- Home

- »

- Consumer F&B

- »

-

Alternative Protein Ingredients Market, Industry Report, 2030GVR Report cover

![Alternative Protein Ingredients Market Size, Share & Trends Report]()

Alternative Protein Ingredients Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Plant Protein, Microbe-based Protein, Insect Protein), By Application (Instant Nutritional Drinks, Yogurts), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-197-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alternative Protein Ingredients Market Summary

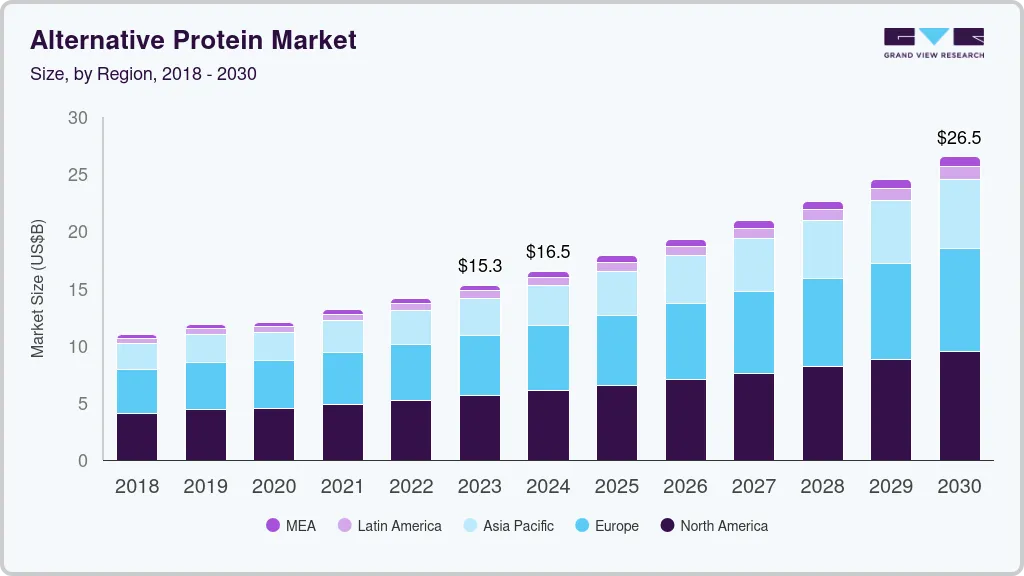

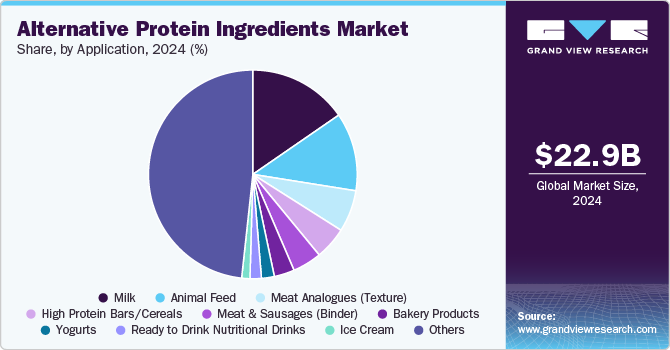

The global alternative protein ingredients market size was estimated at USD 22.95 billion in 2024 and is anticipated to reach USD 50.22 billion by 2030, growing at a CAGR of 14.1% from 2025 to 2030. The rising demand for plant-based alternatives in food and beverages reflects a shifting trend toward plant-centric diets, with innovative product offerings contributing to the market's expansion.

