- Home

- »

- Medical Devices

- »

-

Amniotic Membrane Market Size And Share Report, 2030GVR Report cover

![Amniotic Membrane Market Size, Share & Trends Report]()

Amniotic Membrane Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Hospitals, Specialty Clinics), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-657-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Amniotic Membrane Market Summary

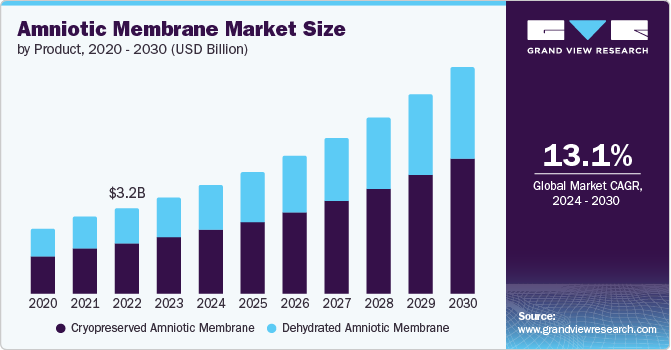

The global amniotic membrane market size was estimated at USD 3.60 billion in 2023 and is projected to reach USD 8.50 billion by 2030, growing at a CAGR of 13.1% from 2024 to 2030. The amniotic membrane, known for its bacteriostatic and pain-relief properties, is primarily used in wound healing. Recent increased awareness has boosted the number of transplants and demand for these tissue-based products while also encouraging more donations, thus driving market growth.

Key Market Trends & Insights

- The North America amniotic membrane market dominated the overall global market and accounted for a 31.5% revenue share in 2023.

- The amniotic membrane market in the U.S. held a significant share of North America's market in 2023.

- By product, the cryopreserved amniotic membrane segment held the largest market share of 59.1% in 2023.

- By application, the ophthalmology segment is anticipated to witness the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3.60 Billion

- 2030 Projected Market Size: USD 8.50 Billion

- CAGR (2024-2030): 13.1%

- North America: Largest market in 2023

Amniotic membranes are typically used for conjunctiva reconstruction, pterygium excisions, surgical wounds, corneal ulcers, and regenerative medicine. Factors influencing market growth include advancements in stem cell and regenerative medicine research, increased R&D investment, and a rise in global surgeries.

Amniotic membranes are typically used in two categories, as a surgical graft or as a biological bandage for treating and managing wounds. The usage of these membranes facilitates re-epithelization acting as a scaffold when used as a graft. Its anti-inflammatory and anti-scarring properties are especially vital in case of burn injuries, reducing intensified inflammation and discomfort in patients. Hence, increasing benefits of amniotic membranes are anticipated to propel the market growth. The use of amniotic membrane is widely seen in the treatment of eye surface disorders. Treatment of bacterial keratitis, corneal ulcers, cataracts, glaucoma, bullous keratopathy, corneal degeneration, ocular dystrophy, eyelid reconstruction, and various others. The rise in the geriatric population base worldwide has spurred the number of ophthalmology surgeries, creating a huge demand for these tissue-based products.

According to Bryn Mawr Communications, LLC., in October 2023, BioTissue's new data on cryopreserved amniotic membrane therapy shows that the Prokera Slim corneal bandage significantly improves outcomes for patients with moderate to severe dry eye disease (DED). A study found that treating patients with Prokera Slim for just two days led to substantial improvement in Dry Eye Workshop (DEWS) scores over a three-month period without complications. This advancement highlights the potential for shorter, more efficient treatments, driving the growth of the amniotic membrane market. The expressions that support our research are,

“The findings presented highlight the progress we’ve made in enhancing treatment options for individuals affected by DED, further emphasizing our focus on empowering healthcare professionals to elevate the standards of care and make a positive difference in the lives of their patients,”

- BioTissue CEO Ted Davis.

