- Home

- »

- Plastics, Polymers & Resins

- »

-

Anaerobic Adhesives Market Size And Share Report, 2030GVR Report cover

![Anaerobic Adhesives Market Size, Share & Trends Report]()

Anaerobic Adhesives Market Size, Share & Trends Analysis Report By Product (Threadlockers, Thread Sealants), By Substrate (Metals, Plastics), By End-use (Automotive, General Industries, Construction), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-355-5

- Number of Report Pages: 201

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Anaerobic Adhesives Market Size & Trends

The global anaerobic adhesives market size was estimated at USD 603.66 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The market driven by the rising demand for anaerobic adhesives in applications like textiles and apparel, additionally, the material's increasing popularity in the production of eyewear frames and photographic films is another key driver, with eyewear manufacturers preferring it due to its lightweight, durable, and flexible nature.

The growing consumer demand for low-tar cigarettes globally and properties that extend the shelf life of food products are enhancing the market growth, with the rise in cigarette usage expected to propel the market growth ahead.

Anaerobic adhesives are unique in their curing process. When deprived of atmospheric oxygen, they solidify into a tough state. They remain in a liquid state until isolated from oxygen and in the presence of metal ions, such as iron or steel. The curing process requires air isolation, metal contact, and sufficient temperature. This characteristic makes them ideal for applications such as thread locking, thread sealing and retaining.

Manufacturers invest in research and development to enhance the strength, durability, and versatility of these adhesives. For instance, new formulations offer improved bond strength, faster curing times, and increased resistance to extreme temperatures and chemicals. These advancements allow them to meet the evolving needs of industries such as automotive, aerospace, and electronics.

The demand is primarily driven by their wide range of industrial applications. In the automotive industry, they are used for thread locking applications to prevent loosening of critical components subjected to shocks and vibrations. In the electronics industry, they provide secure and reliable bonding for circuit board assembly. The manufacturing industry relies on these adhesives for applications such as flange sealing to ensure leak-proof connections in pipelines and tanks.

Product Insights

“Thread Sealants emerged as the fastest growing product with a CAGR of 6.4%”

The thread lockers segment led the market with the largest revenue share of 31.5% in 2023. They provide a reliable and durable locking mechanism for threaded assemblies. They are commonly applied to critical components such as engine mounts, suspension systems, and brake calipers to ensure that the fasteners remain securely in place, even under extreme conditions. Thread lockers also play a crucial role in industries such as aerospace, machinery, and construction, where the reliability and integrity of threaded connections are paramount.

Thread sealants, also known as pipe sealants are designed to provide a reliable seal between threaded pipe connections, preventing leakage of fluids or gases. They are applied to the threads of pipe fittings and cure in the absence of air, creating a tight and durable seal. An example of the application of thread sealants is in plumbing systems. They are commonly used to seal threaded connections in water pipes, gas pipes, and hydraulic systems. Thread sealants ensure leak-free joints, preventing costly and potentially hazardous leaks.

Retaining compounds are anaerobic adhesives specifically formulated to create a strong bond between cylindrical parts with close tolerances. They fill the gaps between the mating surfaces, providing 100% surface-to-surface contact and eliminating movement or play between the parts. Retaining compounds are commonly used to enhance the strength and reliability of press-fit or interference-fit assemblies. They are applied to keyways, splines, and other cylindrical joints to improve the load-bearing capacity and prevent fretting corrosion.

Substrate Insights

“Metals emerged as the fastest growing End Use with a CAGR of 6.3%”

Based on substrate, the plastics segment led the market with the largest revenue share of 43.8% in 2023. These adhesives offer excellent bonding capabilities with various types of plastics, including polypropylene, polyethylene, PVC, and ABS. One of the major applications of anaerobic adhesives on plastics is in the assembly of plastic components in the automotive industry. For instance, they are used to bond plastic parts in a car's interior, such as dashboard components, door panels, and trim. This ensures strong and durable bonds that can withstand the vibrations and temperature fluctuations experienced in a vehicle.

The metals are another crucial substrate segment for anaerobic adhesives. They exhibit exceptional bonding properties with metals like steel, aluminum, and brass. A prominent application of anaerobic adhesives on metals is thread locking. In industries such as manufacturing and construction, they are used to secure threaded fasteners, preventing them from loosening due to vibrations and external forces. For example, in the assembly of heavy machinery, they are applied to bolts and screws to ensure their long-term stability and prevent costly equipment failures.

Apart from plastics and metals, anaerobic adhesives can also bond other substrates such as ceramics, glass, and composites. In the electronics industry, they are used to bond components to ceramic substrates, ensuring reliable electrical connections. In addition, in the construction sector, anaerobic adhesives are employed to bond glass panels, providing structural strength and weather resistance. They offer versatility by enabling reliable bonds across various substrates, expanding their applicability in different industries.

