- Home

- »

- Advanced Interior Materials

- »

-

Americas Reusable Gloves Market Size & Share Report 2030GVR Report cover

![Americas Reusable Gloves Market Size, Share & Trends Report]()

Americas Reusable Gloves Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile), By End-use (Construction, Manufacturing), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-131-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Americas Reusable Gloves Market Trends

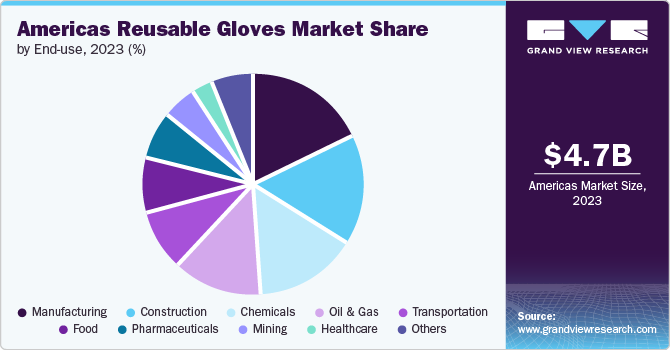

The Americas reusable gloves market size was estimated at USD 4.70 billion in 2023 and is anticipated to grow at a CAGR of 7.9% from 2024 to 2030. The market is expected to witness growth due to the rising awareness among industry players regarding the significance of ensuring the health and safety of employees in workplaces. This heightened awareness can be attributed to increasingly strict occupational safety regulations and the substantial expenses linked to workplace hazards, both of which are poised to act as drivers for market expansion.

The efforts and investments are expected to increase the workforce required in the manufacturing sector, which will, in turn, boost the demand for flame-resistant, cut-resistant, and chemical-resistant reusable gloves. These reusable gloves are made from thicker and more robust materials, making them more durable and resistant to wear & tear. For instance, in March 2023, the Mexican government unveiled a comprehensive strategy aimed at attracting businesses to the country. This strategy, known as the Inter-Oceanic Corridor Plan, involves the establishment of ten new industrial parks spanning the route that connects the Pacific port of Salina Cruz in Oaxaca state to the Gulf coast hub of Coatzacoalcos in Veracruz state.

Various awareness programs and joint initiatives by industry players and private & public offices are likely to increase their inclination toward the use of reusable gloves among workers involved in heavy-duty work. For instance, The Glove Company is a manufacturer of occupational safety and innovative products, including heat-resistant gloves, chemical-resistant gloves, and heavy-duty gloves, among others. The company also offers training to employers for the use of gloves against various hazards with comprehensive knowledge and instructions in accordance with ISO and OSHA Standards. This is expected to increase awareness among employers about the use of reusable gloves in the construction, manufacturing, oil & gas, chemicals, transportation, and mining sectors.

Drivers, Opportunities & Restraints

Due to strict regulations and significant expenses associated with workplace hazards, there is a growing recognition within the industrial sector of the paramount importance of ensuring the safety and security of workers. Safeguarding employees has become a top priority. To mitigate workplace risks and their detrimental effects on operational expenses in terms of compensation and legal settlements, businesses have given top priority to worker safety and implemented stringent safety regulations. The expansion of industrial activities, combined with these rigorous rules, is expected to have a beneficial influence on the demand for reusable gloves across various industries.

After recovering from the pandemic, the manufacturing sector's growth is expected to drive demand for reusable gloves over the forecast period. Industrial production in the U.S. increased from Q3 2021 to Q2 2023, supported by initiatives to revive domestic manufacturing and reduce import dependency. The U.S. government is seeking investments, partnerships, and trade agreements to boost the manufacturing sector. These efforts are expected to increase the workforce, thereby increasing the demand for flame-resistant, cut-resistant, and chemical-resistant reusable gloves.

The market's growth is likely to be restrained by the increasing automation and implementation of Artificial Intelligence (AI) in the industrial sector over the forecast period. As the region transitions into the fourth industrial revolution, countries such as the U.S., Canada, Mexico, and Brazil are advancing into a new phase characterized by "Industrial Internet Initiatives." These initiatives primarily aim to enhance digital manufacturing by increasing the digitization and interconnection of the value chain, product manufacturing, and business models.

Market Characteristics & Concentration

The industry growth stage is high, with an accelerating pace. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations play a significant role in shaping the Americas reusable glove industry dynamics. The market is expected to experience significant CAGR due to heightened awareness among industry stakeholders regarding the significance of ensuring worker safety and security in workplaces. This heightened awareness is driven by strict regulations and the substantial costs associated with workplace hazards. The increasing employment rates in various industries across the Americas have also contributed to the growing emphasis on worker safety.

