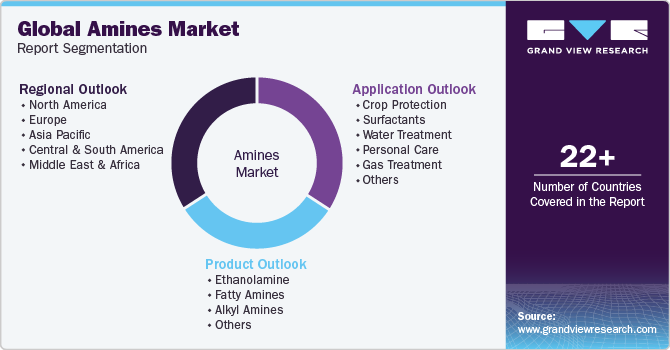

Amines Market Size, Share & Trends Analysis Report By Product (Ethanolamine Fatty Amines, Alkyl Amines), By Application (Crop Protection, Surfactants, Water Treatment, Personal Care, Gas Treatment), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-291-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Amines Market Size & Trends

The global amines market size was size estimated at USD 22.84 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030, owing to rising surfactant demand and increased public awareness of health and food safety. Amines are organic derivatives of ammonia. The prominent end-uses of the product are industries such as crop protection, surfactants, water treatment, personal care, and gas treatments.

Amines, including ethanolamine and fatty amines, are widely employed in the manufacturing of surfactants. The growing use of surfactants in various industries is expected to have a positive impact on the market over the forecast period. The growth of the detergents market in key regions, including Asia Pacific, North America, and Europe, on account of the growing hygiene awareness, is expected to drive the demand for surfactants over the forecast period.

The prominent application of amines is in the manufacturing of crop protection chemicals. They help to control weed growth through enhanced uptake and absorption. The benefits and utility of amines are vast in the crop protection industry worldwide. For instance, turpentine-derived amines are efficient botanicals for sustainable crop care. In addition, amines in crop protection chemicals have good fertilizer compatibility as well as show good performance in hard water. Rapidly increasing population, increasing awareness regarding food & health safety, reduced arable land, and the need for enhanced crop yield are expected to drive the demand for amines over the forecast period.

Manufacturers of the product often invest in research & development activities to improve the performance of their products, introduce new formulations of these compounds in the market, and enhance their production processes. For instance, companies like BASF SE have their research & development laboratories for product improvement. The costs of research & development activities incurred by the manufacturers can influence the prices of products to recover their research & development investments.

The product market is evolving rapidly on a global scale in terms of product development, process innovations, regulations imparting new avenues, and application scope. The market is largely dependent on petroleum-based feedstock, although significant efforts are being undertaken to switch the paradigm. Dependence on crude oil affects the market prices, thereby causing market leaders to stabilize price points on a competitive scale.

Furthermore, multiple agencies and authorities, including the National Institute of Health, REACH, and the U.S. EPA, have classified the product as hazardous waste due to its potential to cause environmental degradation. This factor is likely to set challenges for the overall growth of the product market worldwide. However, with changing dynamics in terms of innovations, the market is likely to attain a positive outlook in the coming years.

Market Concentration & Characteristics

The market is moderately fragmented, with players aiming to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, and research & development. For instance, in 2022, Eastman completed significant expansions to their tertiary amine production facilities in Ghent, Belgium, and Pace, Florida. The Pace plant saw improvements in production flow, while the Ghent facility received a capacity boost. These strategic investments position Eastman to better serve their customers in the home and personal care market.

Established giants like BASF SE and The Dow Chemical Company battle for market share, while challengers like Arkema and Huntsman Corporation constantly innovate to gain a foothold. Mature players face the challenge of expanding their customer base and gaining a competitive advantage over other players in the market. This intense competition can put pressure on profit margins and require continuous efforts to differentiate and innovate.

BASF SE, The Dow Chemical Company, Arkema, Huntsman Corporation, and Solvay S.A., among others, are the key manufacturers operating in the product market. These companies have a stronghold in the emerging markets while exporting their products to various end use applications.

Product Insights

Ethanolamine dominated the market with a revenue share of 52.2% in 2023. This is attributable to its numerous application areas, such as surfactants, corrosion inhibitors, textile processing, gas treatment, and personal care products. It is an organic compound that contains both amine (-NH2) and alcohol (-OH) functional groups. In textile applications, these products are employed as an intermediate in producing softeners, emulsifiers, and textile processing chemicals.

The consumption of monoethanolamine (MEA) has been influenced by several factors, including regulatory requirements, industrial growth, and technological advancements. MEA is primarily utilized in various applications, including solvent purification, gas treatment, and chemical intermediates. The demand for MEA in these applications fluctuates, due to overall growth in end use sectors, such as petrochemicals, oil & gas, and pharmaceuticals, among others.

