- Home

- »

- Next Generation Technologies

- »

-

Americas UAV Market Size And Share, Industry Report, 2033GVR Report cover

![Americas UAV Market Size, Share & Trends Report]()

Americas UAV Market (2025 - 2033) Size, Share & Trends Analysis Report By System, By Application (Military, Commercial), By Type (Fixed-Wing, Rotary Blade), By Size, By Operation Mode, By Point Of Sale, By Payload Capacity, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-451-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Americas UAV Market Summary

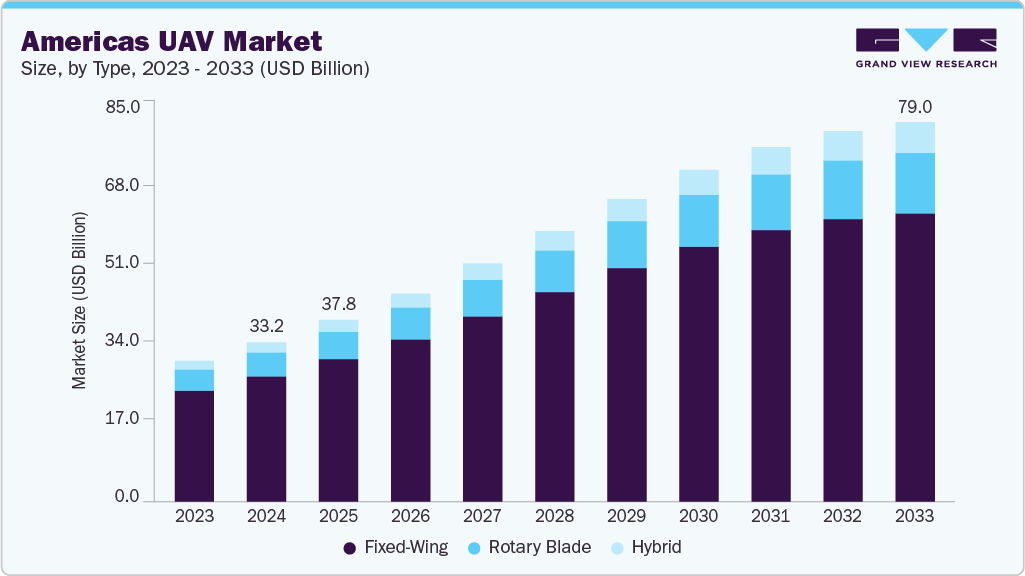

The Americas UAV market size was estimated at USD 33,169.9 million in 2024 and is projected to reach USD 79,041.2 million by 2033, growing at a CAGR of 9.6% from 2025 to 2033. The increasing adoption of UAV applications across commercial sectors such as agriculture, construction, and logistics, the availability of advanced UAVs equipped with cutting-edge technologies like artificial intelligence (AI) and autonomous flight capabilities, and heightened government focus on urban air mobility solutions are the key factors driving the Americas UAV industry expansion.

Key Market Trends & Insights

- The North America UAV industry accounted for the highest revenue share of 89% in 2024.

- The U.S. UAV industry accounted for the largest market share of 86% in 2024.

- Based on system, the platform segment accounted for the largest market share of over 48% in 2024.

- Based on application, the military segment registered the largest revenue share in 2024.

- Based on type, the rotary-blade segment registered the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33,169.9 Million

- 2033 Projected Market Size: USD 79,041.2 Million

- CAGR (2025-2033): 9.6%

- North America: Largest market in 2024

- Latin America: Fastest growing market

The Americas UAV industry is strongly propelled by substantial investments from the military and defense sectors, particularly in the United States. The U.S. leads globally in defense spending, allocating billions annually to develop and procure advanced UAV systems for surveillance, reconnaissance, and combat missions. Programs focusing on high-altitude long-endurance (HALE) drones and armed unmanned combat aerial vehicles (UCAVs) are expanding rapidly, supported by continuous R&D and modernization efforts. This heavy defense expenditure ensures a steady pipeline of innovation and procurement, making military demand a cornerstone of market growth.In addition, commercial sectors such as agriculture, construction, logistics, and utilities are increasingly adopting UAV technology to enhance operational efficiency and reduce costs. Precision agriculture, enabled by drones equipped with advanced sensors and imaging, allows farmers to monitor crops, manage irrigation, and apply pesticides more effectively. Similarly, UAVs facilitate aerial surveying, infrastructure inspection, and delivery logistics, driving demand across these industries. This diversification beyond military use is a key factor accelerating the Americas UAV industry expansion.