Key Market Trends & Insights

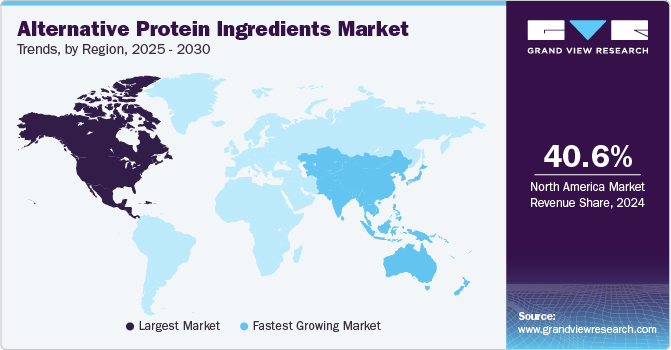

- North America alternative protein ingredients market accounted for a share of 40.6% of the global revenue in 2024.

- The alternative protein ingredients industry in the U.S. is projected to grow at a CAGR of 13.5% from 2025 to 2030.

- By product, the Plant-based protein ingredients accounted for a share of 69.3% of the global revenue in 2024.

- By application, the animal feed segment accounted for a share of 12.1% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22.95 Billion

- 2030 Projected Market Size: USD 50.22 Billion

- CAGR (2025-2030): 14.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This growth underscores a global movement toward more sustainable and plant-focused food choices. Moreover, the substantial growth in social media following emphasizes the increasing demand for and interest in plant-based dining experiences, underscoring the pivotal role of digital platforms in shaping consumer choices within the alternative protein ingredients industry.

Within the alternative protein market the growing awareness of the health benefits linked to plant-based diets, present a significant opportunity to position these proteins as essential components of a nutritious and balanced lifestyle. As consumers increasingly look for alternatives to traditional meat products, the market offers immense potential for innovative plant-based protein options that combine health benefits with a variety of taste profiles to cater to diverse preferences.

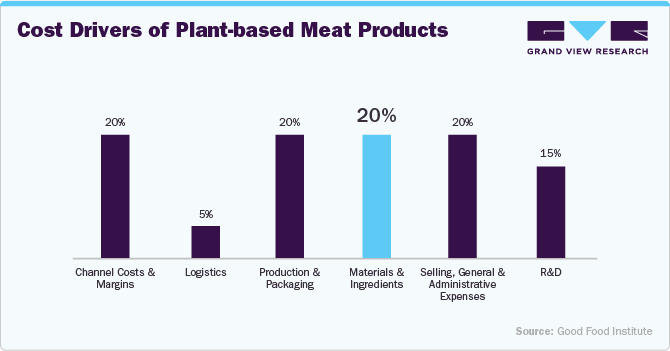

Materials and ingredients, which make up 20% of the total cost of plant-based meat products, are a key driver of demand for alternative protein ingredients like pea protein, soy protein, and wheat gluten. As consumers seek cleaner, more sustainable, and nutritionally rich meat alternatives, manufacturers are increasingly sourcing high-quality proteins and advanced binding agents to enhance taste and texture. This growing demand for premium plant-based and novel proteins, such as microbial and insect-based options, is driving innovation and investment in alternative protein ingredients to optimize cost efficiency and product performance.

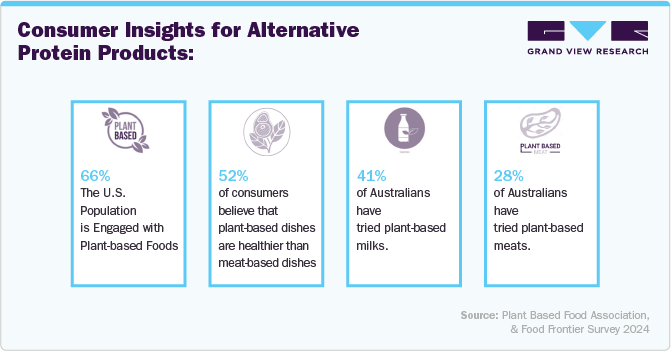

Consumer Insights for Alternative Protein Products

The alternative proteins consumer surveys reveal an increasing shift toward sustainable and health-focused food preferences. Many consumers are prioritizing plant-based proteins, such as pea protein and soy protein, for their nutritional value and reduced environmental footprint. For example, according to the Plant-Based Foods Association, around 66% of the U.S. population engages with plant-based foods, and approximately 52% believe that plant-based dishes are healthier than meat-based options.