Fatty amines are versatile chemicals used in various industries, such as agriculture, personal care, water treatment, and cleaning products. They are essential ingredients in the production of agricultural chemicals, such as herbicides, pesticides, and fungicides. With the increasing demand for food globally and the need to improve agricultural productivity, the demand for these chemicals, and consequently, fatty amines, is on the rise.

Alkyl amines have broad applications, including the manufacturing of pesticides, surfactants, solvents, and rubber reagents. They are utilized across various sectors, including explosives, chemicals, water treatment, pharmaceuticals, and agriculture. They are crucial components in the production of agricultural chemicals, such as herbicides, pesticides, and fungicides. With the increasing global population and the need to enhance agricultural productivity, the demand for these chemicals is rising, consequently driving the demand for alkyl amines. In addition, alkyl amines are used as intermediates in the synthesis of various pharmaceutical compounds.

Applications Insights

Surfactants dominated the market with a revenue share of 27.5% in 2023 owing to the widespread utilization of surfactants across industries such as personal care, household cleaning, agrochemicals, and oil and gas, which have contributed significantly to the segment's dominance. Surfactants are key ingredients in shampoos, soaps, detergents, and other cleaning formulations, where they enable the effective removal of dirt and oil from surfaces. The increasing consumer focus on hygiene, cleanliness, and personal grooming fueled the demand for surfactant-based products, thereby driving market growth.

Moreover, the surfactants segment benefited from advancements in formulation technologies and product innovation, which led to the development of novel surfactants with improved performance characteristics and environmental profiles. Manufacturers focused on producing bio-based surfactants derived from renewable feedstocks, aligning with sustainability initiatives and consumer preferences for eco-friendly products.

There is a growing demand for primary & secondary amines on account of increasing awareness among consumers regarding high crop yield, food & health safety, and decreasing arable land; this, in turn, is expected to have a positive impact on the demand for agricultural products over the forecast period. However, rising environmental concerns and awareness regarding food safety among consumers have resulted in increased demand for bio-based products. The strict regulations in various countries across the globe against the usage of synthetic fertilizers, on account of their harmful effects on the environment, are anticipated to create a barrier to market growth.

Primary & secondary amines are used in industrial water treatment facilities, which include boilers and cooling towers. These products are finding growing application in the water treatment industry owing to their ability to eliminate bacteria in water effectively. Their rising popularity in pool water and industrial water discharge applications due to their excellent germicidal properties is expected to boost market growth. Moreover, a robust manufacturing base of chemical, automotive, and pharmaceutical industries in major economies is expected to maintain the penetration of water treatment facilities high at all times, which is expected to fuel the demand for primary & secondary amines over the forecast period.

Regional Insights

The amines market in North America is expected to exhibit a rise in the demand for disinfectants in the region owing over the forecast period due to increasing awareness regarding personal hygiene in households post the spread of COVID-19. As per an article published by Fortune in July 2020, Lysol, a disinfectant brand offered by Reckitt Benckiser, has shown a 70% increment in sales in North America in the first half of 2020. The hike in sales was evident in the form of Reckitt’s 24% rise in the Financial Times Stock Exchange Group (FTSE) -100 index.

U.S. Amines Market Trends

The U.S. amines market is anticipated to show advancement in growth over the forecast period, considering the growing inclusion of primary & secondary amines by the U.S. manufacturing industries to treat their wastewater. The U.S. EPA has started a Clean Water State Revolving Fund (CWSRF) program that is focused on supplying clean drinking water. Such initiatives, coupled with increasing demand for purified water in the country, are anticipated to drive market growth.

Asia Pacific Amines Market Trends

Asia Pacific amines market dominated the market in 2023 with a global revenue share of 45.6% and has emerged as a prominent regional market for primary & secondary amines in 2023. Rising public awareness regarding health and hygiene, in addition to the adoption of higher standards of cleaning and disinfection, is expected to be the prime driver for cleaners or disinfecting formulations in the region. Consumption of cleaners or disinfecting formulations in the region has highly benefitted from its heightened demand, especially post the COVID-19 pandemic, further accelerating the product market growth at the domestic as well as international levels.