Furthermore, UAVs are playing an increasingly critical role in public safety and emergency management in the Americas. Police, fire departments, and emergency medical services deploy drones for search and rescue, disaster response, and situational awareness, especially in hard-to-reach or hazardous environments. The ability of UAVs to provide rapid, real-time data during emergencies is driving accelerated adoption and fleet expansion in these sectors, contributing significantly to market growth.

Moreover, supportive government policies and regulatory advancements in the Americas are facilitating UAV integration into various applications, including urban air mobility and commercial operations. Initiatives to streamline drone certification, enable beyond visual line of sight (BVLOS) flights, and secure domestic manufacturing supply chains are encouraging innovation and investment. This regulatory environment, combined with active merger and acquisition activities among key players, is strengthening the market ecosystem and driving growth.

System Insights

The platform segment accounted for the largest market share of over 48% in 2024. This growth can be attributed to the increasing demand for UAVs in military, commercial, and recreational applications that drives advancements in airframes, avionics, propulsion systems, and software to enhance performance and capabilities. Innovations in these components enable more efficient, reliable, and versatile UAVs, meeting diverse operational requirements.

The payload segment is expected to witness the fastest CAGR of over 10% from 2025 to 2033, driven by the expanding military and commercial applications that require sophisticated systems onboard UAVs. These include cameras, sensors, and communication tools in UAVs used for tasks such as surveillance, reconnaissance, and communication. The commercial sector, particularly agriculture and logistics, is leveraging UAV capabilities for crop monitoring and package delivery. Subsequently, the need for more capable and diverse payload options is pushing technological advancements and driving the segment growth.

Application Insights

The military segment registered the largest revenue share in 2024, driven by increasing demand for intelligence, surveillance, and reconnaissance (ISR), precision strike capabilities, border security, and combat operations. Technological advancements such as AI integration, autonomous flight, enhanced sensor payloads, and swarm technologies are improving UAV effectiveness and operational flexibility. In addition, the development of hybrid and electric propulsion systems enhances UAV endurance and efficiency, further driving the segmental growth.

The commercial segment is expected to grow at the fastest CAGR from 2025 to 2033, owing to the increasing adoption of drones across various industries such as agriculture, construction, surveillance & monitoring, and delivery services. Businesses are leveraging UAVs for tasks such as aerial surveying, crop monitoring, and last-mile logistics to enhance the efficiency of various operations and reduce associated costs. These trends are expected to drive the segmental growth in the coming years.

Type Insights

The rotary-blade segment registered the largest revenue share in 2024. There is a growing awareness among consumers regarding the benefits of rotary blade UAVs in sectors such as agriculture, surveillance, logistics, and entertainment. This demand is driven by the need for efficient data collection, monitoring, and delivery services. Furthermore, the reduction in manufacturing costs due to technological advancements has made rotary blade UAVs more affordable for both commercial and personal use. This increased accessibilityencourages wider adoption across different industries.

The hybrid segment is expected to grow at the fastest CAGR from 2025 to 2033, owing to its superior performance and adaptability in marine applications. Hybrid UAVs enhance their efficiency and power by integrating the capabilities of batteries and fuel. In addition, these UAVs can fly for long periods with heavier payloads, even in severe weather conditions, thereby driving the segmental growth.

Size Insights

The small segment registered the largest revenue share in 2024. Rapid innovations in drone technology have significantly enhanced the capabilities of small UAVs. The integration of Artificial Intelligence (AI) and machine learning is also enabling smarter navigation and data analysis, further broadening their utility. Furthermore, drones are being utilized for surveillance, reconnaissance missions, border security, disaster response, and emergency management. These trends collectively are expected to fuel the segment's growth in the coming years.

The nano segment is expected to grow at the fastest CAGR from 2025 to 2033. The increasing demand for advanced surveillance and reconnaissance capabilities across various sectors, including military & defense, commercial, and environmental monitoring, is propelling the adoption of nano UAVs owing to their compact size and versatility. In addition, the growing regulatory support from governments to integrate UAVs into national airspace systems has facilitated clearer guidelines for operation and further boosted segment growth.