Technological advancements and digitalization are transforming the way reusable glove suppliers connect with end users. The rise of e-commerce platforms allows suppliers to showcase their glove products online, making it easy for end users to browse and purchase gloves based on their specific needs and preferences. These platforms often provide detailed product descriptions, reviews, and sizing guides. Moreover, some manufacturers are incorporating Internet of Things (IoT) technology into gloves. These smart gloves can monitor various parameters such as hand temperature, humidity, and grip strength, providing valuable data to both users and suppliers for safety and performance optimization.

Key end use industries of reusable gloves include construction, manufacturing, oil & gas, chemicals, food, pharmaceuticals, healthcare, transportation, mining, and household. A few companies operating in the end use industries purchase gloves based on requirements instead of maintaining inventories, which aids the glove suppliers to quote high prices for profits. However, the presence of numerous suppliers and retailers increases the bargaining power of buyers, as they can choose the retailers that offer products at minimum prices.

Material Insights

“The demand for nylon gloves segment is expected to grow at a significant CAGR of 8.8% from 2024 to 2030 in terms of revenue.”

The nitrile gloves dominated the market and accounted for a market share of 37.7% in terms of revenue in 2023.The demand for reusable gloves developed from nitrile is expected to increase significantly in the Americas owing to their surging adoption in the construction, manufacturing, chemicals, mining, and oil & gas industries. More resistance offered by nitrile reusable gloves to puncture and chemicals than reusable gloves developed from vinyl and latex is anticipated to augment the growth of the nitrile reusable gloves segment of the market in the coming years.

The demand for nylon gloves is anticipated to grow at a significant CAGR over the forecast period. Nylon gloves offer lightness and breathability, resulting in superior comfort and dexterity for users. These gloves can be used multiple times as they are wear and tear resistant, thereby reducing the requirement for frequent replacements. They are increasingly adopted for use in different applications in different industries. This fuels the growth of the nylon reusable gloves segment of the market over the forecast period.

End-use Insights

“The demand for chemical end use segment is expected to grow at a significant CAGR of 9.2% from 2024 to 2030 in terms of revenue.”

The manufacturing end use segment led the market and accounted for 17.8% revenue share of the Americas market in 2023. Reusable gloves are extensively used in the manufacturing industry for various tasks, including assembly, painting, welding, and handling sharp and heavy materials. Nitrile and latex gloves are commonly used to protect workers from chemicals, oils, and mechanical hazards. Reusable gloves help workers avoid injuries and provide dexterity for precise assembly and maintenance tasks. Moreover, in the manufacturing end use industry, cut-resistant reusable gloves are widely utilized as these gloves are made from materials like Kevlar or high-performance polyethylene (HPPE) and provide excellent protection against cuts, slashes, and abrasions. They are essential for workers handling sharp objects, such as metal, glass, or machinery components.

The chemical end use segment is expected to register growth at a CAGR of 9.2% over the forecast period. In the chemicals industry, reusable gloves are considered crucial when it comes to ensuring the health and safety of the personnel involved in hazardous activities. Proper selection and utilization of suitable reusable gloves aid in hazard prevention, such as preventing injuries or burns to the hand. The rapid expansion of the chemical and petrochemical industry in the U.S., along with stringent safety regulations, is expected to have a positive impact on the demand for reusable gloves over the forecast period.

Country Insights

“In Americas, the U.S. dominated the market in 2023 and accounted for 56.5% of the market share in 2023.”

U.S. Reusable Gloves Market Trends

The U.S. reusable gloves market is driven by the strong emphasis placed on occupational safety and compliance with safety regulations. This focus continues to drive the demand for reusable gloves across various industries, including manufacturing, construction, healthcare, and more. The rise of e-commerce has made it easier for consumers and businesses in the U.S. to access a wide variety of reusable gloves through online platforms, contributing to increased accessibility, as well as competition, in the market.

The reusable gloves market in Mexico is anticipated to grow significantly over the forecast period. Increasing private investments in the construction of commercial malls, mixed-use buildings (such as offices, housing units, and commercial spaces), and industrial buildings (such as distribution and production facilities) are projected to fuel the growth of the construction industry in Mexico in the coming years. Such projects are expected to drive the demand for reusable gloves, particularly the ones crafted from cotton. These gloves are well suited for general construction activities that demand dexterity, such as the handling of small tools and materials.