The 2024 Food Frontier consumer survey reveals that 22% of Australians are reducing or eliminating animal meat consumption due to climate change concerns, while 16% are doing the same with animal dairy. Additionally, 35% have tried plant-based meats, up from 24% in 2021, with 16% consuming them regularly. These trends indicate a growing consumer shift towards alternative protein sources driven by environmental and health considerations. This increasing demand encourages the development and diversification of alternative protein market.

Alternative proteins, such as plant proteins, inherently contribute to reduced environmental impact compared to their animal-based counterparts. Leveraging this sustainability aspect provides a strategic avenue for market players to appeal to environmentally conscious consumers. Collaborative efforts within the industry to further enhance sustainable practices, from sourcing raw materials to production processes, can help reach a broader customer base that values both personal health and planetary well-being.

Alternative protein ingredients consumer insights reveal that health, sustainability, and innovation are key drivers shaping purchasing decisions in this market. For instance, consumers are increasingly drawn to plant-based protein options like almond and pea protein due to their perceived health benefits, such as being cholesterol-free and rich in essential nutrients.

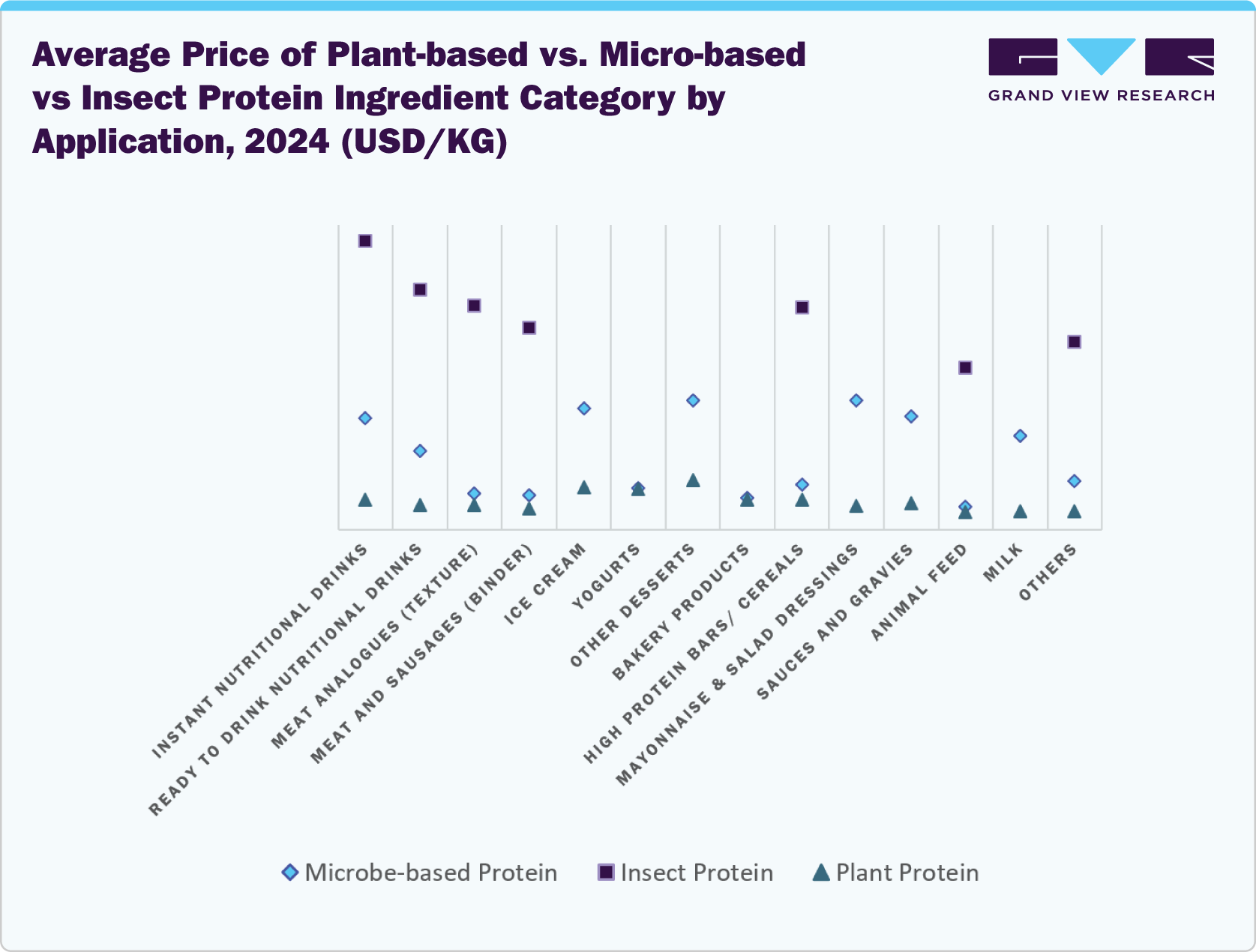

Pricing Analysis

Microbe-based protein ingredients are priced highest in desserts and dressings due to specialized processing, while it remain affordable in animal feed applications. Insect protein ingredients command premium pricing in functional foods like nutritional drinks and meat analogs, with lower costs in animal feed applications. Plant protein ingredients are costliest in dairy alternatives such as yogurts and desserts but remain economical for animal feed, reflecting its broad accessibility and ease of production.