End-use Insights

“Electrical & Electronics emerged as the fastest growing End Use with a CAGR of 6.5%”

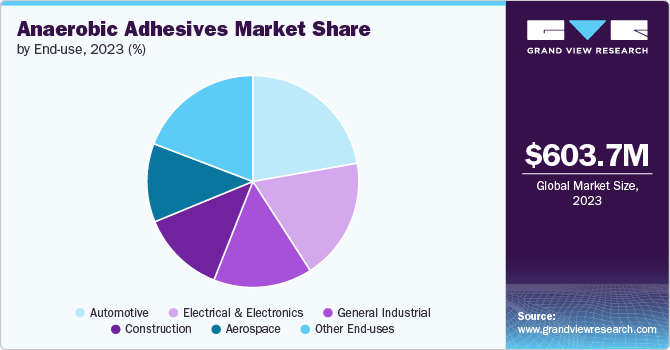

Based on application, the automotive segment led the market with the largest revenue share of 22.25% in 2023. These adhesives are used in various automotive applications to enhance assembly efficiency, improve safety, and ensure reliable performance. Thread lockers are applied to critical components such as engine mounts, suspension systems, and brake calipers to prevent loosening of threaded fasteners due to vibrations and thermal expansion. This ensures the integrity and reliability of the assembled parts, contributing to the overall safety and performance of vehicles.

The electrical and electronics segment is another major application for anaerobic adhesives. They find use in the assembly and bonding of electrical and electronic components, providing insulation, protection, and mechanical stability. One relevant example is the use of anaerobic adhesives in the manufacturing of fly-back transformers, automotive power trains, and relays. They offer high bond strength and resistance to harsh temperature and pressure conditions, ensuring the reliability and durability of electrical and electronic devices.

Anaerobic adhesives also find applications in general industries beyond automotive and electrical/electronics. They are used in various industrial sectors where reliable bonding and sealing of threaded connections or cylindrical assemblies are required. Retaining compounds are used in machinery and equipment manufacturing. Retaining compounds are applied to keyways, splines, and other cylindrical joints to enhance load-bearing capacity and prevent fretting corrosion. This ensures the longevity and performance of industrial machinery and equipment.

Regional Insights

“Asia Pacific emerged as the fastest growing market with a CAGR of 6.5% from 2024-2030”The anaerobic adhesives market in North America is anticipated to grow at a significant CAGR during the forecast period, as it is an important segment. The region has a well-established automotive industry and a strong focus on technological advancements. One relevant instance is the use of these products in the assembly of automotive components, such as engine mounts and brake calipers, to ensure secure and reliable connections. The region also has a significant presence of key market players, such as 3M and Henkel AG & Co. KGaA, contributing to the growth and innovation in the North American market.

Asia Pacific Anaerobic Adhesives Market Trends

Asia Pacific dominated the anaerobic adhesives market with the revenue share of 35.95% in 2023. The region is experiencing rapid economic development, leading to increased industrialization and infrastructure projects. Surging demand for anaerobic adhesives in China and India, being major producers of automotive and electronic products, drive the market growth in the region. The growth in aircraft and automotive sectors, coupled with the emphasis on high-performance materials, creates a favorable market environment for anaerobic adhesives in the Asia Pacific region.

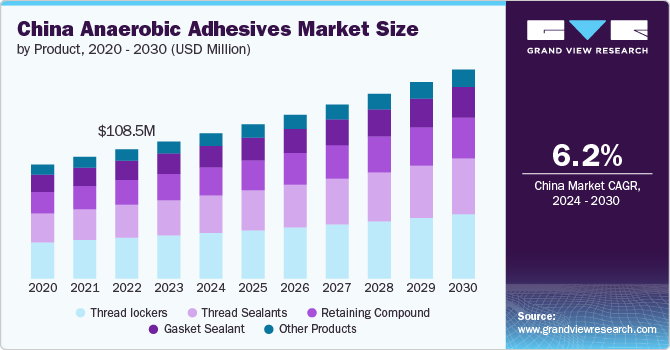

The anaerobic adhesives market in China plays a crucial role in the Asia Pacific market, being the world's largest producer of automotive and electronic products. The country's automotive industry is projected to witness significant growth, with a substantial number of new deliveries and increased demand for anaerobic adhesives. For instance, Boeing's Commercial Outlook predicts over 8,750 new deliveries in China by 2040, driving the demand for anaerobic adhesives in the automotive sector. In addition, China's rapid economic development and infrastructure projects contribute to the market growth in the country.

