- Home

- »

- Plastics, Polymers & Resins

- »

-

Americas Recycled Polyethylene Terephthalate Market, Report 2030GVR Report cover

![Americas Recycled Polyethylene Terephthalate Market Size, Share & Trends Report]()

Americas Recycled Polyethylene Terephthalate Market Size, Share & Trends Analysis Report By Product (Clear, Colored), By Application (Fiber, Sheet & Film, Strapping, Food And Beverage Containers & Bottles), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-120-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

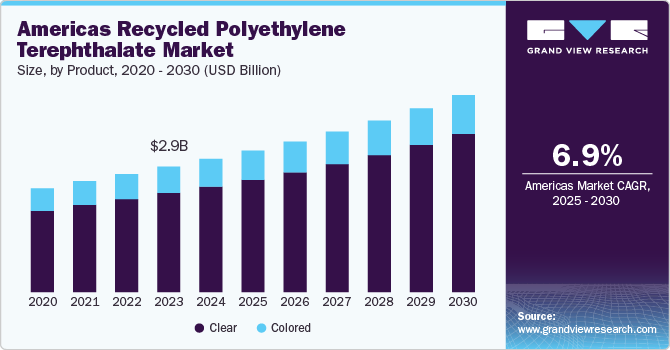

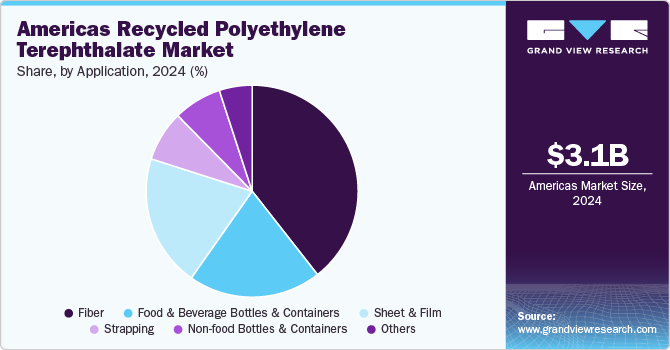

The Americas recycled polyethylene terephthalate market size was estimated at USD 3.14 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. Increasing awareness and emphasis on environmental sustainability. As consumers and businesses become more conscious of the environmental impact of plastic waste, there has been a growing demand for eco-friendly solutions. The Americas region, encompassing North America, Central & South America, has seen a rise in recycling initiatives, government regulations, and corporate commitments to incorporate recycled materials like rPET in various industries. Additionally, the circular economy approach, where products are recycled and reused, has gained traction, further boosting the demand for rPET in packaging, textiles, and other applications. The focus on reducing plastic waste and promoting recycled materials in the Americas is driving the growth of the rPET market, contributing to a more sustainable and greener future for the region.

In the Americas, there is a noticeable shift toward sustainable packaging, which has increased the demand for recycled polyethylene terephthalate (rPET). Leading brands in industries like food and beverages, personal care, and home care are prioritizing rPET as part of their sustainability goals. This trend is being driven by growing consumer preferences for eco-friendly products, regulations around single-use plastics, and the rising importance of corporate environmental responsibility. Companies are increasingly investing in closed-loop recycling systems to improve their use of rPET, further driving innovation and expansion within the market.

Drivers, Opportunities & Restraints

The Americas’ recycled polyethylene terephthalate market is driven by government regulations and policies aimed at reducing plastic waste. Several countries, including the United States and Brazil, are implementing stricter environmental standards and pushing for higher recycling rates. These regulations encourage companies to use more recycled materials in packaging and manufacturing. In the U.S., states like California have introduced mandates for the inclusion of recycled content in packaging. This, combined with consumer pressure for sustainability, is compelling manufacturers to adopt rPET, thereby increasing demand across the region.

The increasing demand for sustainable packaging solutions presents a significant opportunity for growth in the rPET market across the Americas. As major corporations commit to higher recycled content in their packaging, there is a strong opportunity for rPET producers to expand their production capacities. Innovations in recycling technologies, such as advanced mechanical and chemical recycling methods, could further unlock the potential of rPET, making it more cost-effective and high-quality. Companies that can offer innovative, cost-efficient, and sustainable rPET solutions stand to benefit from long-term partnerships with large brands seeking to meet sustainability targets.