Continued investment in research and development (R&D) can lead to the development of plant-based alternatives that mimic the taste and texture of traditional meat and introduce novel and appealing flavor profiles. The culinary versatility of plant-based proteins opens doors for chefs, restaurants, and food manufacturers to craft a diverse array of plant-based dishes, appealing to committed vegetarians as well as flexitarians and meat enthusiasts willing to explore plant-based options.

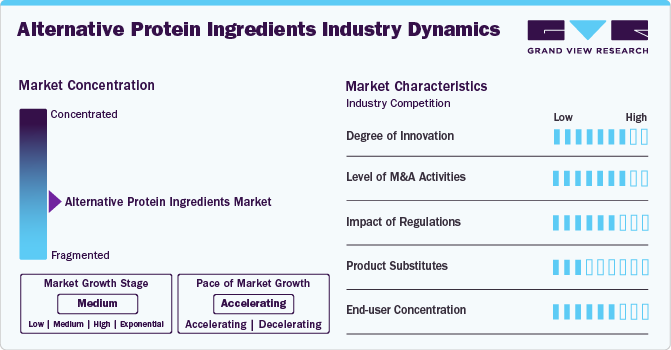

Market Concentration & Characteristics

The alternative protein industry has witnessed remarkable product innovation across various categories. Plant-based meats have seen advancements in taste, texture, and nutritional profile, with companies utilizing innovative ingredients and processing techniques to closely mimic the sensory experience of conventional meat products. Insect-based foods have emerged as a novel protein source, with companies exploring creative formulations and flavor profiles to make them more palatable and appealing to consumers.

In the rapidly growing alternative protein industry, merger and acquisition (M&A) activities have been prevalent as companies seek to strengthen their market positions, expand their product portfolios, and gain access to new technologies and distribution channels. Additionally, partnerships between traditional food companies and alternative protein producers have become increasingly common, enabling mutual benefits such as leveraging existing supply chains and expertise.

Regulations play a significant role in shaping the development and growth of the alternative protein industry, influencing areas such as food safety, labeling requirements, ingredient approvals, and market access. While regulations can assure consumers of product safety and quality, they can also present challenges for companies operating in this space. Striking a balance between ensuring consumer protection and fostering innovation is crucial for regulatory bodies. For example, regulatory approval processes for novel ingredients or production methods, such as cultured meat, can be lengthy and complex, potentially hindering market entry and investment.

