Aluminum Wire Market Size, Share & Trends Analysis Report By Product (Electrical, Mechanical), By Application (Power & Energy, Electrical & Electronics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-051-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Aluminum Wire Market Size & Trends

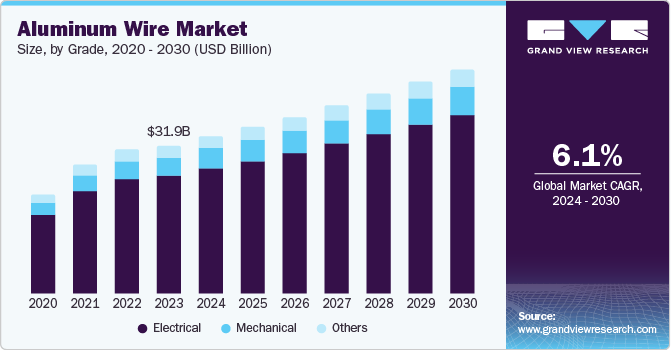

The global aluminum wire market size was estimated at USD 33.93 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. This growth can be attributed to a surge in demand from various end-use industries, particularly in construction and renewable energy, is propelling the market forward. In addition, advancements in electrical infrastructure and the increasing adoption of lightweight materials, such as aluminum wire, are enhancing efficiency in power distribution. Furthermore, the transition to cleaner energy sources and the rise of electric vehicles further amplify the need for aluminum wire, positioning it as a vital component in modern electrical applications.

Aluminum wire is a form of electrical conductor made mainly from aluminum, known for its lightweight, high conductivity, and corrosion-resistant properties. The demand for aluminum wire is surging globally due to its extensive applications across various sectors. Industries such as electronics, automotive, and food and beverages utilize aluminum wire extensively. Its antimicrobial properties help inhibit microorganism growth, making it suitable for food preservation. In the automotive sector, aluminum wire reduces vehicle weight without compromising strength or carrying capacity, enhancing fuel efficiency.

The rising demand in the automotive industry, particularly with the growth of hybrid and electric vehicles is one of the significant factors, contributing to the markets’ growth. In addition, developing economies are experiencing rapid urbanization and industrialization, leading to increased demand for aluminum wire in industrial, residential, and commercial sectors. The focus on energy efficiency in electrical infrastructure and the expansion of renewable energy projects, such as wind and solar, further fuels market growth.

Aluminum wires are favored in construction for electrical distribution due to their mechanical and electrical properties. They provide a safer option for home wiring compared to alternatives. Furthermore, the growing need for industrial Ethernet driven by internet connectivity demands more aluminum wire usage across various industries.

Product Insights

The electrical segment dominated the global aluminum wire industry and accounted for the largest revenue share of 79.5% in 2024. This growth can be attributed to the increasing demand for efficient power transmission and distribution systems. In addition, as urbanization accelerates and infrastructure projects expand, aluminum wire's lightweight and corrosion-resistant properties make it an ideal choice for electrical applications. Furthermore, the shift towards renewable energy sources, such as solar and wind, necessitates reliable electrical connections, further boosting the need for aluminum wire in various electrical installations.

The mechanical segment is expected to grow at a CAGR of 6.1% over the forecast period, owing to the rising demand for lightweight materials in industries such as automotive and aerospace is a significant growth factor. In addition, aluminum wire's strength-to-weight ratio allows manufacturers to reduce overall vehicle weight while maintaining structural integrity. This is crucial for improving fuel efficiency and lowering emissions in vehicles. Furthermore, advancements in manufacturing technologies and increased adoption of aluminum wire in mechanical applications contribute to its expanding market presence across diverse sectors.

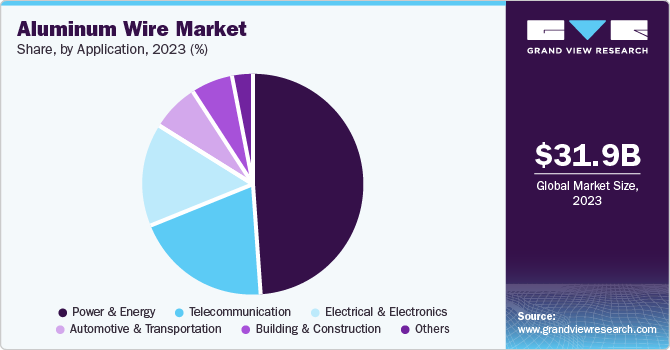

Application Insights

The power & energy segment led the market and accounted for the largest revenue share of 48.9% in 2024, primarily driven by the increasing demand for efficient energy transmission and distribution systems. In addition, as countries modernize their electrical grids and integrate renewable energy sources such as solar and wind, aluminum wire's lightweight and cost-effective properties make it an ideal choice for overhead power lines. Furthermore, the rising focus on reducing energy losses during transmission further enhances the demand for aluminum wire in this sector.

The electrical & electronics segment is expected to grow at a CAGR of 6.0% from 2025 to 2030, owing to the growing need for lightweight and efficient materials in various applications. In addition, the automotive industry's shift towards electric vehicles necessitates reliable wiring solutions, where aluminum wire plays a crucial role due to its excellent conductivity and reduced weight. Furthermore, advancements in technology and innovations in manufacturing processes are enhancing the performance characteristics of aluminum wire, making it increasingly suitable for modern electronic devices and systems.

Regional Insights

The Asia Pacific aluminum wire market dominated the global market and accounted for the largest revenue share of 80.2% in 2024. This growth can be attributed to substantial investments in power grid infrastructure and a surge in renewable energy projects. In addition, as countries in the region, particularly India and China, expand their electrical networks to meet rising energy demands, aluminum wire's lightweight and corrosion-resistant properties make it a preferred choice for power distribution. Furthermore, urbanization and increasing electricity consumption further amplify the need for efficient wiring solutions, positioning the Asia Pacific as a key player in the global aluminum wire market.