Operation Mode Insights

The remotely piloted segment registered the largest revenue share in 2024. The increasing adoption of remotely piloted UAVs across various applications, such as military operations, surveillance, and commercial uses, is significantly contributing to the segment's growth. The ability of these UAVs to conduct missions without risking human lives has made them popular, particularly in defense and law enforcement sectors where real-time data and reconnaissance are paramount. In addition, advancements in drone technology, including improved navigation systems, payload capabilities, and operational efficiency, have further boosted the demand for remotely piloted UAVs

The fully autonomous segment is expected to grow at the fastest CAGR from 2025 to 2033. Fully autonomous UAVs provide significant operational efficiencies, such as reduced labor costs and enhanced precision in tasks such as aerial mapping, surveillance and monitoring, and logistics. Their ability to operate in hazardous environments without risking human lives is further driving the adoption of a fully autonomous operation mode.

Point Of Sale Insights

The OEM segment registered the largest revenue share in 2024. The segment growth can be attributed to various factors, such as the strategic positioning for direct consumer engagement at the point of sale, widespread adoption in defense and government operations, increased defense expenditure on unmanned systems, the presence of major UAV developers in the region, and collaboration between manufacturers and UAV solutions companies.

The aftermarket segment is expected to grow at the fastest CAGR from 2025 to 2033. The increasing need for aftermarket services such as maintenance, repair, and upgrades is propelling thesegment's growth. Technological advancements in UAV capabilities, including enhanced sensors and communication systems, are also contributing to this growth, as users seek to optimize their existing UAV fleets. In addition, the rising trend of military modernization initiatives in developing countries is driving the demand for advanced UAV systems, which necessitates robust aftermarket support. All these factors are expected to fuel segment growth in the coming years.

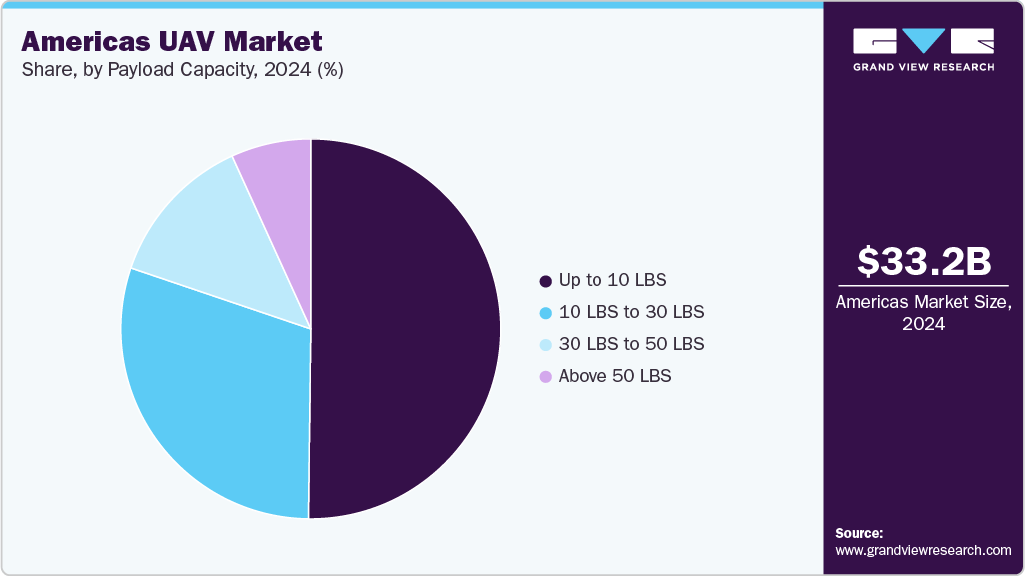

Payload Capacity Insights

The up to 10 LBS segment registered the largest revenue share in 2024. This range holds an optimal balance between payload capacity and operational efficiency, making it ideal for diverse applications such as agriculture, surveillance, and logistics. The increasing demand for versatile UAVs capable of carrying advanced sensors and cameras enhances their appeal across various sectors, including defense and commercial enterprises, thereby driving the segmental growth.

The 10 LBS to 30 LBS segment is expected to grow at the fastest CAGR from 2025 to 2033. This particular payload capacity segment offers a versatile balance between payload capacity and operational efficiency, making it suitable for a wide range of applications, including surveillance, logistics, and emergency services. The high demand for UAVs equipped with advanced sensors and imaging technology can be attributed to their utility in various sectors, particularly in commercial and military operations. This trend is expected to further fuel the segmental growth in the coming years.