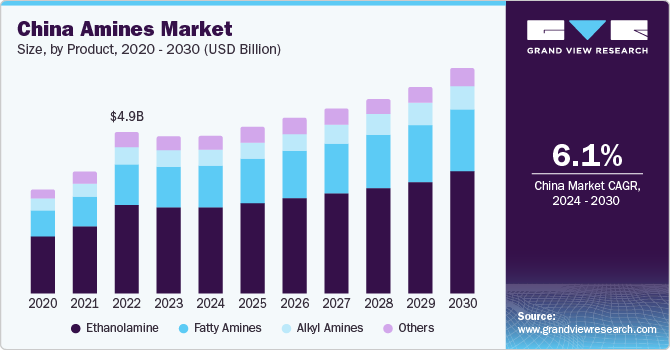

The amines market in China is expected to grow at a significant CAGR over the forecast period. China, being the epicenter of the COVID-19 outbreak, has led to high pressure amongst the Chinese government and consumers. Implementation of disinfection practices such as spray trucks and disinfection tunnels (which are not considered safe anymore) were also carried out at a large scale in the country. Due to the preventive measures being taken by the government in attempts to curb the spread of COVID-19 in the country, the demand for cleaners or disinfecting formulations in China registered a huge spike in 2020. To meet this demand, the country witnessed several production expansions and technological advancements by the manufacturers.

The India amines market is expected to grow at a significant CAGR over the forecast period. In India, wastewater management is carried out by using either decentralized systems or conventional centralized systems. As a result, many water treatment plants across the country are adopting a range of technologies to ensure treated water is available to the large populations of the country. Remondis AG & Co KG and M/s. Degremont S.A., among others, are the key players that have entered the Indian water treatment sector. Thus, increasing water treatment-related activities are further expected to propel the demand for amines in the country.

Europe Amines Market Trends

The amines market in Europeis expected to show significant growth over the forecast period. The European region is one of the major producers of agricultural products in the world. Rising population and decline in the availability of arable land are boosting the demand for agricultural chemicals, which, in turn, is expected to boost the demand for tertiary amines. Agricultural chemicals play a vital role in boosting soil fertility both efficiently and effectively. However, rising environmental concerns and inclination toward consuming organic fertilizer-based products among consumers are expected to hamper the demand for tertiary amines in the market.

The high demand for surfactants for industrial and domestic uses may contribute to the segment's growth. The steady rise in consumer spending on personal hygiene is expected to directly impact the demand for tertiary amines. Furthermore, the presence of key manufacturers in the country with high surfactant exports across Europe is likely to propel market demand.

The tertiary amines market in Europe is primarily driven by the agriculture industry. Also, the rising demand for disinfectant products across the region is expected to boost the demand for tertiary amines in the market over the forecast period.

The growth of the primary & secondary amines market in Germany can be attributed to increasing groundwater and surface water pollution, stringent regulations regarding water treatment, and increasing demand for chemicals from municipal and manufacturing sectors. According to the German portal deutschland.de, 96% of wastewater from public institutions and private homes is purified in water treatment plants. The country also has a presence of approximately 10,000 water treatment plants. Such factors are likely to bolster product demand in the country.

The UK amines market is expected to grow at a significant CAGR over the forecast period. The UK has around 7000 sewage treatment plants across the nation, with more ongoing investments to upgrade the existing assets. The emphasis on water treatment was further boosted when the country faced a threat of prosecution from the European Union Court of Justice for failing to meet the standards set by European Directives. This has triggered substantial investments and development of wastewater treatment technologies over the past few years, which has generated high demand for primary & secondary amines.

Central & South America Amines Market Trends

The Central & South America amines market is witnessing health and hygiene trends that are expected to be the drivers for cleaners & disinfecting formulations. Growing population, urbanization, and awareness in terms of sanitization and cleanliness are expected to add to market growth. Increasing adoption of higher standards of sanitation and disinfection is likely to increase the sales of products in the near future. The outbreak of COVID-19 in the country has further accelerated the production and consumption of disinfectants in the Brazilian market. Preventive steps taken by the country, such as disinfecting tunnels to curb the spread of coronavirus, are expected to expand the application of primary & secondary amines in the country.

The amines market in Brazil is experiencing significant growth, fueled by the expanding pharmaceutical, agrochemical, personal care, construction, and energy sectors. There is an increasing focus on the development and use of specialty amines to meet specific application requirements across various industries. Environmental concerns and sustainability initiatives are driving the demand for amines used in the production of eco-friendly products, such as bio-based surfactants, personal care formulations, and biofuels. The growing adoption of water treatment technologies and mineral processing is also contributing to the market demand. Stringent regulations and emphasis on safety are prompting manufacturers to develop safer and more efficient amine-based products and processes.

Middle East & Africa Amines Market Trends

The amines market in Middle East & Africa is expected to register a comparatively slower growth rate compared to other regions over the forecast period. However, increasing wastewater treatment activities, along with the growth of consumer-oriented markets such as personal care & cleaning products in the region, are anticipated to fuel growth in the projected years.