China Aluminum Wire Market Trends

The aluminum wire market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by rising investments in power infrastructure. The government's focus on modernizing the electrical grid and integrating renewable energy sources is propelling demand for aluminum wires. In addition, recent trends indicate that major companies are increasing their purchases of aluminum wires, driven by the soaring prices of copper alternatives.

Europe Aluminum Wire Market Trends

Europe aluminum wire market is expected to grow at a CAGR of 5.0% over the forecast period, owing to stringent regulations promoting energy efficiency and sustainability. The European Union's commitment to reducing carbon emissions has led to increased investments in renewable energy infrastructure, where aluminum wire is favored for its lightweight and efficient properties. Furthermore, advancements in technology and manufacturing processes are enhancing the performance of aluminum wires, making them suitable for various applications across the electrical and automotive sectors.

The aluminum wire market in Germany led the European market and held the significant revenue share in 2024, primarily due to the automotive industry's shift towards electric vehicles (EVs). In addition, as manufacturers seek to reduce vehicle weight while maintaining strength, aluminum wire becomes an essential component in wiring systems. Furthermore, Germany's robust focus on renewable energy projects and infrastructure modernization contributes to a growing need for efficient electrical wiring solutions, positioning aluminum wire as a vital material for future developments.

North America Aluminum Wire Market Trends

North America aluminum wire market is expected to witness substantial growth over the forecast period, owing to significant investments made in electrical infrastructure and a rising focus on renewable energy sources. In addition, as utilities upgrade their transmission systems to accommodate growing energy demands, aluminum wire's cost-effectiveness and performance advantages make it an attractive option. Furthermore, the expansion of electric vehicle production further drives demand for lightweight wiring solutions, reinforcing aluminum wire's significance in North America's evolving energy landscape.

U.S. Aluminum Wire Market Trends

The growth of aluminum wire market in the U.S. is expected to be driven by the heightened awareness of sustainability and energy efficiency. Furthermore, government initiatives aimed at promoting renewable energy adoption are leading to increased investments in infrastructure projects that require reliable wiring solutions. Moreover, as electric vehicles gain popularity, manufacturers are increasingly incorporating aluminum wire into their designs to enhance fuel efficiency and reduce overall vehicle weight, contributing to a positive outlook for the aluminum wire market in the U.S.

Key Aluminum Wire Company Insights

Key companies in the global aluminum wire industry include Kaiser Aluminum, Nexans, Norsk Hydro ASA, and others. These players are adopting various strategies to enhance their competitive edge. These include forming strategic partnerships and collaborations to expand their market reach and share. In addition, companies are focusing on capacity expansion and innovation in product development to meet the evolving demands of various industries. Furthermore, many firms are also investing in environmentally friendly manufacturing processes and materials, aligning with global trends towards energy efficiency and reduced carbon footprints.

-

Ducab specializes in the production of high-quality aluminum and copper solutions for the electrical supply chain. The company operates in various segments, including cable and wire manufacturing, high voltage solutions, and metals production. Ducab Metals Business (DMB), a subsidiary, focuses on aluminum rods, wires, and overhead conductors, catering to diverse industries such as energy, construction, and transportation.

-

Norsk Hydro ASA specializes in manufacturing a wide range of aluminum solutions for various applications, particularly in the automotive and construction sectors. The company operates in segments such as extruded products, rolled products, and primary aluminum production. By focusing on sustainability and innovation, the company meet the growing demand for lightweight and energy-efficient materials in multiple industries worldwide.

Key Aluminum Wire Companies:

The following are the leading companies in the aluminum wire market. These companies collectively hold the largest market share and dictate industry trends.

- Cerrowire LLC

- Ducab

- Henan Chalco Aluminium

- Kaiser Aluminum

- Alcoa

- Nexans

- Norsk Hydro ASA

- Prysmian S.p.A.

- Southern Cable Group Berhad

- Southwire Company, LLC

- Sumitomo Electric Industries Ltd.

Recent Developments

-

In March 2024, Hydro and NKT announced a strategic partnership aimed at decarbonizing electricity infrastructure by integrating low-carbon aluminum wire into power cable solutions. This collaboration will focus on research and development to enhance aluminum wire rod applications, reducing carbon footprints while ensuring high quality. By utilizing Hydro's advanced aluminum production technology, the partnership seeks to optimize the aluminum value chain and support the transition to renewable energy, ultimately contributing to a greener future in power transmission.

-

In January 2024, Alcoa announced its agreement to supply Nexans with low-carbon aluminum, including metal produced from the innovative ELYSIS™ technology, which eliminates greenhouse gas emissions during production. This marks Nexans as the first cable manufacturer to utilize this aluminum, which will be used in various cables, including aluminum wire for low, medium, and high voltage applications. The collaboration underscores a commitment to sustainable electrification and aims to significantly reduce carbon emissions in the industry.

Aluminum Wire Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 35.90 billion |

|

Revenue forecast in 2030 |

USD 48.28 billion |

|

Growth Rate |

CAGR of 6.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, China, India, Japan, South Korea, Indonesia, Germany, UK, Italy, Spain, France, Brazil, Argentina, GCC |

|

Key companies profiled |

Cerrowire LLC; Ducab; Henan Chalco Aluminium; Kaiser Aluminum; Alcoa; Nexans; Norsk Hydro ASA; Prysmian S.p.A.; Southern Cable Group Berhad; Southwire Company, LLC; Sumitomo Electric Industries Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aluminum Wire Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum wire market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrical

-

Mechanical

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Electrical & Electronics

-

Telecommunication

-

Power & Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

GCC

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."