Regional Insights

The North America UAV industry accounted for the highest revenue share of 89% in 2024. The North America market is expanding rapidly due to substantial investments in defense and commercial UAV applications. The region benefits from technological advancements and a robust ecosystem of UAV manufacturers and research institutions. In addition, the market players are actively involved in merger & acquisition activities to gain a competitive edge.

U.S. UAV Market Trends

The U.S. UAV industry accounted for the largest market share of 86% in 2024. In the U.S., UAVs are experiencing significant demand stemming from military modernization programs and the integration of UAVs into homeland security and commercial applications. The U.S. government’s focus on enhancing surveillance and reconnaissance capabilities fuels demand. Moreover, the market players are continuously updating and upgrading their products by integrating the latest sensors along with propulsion systems for better efficiency and flight time.

Latin America UAV Market Trends

The Latin America UAV industry is expected to grow at the fastest CAGR of over 11% from 2025 to 2033, primarily driven by the expanding use of small UAVs in civil and commercial sectors such as agriculture, mining, engineering, and construction, where drones are employed for monitoring and surveying vast and often inaccessible areas. The region's large forested and uninhabited lands, including the Amazon rainforest, necessitate UAV deployment for environmental protection and illegal deforestation detection, often involving indigenous communities.

The Brazil UAV industry accounted for the largest market share of over 30% in 2024, driven by increasing adoption across industries such as agriculture, construction, media, and delivery services. The country’s vast geographical size and diverse landscapes create high demand for drones in surveying, monitoring, aerial photography, and precision farming.

Key Americas UAV Company Insights

Some of the key players operating in the Americas UAV industry include Draganfly Innovations, Inc. and Airbus SE, among others.

-

Draganfly Innovation, Inc. develops and manufactures multi-rotor drones, industrial aerial video drones, civilian small UAVs, and wireless video systems that have applications in public safety, aerial photography, industrial inspection, and education sectors. The company also offers helicopters, helicopter parts, and wireless video systems online.

-

Airbus SE is a global aerospace company known for developing advanced aerospace products and delivering related services worldwide. The company has categorized its products and services under commercial aircraft, helicopters, defense, space, and security. The company connects people and places across the globe through its air and space products.

AgEagle Aerial Systems, Inc. and Shield AI are some of the emerging market participants in the Americas UAV industry.

-

AgEagle Aerial Systems Inc. is a provider of advanced drone solutions, specializing in professional-grade fixed-wing drones and aerial imagery-based data collection and analytics. The company caters to various offerings to serve various industries, including agriculture, construction, defense, environmental and monitoring, forestry, mining, quarries, aggregates, public safety, surveying, mapping, and GIS, among others.

-

Shield AI is a technology firm at the forefront of AI and robotics innovation, focusing on developing autonomous systems for defense and civilian applications. The company's flagship product, the AI-driven autonomous drone, is designed to operate in challenging environments, enhancing situational awareness and safety for military and first responders.

Key Americas UAV Companies:

- Advanced Aircraft Company

- AgEagle Aerial Systems Inc.

- Aliter Technologies, Inc.

- ARA Robotics

- Aurelia Technologies Inc.

- Draganfly Innovations, Inc.

- Drone Delivery Canada Corp

- Drone Volt SA

- DroneUp, LLC

- Elistair

- Elroy AirMed.

- FlyingBasket SRL

- Freefly Systems

- Guangzhou EHang Intelligent Technology Co. Ltd

- Inova Drone, Inc.

- Inspired Flight Technologies, Inc.

- Optelos

- Parrot Drone SAS

- Quantum-Systems GmbH

- Sentera, Inc.

- Vantage Robotics, Inc.

Recent Developments

-

In June 2025, DroneSense and Parrot announced a strategic partnership and the launch of the Parrot ANAFI UKR GOV micro-UAV at the 2025 Paris Air Show. This drone solution is Blue UAS-approved and NDAA-compliant, designed specifically for U.S. public safety agencies. It features encrypted communications, advanced navigation in GNSS-denied environments, and secure backup radio communications, enhancing situational awareness and tactical coordination for public safety missions

-

In May 2025, Draganfly Inc. announced a strategic partnership with Autonome Labs to develop an integrated UAV-based demining solution. This collaboration combines Draganfly’s Heavy Lift drone platform with Autonome’s M.A.G.I.C. (Mine and Ground Inert Clearance) mesh system, designed to safely deploy a smart mesh that detects, neutralizes, and detonates landmines across hazardous terrains.