In addition, according to MJH Life Sciences data published in June 2023, a 3-layer amniotic membrane was successfully used to treat a severe case of keratoconjunctivitis sicca, a type of severe dry eye and ocular surface disease. The patient, unresponsive to multiple previous therapies, showed significant improvement in visual acuity and resolution of keratitis after two weeks of treatment. This new 3-layer, dehydrated amniotic membrane combines the benefits of both dehydrated and cryopreserved membranes, enhancing therapeutic outcomes and driving the market growth for amniotic membranes.

Increasing research in stem cell and regenerative medicine, substantial R&D investments, and a rise in global surgeries are key factors expected to drive market growth. In May 2020, researchers from the Eugenia Menni Research Centre in Italy discovered that stem cells from the human amniotic membrane can slow scarring in pulmonary fibrosis. This pre-clinical research offers potential new treatments for this severe condition, further highlighting the significant therapeutic potential of amniotic membranes and encouraging market expansion.

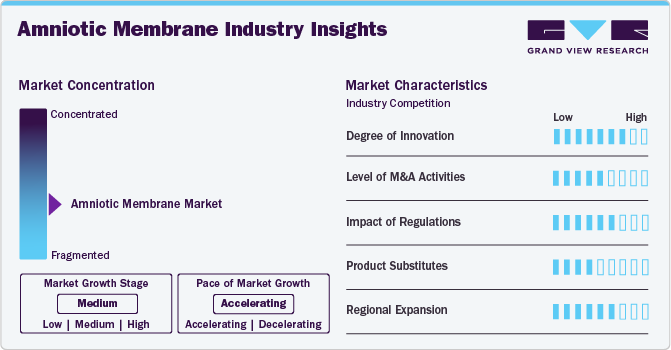

Market Concentration & Characteristics

The market for amniotic membrane is characterized by a high degree of industry concentration with several key players dominating the field. Companies such as MiMedx, Amnio Technology, LLC, and Applied Biologics are prominent due to their extensive product portfolios and significant investments in R&D. The market is driven by increasing applications in wound healing, ophthalmology, and regenerative medicine. Technological advancements, coupled with rising awareness and adoption of amniotic membrane products, further enhance market growth.

The amniotic membrane industry is characterized by a high degree of innovation, with advancements in preservation techniques, such as cryopreservation and vacuum drying. For instance, in April 2024, NuVision Biotherapies' vacuum-dried amnion, Omnigen, offers room-temperature stability and quick rehydration, making it practical for non-surgical applications. This innovation reduces logistical barriers and expands usage to outpatient settings, significantly impacting the market. It is used in treatments for limbal stem cell deficiency and pterygium management, with ongoing trials for dry eye disease. These developments enhance accessibility and broaden the therapeutic potential of amniotic membranes.

Regulations significantly impact the amniotic membrane industry by ensuring product safety, efficacy, and quality. Stringent guidelines by bodies such as the FDA and EMA require thorough clinical testing and documentation, which can lengthen the approval process but enhance trust in products. Compliance with these regulations is essential for market entry and expansion. In addition, regulatory frameworks support innovation by establishing clear standards and encouraging companies to develop new and effective treatments. Thus, while regulations can increase development costs and time, they ultimately drive market credibility and growth.

Mergers and acquisitions in the amniotic membrane industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in February 2024, RTI Surgical, a global surgical implant company, finalized the acquisition of Cook Biotech, a pioneer in biologic tissue engineering. This acquisition aims to enhance RTI's portfolio with Cook Biotech's innovative regenerative medicine products, strengthening its position in the healthcare market focused on advanced biologic solutions for surgical procedures.

In the amniotic membrane industry, synthetic biomaterials like bioengineered skin substitutes, collagen matrices, and hydrogels serve as alternatives to natural amniotic membranes. These substitutes replicate amniotic membrane properties, offering benefits such as scalability, consistency, and lower disease transmission risk. They often include growth factors or stem cells to boost tissue regeneration in wound care and ophthalmology. Despite addressing supply chain and ethical issues, their clinical effectiveness and cost-efficiency compared to natural membranes drive ongoing research for enhancing medical treatment outcomes.

