- Home

- »

- Catalysts & Enzymes

- »

-

Americas Enzymes Market Share Report, 2021-2028GVR Report cover

![Americas Enzymes Market Size, Share & Trends Report]()

Americas Enzymes Market (2021 - 2028) Size, Share & Trends Analysis Report By Source (Plants, Animals, Microorganisms), By Product (Carbohydrase, Proteases, Lipases), By Application, And Segment Forecasts

- Report ID: GVR-4-68039-340-4

- Number of Report Pages: 126

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The Americas enzymes market size was valued at USD 4.96 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2021 to 2028. The rising consumer awareness regarding health has boosted the consumption level of functional food items, thereby anticipated to positively impact the demand for enzymes over the forecast period. The demand for enzymes is increasingly growing for natural flavor and taste, coupled with the exotic food products, over the past decade, which has triggered the market growth. The product is used in several end uses including fruit juice clarification, germination in breweries, cheese manufacturing, pre-digestion of baby food, and meat tenderization. Furthermore, the growing customer awareness about the significant consumption of dietary requirements, population explosion, and enhanced food quality are likely to positively affect the market growth in the near future.

Enzymes are extracted from plant materials, animal organs, and microorganisms. The manufacturers are focusing on backward integration by using suitable microorganisms to make enzymes and later use the same to produce them on a commercial level. Prominent companies such as Novozymes and BASF SE are conducting various research & development activities to develop the product for unexplored application industries.

Moreover, the manufacturers are adopting environmentally friendly and modern technologies to customize the product, differentiate the final product from its competitors, and augment its properties. On-site manufacturing is also being preferred by the manufacturers as it provides several benefits such as downstream processing, warehousing and shipping bulk quantities of enzymes, and stabilizing agents. These factors are likely to propel the growth of the market during the forecast period.

The market is anticipated to grow at a significant rate over the forecast period on the account of various technological breakthroughs in the enzyme industry. Enzyme technology is widely used in the production, isolation, and purification of enzyme insoluble forms. Protein engineering and recombinant DNA technology are used in the production of efficient and diverse enzymes. The enzymes manufactured through these technologies are suitable for use in numerous specialty applications, including therapeutics, structural biology, microbiology, diagnostics, biochemistry, and biocatalysis.

Source Insights

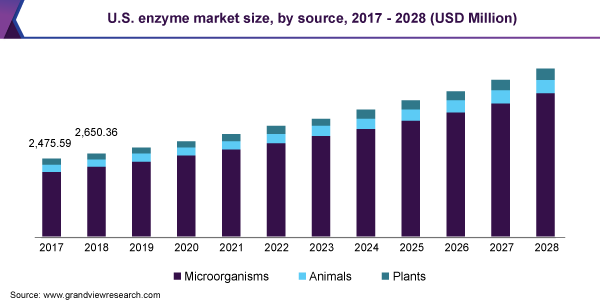

In terms of revenue, microorganisms dominated the market with a share of 85.61% in 2020. This is attributed to their multiple uses in the production of food items, such as baked goods, dairy items, beer, and processed foods. Fungi-based enzymes are widely used in different types of cheese including Camembert and blue cheese. Moreover, they are suitable for a vegetarian diet, unlike animal-sourced enzymes. Therefore, this is expected to boost the growth of the segment over the forecast period.

Key enzymes found in plants comprise protease, lipase, cellulase, and amylase. Plant-based enzymes are present naturally in the human body, but cellulase is made from fungi, bacteria, and protozoans. The demand for plant-based enzymes is anticipated to rise over the forecast period as it helps to reduce indigestion, heartburn, and reflux. Furthermore, it helps in reducing the stress on the small intestine by improving the digestion rate.

Animal-based enzymes are obtained from the stomach and pancreas of swine and cattle. The consumption of meat or eggs may cause bacterial infections in some consumers, which may hamper the market growth. However, these products are useful for treating conditions, such as pancreatic cancer, pancreatitis, and exocrine pancreatic insufficiency, which is anticipated to fuel their demand in the pharmaceutical sector.

Product Insights

In terms of revenue, carbohydrase dominated the market with a share of 47.52% in 2020. This is attributed to the rising demand for amylases and pectinases in fruit juice processing for maceration, liquefaction, and clarification to enhance the quantity and quality of the product. Amylase, cellulase, lactase, mannanase, and pectinase are the prominent carbohydrase used in several end-use industries, such as animal feed, food and beverage, and pharmaceutical. The increasing consumption of carbohydrates as an ingredient and a processing aid in sugar production is likely to augment the segment growth over the forecast period.

Proteases are extensively used for protein breakdown in various end-use industries, including animal feed, chemicals, detergents, food, and pharmaceutical. Growing awareness among consumers regarding the decreasing nutrition level has led to a surge in protein consumption, which is expected to augment the demand for proteases in the food industry over the forecast period. However, the possible risks such as irritation and allergic reactions associated with these enzymes may hamper the market growth.

Lipases are used for digesting, transporting, and processing dietary lipids, such as triglycerides, oils, and fats. They are majorly used for biodiesel production, which involves the processing of glycerides and fatty acids via transesterification and esterification reactions. Moreover, the cost of the final product is lower with lipase compared to other enzymes, which has attracted many manufacturers, thereby augmenting the segment growth.