-

In June 2024, Draganfly Innovations, Inc. partnered with First Atlantic Nickel Corp., a mineral exploration company based in Canada, to deploy its proprietary drone survey technologies for exploring potential awaruite nickel deposits in Atlantic Canada. Draganfly Innovations, Inc.’s specialized drones and sensors were customized to efficiently locate and assess awaruite mineralization zones, supporting the initial stages of the Atlantic Nickel Project exploration.

Americas UAV Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37,846.8 million

Revenue forecast in 2033

USD 79,041.2 million

Growth rate

CAGR of 9.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, application, type, size, operation mode, point of sale, payload capacity, and region

Regional scope

North America; Latin America

Country scope

U.S.; Canada; Brazil; Mexico

Key companies profiled

Advanced Aircraft Company; AgEagle Aerial Systems Inc.; Aliter Technologies, Inc.; ARA Robotics; Aurelia Technologies Inc.; Draganfly Innovations, Inc.; Drone Delivery Canada Corp; Drone Volt SA; DroneUp, LLC; Elistair; Elroy AirMed; FlyingBasket SRL; Freefly Systems; Guangzhou EHang Intelligent Technology Co. Ltd; Inova Drone, Inc.; Inspired Flight Technologies, Inc.; Optelos; Parrot Drone SAS; Quantum-Systems GmbH; Sentera, Inc.; Vantage Robotics, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas UAV Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Americas UAV market report based on system, application, type, size, operation mode, point of sale, payload capacity, and region:

-

System Outlook (Revenue, USD Million, 2021 - 2033)

-

Platform

-

Airframes

-

Avionics

-

Propulsion Systems

-

Software

-

-

Payload

-

Ground Control Stations

-

Others

-

-

Americas UAV Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Military

-

ISR

-

Logistics & Supply

-

Others

-

-

Commercial

-

Inspection & Maintenance

-

Mapping & Surveying

-

Delivery

-

Surveillance & Monitoring

-

Others

-

-

Government

-

Border Patrol

-

Traffic Monitoring

-

Police Operations

-

Others

-

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Fixed-Wing

-

Rotary Blade

-

Hybrid

-

-

Size Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Nano

-

Small

-

Medium

-

Large

-

Others

-

-

Operation Mode Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Remotely Piloted

-

Partially Autonomous

-

Fully Autonomous

-

-

Point of Sale Outlook (Revenue, USD Million, 2021 - 2033)

-

OEM

-

Aftermarket

-

-

Payload Capacity Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Up to 10 LBS

-

10 LBS to 30 LBS

-

30 LBS to 50 LBS

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Latin America

-

Brazil

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The global Americas UAV market size was estimated at USD 33.17 billion in 2024 and is expected to reach USD 37.85 billion in 2025.

b. The global Americas UAV market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2033 to reach USD 79.04 billion by 2033.

b. North America accounted for a market revenue share of over 89% in 2024, due to substantial investments in defense and commercial UAV applications. The region benefits from technological advancements and a robust ecosystem of UAV manufacturers and research institutions. In addition, the market players are actively involved in merger & acquisition activities to gain a competitive edge.

b. Some key players operating in the Americas UAV market include Advanced Aircraft Company, AgEagle Aerial Systems Inc., Aliter Technologies, Inc., ARA Robotics, Aurelia Technologies Inc., Draganfly Innovations, Inc., Drone Delivery Canada Corp, Drone Volt SA, DroneUp, LLC, Elistair, Elroy AirMed, FlyingBasket SRL, Freefly Systems, Guangzhou EHang Intelligent Technology Co. Ltd, Inova Drone, Inc., Inspired Flight Technologies, Inc., Optelos, Parrot Drone SAS, Quantum-Systems GmbH, Sentera, Inc., and Vantage Robotics, Inc.

b. The key factors driving the Americas UAV market include the expansion of UAV applications in commercial sectors such as agriculture, construction, and logistics, the availability of advanced UAVs featuring advanced technologies such as AI and autonomous, and an increased focus of governments on urban air mobility solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.