The amniotic membrane industry is experiencing robust global expansion due to advanced healthcare expenditure, rising incidences of chronic diseases, and improving healthcare access and awareness. Regional expansion in the amniotic membrane industry involves penetrating new geographical markets to broaden the customer base and increase market share. For instance, in March 2022, Laboratories Thea SAS announced an agreement with Akorn Operating Company LLC to purchase seven branded ophthalmic products, including AcellFX, to expand its presence in the U.S. AcellFX is an acellular amniotic membrane that provides covering for repair or a protective environment to the ocular surface.

Product Insights

The cryopreserved amniotic membrane segment held the largest market share of 59.1% in 2023 and is anticipated to register the fastest CAGR over the forecast period. Cryopreserved amniotic membrane (CAM) is a biologically active tissue preserved through cryogenic freezing to maintain its cellular and structural integrity. This preservation technique involves storing the membrane at extremely low temperatures, typically in liquid nitrogen, to retain its therapeutic properties, including essential growth factors, cytokines, and extracellular matrix components crucial for tissue repair and regeneration.

CAM is widely utilized in various medical fields due to its unique properties. In ophthalmology, it is applied to treat corneal defects, such as persistent epithelial defects, ulcers, and chemical burns, promoting faster healing and reducing inflammation and scarring. In wound care, CAM is effective in managing chronic wounds like diabetic foot ulcers, venous leg ulcers, and pressure sores by providing a biological scaffold that supports cell proliferation and tissue regeneration. In addition, its anti-inflammatory and antimicrobial properties help in reducing infection risks and promote a conducive healing environment.

Application Insights

The others segment held the largest market share of 41.6% in 2023. The amniotic membrane market extends to dermatology, dentistry, and gynecology. In dermatology, it is used to treat burns, chronic ulcers, and skin graft sites, leveraging its regenerative properties to accelerate healing. In dentistry, amniotic membranes aid in periodontal surgeries and oral tissue regeneration, enhancing recovery and reducing inflammation. Gynecology applications include treating vaginal atrophy and serving as a biological barrier in pelvic surgeries. These diverse applications benefit from the amniotic membrane’s anti-inflammatory, antimicrobial, and tissue-repairing properties, expanding its utility across various medical disciplines.

The ophthalmology segment is anticipated to witness the fastest CAGR over the forecast period. Amniotic membranes are utilized in treating various ocular surface disorders, including corneal ulcers, persistent epithelial defects, and chemical burns. Their anti-inflammatory, anti-scarring, and regenerative properties promote faster healing and reduce the risk of infection and scar formation. In addition, they are used in pterygium surgery and conjunctival reconstruction. The demand for amniotic membranes in ophthalmology is driven by their effectiveness in enhancing patient outcomes, leading to improved vision restoration and overall eye health, making them a valuable asset in advanced ophthalmic care. For instance, in June 2023, a study in Graefe's Archive for Clinical and Experimental Ophthalmology assessed the vacuum-dehydrated amniotic membrane, Omnigen, on a contact lens (Omnilenz) for treating acute chemical eye injuries. Among 23 eyes, approximately 50% showed significant epithelial healing and improved visual acuity after the first application. Omnilenz was well tolerated, with no major complications, indicating its potential effectiveness for chemical eye injuries.

