- Home

- »

- Petrochemicals

- »

-

Aluminum Hydroxide Market Size, Industry Report, 2030GVR Report cover

![Aluminum Hydroxide Market Size, Share & Trends Report]()

Aluminum Hydroxide Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (Industrial Grade, Pharma Grade), By End-use (Construction, Pharmaceuticals, Automotive, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-520-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aluminum Hydroxide Market Summary

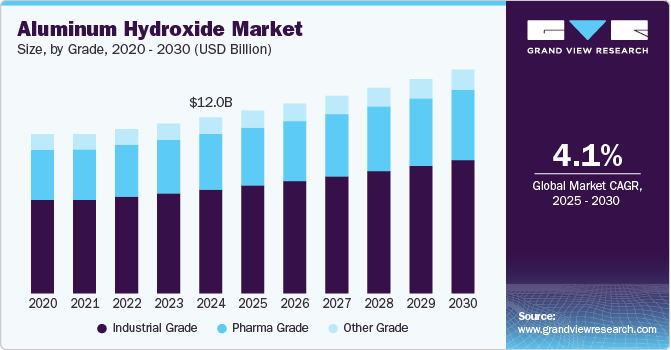

The global aluminum hydroxide market size was estimated at USD 12,051.5 million in 2024 and is projected to reach USD 15,309.5 million by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The increasing demand for products is mainly driven by their uses in pharmaceuticals, water treatment, and flame retardants.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, industrial grade accounted for a revenue of USD 7,389.8 million in 2024.

- Industrial Grade is the most lucrative grade segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 12,051.5 Million

- 2030 Projected Market Size: USD 15,309.5 Million

- CAGR (2025-2030): 4.1%

- Asia Pacific: Largest market in 2024

Furthermore, the market presents opportunities in producing energy storage solutions, lightweight materials, and emerging technologies like electric vehicles and 5G.

The growing demand for medical applications is driving the global industry. Additionally, its use as a flame retardant and the increasing safety standards in building construction are contributing factors. Aluminum hydroxide is widely available and primarily utilized in polymer applications. The rise in polymer production activities in the Asia-Pacific region and Europe is expected to boost growth further. Furthermore, the increasing demand for fire-resistant and lightweight products in the automotive industry, which allows for greater design flexibility, is projected to enhance growth.

Due to its cost-effectiveness, the growing demand for products in the painting and coating industries is driving market growth. However, the increasing adoption of alternative products, such as magnesium hydroxide, may hinder market expansion on a global scale. Additionally, the rising use of products in batteries and chemicals is expected to create favorable growth opportunities. Nonetheless, challenges such as fluctuating raw material prices and heightened health risks associated with exposure to aluminum hydroxide pose significant concerns for the industry.

Drivers, Opportunities & Restraints

Aluminum hydroxide is widely used in water treatment applications for coagulation and flocculation. The increasing consumption of products in water treatment plants is primarily driven by the growing demand for clean and safe water, fueled by a rising population and increased industrialization. Additionally, strict government regulations regarding water quality and the need for efficient water treatment technologies are significant factors contributing to the use of products in these processes. In an era of water scarcity, the Aluminum Hydroxide Market is expected to experience substantial growth, mainly due to the rising demand for products in water treatment applications.

Exposure to the product industry, commonly used as a flame retardant and filler in adhesives, coatings, and construction materials, poses potential health risks. Prolonged inhalation of aluminum hydroxide dust may lead to respiratory issues, lung irritation, and long-term pulmonary disorders. Ingestion or excessive exposure has been linked to neurotoxic concerns, with some studies suggesting a possible association with cognitive decline. Additionally, skin and eye contact may cause irritation, emphasizing the need for proper handling, protective equipment, and regulatory compliance to mitigate health hazards.

The aluminum hydroxide industry faces several challenges, including fluctuating raw material prices and supply chain disruptions, which impact production costs and market stability. Stringent environmental regulations on mining and processing aluminum compounds have increased compliance costs for manufacturers. Additionally, competition from alternative flame retardants and fillers, such as magnesium hydroxide and phosphorus-based compounds, limits market expansion. Growing health concerns related to prolonged exposure further drive the demand for safer substitutes, challenging the widespread use of product market in various industries.

Grade Insights

The industrial grade segment accounted for the largest revenue share of 59.0% in 2024 and is expected to continue to dominate the industry over the forecast period. Industrial-grade products are high-purity chemical compounds widely used as flame retardants, fillers, and precursors in ceramics, glass, and water treatment applications. It is valued for its ability to release water molecules when heated, reducing fire hazards in polymers, adhesives, and coatings. The market for industrial-grade is driven by increasing fire safety regulations in the construction and automotive industries, which require non-toxic and halogen-free flame retardants.