Key Americas Reusable Gloves Company Insights

Some of the key players operating in the market include Ansell Ltd., Showa Group, Superior Gloves, and MCR Safety.

-

Ansell manufactures gloves to protect against cuts, impact, and radiation attenuation. Its medical segment offers products such as surgical, medical, and examination gloves and healthcare devices. The industrial segment provides protective solutions such as suits, clothing, gloves, and respiratory products. It offers its products under various brand names, including VIKING, AlphaTec, BioClean, HyFlex, MICROFLEX, MICRO-TOUCH, GAMMEX, and EDGE. The company has been serving customers in more than 100 countries.

-

Showa Group specializes in the development and distribution of a wide range of products. Its product line encompasses a wide range of gloves that cater to the diverse requirements of end users. The company offers gloves for chemical protection, cut-resistant applications, general-purpose usage, single-use scenarios, cold weather conditions, and heat-resistant environments.

United Gloves, The Glove Company, The Globus Group, Newell Co, and Altex Gloves USA, LLC are some of the emerging market participants in the market.

- The Glove Company manufactures, designs, and distributes gloves. It has 167 product lines dedicated to gloves with 98 registered trademarks. The product line of the company includes disposable gloves and reusable/material-handling gloves. They are also free from vinyl, MBT, and phthalate. These gloves are used in automotive, hydraulic repairs & maintenance, hospitality, food manufacturing, aviation and defense, commercial/domestic cooking, material handling, steel and metal manufacturing, and construction applications.

- Newell Co. is a global manufacturer that offers comprehensive worker safety solutions, including safety eyewear, head protection, hearing protection, hand protection, and respiratory protection products. Newell Co. has a significant global presence, with operations in Europe, the Middle East, Asia Pacific, and North America.

Key Americas Reusable Gloves Companies:

- The Glove Company

- SHOWA GROUP

- Superior Glove

- MCR Safety

- United Glove

- ANSELL LTD.

- Kimberly-Clark Corp.

- The Globus Group

- Newell Co.

- Altex Gloves USA, LLC

Recent Developments

-

In April 2024, Ansell Announces the Acquisition of Kimberly-Clark's Personal Protective Equipment Business. The acquisition is expected to accelerate Ansell's growth strategy, strengthening its global position in attractive and expanding segments, including the Scientific sector, where Ansell's unique offerings are highly valued.

-

In February 2023, Ansell Ltd. announced the acquisition of Careplus (M) Sdn Bhd (Careplus). This acquisition increased Ansell’s production capacity of surgical gloves to meet the growing global demand, strengthen its supply chain, and ensure greater control over the quality of its products.

-

In February 2022, SHOWA Group revealed its plans to expand its facility in Alabama, resulting in a boost to its annual production capacity of nitrile gloves to 2.8 billion units.

Americas Reusable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.06 billion

Revenue forecast in 2030

USD 8.01 billion

Growth Rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, country

Key companies profiled

The Glove Company, SHOWA GROUP, Superior Glove, MCR Safety, United Glove, ANSELL LTD., Kimberly-Clark Corp., The Globus Group, Newell Co., Altex Gloves USA, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Reusable Gloves Market Report Segmentation

This report forecasts revenue growth at the country level and analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Americas reusable gloves market based on material, end-use, and country :

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural Rubber/Latex

-

Nitrile

-

Leather

-

Nylon

-

Vinyl

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Household

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Peru

-

Central America

-

Frequently Asked Questions About This Report

b. The Americas reusable gloves market size was estimated at USD 4.70 billion in 2023 and is expected to reach USD 5.06 billion in 2024.

b. The Americas reusable gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 and reach USD 8.01 billion by 2030.

b. U.S. dominated the Americas reusable gloves market in 2023 and accounted 56.5% of the market share in 2023 owing to the market is expected to witness growth due to the rising awareness among industry players regarding the significance of ensuring health and safety of employees in workplaces.

b. Some of the key players operating in the Americas reusable gloves market include The Glove Company, SHOWA GROUP, Superior Glove, MCR Safety, United Glove, ANSELL LTD., Kimberly-Clark Corp., The Globus Group, Newell Co., Altex Gloves USA, LLC, among others.

b. The key factors that are driving the Americas reusable gloves market include the stringent occupational safety regulations and standards in industries such as manufacturing, construction, healthcare, and automotive have been a major driver for the growth of the reusable gloves market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.