A major restraint in the Americas rPET market is the limited availability of high-quality recycled materials. While demand is growing, the supply chain for post-consumer PET waste remains underdeveloped in many regions, limiting the amount of feedstock available for rPET production. Collection and sorting infrastructure in some areas are insufficient, which can lead to contamination and reduce the overall quality of recycled PET. Additionally, the cost of recycling technologies and logistics can make rPET more expensive than virgin PET, discouraging some companies from fully transitioning to recycled alternatives.

Product Insights

Clear recycled polyethylene terephthalate (rPET) is a highly penetrated segment accounting for over 79.24% revenue market share in 2024. Clear rPET (recycled Polyethylene Terephthalate) holds the dominant position in the Americas' recycled PET market for several compelling reasons. Firstly, the popularity of clear rPET is driven by its widespread applications in the beverage industry. It is commonly used in producing water and soda bottles due to its transparent nature, allowing consumers to see the product inside, which is a crucial factor in influencing their purchasing decisions. This visibility not only enhances product appeal but also reassures consumers about the content’s quality and safety, making it a preferred choice for manufacturers and consumers alike.

The growing emphasis on environmental sustainability has fueled the demand for eco-friendly packaging alternatives, and colored rPET is playing an important role in this transition. Colored rPET, made from recycled PET materials, helps reduce the dependency on virgin plastics and contributes to lowering greenhouse gas emissions. While not as prominent as clear rPET, colored rPET is gaining attention in industries where aesthetics and branding are important, such as personal care, cosmetics, and household products. As more companies align their packaging strategies with sustainability goals, the demand for colored rPET has seen a steady increase, offering an attractive solution for brands looking to balance environmental responsibility with design flexibility. Its recyclable nature and ability to maintain brand identity make it a compelling choice, reflecting the shift toward environmentally conscious products and driving its adoption in the Americas' recycled PET market.

Application Insights

The fiber industries dominate the recycled polyethylene terephthalate market in Americas. The fiber segment accounted for 39.27% of revenue market share in 2024 as a result of its widespread applications and the growing demand for sustainable textiles. As consumers increasingly prioritize eco-friendly choices, the textile industry has been quick to respond by embracing recycled PET fiber as a viable solution. By utilizing post-consumer PET bottles and diverting them from landfills, the production of recycled PET fiber significantly reduces the environmental impact of the fashion and apparel sector.

The non-food bottles and containers segment of the Americas' rPET market is experiencing steady growth, driven by the increasing adoption of recycled materials in industries like personal care, household products, and cleaning supplies. A key driver is the growing consumer demand for eco-friendly packaging, especially for products like shampoos, detergents, and cosmetics. Many leading brands in these sectors are under pressure to reduce their carbon footprint and are shifting toward rPET to align with sustainability goals.

Country Insights

North America dominated the Americas recycled polyethylene terephthalate market and accounted for largest revenue share of 64.42% in 2024, driven by the growing demand for lightweight, durable materials in the automotive industry. With the region focusing heavily on reducing vehicle emissions and improving fuel efficiency, car manufacturers are turning to plastic compounds as an alternative to heavier metal parts. These materials help decrease vehicle weight without compromising safety or performance.

U.S. Americas Recycled Polyethylene Terephthalate Market Trends

n the U.S., the plastic compounding market is driven by the rapid expansion of the construction industry, where plastic compounds are used extensively in piping, insulation, and exterior components. The focus on energy-efficient buildings and sustainable construction practices has increased the demand for advanced plastic materials that offer durability, flexibility, and thermal efficiency. Government initiatives promoting green building standards and infrastructure development are also supporting the growth of plastic compounding in the U.S., as these materials provide cost-effective and eco-friendly alternatives to traditional construction materials.

Latin America Recycled Polyethylene Terephthalate Market Trends

In Latin America, the plastic compounding market is being driven by the growing packaging industry, particularly in the food and beverage sector. As the region experiences an increase in urbanization and consumer spending, there is a higher demand for flexible and rigid packaging solutions made from plastic compounds. These materials offer key benefits like extended shelf life, product protection, and cost-effectiveness.