Product substitutes for the alternative protein ingredients industry include traditional animal-derived proteins such as beef, pork, poultry, fish, dairy, and eggs. These conventional protein sources have been staples in diets worldwide for centuries and continue to dominate the global protein market. Additionally, there are also other non-meat alternatives, such as legumes, nuts, and seeds, which have been consumed for their protein content for millennia.

Product Insights

Plant-based protein market accounted for a share of 69.3% of the global revenue in 2024. Plant-based proteins are being investigated for their role in managing chronic conditions, supporting immune health, and addressing specific nutritional deficiencies. The pharmaceutical industry's interest in plant-based proteins not only broadens the application scope of these proteins but also elevates their perceived value as functional and therapeutic ingredients. The surge in demand for plant-based protein products is evident in the wide range of available plant-based protein supplements, shakes, and snacks. Fitness enthusiasts, including athletes and bodybuilders, incorporate these products into their dietary routines to meet their protein requirements while aligning with their ethical and environmental values.

The oat protein ingredients market is emerging as a popular choice in the plant-based protein sector, valued for its nutritional benefits and versatility. Known for its high content of essential amino acids, oat protein is widely used in products such as breakfast cereals, plant-based milks, and protein bars.

The soy protein ingredients market remains a cornerstone in the plant protein market, widely recognized for its high-quality protein content and versatility. It is extensively used in a variety of food products, including meat alternatives, dairy-free products, and nutritional supplements. The rising consumer inclination toward plant-based diets and the well-documented health benefits of soy protein, such as heart health and muscle maintenance, are significant drivers of its demand.

Pea protein ingredients are gaining significant popularity as a sustainable and allergen-friendly alternative to other plant proteins. Its high digestibility and rich amino acid profile make it suitable for various applications, including plant-based meats, dairy alternatives, and protein supplements. Recent product launches in the pea protein market highlight its expanding use and innovation. For instance, in February 2024, Roquette introduced NUTRALYS TP70S, a textured pea protein specifically designed for meat substitutes, offering improved texture and moisture retention.

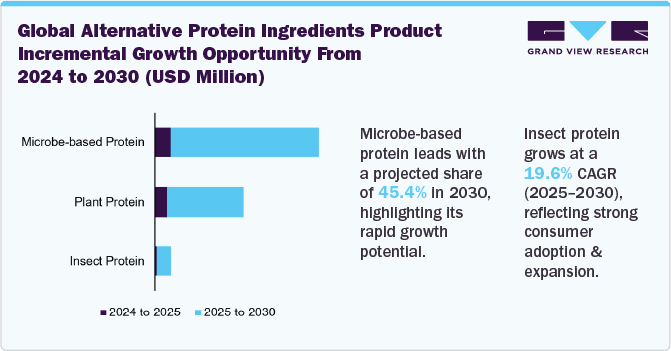

The insect protein ingredients market is projected to grow at a CAGR of 19.6% from 2025 to 2030. Increasing concerns about sustainability and the environmental impact of traditional livestock farming have fueled interest in alternative protein sources, such as insects, which require significantly fewer resources to produce. For instance, companies such as Entomo Farms have capitalized on this trend by pioneering large-scale insect farming operations, providing a sustainable source of protein. Insects are highly nutritious and rich in protein, healthy fats, and essential vitamins and minerals, making them an attractive option for health-conscious consumers. This nutritional profile has led to the development of innovative insect-based products, such as cricket flour, from companies such as Bitty Foods, which can be used as a sustainable protein source in various food applications.

Coleoptera, commonly known as beetles, are emerging as a promising source of insect protein market. Beetle larvae, particularly mealworms, are rich in protein and essential nutrients, making them a highly nutritious food source. The environmental benefits of beetle farming, such as low greenhouse gas emissions and minimal land use, are significant drivers for their adoption.