Application Insights

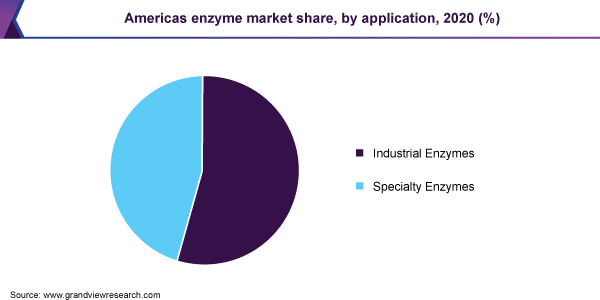

Industrial enzymes held the largest share of 54.53% in 2020. In the industrial enzymes segment, food and beverages dominated the market in 2020. This is attributed to the various attributes associated with the product. It promotes flavor enhancement, improves texture and color, provides softness, and ensures longer shelf life. Specialized enzyme solutions assist producers to achieve higher yields, lower costs, enhance the quality of the final products, optimizing resources, reduce wastage, and lower environmental pollution. These factors are anticipated to propel the segment growth over the forecast period.

Enzymes find application in research and biotechnology as they are used further in several end-use industries and possess health benefits. Oxidase, glutaminase, arginase, dehydrogenase, deiminase, and ribonuclease are used in oncology and cancer treatment. The R&D centers of different companies are focusing on commercial processing, the development of technologies, and innovative enzyme formulations for human welfare. The growing demand for funding initiatives, medicinal drugs, and extensive research activities are anticipated to drive this sector, which, in turn, is likely to fuel the demand in the coming years.

The important applications of products in the pharmaceutical sector include killing disease-causing microorganisms, promoting wound healing, increasing research & development, and diagnosing diseases. This has made it possible for specialty enzymes to be used in the formulation and delivery of drugs. Furthermore, the growing population, rising awareness regarding diseases, and mounting demand from consumers are the factors expected to drive its utilization in pharmaceutical applications.

Regional Insights

North America dominated the market with a share of 85.54% in 2020. This is attributed to a strong presence of key end-use industries including personal care and cosmetics, pharmaceuticals, laundry detergent, and food and beverage, along with a wide scope for research & development activities in the major countries of the region. The U.S. dominated the North American market in 2020 owing to increasing product demand from the dairy and brewing sectors.

Ascending requirement for dietary fibers and functional foods is likely to emerge as one of the key factors driving the demand for carbohydrates in the U.S. The market is projected to witness significant growth in Canada in the personal care applications over the forecast period owing to the presence of international brands, such as L'Oréal and Procter & Gamble. Moreover, the rising demand for digestible enzymes to enhance the nutritional content of the feed is anticipated to emerge as one of the key factors driving the demand for carbohydrase in Mexico.

The market in Central and South America is expected to witness significant growth owing to the rising demand from various applications, including animal feed, textile, paper and pulp, personal care, and diagnostics. Enzymes are used to enhance the texture and flavor of food items and convert starch into simpler sugars that are present in pasta and bread. Moreover, the consumption of dairy and confectionery items is increasing, which is expected to boost the market growth in the country over the forecast period.

Key Companies & Market Share Insights

The market is oligopolistic wherein more than 70.0% of the overall share is taken by Novozymes, DSM, and DuPont. Other prominent players such as BASF SE, Novus International, Associated British Food plc, and Advanced Enzyme Technologies account for a comparatively less share in the marketspace. The manufacturers holding a majority share are based out of America, however, have a strong presence across the globe.

The leaders are well equipped with large manufacturing facilities and are engaged in several research & development activities. These players are considered among the largest companies in terms of employee count, revenue, clientele base, and global footprint. The major three companies are well integrated across the value chain and serve the customers of the American region with the utmost efficiency. Some prominent players in the Americas enzymes market include:

-

Novozymes

-

DSM

-

DuPont

-

BASF SE

-

Novus International

-

Associated British Foods plc

-

Advanced Enzyme Technologies

-

Adisseo

Americas Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 5.33 billion

Revenue forecast in 2028

USD 8.62 billion

Growth Rate

CAGR of 7.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, region

Regional scope

North America; Central & South America

Country scope

U.S.; Canada; Mexico; Brazil; Argentina

Key companies profiled

BASF SE; DSM; Novozymes; DuPont; Novus International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this report, Grand View Research has segmented the Americas enzymes market report on the basis of source, product, application, and region:

-

Source Outlook (Revenue, USD Million, 2017 - 2028)

-

Plants

-

Animals

-

Microorganisms

-

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Carbohydrase

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Industrial Enzymes

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceuticals

-

Personal Care & Cosmetics

-

Wastewater

-

Others

-

-

Specialty Enzymes

-

Pharmaceuticals

-

Research & Biotechnology

-

Diagnostics

-

Biocatalyst

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The Americas enzymes market size was valued at USD 4.96 billion in 2020 and is anticipated to reach USD 5.33 billion by 2021.

b. The Americas enzymes market is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2021 to 2028 to reach 8.62 billion by 2028.

b. The microorganisms source segment dominated the Americas enzymes market with a share of 85.61% in 2020. This is attributed to their multiple uses in the production of food items such as baked goods, dairy items, beer, and processed foods.

b. The industrial enzymes segment held the largest share of 54.53% in 2020 in the Americas enzymes market. In this segment, the food and beverages sub-segment dominated the market in 2020.

b. North America dominated the Americas enzymes market with a share of 85.54% in 2020. This is attributed to a strong presence of key end-use industries, including personal care and cosmetics, pharmaceuticals, laundry detergent, and food and beverage, along with a wide scope for research & development activities in the major regional countries.

b. In terms of volume, the carbohydrase segment dominated the Americas enzymes market with a share of 47.52% in 2020. This high share is attributable to the rising demand for amylases and pectinases in fruit juice processing for maceration, liquefaction, and clarification to enhance the quantity and quality of the product.

b. Some prominent industry participants in the Americas enzymes market include Novozymes, DSM, DuPont, BASF SE, Novus International, Associated British Foods plc, Advanced Enzyme Technologies, and Adisseo.

b. The rising demand for proteases and carbohydrase in food & beverage applications in the North American region, especially in the U.S., is expected to fuel the enzymes market in the Americas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.