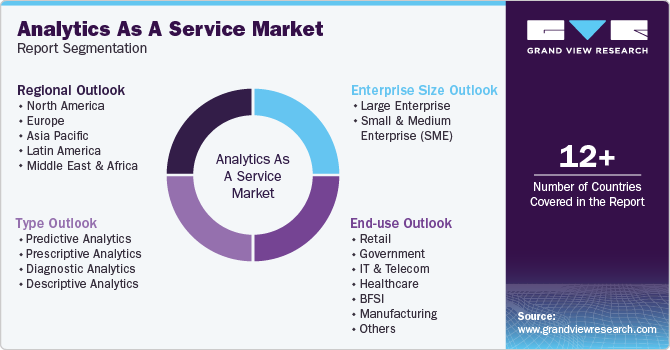

Analytics As A Service Market Size, Share & Trends Analysis Report By Type (Prescriptive, Descriptive), By Enterprise Size (Large Enterprise, SME), By End-use (BFSI, Healthcare), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-243-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Analytics As A Service Market Size & Trends

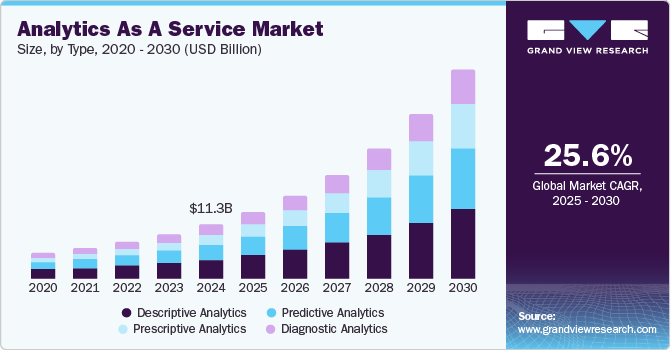

The global analytics as a service market size was valued at USD 11.32 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030. Analytics as a service (AaaS) is a deployment model in which a third-party vendor provides analytical solutions through a cloud platform. The increased demand among organizations to evaluate consistency in the patterns among the data has resulted in a growing focus on enhancing their computational and statistical abilities, which bode well for market growth. The growth is driven by enterprises emphasizing analytics for data-driven decision-making to improve the performance of various aspects of business, such as sales, demand forecasting, and raw materials procurement. The growing adoption of cloud-based solutions is expected to influence the demand for AaaS positively.

The shift of businesses from traditional systems towards digital solutions plays a significant role in the centralization of data across all the departments and functions of an organization, thereby increasing the demand for AaaS. The increasing demand for analytical solutions across a range of applications, such as predicting electricity consumption, trade market, and traffic trend predictions, has boosted the market growth. Various companies, including Google LLC; IBM; and Oracle Corporation; provide analytical solutions through their flagship cloud platform, which has significantly impacted the growth. For instance, IBM provides its analytical solutions-Watson Analytics through Watson Cloud, which helps the company’s clientele to analyze structured data.

The rising usage of analytical solutions in demand sensing of products in the e-commerce and retail sectors is another major factor that has boosted market growth. Demand sensing is extensively used in the retail industry to determine potential consumers of a product, helping retailers understand consumer behavior and its impact on the entire supply chain. Additionally, there has been a rise in the adoption of analytical solutions to translate data generated by the use of RFID tags which bodes well for market growth.

For instance, in August 2019, Nike, Inc. acquired Celect, Inc., a developer of a cloud-based, predictive analytics platform. Post-acquisition, Nike, Inc. began to use RFID technology and Celect, Inc.’s predictive analytical solutions to optimize inventory performance. Moreover, technologies such as virtual reality (VR) and augmented reality (AR) are data-immersive technologies and require high bandwidth for operations, resulting in the generation of large amounts of data. As a result of the generation of huge unstructured data, analytical solutions are used to categorize, process, and display it into meaningful insights.

In recent years, there has been a rapid increase in volumes of business data being generated across various industries, such as transportation, manufacturing, healthcare, and retail. As a result, enterprises focus on aggregating data collected from multiple departments and converting raw data into meaningful insights. The increasing investments in big data analytics by government agencies and incumbents of various industries, such as banking, manufacturing, and professional services, bode well for market growth. For instance, the BFSI sector alone invested approximately USD 20.8 billion in big data analytics in 2018.

The surge in data security concerns on account of the rise in cyber-crimes is a significant factor that negatively impacts market growth. As data is always stored on a remote server, end users are accessing the data while in transit over the internet, the data and applications may be vulnerable to cyberattacks. Therefore, public safety organizations have implemented stringent regulations, and service providers have to abide by these regulations. For instance, the General Data Protection Regulation (GDPR) requires companies to protect the data processed through any system or software, and it applies to organizations operating in the European Union.