Pharma-grade is a high-purity product primarily used as an active pharmaceutical ingredient (API) in antacids and vaccine adjuvants. It neutralizes stomach acid, relieving conditions such as acid reflux and indigestion. In vaccines, it enhances immune responses by serving as an adjuvant, thereby improving efficacy. A key market driver for pharma-grade is the rising prevalence of gastrointestinal disorders and the increasing demand for vaccines, especially in global immunization programs.

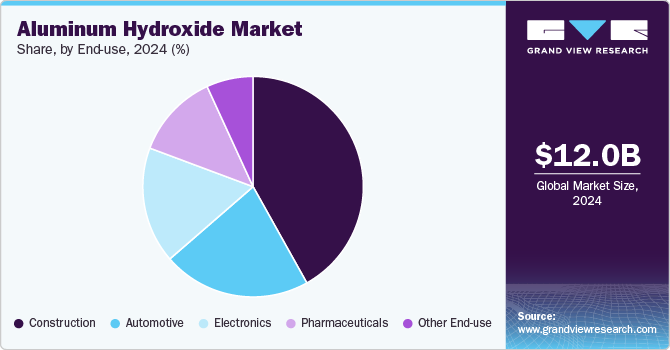

End-use Insights

The construction segment dominated the market with a revenue share of 41.9% in 2024, during the forecast period. In the construction industry, aluminum hydroxide is primarily used as a flame retardant and smoke suppressant in building materials such as plastics, coatings, and insulation. Its ability to release water molecules when exposed to high temperatures helps slow the spread of fire, making it a crucial additive for fire-resistant structures. Additionally, it enhances the durability and weather resistance of construction composites. A key market driver is the rising adoption of stringent fire safety regulations in residential and commercial buildings, driving demand for non-toxic, eco-friendly flame retardants like aluminum hydroxide.

In the automotive industry, aluminum hydroxide is widely used as a flame retardant in vehicle components such as interior panels, wiring, and plastic parts to enhance fire safety. Its non-toxic and halogen-free properties make it a preferred choice for lightweight, heat-resistant materials in electric and conventional vehicles. Additionally, it contributes to improving insulation and durability in automotive coatings and composites. A key market driver is the growing emphasis on vehicle safety standards and the rising adoption of electric vehicles (EVs), which require advanced flame-retardant materials to meet stringent regulatory requirements.

Regional Insights

The North American aluminum hydroxide market is experiencing growth. The demand for aluminum hydroxide is anticipated to increase due to increasing construction activity in the region. The demand for the product market is also expected to grow substantially due to increased automotive production in the region.

Asia Pacific Aluminum Hydroxide Market Trends

The Asia Pacific region is dominant in the aluminum hydroxide market, Rapid industrialization in the region is anticipated to increase the demand for aluminum hydroxide throughout the forecast period. Additionally, government initiatives to enhance the manufacturing sector in countries like China, India, and South Korea are expected to drive further the need for mercury removal solutions and automotive. These factors contribute to the growing demand for coal-based activated carbon.

The aluminum hydroxide market in China is expected to grow during the forecast period. This growth is attributed to the increasing awareness among consumers about the grade market and led to increased demand for grades in the region.

Europe Aluminum Hydroxide Market Trends

The aluminum hydroxide market in Europe is witnessing significant growth, primarily driven by its application as a flame retardant in construction materials, adhering to stringent fire safety regulations. A recent report by European Aluminum highlights a 5% reduction in carbon emissions per kilogram of aluminum produced since 2015, with 78% of the electricity used in production coming from renewable sources. This environmental progress underscores the industry's commitment to sustainability, further bolstering the market's expansion.

Latin America Aluminum Hydroxide Market Trends

The Latin American aluminum hydroxide market is expected to experience significant growth, fueled by rising consumer demand for automotive, construction, and pharmaceuticals. Key contributors to this growth include Brazil and Argentina, where increasing disposable incomes and a heightened interest in personal grooming are noticeable. The market is expected to grow due to a rise in construction activity, automotive production, and pharmaceutical production in the region.

Middle East & Africa Aluminum Hydroxide Market Trends

The market in the Middle East and Africa is set for growth. This expansion is fueled by an increasing demand for pharmaceuticals and medical and the rising production of automotive in the region. Key markets in the region include Saudi Arabia and South Africa, where construction and automotive activity is increasing annually.