Brazil Recycled Polyethylene Terephthalate Market Trends

In Brazil, the plastic compounding market is benefiting from the rapid expansion of the electronics and electrical sectors. With increased demand for consumer electronics, appliances, and industrial equipment, plastic compounds are playing a critical role in manufacturing components that require high durability, heat resistance, and electrical insulation. The country’s growing middle class and increasing access to technology have further boosted this demand.

Key Americas Recycled Polyethylene Terephthalate Company Insights

The Americas recycled polyethylene terephthalate (rPET) market is driven by key players actively focusing on enhancing recycling processes and expanding their production capacities. Companies such as Indorama Ventures, Alpek S.A.B. de C.V., and CarbonLITE Recycling lead the market by incorporating advanced recycling technologies like bottle-to-bottle recycling. Indorama, in particular, has invested in recycling infrastructure across the Americas, aiming to produce high-quality food-grade rPET. These companies are not only capitalizing on the growing demand for sustainable packaging but are also forming strategic partnerships with beverage and consumer goods companies to meet stringent sustainability goals.

Key Americas Recycled Polyethylene Terephthalate Companies:

- Indorama Ventures Public Company Limited

- Clear Path Recycling LLC

- Plastipak Holdings, Inc.

- CarbonLite Industries LLC

- Verdeco Recycling

- Phoenix Technologies International LLC

- Envision Plastics Industries LLC (Altium Packaging LP)

- UNIFI, Inc.

- Alpek Polyester

- Custom Polymers, Inc.

- Amcor plc

- Loop Industries, Inc.

Recent Developments

-

In October 2023, Chlorophyll Water, a U.S. water brand, introduced new bottles made entirely from 100% rPET. This initiative aims to enhance sustainability in its packaging. The company is using Avery Dennison's innovative label technology, which allows for efficient recycling and reduces waste.

-

In May 2022, Cascades, Inc. launched 100% rPET food tray in North America. The tray is designed for various food applications, making it a versatile choice for manufacturers looking to enhance their eco-friendly packaging options.

Americas Recycled Polyethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,338.66 million

Revenue forecast in 2030

USD 4,652.10 million

Growth rate

CAGR of 6.9% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North america; latin america

Country Scope

U.S.; Canada; Mexico; Brazil

Key companies profiled

Indorama Ventures Public Company Limited; Clear Path Recycling LLC; Plastipak Holdings, Inc.; CarbonLite Industries LLC; Verdeco Recycling; Phoenix Technologies International LLC; Envision Plastics Industries LLC (Altium Packaging LP); UNIFI, Inc.; Alpek Polyester; Custom Polymers, Inc.; Amcor plc; Loop Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Recycled Polyethylene Terephthalate Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Americas recycled polyethylene terephthalate market report on the basis of product, application, and country:

-

Product Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Clear

-

Colored

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Fiber

-

Sheet and Film

-

Strapping

-

Food & Beverage Containers and Bottles

-

Non-Food Containers and Bottles

-

Others

-

-

Country Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The Americas recycled polyethylene terephthalate market size was estimated at USD 3.14 billion in 2024 and is expected to reach USD 3,338.66 million in 2025.

b. The Americas recycled polyethylene terephthalate market is expected to grow at a compound annual growth rate of 6.86% from 2025 to 2030 to reach USD 4,652.10 million by 2030.

b. The clear type recycled polyethylene terephthalate under products segment dominated the America recycled polyethylene terephthalate market with a share of more than 79.24% in 2024. This is attributable to its use in the packaging of food, beverage bottling, cosmetics, pharmaceuticals, and electronics.

b. Some key players operating in the Americas recycled polyethylene terephthalate market include Indorama Ventures (USA) Inc., Clear Path Recycling LLC, Plastipak Holdings, Inc., CarbonLite Industries LLC, Verdeco Recycling Inc., Phoenix Technologies International LLC, Envision Plastics Industries LLC, Unifi Manufacturing Inc., and DAK Americas LLC

b. Key factors that are driving the Americas recycled polyethylene terephthalate market growth include increasing demand for rPET from the food & beverage industry, funding and grants to develop plastic recycling infrastructure in America.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."