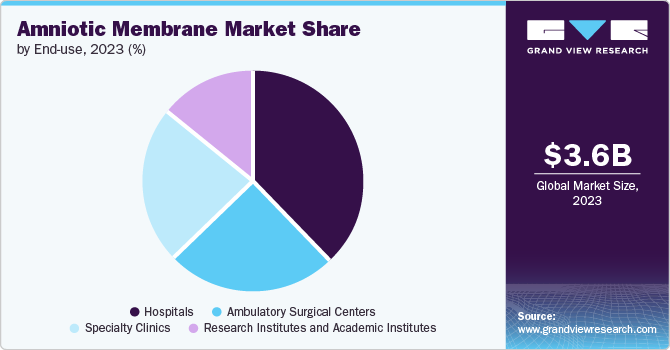

End-use Insights

The hospitals segment accounted for the largest revenue share of 38.4% in 2023. Hospitals benefit from the membranes' regenerative properties, anti-inflammatory effects, and ability to reduce scarring, making them valuable in treating chronic wounds, corneal defects, and during reconstructive surgeries. The demand in hospitals is driven by the need for advanced, effective treatment options to improve patient outcomes, highlighting the importance of amniotic membranes in modern medical care.

The ambulatory surgical centers (ASCs) segment is anticipated to witness the fastest CAGR over the forecast period. ASCs utilize amniotic membranes for outpatient procedures due to their regenerative and anti-inflammatory properties, enhancing healing and reducing complications. Applications include ophthalmic surgeries, such as pterygium excision, and minor wound care procedures. The efficiency, cost-effectiveness, and quick turnaround of ASCs make them ideal for using amniotic membranes, addressing the need for advanced, minimally invasive treatments that improve patient outcomes and reduce recovery times. As per the data from SurgeryView product (Definitive Healthcare), there were over 11,800 operative ASCs across the U.S. in 2022. This segment's growth is driven by the increasing preference for outpatient care and advancements in medical technologies.

Regional Insights

The North America amniotic membrane market dominated the overall global market and accounted for a 31.5% revenue share in 2023. Some key factors contributing to the growth include well-established healthcare facilities and the presence of leading industry players. The region's increasing focus on regenerative medicine and rapid adoption of advanced technologies are key factors enhancing market expansion. Notable advancements in the preservation and application of amniotic membranes for ocular and wound care therapies further support this growth. In addition, favorable regulatory frameworks and continuous investment in research and development contribute to the market's robust outlook during the forecast period.

U.S. Amniotic Membrane Market Trends

The amniotic membrane market in the U.S. held a significant share of North America's market in 2023. The rising incidence of accidents, such as road and trauma events, is expected to propel market growth. According to a report by Amaro Law Firm published in March 2023, there are 7.3 million motor vehicle accidents annually in the U.S. Consequently, the increasing number of accidents is anticipated to boost the demand for amniotic membrane during the forecast period.

Europe Amniotic Membrane Market Trends

Theamniotic membrane market in Europe accounted for the second-highest revenue share of 27.3% over the forecast period. The healthcare system in Europe is publicly funded, and some countries have adopted universal healthcare systems, thereby increasing product demand. A rising number of patients suffering from chronic diseases is expected to boost the adoption of amniotic membranes among healthcare professionals. For instance, according to the European Chronic Disease Alliance, chronic diseases, including heart disease, stroke, cancer, chronic respiratory diseases, and diabetes, are the primary cause of death in Europe, accounting for 86% of all fatalities and 77% of the total disease burden.

The UK amniotic membrane market is one of the major markets in the region. According to The Primary Care Dermatology Society data published in October 2023, over 500,000 people now live with some form of venous ulceration in the UK, a number that has doubled in the past decade. This rise in cases has significantly increased the demand for advanced wound care solutions, including amniotic membrane products. The effectiveness of these membranes in promoting healing and reducing infection rates makes them a crucial component in managing venous leg ulcers, driving market growth and adoption among healthcare providers.

The amniotic membrane market in France is expected to grow over the forecast period, driven by its diverse medical applications. These membranes are increasingly used for reconstructing the conjunctiva surface, pterygium excisions, surgical wounds, corneal ulcers, pressure and venous leg ulcers, limbal stem cell deficiency, and regenerative medicine. The rise in chronic wounds and surgical procedures has boosted the demand for these advanced wound care solutions. Their ability to promote faster healing and reduce inflammation makes them a preferred choice among healthcare providers.