The micro-based protein ingredients market is projected to grow at a CAGR of 24.0% from 2025 to 2030. One of the key advantages of microbe-based proteins is their nutritional profile. These proteins can be tailored to possess a diverse array of amino acid compositions, making them suitable for a wide range of applications, from sports nutrition and dietary supplements to plant-based meat alternatives and functional food ingredients. Additionally, the production process can be optimized to enhance the bioavailability and digestibility of the proteins, further improving their nutritional value.

Application Insights

The use of alternative protein ingredients in the animal feed industry accounted for a share of 12.1% of the global revenue in 2024. The driving force behind the growing demand for alternative proteins in the animal feed industry is a convergence of various factors that align with evolving consumer preferences, sustainability concerns, and advancements in nutritional research. One key factor is the increasing awareness among pet owners and livestock producers about the environmental impact of traditional animal-based protein sources, such as meat and fishmeal.

Moreover, the companies are introducing various alternative protein products for animal feed that further propel the alternative protein ingredients market growth. For instance, in June 2023, BENEO introduced a new range of high-quality and non-GMO vegetable proteins for pet food manufacturers. The demand for plant-based pet food is growing, and BENEO's toolbox of plant-based proteins, which feature rice protein, vital wheat gluten, and faba bean protein concentrate, provide nutritional and technical benefits.

The alternative protein ingredients in milk are projected to grow at a CAGR of 20.0% from 2025 to 2030. The demand for alternative protein ingredients in the milk industry is experiencing significant growth, largely driven by evolving consumer preferences and a heightened focus on sustainability. A pivotal factor is the growing consumer acceptance of alternative proteins, which has fueled the global popularity of plant-based and non-dairy products. This shift is further supported by increasing cases of lactose intolerance, dairy allergies, and the adoption of vegan and flexitarian diets. As a result, consumers are actively seeking protein-rich alternatives like almond, soy, oat, pea, and rice-based milk, which provide comparable nutritional benefits without relying on animal-derived components.

The growing consumer demand for health-conscious and sustainable products is a major factor driving the adoption of alternative protein ingredients in the ready-to-drink (RTD) nutritional drinks market. As health and fitness trends continue to rise, consumers are seeking protein-rich beverages that align with their dietary preferences, such as vegetarian, vegan, or flexitarian diets.

Regional Insights

North America alternative protein ingredients market accounted for a share of 40.6% of the global revenue in 2024. Increasing consumer awareness of environmental sustainability and animal welfare has led to a shift towards plant-based and alternative protein sources. For example, the rising demand for plant-based meat products, such as Beyond Meat and Impossible Foods, showcases consumers' willingness to embrace alternative protein options for ethical and environmental reasons. The growing demand for protein-rich foods due to health and wellness trends, combined with the rise of flexitarian, vegetarian, and vegan diets, has created a substantial market opportunity for alternative protein products. Products like oat milk from companies like Oatly and Almond milk from Califia Farms are excellent examples of how non-animal-based proteins fulfill the demands of consumers pursuing plant-based dietary choices.

U.S. Alternative Protein Ingredients Market Trends

The alternative protein ingredients industry in the U.S. is projected to grow at a CAGR of 13.5% from 2025 to 2030. The growth is mainly driven by several key trends and factors influencing consumer preferences. One of the notable alternative ingredients market growth trends is the growing popularity of plant-based proteins due to taste and texture enhancements. These improvements, coupled with changes in consumer diets and increased environmental awareness, have contributed to the rise in demand for plant-based proteins.

Canada alternative protein ingredients market was valued at USD 550.7 million in 2024. Canada's strong tradition of agricultural innovation and research has fostered the development of alternative protein sources, such as pulses (e.g., lentils and chickpeas), which are abundant in the country. For example, companies like Prairie Fava have capitalized on Canada's pulse crops to produce protein-rich fava bean ingredients for alternative protein products.