Europe Anaerobic Adhesives Market Trends

The anaerobic adhesives market in Europe is a mature market for anaerobic adhesives, with a strong presence of automotive and industrial sectors, helping it become the second biggest market in the world. The region emphasizes technological advancements and sustainability, driving the demand for high-performance adhesives. A major driver in the region is the use of anaerobic adhesives in the manufacturing of machinery and equipment, where retaining compounds are applied to enhance load-bearing capacity and prevent corrosion.

Key Anaerobic Adhesives Company Insight

The competitive landscape of the global market is shaped by various factors, including advancements in formulations, sustainability initiatives, and improved curing technologies. Major players in the market are continuously striving to develop more efficient formulations that enhance product performance while minimizing pollution during processing. The companies in the market are focusing on continuous research and development to improve its product offerings and meet the evolving needs of customers. They have also introduced products with improved performance characteristics, such as high temperature resistance and enhanced bond strength.

Some of the key players operating in the global market include

-

3M is a well-known manufacturer of anaerobic adhesives and offers a wide range of products for various applications. - Their product portfolio includes anaerobic threadlockers, anaerobic structural adhesives, retaining compounds, gasket sealants, and more

-

Henkel is a leading manufacturer of anaerobic adhesives and offers a diverse range of products for different industries. - Their product portfolio includes anaerobic threadlockers, retaining compounds, gasket sealants, and more. - Henkel emphasizes research and development to improve their product offerings and meet the evolving needs of customers

Permabond and Astral Adhesives are some of the emerging market participants in the global market.

-

Permabond is a manufacturer of industrial adhesives, including anaerobic adhesives, catering to various industries. - Their product portfolio includes anaerobic threadlockers, retaining compounds, gasket sealants, and more. Permabond focuses on providing expert technical help, product recommendations, and even the development of custom formulations for specific industries

-

Astral Adhesives is a manufacturer of various types of adhesives, including anaerobic ones. Their product portfolio includes anaerobic threadlockers, retaining compounds, and other adhesive solutions

Key Anaerobic Adhesives Companies:

The following are the leading companies in the anaerobic adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Parson Adhesives, Inc.

- 3M

- Permabond LLC

- ITW LLC & Co. KG

- WEICON GmbH & Co. KG

- Loxeal S.r.l.

- Henkel AG & Co. KGaA

- Bodo Möller Chemie GmbH

- Hangzhou Fenloc Bondtek Co.,Ltd.

- ASTRAL ADHESIVES

Recent Developments

-

In May 2024, H.B. Fuller announced the acquisition of ND Industries Inc, a manufacturer of specialty adhesives and fastener solutions. The acquisition is expected to help enrich the aerobic product range of H.B. Fuller

-

In April 2022, Parson Adhesives India Pvt. Ltd announced the plans to built production facility of anaerobic adhesives in the city of Vadodara, India. The new venture is expected to help the company expand its manufacturing capacity by 200%, catering to automotive, electronics and other sectors

Anaerobic Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 637.29 million

Revenue forecast in 2030

USD 892.80 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, substrate, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Parson Adhesives, Inc.; 3M; Permabond LLC; ITW LLC & Co. KG; WEICON GmbH & Co. KG; Loxeal S.r.l.; Henkel AG & Co. KGaA; Bodo Möller Chemie GmbH; Hangzhou Fenloc Bondtek Co.,Ltd.; ASTRAL ADHESIVES

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Anaerobic Adhesives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global anaerobic adhesives market report based on product, substrate, end-use and region:

-

Product Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Threadlockers

-

Thread Sealants

-

Retaining Compound

-

Gasket Sealant

-

Other Products

-

-

Substrate Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Metals

-

Plastics

-

Other Substrates

-

-

End-use Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

General Industries

-

Construction

-

Aerospace

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global anaerobic adhesives market was valued at USD 603.66 million in 2023 and is expected to reach USD 637.29 million by 2024

b. The global anaerobic adhesives market is anticipated to grow at a moderately high CAGR of 5.8% from 2024 to reach USD 892.80 million by 2030

b. Asia Pacific dominated the market and accounted for a 35.95% share in 2023. The region is experiencing rapid economic development, leading to increased industrialization and infrastructure projects.

b. The competitive landscape of the anaerobic adhesives market is shaped by various factors, including advancements in formulations, sustainability initiatives, and improved curing technologies. Major players in the market are continuously striving to develop more efficient formulations that enhance product performance while minimizing pollution during processing. Some of the key players in the market are 3M, Henkel, Permabond, Astral Adhesives, among others

b. The global anaerobic adhesives market is driven by the rising demand for anaerobic adhesives in applications like textiles and apparel, additionally, the material's increasing popularity in the production of eyewear frames and photographic films is another key driver, with eyewear manufacturers preferring it due to its lightweight, durable, and flexible nature.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."