Type Insights

The descriptive analytics segment accounted for the leading revenue share of 35.1% in the global market in 2024. Organizations are increasingly recognizing the importance of data in shaping strategic decisions. Descriptive analytics help businesses understand their historical performance and customer behavior, leading to more informed choices. It also enables businesses to identify inefficiencies and optimize operations, leading to cost savings and improved productivity. The increasing volume of data generated has led enterprises to demand solutions that can present this data in an understandable format, thus helping them spot various challenges, developments, and opportunities that help shape strategies and courses of action. Additionally, as brands recognize the importance of customizing their marketing efforts to ensure better customer experience, the need for descriptive analytics tools to segment customer base and understand purchasing patterns has risen substantially, aiding market growth.

The prescriptive analytics segment is anticipated to advance at the fastest CAGR during the forecast period. Companies increasingly use analytics tools that can understand historical data and generate predictive patterns to form a guided decision or action that the user needs to take. Industries such as healthcare, insurance, finance, and oil & gas, which have well-defined applications, extensively leverage prescriptive analytics solutions. For instance, financial institutions use these tools to predict the chances of default for loan applicants and their creditworthiness, enabling them to evaluate loan applications better, manage credit risk, and set interest rates. Meanwhile, in the healthcare sector, these analytics are used to understand patient symptoms and medical imaging data so that medical professionals can make accurate diagnoses and recommend the optimum treatment path. These benefits have compelled analytics service providers to bring advancements to their solutions continuously.

Enterprise Size Insights

Large enterprises accounted for a leading revenue share in the global market in 2024, as these businesses generate substantial data volumes that need to be analyzed comprehensively and time-efficiently. AaaS solutions offer easy scalability to accommodate growing data volumes and user demands, making them ideal for large enterprises that experience fluctuations in data needs. With pre-built analytics models and frameworks, businesses can quickly implement solutions and derive insights without facing lengthy development cycles. For instance, in the retail sector, major brands have extensively adopted analytical solutions to boost the accuracy of sales forecasting models and lessen inventory. As the impact of big data analytics and predictive analytics becomes more prominent across different industries, the market is anticipated to witness substantial expansion.

The small and medium enterprise (SME) segment is anticipated to expand at the fastest CAGR during the forecast period. The rapidly growing number of SMEs, particularly in developing economies such as India and China, has driven the demand for analytics solutions to help businesses drive sales, retain customers, and acquire new ones. AaaS providers have developed economical offerings and provide long-term support through platform upgrades and additional features for these enterprises, enabling better collaborations. Small enterprises can utilize powerful analytics tools such as machine learning algorithms and predictive analytics that they may not otherwise be able to afford or have the required expertise to implement. Additionally, the importance of data security and compliance is greater among small businesses, and AaaS providers offer robust security measures and ensure compliance with data regulations that help these enterprises focus on their core functionalities.

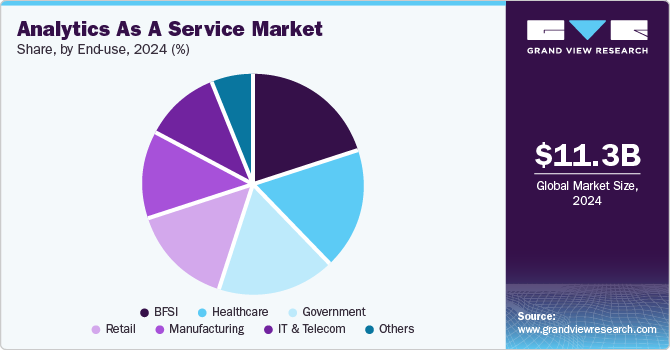

End-use Insights

The BFSI segment accounted for a leading revenue share in the global market and is anticipated to maintain a substantial contribution in the coming years. This sector is heavily regulated, necessitating comprehensive data analysis for compliance reporting and risk assessment. AaaS solutions can automate and streamline these processes, ensuring stringent adherence to regulations. Moreover, the presence of legacy systems in a majority of financial institutions has enhanced market demand, as providers can offer compatibility features that allow for smoother integration and data flow. The constant risk of fraudulent activities faced by organizations in this sector has further highlighted the importance of analytics tools. Firms can prevent significant financial losses by using predictive analytics to detect anomalies or unusual patterns in transaction data. The wide range of features offered by data analytics solution providers has helped maintain a strong share of this segment. In December 2023, Accenture announced its collaboration with the Union Bank of India (UBI), a public sector institution, to develop a scalable and secure data lake platform offering advanced analytics and reporting features. The partnership aims to improve UBI’s operational efficiency, effectively manage risks, and elevate its customer-focused services.

The IT & telecom industry is expected to advance at the fastest CAGR during the forecast period. The increasing focus of telecom companies on providing premium services to customers, coupled with the generation of significant amounts of data in this sector, has boosted the adoption of analytics solutions. This platform can be easily scaled to accommodate the growing data volumes that are common in this sector, ensuring that organizations can adapt to evolving requirements. They can help analyze network traffic and performance data in real-time, enabling telecom companies to identify bottlenecks, outages, and areas for optimization. Additionally, the challenge of customer churn can also be effectively addressed using analytics as a service solution, as they can leverage historical data to identify patterns that lead to such customer behavior, aiding companies to implement targeted retention strategies. In January 2024, Databricks announced the launch of its unified AI and data platform, called the Data Intelligence Platform for Communications, for telecom carriers and network service providers. Using this platform, Communication Service Providers (CSPs) would be able to have a holistic view of their operations, networks, and customer interactions without compromising data privacy or confidential IP.