The amniotic membrane market in Germany is projected to expand in the forecast period due to the ophthalmology sector witnessing significant growth in the market. Amniotic membranes are increasingly used in treating ocular surface disorders, corneal defects, and other ophthalmic conditions due to their regenerative properties and effectiveness in promoting healing and reducing inflammation. The market expansion is driven by advancements in biotechnology, rising awareness among healthcare professionals, and increasing patient demand for non-invasive treatment options.

Asia Pacific Amniotic Membrane Market Trends

The amniotic membrane market in the Asia Pacific region is expected to grow at the fastest growth rate during the forecast period. China and Japan are poised to lead the Asia Pacific market in the upcoming period. Moreover, the availability of trained professionals and the presence of developing healthcare facilities are expected to drive market growth over the forecast period. In addition, the increasing awareness of the benefits offered by the amniotic membranes is likely to propel market growth.

The Japan amniotic membrane market is expected to grow at the fastest growth rate over the forecast period. Most countries in this area are experiencing economic development with a gradual rise in disposable income. Many multinational corporations are making substantial investments in this region as a result. In addition, Japan's increasing healthcare spending, comprising 9.8% of its GDP in 2022, according to the Organization for Economic Cooperation & Development, is anticipated to fuel market growth in the forecast period.

The amniotic membrane market in China is expected to grow over the forecast period. The expanding healthcare infrastructure, growing healthcare workforce, and well-established medical facilities in China are anticipated to drive market expansion in the future. For instance, according to CEIC data from 2022, the number of hospitals in China increased to 36,976 units from the previous figure of 36,570 units in 2021. Furthermore, the increasing incidence of surgical wounds in China is expected to boost the market for amniotic membrane.

The India amniotic membrane market is experiencing significant growth due to a surge in eye infections, which have risen by 70%, according to Hindustan Times in August 2023. Recent rains and floods have worsened sanitation conditions, leading to an increase in viral and bacterial diseases. Health experts highlight the rising demand for amniotic membranes, known for their regenerative and anti-inflammatory properties, in treating ocular surface disorders. As infections increase, the need for effective eye care solutions drives market growth, positioning the amniotic membrane sector for continued expansion.

Latin America Amniotic Membrane Trends

The amniotic membrane market in Latin America is driven by a rise in healthcare spending and infrastructural investments. Furthermore, the rising incidence of accidents and trauma cases is expected to boost the market for amniotic membrane.

MEA Amniotic Membrane Market Trends

The amniotic membrane market in the Middle East & Africa (MEA)is growing at a moderate rate owing to several factors, such as high spending capacity & living standards, the presence of well-established medical infrastructure, and the increasing number of cancer cases. The high cancer prevalence, coupled with an increasing preference for early disease diagnosis, is expected to drive market growth. In addition, growing government initiatives to increase reimbursement coverage are expected to boost market penetration during the forecast period.

The Saudi Arabia amniotic membrane market is anticipated to expand in the forecast period. The rise in healthcare spending, projected at USD 50.4 billion for 2023, according to a report by the International Trade Administration and the U.S. Department of Commerce, is expected to drive this expansion. Additionally, the increasing presence of hospitals and healthcare professionals is a key factor fueling market growth.

The amniotic membrane market in Kuwait is anticipated to experience moderate growth, fueled by increased healthcare spending and awareness campaigns emphasizing its tissue-based products to reduce wound care costs. Furthermore, a WHO report from January 2023 highlights a growing number of healthcare professionals, which is expected to further drive market expansion.

Key Amniotic Membrane Company Insights

The market is highly competitive, with key players such as Alliqua BioMedical Inc., Amnio Technology, LLC, and Applied Biologics LLC holding significant positions. The major companies are undertaking various organic and inorganic strategies, such as new product development, collaborations, acquisitions, mergers, and regional expansion, to serve their customers' unmet needs.

