- Home

- »

- Homecare & Decor

- »

-

Americas Range Hood Market Size, Industry Report, 2030GVR Report cover

![Americas Range Hood Market Size, Share & Trends Report]()

Americas Range Hood Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Under Cabinet, Ceiling Mount), By Distribution Channel (Supermarkets & Hypermarkets, Online/E-commerce), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-339-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Americas Range Hood Market Size & Trends

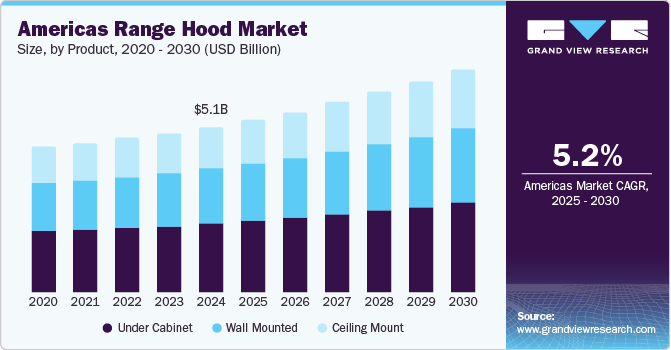

The Americas range hood market size was estimated at USD 5.05 billion in 2024 and is expected to expand at a CAGR of 5.2% from 2025 to 2030. The growing popularity of modular kitchens and the rise in home renovation activities are driving market growth. As real estate and commercial construction continue to expand, the demand for range hoods in these sectors is expected to increase. The ongoing development of infrastructure and the issuance of new building permits in the region are likely to further fuel market growth. Technological innovations in kitchen appliances and the integration of IoT in kitchen hood devices are anticipated to play a significant role in accelerating market expansion.

In 2024, Mexico's construction industry recorded a growth of 4.1%, driven by investments in residential and infrastructure projects. The National Institute of Statistics and Geography (INEGI) reported a 6.3% year-on-year increase in the construction production volume index during the first three quarters of 2024. Furthermore, in February 2025, the U.S. housing inventory rose to 1.24 million units, marking a 5.1% rise from the previous month and a 17% rise from 2024. The expansion in infrastructure and the rise in new building permits are expected to further boost market growth.

Manufacturers are focusing on developing innovative devices owing to consumer preference for smart features, such as noise reduction, wireless connectivity, and the installation of temperature, optic, and infrared sensors in the products. For example, range hood manufacturers incorporate various insulation layers, sound-dampening bases, and motorized filtration systems to minimize noise. The market growth is driven by technological advancements, better brand services, and IoT integration in kitchen hoods. Consumers seek range hoods that match their kitchen design, offering various sizes, colors, and styles, with features such as lighting. There is a growing demand for sleek, minimalist designs that complement modern aesthetics.

Product Insights

The under-cabinet range hood segment dominated the Americas range hood market with a revenue share of 42.1% in 2024. This high share is attributed to the fact that the under-cabinet range hood mounts directly beneath an over-the-range cabinet and blends into the design flow of the cabinets above and around the range or cooktop. Careful measurement of available dimensions in the under-cabinet area is important when choosing an under-cabinet range vent.

The ceiling-mount range hood segment is expected to grow at the fastest CAGR of 6.0% over the forecast period. The increasing trend of kitchen remodeling in the country is expected to spur the demand for trendy ceiling-mounted range hoods. The growing popularity of kitchen renovation is expected to have a positive influence on this range hood products owing to the greater availability of products of this category. According to a report by the National Kitchen & Bath Association, deferred remodeling projects from early 2024 were estimated to drive future demand, and by 2027, the number of homes in prime remodeling years is estimated to increase by 2.2 million, reaching 24 million in total.

Distribution Channel Insights

The specialty retail segment led the Americas range hood industry and accounted for the largest revenue share in 2024. These stores are often favored for their specialized expertise, carefully curated product offerings, and the opportunity to provide a more personalized shopping experience compared to general retail outlets. These outlets include the official stores owned by major brands such as Whirlpool Corporation, Haube Range Hoods, and KOBE Range Hoods. Williams-Sonoma has multiple retail stores specializing in kitchenware, cookware, and home furnishings. In 2023, an annual operating margin of 16.4% was delivered, and full-year earnings per share of USD 14.85 were achieved, according to Laura Alber, President and Chief Executive Officer.

The online/e-commerce channel is expected to grow at the fastest CAGR over the forecast period. Increasing penetration of the Internet among the middle-class population and the rising usage of smartphones and similar devices are among the key reasons driving online retail. Consumers are rapidly shifting toward the online mode of purchase with the rise of e-commerce giants such as Amazon, Alibaba, eBay, and JD.com. By observing the drastic shift in consumer behavior from offline to online, several range hood manufacturers are opting for direct-to-consumer sales to primarily sell their range hood products and gain higher profit margins. Direct-to-consumer sales channels are also expected to strengthen brand relationships with customers by delivering high-quality products quickly.

