- Home

- »

- Plastics, Polymers & Resins

- »

-

Amorphous Polyethylene Terephthalate Market Report, 2030GVR Report cover

![Amorphous Polyethylene Terephthalate Market Size, Share & Trends Report]()

Amorphous Polyethylene Terephthalate Market (2024 - 2030) Size, Share & Trends Analysis Report By Applications (Bottles, Food Packaging), By End Use (Food & Beverage, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-388-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Amorphous Polyethylene Terephthalate Market Summary

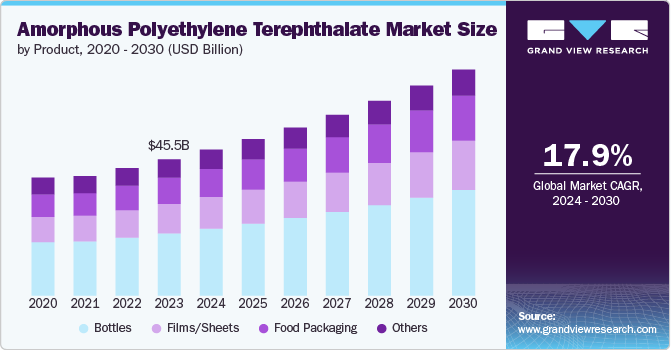

The global Amorphous Polyethylene Terephthalate (APET) market size was estimated at 45.49 billion in 2023 and is expected to reach USD 75.41 billion by 2030, growing at a CAGR of 7.55% from 2024 to 2030. The market is primarily driven by the growing demand for lightweight, durable, and recyclable packaging solutions across various industries, including food, beverage, and pharmaceuticals.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of over 50.0% in 2023.

- The amorphous polyethylene terephthalate market in China dominates the Asia Pacific’s APET market.

- By application, bottles segment registered the largest revenue share of over 45.0% in 2023.

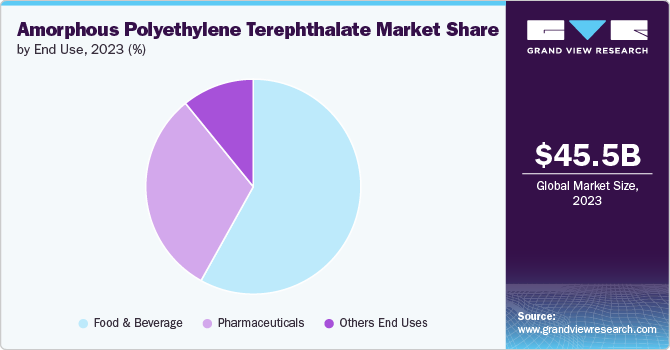

- By end use, the food & beverage segment accounted for the highest revenue share of over 58.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 45.49 Billion

- 2030 Projected Market Size: USD 75.41 Billion

- CAGR (2024-2030): 7.55%

- Asia Pacific: Largest market in 2023

APET's excellent clarity, high strength, and barrier properties make it an ideal material for food and beverage packaging, including bottles, trays, and clamshells. For instance, the increasing consumption of bottled beverages and ready-to-eat meals has significantly boosted the demand for APET packaging, which helps in preserving the freshness and extending the shelf life of products.Additionally, shift towards sustainable and eco-friendly materials in packaging is driving the growth of the market. Increasing environmental concerns and regulatory pressures to reduce plastic waste has led industry players to seek alternatives that can be easily recycled. APET stands out due to its recyclability and reduced environmental impact compared to other plastics. Companies are increasingly adopting APET in their packaging solutions to meet sustainability goals and comply with regulations, thereby driving market growth.

Technological advancements and innovations in the production of APET is also shaping the market dynamics. Improved manufacturing processes and the development of new grades of APET have enhanced its properties, making it more versatile and suitable for a broader range of applications. Innovations such as co-extrusion and multilayer APET films provide better performance characteristics, including improved barrier properties and enhanced visual appeal. These advancements have opened up new opportunities for APET in industries such as electronics, pharmaceuticals, and personal care, further driving its demand and positively influencing the market.

