- Home

- »

- Smart Textiles

- »

-

Americas And Europe Polymer Coated Fabrics Market, 2030GVR Report cover

![Americas And Europe Polymer Coated Fabrics Market Size, Share & Trends Report]()

Americas And Europe Polymer Coated Fabrics Market Size, Share & Trends Analysis Report By Product (Polyvinyl Chloride, Polyurethane), By Application (Light Vehicles, Marine), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-040-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

The Americas and Europe polymer coated fabrics market size was estimated at USD 7.99 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. The growing demand across key sectors, including automotive, protective clothing, construction, and furniture, is significantly driving market growth in the polymer-coated fabrics industry. The automotive sector plays a pivotal role in utilizing these fabrics in essential applications such as upholstery, airbags, and soft tops. In addition, increasing production of light commercial vehicles (LCVs) and stringent safety regulations necessitate a higher demand for durable, high-quality coated materials.

In addition to automotive applications, there is a growing need for polymer coated fabrics in protective clothing, largely driven by government regulations aimed at enhancing worker safety. Regulatory frameworks, such as the European Union’s Personal Protective Equipment (PPE) regulations and similar legislation in the United States, are encouraging the adoption of these materials within various industrial sectors. The focus on safeguarding workforce health has catalyzed innovation and the production of advanced protective textiles, ensuring workers are equipped with safety and comfort.

The construction and furniture industries also significantly contribute to expanding the polymer coated fabrics market. The continued growth of the construction sector, along with evolving consumer trends in home decoration and furniture design, has led to increased use of polymer fabrics in carpets, mats, and upholstery products. As consumers prioritize style and durability in their home furnishings, manufacturers are adapting by integrating polymer-coated materials that offer enhanced aesthetic and functional benefits.

Furthermore, increased consumer spending, driven by higher disposable incomes, fuels demand for vehicles and textile products, stimulating the polymer coated fabrics market. Moreover, rapid industrialization and urbanization in countries such as India and China are contributing to heightened demand for automotive interiors and protective textiles. As these regions continue to grow, the polymer coated fabrics market is expected to benefit from a sustained increase in demand, positioning itself as a dynamic segment within the broader textile industry.

Product Insights

Polyvinyl chloride (PVC) dominated the market with a revenue share of 73.5% in 2024. PVC is extensively utilized in the construction, automotive, and protective clothing sectors due to its chemical resistance, moisture resistance, and durability against abrasion. Its lightweight nature and cost efficiency make it ideal for upholstery and industrial fabrics, while its recyclability enhances its attractiveness in environmentally conscious industries.

The polyurethane segment is expected to grow at the fastest CAGR of 7.2% over the forecast period. Polyurethane is highly regarded for its durability, flexibility, and abrasion resistance, making it suitable for automotive interiors, construction materials, and protective clothing. Its lightweight characteristics contribute to vehicle fuel efficiency, while its thermal insulation benefits energy-efficient building designs, with an increasing focus on sustainable bio-based innovations.

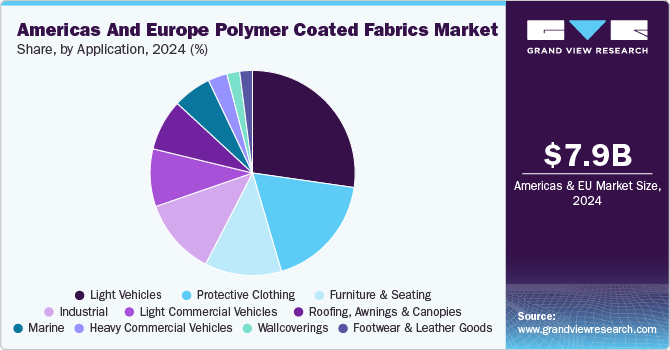

Application Insights

Light vehicles led the segment with a revenue share of 25.6% in 2024. The growing automotive production and consumer demand for lightweight, fuel-efficient vehicles have intensified the need for high-performance materials such as polymer-coated fabrics. Essential in applications such as upholstery, airbags, and soft tops, these materials provide durability and wear resistance, while stringent safety regulations further drive their adoption.

Protective clothing is projected to grow at the fastest CAGR of 9.4% over the forecast period, driven by stringent government regulations and safety standards for worker protection. Initiatives such as the EU’s PPE regulations and OSHA guidelines in the U.S. promote polymer-coated fabrics, which offer durability and chemical resistance, essential for protective apparel across various industries.

