some of the emerging market participants in the androgenetic alopecia market. Emerging players focus more on collaborating with various distribution channels, availability of devices and OTC products on e-commerce platforms is expected to increase their reach to customers across the globe.

Key Androgenetic Alopecia Companies:

The following are the leading companies in the androgenetic alopecia market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these androgenetic alopecia companies are analyzed to map the supply network.

- Johnson & Johnson Services, Inc.

- Cipla, Inc.

- Sun Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma

- Lexington Intl., LLC

- Freedom Laser Therapy, Inc. (iRESTORE Hair Growth System)

- Curallux, LLC

- Apira Science, Inc. (iGROW Laser)

- Theradome Inc.

Recent Developments

-

In December 2023, Sun Pharmaceutical Industries Ltd. entered into a strategic collaboration with Aclaris. Sun Pharma will get exclusive rights for the use of deuruxolitinib JAK inhibitor or other isotopic forms of ruxolitinib used to treat alopecia areata and androgenetic alopecia

-

In July 2023, Cosmo Pharmaceuticals initiated phase 3 clinical trials for its topical androgen receptor-blocking drug, Clascoterone Solution

-

In June 2023, Dr. Reddy’s Laboratories Ltd. announced an expansion of its generics business in India with the launch of RgenX. This dedicated division offers a wider range of affordable products to patients

-

In June 2023, Pfizer, Inc. received the U.S. FDA approval of Litfulo (ritlecitinib) to treat hair loss caused by alopecia. The drug blocks inflammatory signals that increase hair loss

-

In March 2023, Sun Pharmaceutical Industries Ltd., completed the acquisition of Concert Pharmaceuticals, Inc., which is involved in the development of novel treatment options for different types of alopecia

Androgenetic Alopecia Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.93 billion

Revenue forecast in 2030

USD 4.76 billion

Growth rate

CAGR of 8.45% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, number of patients treated in thousands, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender, treatment, end use, sales channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson Services, Inc.; Cipla, Inc.; Sun Pharmaceutical Industries Ltd.; Merck & Co., Inc.; Dr. Reddy’s Laboratories Ltd.; Aurobindo Pharma; Lexington Intl., LLC; Freedom Laser Therapy, Inc. (iRESTORE Hair Growth System); Curallux, LLC; Apira Science, Inc. (iGROW Laser); Theradome Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Androgenetic Alopecia Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global androgenetic alopecia market report based on gender, treatment, end use, sales channel, and region:

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology Clinics

-

Homecare Settings

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescriptions

-

OTC

-

-

Regional Outlook (Number of Patients Treated in Thousands; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global androgenetic alopecia market size was valued at USD 2.72 billion in 2023 and is expected to reach USD 2.93 billion in 2024.

b. The global androgenetic alopecia market is projected to grow at a compound annual growth rate (CAGR) of 8.45% from 2024 to 2030 to reach USD 4.76 billion by 2030.

b. Pharmaceuticals segment accounted for largest revenue share of 98.37% in 2023. Increasing product availability in market positively impacts the segment growth. Several prescription treatments are available in market for hair regrowth in androgenetic alopecia patients, including minoxidil, betamethasone dipropionate, and fluocinolone acetonide.

b. Some key players operating in the androgenetic alopecia market include Johnson & Johnson Services, Inc., Cipla, Inc., Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma, Lexington Intl., LLC, Freedom Laser Therapy, Inc. (iRESTORE Hair Growth System), Curallux, LLC, Apira Science, Inc. (iGROW Laser), Theradome Inc.

b. Key factors that are driving the market growth include increasing demand for therapeutics due to rising incidence of androgenic alopecia (AGA) globally growing research & development in therapeutics and an increasing healthcare expenditure across various regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.