Azerbaijan is one of the prominent water treatment markets in the Middle East region. Various projects are being implemented in the region for the reconstruction of water supply and sewage systems. These projects are implemented through the close cooperation of the Asian Development Bank, the World Bank, and the Japan International Cooperation Agency, among others. The Azersu Open Joint Stock Company (OJSC) plays a vital role in the implementation of water supply and sanitation services in the Republic of Azerbaijan.

The amines market in Saudi Arabia is expected to grow at a significant CAGR over the forecast period. According to the Sustainable Water Alliance, Saudi Arabia is the third-largest consumer of water in the world, and it is expected to become the third-largest country in the use of treated water after China & the U.S. in the coming few years. Presently, only 18% of wastewater is reused, but various steps are underway to increase wastewater treatment, and many wastewater companies are also investing in developing proper infrastructure. For example, the National Water Company is planning to invest around USD 23 billion in Saudi Arabia to build sewage and treatment infrastructure in the next 20 years. Growing investment and various initiatives by the government are expected to boost wastewater treatment activities, which, in turn, is expected to boost the demand for tertiary amines in the region over the projected period.

Key Amines Company Insights

Some of the key players operating in the market include BASF SE, The Dow Chemical Company, Arkema, Huntsman Corporation, and Solvay S.A.

-

Established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reducing production & operating costs. In addition, companies involved in manufacturing amines develop new products and production technologies. Companies are also backwardly integrating to save the cost of the operation involved in raw material procurement.

-

Manufacturers of amines such as BASF SE, SABIC, Dow, INEOS Group, and LyondellBasell Industries Holdings B.V., among others are backward integrated in the value chain of the amines market and hence, are involved in the manufacture of different raw materials.

Key Amines Companies:

The following are the leading companies in the amines market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema S.A.

- Akzo Nobel N.V.

- BASF SE

- SABIC

- The Dow Chemical Company

- Huntsman Corporation

- Mitsubishi Gas Chemical Company

- Taminco Corporation

- Celanese Corporation

- Solvay S.A.

- INEOS Group

- Lanxess Corporation

- LyondellBasell Industries Holdings B.V

Recent Developments

-

In February 2024, BASF SE partnered with OQEMA, a prominent chemical distributor in Europe. This collaboration leverages OQEMA's well-established distribution network and local market knowledge, along with BASF's expertise in producing high-quality standard amines. By combining their strengths, both companies aim to capture a larger market share and drive mutual growth within the UK and Irish standard amines sector.

-

In August 2022, Global Amines Company Pte. Ltd., a joint venture between Clariant and Wilmar, signed an agreement to acquire Clariant's quats and esterquats business for US$ 113 million, with an expected closing date in the first half of 2023.

-

In February 2022, Kao Corporation announced plans to construct a new tertiary amine production facility in Pasadena, Texas, USA. This strategic expansion will not only cater to the growing need for hygiene applications but also serve a broader range of industrial uses.

-

In June 2022, BASF SE announced a production capacity increase for specialty amines at their Geismar, Louisiana facility. This expansion of their world-scale, flexible production asset will be completed by mid-2023 and will allow them to significantly boost output of their Baxxodur polyetheramines and LupragenTM tertiary amines.

Amines Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 22.86 billion |

|

Revenue forecast in 2030 |

USD 30.74 billion |

|

Growth Rate |

CAGR of 5.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

July 2024 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; Itay; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia |

|

Key companies profiled |

Arkema S.A.; Akzo Nobel N.V.; BASF SE; SABIC; The Dow Chemical Company; Huntsman Corporation; Mitsubishi Gas Chemical Company; Taminco Corporation; Celanese Corporation; Solvay S.A.; INEOS Group; Lanxess Corporation; LyondellBasell Industries Holdings B.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Amines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global amines market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethanolamine

-

Fatty Amines

-

Alkyl Amines

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Crop Protection

-

Surfactants

-

Water Treatment

-

Personal Care

-

Gas Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include increasing use of the product and its derivatives for production of personal care products and increasing demand for surfactants.

b. The global amines market size was estimated at USD 22.84 billion in 2023 and is expected to reach USD 22.86 billion in 2024.

b. The global amines market is expected to grow at a compounded annual growth rate (CAGR) of 5.1% from 2024 to 2030 to reach USD 23.76 billion by 2030.

b. Ethanolamine was the largest product, accounting for 52.2% of amines market share in 2023. Ethanolamine is majorly used as a cleaning agent, in the form of monoethanolamine and triethanolamine.

b. Some prominent players in the global amines market include Arkema S.A., Akzo Nobel N.V. , BASF SE, SABIC . The Dow Chemical Company, Huntsman Corporation

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."