Moreover, the economic growth in emerging markets has led to increased consumer spending on packaged goods, thereby boosting the demand for APET. Rapid urbanization, rising disposable incomes, and changing lifestyles in countries such as China, India, and Brazil are driving the consumption of packaged food and beverages, leading to higher demand for APET packaging. Additionally, the expanding retail sector and the growth of e-commerce are creating more opportunities for APET in packaging applications, as it offers the durability and protection required for shipping and handling goods.

Application Insights

Bottles segment registered the largest revenue share of over 45.0% in 2023. APET is widely used in the production of bottles, particularly for beverages, personal care products, and pharmaceuticals. Its clarity, strength, and barrier properties make it an ideal material for containing liquids. APET bottles are lightweight, shatter-resistant, and recyclable, contributing to their popularity in various industries.

APET films and sheets are utilized in diverse applications, including packaging, labeling, and printing. These materials offer excellent transparency, durability, and printability. They are commonly used for food packaging, blister packs, thermoforming applications, and as protective layers for electronics and other products.

The food packaging application segment is anticipated to grow at the fastest CAGR of 8.12% during the forecast period. In the food industry, APET is valued for its safety, clarity, and barrier properties. It is used to create containers, trays, and packaging for fresh produce, baked goods, prepared meals, and other food items. APET food packaging helps extend shelf life, maintains product freshness, and allows for an attractive presentation of food products.

End Use Insights

The food & beverage end use segment accounted for the highest revenue share of over 58.0% in 2023. Besides, the segment is expected to grow at the fastest CAGR of 7.85% over the forecast period. APET is widely used in the food and beverage industry due to its excellent barrier properties, clarity, and durability. It is commonly employed in packaging for fresh produce, baked goods, ready-to-eat meals, and beverages. APET containers and trays provide good protection against moisture and gases, helping to extend the shelf life of food products. Its transparency allows consumers to see the contents, which is particularly advantageous for showcasing food items.

In the pharmaceutical sector, APET is utilized for packaging various medical products and drugs. Its chemical resistance and barrier properties make it suitable for protecting sensitive medications from moisture and contamination. APET is often used in blister packs, bottles, and containers for pills, tablets, and liquid medications. The material's clarity also allows for easy inspection of the contents, which is crucial in the pharmaceutical industry for quality control and patient safety.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 50.0% in 2023. Rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations are fueling the demand for packaging materials. APET, known for its versatility and cost-effectiveness, has experienced a surge in demand across various industries, including food and beverages, pharmaceuticals, and consumer goods. For instance, the thriving e-commerce sector in countries such as China and India has significantly increased the need for protective packaging, including APET films and sheets, thus driving the growth of the APET market in the region.

The amorphous polyethylene terephthalate market in China dominates the Asia Pacific’s APET market space due to a combination of factors including its vast manufacturing capacity, robust domestic demand, and strategic investments in technological advancements. As one of the largest producers and consumers of APET, China's dominance can be attributed to its well-established plastic manufacturing industry. The country's manufacturing infrastructure is highly developed, with numerous factories equipped with advanced machinery capable of producing large volumes of APET at competitive costs. This scale of production allows Chinese manufacturers to meet both domestic and international demand efficiently, giving them a significant edge in the market.

North America Amorphous Polyethylene Terephthalate Market Trends

The region's strong focus on sustainability and recycling initiatives contributes to the growth of the APET market. This trend is further supported by government regulations and consumer awareness campaigns promoting recycling and reducing plastic waste. The presence of advanced recycling infrastructure in North America also facilitates the collection and processing of APET products, creating a circular economy for this material.

Europe Amorphous Polyethylene Terephthalate Market Trends

Stringent regulations and initiatives promoting recycling and circular economy principles in Europe have boosted the growth of the APET market. The European Union's Circular Economy Action Plan and plastic waste reduction targets have encouraged manufacturers to use more recyclable materials such as APET. Countries such as Germany and the Netherlands have implemented successful bottle deposit schemes, which have increased the collection and recycling rates of PET bottles, further supporting the market.