Key Amniotic Membrane Companies:

The following are the leading companies in the amniotic membrane market. These companies collectively hold the largest market share and dictate industry trends.

- Alliqua BioMedical Inc.

- Amnio Technology, LLC

- Applied Biologics LLC

- Human Regenerative Technologies, LLC

- DermaSciences

- Katena Products, Inc.

- MiMedx Group Inc.

- Skye Biologics, Inc.

- Amniox Medical Inc.

- Organogensis, Inc.

Recent Developments

-

In February 2024, Verséa introduced a point-of-care platform for amniotic membrane grafting. This innovation facilitates rapid and effective testing, enhancing patient care in ophthalmology by providing immediate diagnostic results and treatment options.

-

In December 2023, NovaBay Pharmaceuticals partnered with Woo University to educate eyecare professionals on the use of amniotic membranes. The partnership includes a free webinar providing continuing education credits, discussing clinical applications, patient selection, and billing for amniotic membranes, particularly NovaBay's Avenova Allograft, which aids in ocular surface repair.

-

In February 2022, Amnio Technology launched two new dual-layer allografts, Dual Layer PalinGen X-Membrane and PalinGen Dual-Layer Membrane. These products, recognized by the FDA as minimally manipulated for homologous use, aid in wound management for acute, chronic, and surgical wounds due to their preserved extracellular matrix and regulatory proteins.

Amniotic Membrane Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.06 billion

Revenue forecast in 2030

USD 8.50 billion

Growth rate

CAGR of 13.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Alliqua BioMedical Inc.; Amnio Technology, LLC; Applied Biologics LLC; Human Regenerative Technologies, LLC; DermaSciences, Katena Products, Inc.; MiMedx Group Inc.; Skye Biologics, Inc.; Amniox Medical Inc.; Organogensis, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Amniotic Membrane Market Report Segmentation

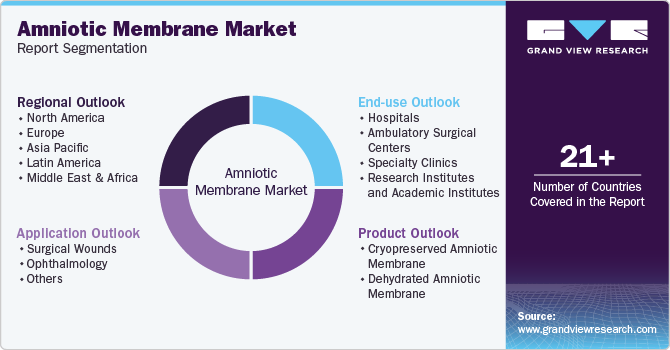

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global amniotic membrane market report on the basis of product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cryopreserved Amniotic Membrane

-

Dehydrated Amniotic Membrane

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Wounds

-

Ophthalmology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Research Institutes and Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global amniotic membrane market size was estimated at USD 3.60 billion in 2023 and is expected to reach USD 4.06 billion in 2024.

b. The global amniotic membrane market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 8.5 billion by 2030.

b. Cryopreserved amniotic membrane held the largest market share of 59.1% in 2023 owing to high effectivity and usage. Usage of these membranes in ocular surgeries facilitates faster recovery and reduced inflammation of the eye, promoting market growth.

b. Major market players included in the amniotic membrane market are Alliqua BioMedical, Inc.; Amnio Technology, LLC; Applied Biologics LLC; Human Regenerative Technologies, LLC; DermaSciences; Katena Products, Inc.; MiMedx Group, Inc.; Skye Biologics, Inc.; Amniox Medical, Inc.; and Organogensis, Inc.

b. Key factors that are driving growth are rising awareness regarding transplants leading to a rise in the number of transplants due to increasing demand for tissue-based products. It has also led to a rise in the number of donations thus, fueling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.