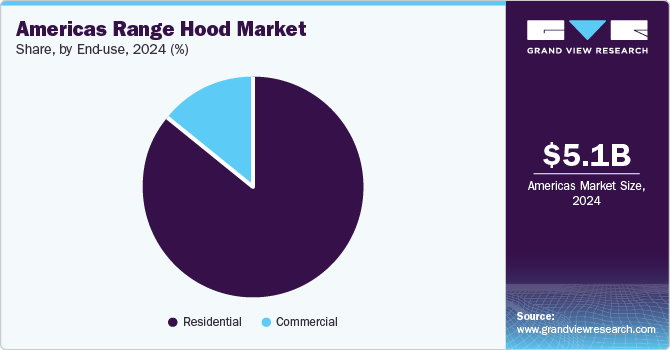

End Use Insights

The residential sector dominated the Americas range hood market with the largest revenue share in 2024. This high share is attributed to modern urban lifestyles, smart upgrades, and visually appealing product innovations by key industry participants, driving the adoption rate of premium range hoods. According to the annual housing report from the Harvard Joint Center for Housing Studies, the home remodeling market reached USD 567 billion in 2022 globally, marking an increase of 15% from 2021. The rise in remodeling projects has significantly contributed to the demand for range hoods in the residential segment.

The commercial sector is estimated to grow at a significant CAGR over the forecast period. The growth of the hospitality sector has boosted the hotel industry, leading to the construction of more hotels nationwide. A flourishing travel and tourism market, driven by consumer demand for luxury stays at resorts and top-rated hotels, presents considerable growth opportunities for various sectors. These trends are expected to increase the demand for premium cookware in hotel chains and restaurants, thereby driving the need for range hoods in commercial kitchens.

Regional Insights

The U.S. dominated the America’s range hood market and accounted for the largest revenue share in 2024. The growing residential sector, driven by a rise in the number of households and significant home improvement projects undertaken by consumers, is fueling the demand for range hoods in the country. According to the National Association of Home Builders (NAHB), 82% of the remodelers in the U.S. ranked kitchen renovation as their top job as of 2019. Consumers are likely to invest in high-end kitchen appliances that complement their kitchen decor. Furthermore, the U.S. travel and tourism industry grew by 7.0% in 2023, and the WTTC's 2024 Economic Impact Trends Report highlighted the U.S. as the top player in travel and tourism, contributing USD 2.36 trillion to its economy in 2023. This growth has boosted the hotel industry and increased demand for range hoods in commercial kitchens.

Canada Range Hood Market Trends

The Canada range hood market is expected to grow at the fastest CAGR over the forecast period. Steady growth in the number of food service joints and residential construction projects is the main factor driving the demand for range hoods. Investments in residential building construction increased by 2.2% (USD 323.9 million) in Canada, reaching USD 15.1 billion in December 2024.

Key Americas Range Hood Company Insights

Some of the major companies in the Americas range hood industry include Asko Appliances AB; Broan-Nu Tone, LLC.; BSH Hausgeräte GmbH; and Elica S.p.A. The industry has many international and local players. The impact of these established players on the market is quite high as most of them have vast distribution networks across the North America and Latin America regions to reach out to their large customer base. The key players operating in the Americas range hood market are focusing on strategic initiatives such as product launches, participation in events, and expansions to drive revenue growth and reinforce their position in the market.

-

Broan-NuTone, LLC is a manufacturer of ventilation and indoor air quality solutions, specializing in range hoods, exhaust fans, and air purifiers. The company provides products for residential and commercial spaces, focusing on performance, energy efficiency, and enhancing home comfort and safety.

Key Americas Range Hood Companies:

- Whirlpool Corporation

- Broan-NuTone, LLC

- GE Appliances, a Haier Company

- Robert Bosch GmbH

- Haube Range Hood Co.

- KOBE Range Hoods

- Victory Range Hoods

- Proline Range Hoods

- Faber US and Canada

- Vent-A-Hood® Ltd.

Recent Developments

-

In January 2025, Zephyr introduced the Forte Wall Custom Range Hood as part of its Designer Collection. Combining traditional design with professional-grade quality, this range hood is tailored for home chefs.

Americas Range Hood Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.27 billion

Revenue forecast in 2030

USD 6.79 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use, region

Regional scope

U.S.; Canada; South America

Country scope

U.S.; Canada; Brazil

Key companies profiled

Whirlpool Corporation; Broan-NuTone, LLC; GE Appliances; a Haier Company; Robert Bosch GmbH; Haube Range Hood Co.; KOBE Range Hoods; Victory Range Hoods; Proline Range Hoods; Faber US and Canada; Vent-A-Hood® Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas Range Hood Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Americas range hood market report based on product, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Under Cabinet

-

Wall Mounted

-

Ceiling Mount

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Retail

-

Online/e-commerce

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

-

Canada

-

Toronto

-

Montreal

-

Calgary

-

Ottawa

-

-

South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The Americas range hood market was estimated at USD 5.05 billion in 2024 and is expected to reach USD 5.26 billion in 2025.

b. The Americas range hood market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 6.79 billion by 2030.

b. The U.S. dominated the Americas range hood market with a share of 48.28% in 2024. The growing residential sector, driven by a rise in the number of households and significant home improvement projects undertaken by consumers, is fueling the demand for range hoods in the country.

b. Some of the key players operating in the Americas range hood market include IWhirlpool Corporation; Broan-NuTone, LLC; GE Appliances; a Haier Company; Robert Bosch GmbH; Haube Range Hood Co.; KOBE Range Hoods; Victory Range Hoods; Proline Range Hoods; Faber US and Canada; Vent-A-Hood® Ltd.

b. The growing popularity of modular kitchens and the rise in home renovation activities are driving market growth. As real estate and commercial construction continue to expand, the demand for range hoods in these sectors is expected to increase.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.