Regional Insights

The central Europe polymer coated fabrics market dominated the Americas and Europe polymer coated fabrics market with a revenue share of 31.4% in 2024. Central Europe boasts robust manufacturing capabilities and rising demand across industries, particularly automotive and construction. Increased emphasis on worker safety regulations has heightened the need for protective clothing made from polymer-coated fabrics. Furthermore, a growing focus on sustainability and the region’s strategic location enhance its market presence and trade opportunities.

Germany Polymer Coated Fabrics Market Trends

The polymer coated fabrics market in Germany dominated the Central Europe polymer coated fabrics market in 2024. Germany’s commitment to innovation and technology propels advancements in polymer coatings, improving product quality and functionality. Moreover, stringent regulations on environmental sustainability and worker safety boost the adoption of polymer-coated fabrics in protective clothing. Its status as a manufacturing hub enables effective service to regional and international markets.

North America Polymer Coated Fabrics Market Trends

North America polymer coated fabrics market is expected to register the fastest CAGR of 7.3% in the forecast period. The region’s emphasis on safety regulations and protective clothing accelerates the adoption of polymer-coated fabrics across diverse applications. Furthermore, advancements in manufacturing technologies, the rising demand for lightweight materials in vehicles, and a robust presence of leading manufacturers support market growth in North America.

The polymer coated fabrics market in the U.S. dominated the North America polymer coated fabrics market in 2024. The increasing demand for textiles in furniture and protective clothing industries drives market growth. Innovations in polymer technology and a transition toward sustainable materials further enhance the attractiveness of U.S.-made products. The country’s robust manufacturing base and extensive distribution networks effectively meet domestic and international demand.

Key Americas And Europe Polymer Coated Fabrics Company Insights

Some key companies operating in the market include OMNOVA North America Inc., SPRADLING, SRF Ltd. (KAMA Holdings Ltd.), BASF, and Continental AG, among others. Key players are prioritizing acquisitions and product innovations to increase market share through strategic investments in R&D for sustainable materials and expanding distribution networks to address growing demand.

-

SRF Ltd. specializes in manufacturing a diverse range of polymer-coated fabrics, primarily for automotive and industrial applications. The company prioritizes innovation and sustainability, providing high-performance materials that adhere to rigorous safety and quality standards.

-

The Freudenberg Group specializes in advanced textiles and coatings for multiple sectors, including automotive, construction, and protective apparel. The company focuses on sustainability and innovation, utilizing its expertise to create solutions that address evolving customer needs and regulatory standards.

Key Americas And Europe Polymer Coated Fabrics Companies:

- OMNOVA North America Inc.

- SPRADLING

- SRF Ltd. (KAMA Holdings Ltd.)

- BASF

- Continental AG

- SERGE FERRARI Group

- Sioen Industries NV

- Freudenberg Group

- Compagnie de Saint-Gobain

- Seaman Corporation

Recent Developments

-

In November 2024, BASF opened a new production line in Heerenveen, Netherlands, enhancing capacity for water-based dispersions while maintaining CO2 neutrality and supporting the transition to sustainable packaging solutions.

-

In October 2024, Continental AG showcased world premieres at the Sicam exhibition, introducing printed, 3D formable PET films and emphasizing sustainability with innovative, high-quality surfaces reflecting market trends and customer demands.

-

In September 2024, Freudenberg Performance Materials acquired significant assets of the Heytex Group, enhancing its coated technical textiles portfolio and bolstering R&D capabilities with three production locations in Germany and China.

Americas And Europe Polymer Coated Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.51 billion

Revenue forecast in 2030

USD 11.82 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in thousand square meters, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

OMNOVA North America Inc.; SPRADLING; SRF Ltd. (KAMA Holdings Ltd.); BASF; Continental AG; SERGE FERRARI Group; Sioen Industries NV; Freudenberg Group; Compagnie de Saint-Gobain; Seaman Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Americas And Europe Polymer Coated Fabrics Market Report Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Americas and Europe polymer coated fabrics market report based on product, application, and region:

-

Product Outlook (Volume, Thousand Square Meters; Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polyurethane (PU)

-

-

Application Outlook (Volume, Thousand Square Meters; Revenue, USD Million, 2018 - 2030)

-

Light Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

Marine

-

Furniture & Seating

-

Protective Clothing

-

Industrial

-

Roofing, Awnings & Canopies

-

Wallcoverings

-

Footwear & Leather Goods

-

Others

-

-

Regional Outlook (Volume; Thousand Square Meters; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Central Europe

-

France

-

Germany

-

Italy

-

Spain

-

UK

-

-

Eastern Europe

-

Poland

-

-

South America

-

Brazil

-

Argentina

-

Colombia

-

Ecuador

-

Chile

-

Peru

-

-

Central America

-

Mexico

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."