Key Aluminum Hydroxide Company Insights

Some key players operating in the industry include BASF SE and Sumitomo Chemical Co. Ltd..

-

Huber Materials is a significant player in the global market for industrial chemicals, specializing in advanced materials like alumina trihydrate (ATH), magnesium hydroxide (MDH), specialty aluminas, and calcium carbonate. These materials are used in a wide array of applications, from paints and coatings to food and pharmaceuticals. The company has a presence globally.

-

Sumitomo Chemical Co Ltd. is a chemical manufacturer that provides various products across several sectors, including functional and energy materials, health and crop science, petrochemicals, materials and chemicals, and pharmaceuticals. Its portfolio features a range of organic and inorganic industrial alumina products, chemicals, optical materials, polymer alloys, dyestuffs, thermoplastic elastomers, agricultural insecticides, polymer additives, and various petrochemical products. The company has a global presence.

Key Aluminum Hydroxide Companies:

The following are the leading companies in the aluminum hydroxide market. These companies collectively hold the largest market share and dictate industry trends.

- Almatis

- Alteo

- ALUMINA - CHEMICALS & CASTABLES

- Aluminum Corporation of China Ltd (Chalco)

- MAL - Magyar Aluminum

- Sumitomo Chemical Co. Ltd.

- Huber Materials.

- Sibelco

- LKAB Minerals AB

- Donau Carbon GmbH

- TOR Minerals International, Inc.

- Hindalco (Aditya Birla Management Corporation Pvt. Ltd)

Recent Developments

-

In April 2024, Finolex Cables launched a range of eco-friendly wires under the FinoGreen brand, expected to represent approximately 5% of the company's wire business. The FinoGreen industrial cables are flame-retardant and halogen-free, designed to prevent accidental fires and reduce risks in electrical installations.

-

In July 2023, Hindustan Unilever Limited (HUL) launched its new Pureit Revito Series of water purifiers. These purifiers utilize DURAViva, a cutting-edge filtration technology certified with a WQA gold seal. This technology effectively removes heavy metals and can provide up to 8,000 liters of purified water. Additionally, the water purifier conserves up to 70% of water and enriches the purified water with essential minerals, including calcium and magnesium.

Aluminum Hydroxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.50 billion

Revenue forecast in 2030

USD 15.31 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Almatis; Alteo; ALUMINA - CHEMICALS & CASTABLES; Aluminum Corporation of China Ltd (Chalco); MAL - Magyar Alumnium; Sumitomo Chemical Co. Ltd.; Huber Materials.; Sibelco; LKAB Minerals AB; Donau Carbon GmbH; TOR Minerals International, Inc.; Hindalco (Aditya Birla Management Corporation Pvt. LTd).

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Hydroxide Market Report Segmentation

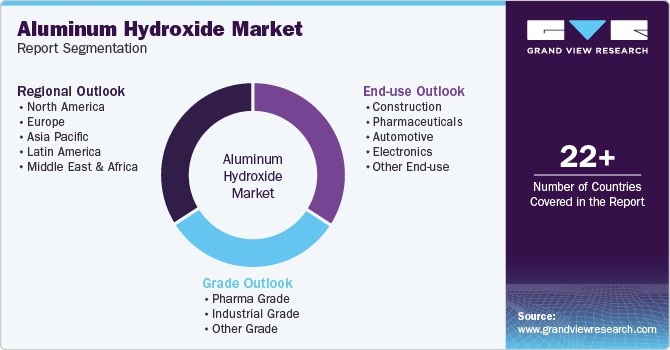

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum hydroxide market report based on the grade, end-use, and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharma Grade

-

Industrial Grade

-

Other Grade

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Pharmaceuticals

-

Automotive

-

Electronics

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aluminum hydroxide market size was estimated at USD 12.05 billion in 2024 and is expected to reach USD 12.50 billion in 2025.

b. The global aluminum hydroxide market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 15.31 billion by 2030.

b. Asia Pacific dominated the aluminum hydroxide market with a share of 36.8% in 2024. This is attributable to increasing construction activity in the region

b. Some key players operating in the aluminum hydroxide market include Almatis, Alteo, ALUMINA - CHEMICALS & CASTABLES, Aluminum Corporation of China Ltd (Chalco), MAL - Magyar Alumnium, Sumitomo Chemical Co. Ltd., Huber Materials., Sibelco, LKAB Minerals AB, Donau Carbon GmbH,

b. Key factors that are driving the market growth include the increasing use of pharmaceuticals, water treatment, and flame retardants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.