Regional Insights

The North America Analytics as a service market accounted for a leading revenue share of 36.8% in 2024. The market demand is fueled by the need for cost-effective, scalable, and real-time analytics solutions among regional businesses. As organizations increasingly recognize the value of data-driven decision-making, AaaS has become essential to their business strategies, enabling them to remain competitive in a rapidly evolving environment. Additionally, the region is an early adopter of technologies such as Big Data and the Internet of Things, leading to the generation of substantial data volumes that have driven the use of analytics as a service. The presence of associations such as the National Cloud Technologists Association and the Cloud Native Computing Foundation has encouraged the use of cloud computing to deploy solutions such as big data analytics and predictive analytics. Additionally, the well-established healthcare sector in regional economies such as the U.S. and Canada has driven the utilization of analytical solutions to improve patient outcomes, aiding industry growth.

U.S. Analytics As A Service Market Trends

The analytics as a service market in U.S. accounted for a dominant revenue share in the regional market in 2024. Extensive use of social media platforms and the exponential growth of the e-commerce sector have compelled businesses to adopt analytics solutions to derive actionable insights and boost their competitive advantage in the economy.

Europe Analytics As A Service Market Trends

Europe is anticipated to grow substantially from 2025 to 2030, aided by the extensive use of tools such as predictive and prescriptive analytics by enterprises to drive profits and growth in economies such as Germany, France, and the UK. Additionally, the presence of stringent regulations such as the General Data Protection Regulation (GDPR) has compelled European companies to use AaaS platforms to ensure compliance through enhanced data governance and reporting capabilities. The demand for big data services is also expanding at a strong pace, aided by the continuing advancement of digitalization. European companies are increasingly seeking agility in their IT solutions, creating a strong demand for analytics-driven processes that have enabled the expansion of the regional analytics as a service market.

Asia Pacific Analytics As A Service Market Trends

Asia Pacific analytics as a service market is anticipated to advance at the fastest CAGR during the forecast period, aided by the increasing establishment of major businesses in the region and the presence of organizations such as Asia Analytics Alliance and Asia Cloud Computing Association (ACCA). Moreover, rapid adoption and increasing awareness of big data analytics and cloud-based technologies are expected to ensure noticeable market expansion in economies such as India, Australia, and Japan.

Key Analytics As A Service Company Insights

Some of the major companies involved in the global AaaS market include GoodData, SAS Institute, and Microsoft, among others.

-

GoodData is a U.S.-based business intelligence and analytics platform that provides companies with advanced tools to analyze their data. The company offers a cloud-based analytics platform that enables organizations to integrate, analyze, and visualize data from multiple sources. It also allows them to embed analytics directly into their applications, providing users with actionable insights within their existing workflows. In October 2023, GoodData introduced ‘FlexQuery Analytics Lake’, which combines data storage, processing, and analytics capabilities in a single platform, enabling businesses to gain insights from various data sources.

-

SAS Institute is a major global business intelligence (BI) and data management software solutions provider. The company’s products include advanced analytics solutions, AI & machine learning, data management, cloud, fraud and security intelligence, IoT (Internet of Things), marketing and operational analytics, and risk management.

Key Analytics As A Service Companies:

The following are the leading companies in the analytics as a service (AaaS) market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- GoodData Corporation

- Google LLC

- Hewlett Packard Enterprise Development LP

- IBM

- Microsoft

- Oracle

- SAP SE

- SAS Institute Inc.

- Cloud Software Group, Inc.

Recent Developments

-

In October 2024, GoodData announced a partnership with Witboost to launch an integrated solution designed to streamline the management, analysis, and governance of data for organizations. The new integration offers features such as automated lifecycle management, streamlined deployment and change management, and robust data governance and security.

-

In September 2024, SAS Institute announced a two-year partnership with Duke Health that would allow the latter to leverage AI, machine learning, and operational analytics capabilities of SAS to advance patient care and healthcare operations.

Analytics As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.95 billion |

|

Revenue forecast in 2030 |

USD 43.61 billion |

|

Growth rate |

CAGR of 25.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Amazon Web Services, Inc.; GoodData Corporation; Google LLC; Hewlett Packard Enterprise Development LP; IBM; Microsoft; Oracle; SAP SE; SAS Institute Inc.; Cloud Software Group, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Analytics As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global analytics as a service market report based on type, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Predictive Analytics

-

Prescriptive Analytics

-

Diagnostic Analytics

-

Descriptive Analytics

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise (SME)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Government

-

IT & Telecom

-

Healthcare

-

BFSI

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."