Key Amorphous Polyethylene Terephthalate Company Insights

The market is characterized by intense competition and rapid growth. Key players dominate the market space, leveraging their extensive production capacities and global presence. Market share is largely determined by factors such as product quality, pricing strategies, and technological innovations. Besides, environmental concerns and sustainability initiatives are reshaping the competitive landscape, with companies investing in recycling technologies and bio-based alternatives to maintain their market positions. As the industry evolves, strategic partnerships, mergers, and acquisitions are becoming common strategies for companies to expand their market share and geographical reach.

Key Amorphous Polyethylene Terephthalate Companies:

The following are the leading companies in the amorphous polyethylene terephthalate market. These companies collectively hold the largest market share and dictate industry trends.

- JBF Industries Ltd.

- Reliance Industries Limited

- China Petroleum & Chemical Corporation

- Covestro AG

- Jiangsu Sanfangxiang Group Co., Ltd.

- M&G Chemicals

- Petro Polymer Shargh

- Quadrant group of companies

- LOTTE Chemical CORPORATION

- Polisan Holding

- TEIJIN LIMITED

- Equipolymers

- Alpek Polyester

Recent Developments

-

In February 2024, Rumpke Waste & Recycling partnered with Eastman Chemical Company to enhance the recycling of hard-to-process colored polyethylene terephthalate (PET) materials. This collaboration aims to address the challenges posed by unrecyclable plastics, promoting circularity and sustainability by diverting waste from landfills and incineration.

-

In November 2023, Aloxe, a French company, inaugurated a new USD 26.5 million recycled PET plastic manufacturing plant in Messein, France, which is the largest such facility in the country. The plant, built on a brownfield site, will increase Aloxe's PET recycling capacity in France from 12.5 kt to 50 kt per year by the end of 2023, with plans to reach 120 kt capacity across France, Poland, and Italy in 2024.

-

In April 2022, Indorama Ventures Public Company Limited, a global chemical producer, completed the acquisition of a PET packaging company in Vietnam. The move is part of Indorama's strategy to expand its presence in the growing Vietnamese market and strengthen its position in the PET packaging industry.

Amorphous Polyethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.74 billion

Revenue forecast in 2030

USD 75.41 billion

Growth rate

CAGR of 7.55% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Application, end Use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina, Saudi Arabia, South Africa

Key companies profiled

JBF Industries Ltd.; Reliance Industries Limited; China Petroleum & Chemical Corporation; Covestro AG; Jiangsu Sanfangxiang Group Co., Ltd.; M&G Chemicals; Petro Polymer Shargh; Quadrant group of companies; LOTTE Chemical CORPORATION; Polisan Holding; TEIJIN LIMITED; Equipolymers; Alpek Polyester

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Amorphous Polyethylene Terephthalate Marker Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the amorphous polyethylene terephthalate market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Bottles

-

Films/Sheets

-

Food Packaging

-

Others

-

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global amorphous polyethylene terephthalate market size was estimated at USD 45.49 billion in 2023 and is expected to reach USD 48.74 billion in 2024.

b. The global amorphous polyethylene terephthalate market is expected to grow at a compound annual rate of 7.55% from 2024 to 2030, reaching USD 75.41 billion by 2030.

b. Bottles segment registered largest revenue market share of over 45.0% in 2023. APET is widely used in the production of bottles, particularly for beverages, personal care products, and pharmaceuticals.

b. Some of the major companies in the global amorphous polyethylene terephthalate market include JBF Industries Ltd.; Reliance Industries Limited; China Petroleum & Chemical Corporation; Covestro AG; Jiangsu Sanfangxiang Group Co., Ltd.; M&G Chemicals; Petro Polymer Shargh; Quadrant group of companies; LOTTE Chemical CORPORATION; Polisan Holding; TEIJIN LIMITED; Equipolymers; Alpek Polyester.

b. The amorphous polyethylene terephthalate market is primarily driven by the growing demand for lightweight, durable, and recyclable packaging solutions across various industries, including food, beverage, and pharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.