Asia Pacific Alternative Protein Ingredients Market Trends

Asia Pacific alternative protein ingredients industry is projected to grow at a CAGR of 15.4% from 2025 to 2030. Rising consumer interest in sustainability and ethical consumption is driving the demand for alternative protein sources. For instance, the growing popularity of plant-based meat products like Omnipork in the region reflects this shifting consumer preference towards sustainable and ethical food options.

China alternative protein ingredients market accounted for a share of 35.0% in 2024. The country's substantial population and rapid urbanization have led to increased demand for protein, creating a significant market opportunity for alternative protein products. As a result, Chinese companies like Whole Perfect Food are investing in plant-based meat products to cater to this growing demand.

Alternative protein ingredients market in Japan is projected to grow at a CAGR of 14.5% from 2025 to 2030. The environmental sustainability and food security concerns have garnered attention in Japan, leading to an increased interest in alternative protein sources. Government support for sustainable food production and initiatives to reduce reliance on animal protein have created a conducive environment for the industry’s growth. For example, collaborations between the private sector and research institutions have led to the development of new technologies for producing plant-based proteins.

Australia alternative protein ingredients market is projected to grow at a CAGR of 14.3% from 2025 to 2030. The growth of the market is driven by rising consumer demand for sustainable and plant-based food options, driven by health, environmental, and ethical concerns. Increasing veganism and flexitarian lifestyles are pushing manufacturers to innovate with ingredients like pea protein, soy protein, and faba bean protein, which are widely used in plant-based meats, dairy alternatives, and protein bars.

Europe Alternative Protein Ingredients Market Trends

Europe alternative protein ingredients industry is expected to grow at a CAGR of 14.0% from 2025 to 2030. The European Commission has been actively exploring ways to enhance the production of plant proteins in Europe. This includes reviewing supply and demand and assessing the possibilities for developing production without harming the environment. Protein crops are known for fixing atmospheric nitrogen in the soil, contributing to a more sustainable nutrient cycle.

Germany alternative protein Ingredients market accounted for a share of 23.8% of the European market in 2024. One of the primary reasons is the changing dietary preferences of the German population. The number of vegans and vegetarians is increasing, with over 13% of the population following a vegetarian diet and about 2.7% adhering to a vegan lifestyle. Moreover, nearly 30% of the population identifies as flexitarian, indicating a preference for plant-based diets with occasional meat consumption. This shift is reflected in the growing number of vegan and vegetarian restaurants, particularly in urban areas like Berlin, which is known for its diverse and innovative food landscape.

Alternative protein ingredients market in the UK is projected to grow at a CAGR of 14.5% from 2025 to 2030. The industry has seen a growing shift from animal-based diets, driven by factors like health awareness and environmental sustainability. Young and urban populations who believe consuming less meat is better for health and the environment are the primary consumers of plant-based foods. In 2022, there was a notable increase in the per capita consumption of soy protein, and the UK government's promotion of a healthy lifestyle has further boosted this trend.

France alternative protein ingredients market is expected to grow at a CAGR of 13.6% from 2025 to 2030. The plant protein industry in France has experienced significant growth in recent years, primarily driven by shifting consumer preferences toward sustainable and plant-based diets. With increasing awareness of environmental and health issues, a growing number of French consumers are actively looking for alternatives to animal-based proteins, contributing to the rising popularity of alternative proteins.

Middle East & Africa Alternative Protein Ingredients Market Trends

The alternative protein ingredients industry in the Middle East & Africa is projected to grow at a CAGR of 14.2% from 2024 to 2030. The region has been witnessing a significant consumer shift towards health & wellness in recent years, with increased focus on protein intake, meal replacement, and weight management, among others. The growing middle-class population and rising consumer disposable income levels are expected to influence the regional market growth in the forthcoming years.

South Africa alternative protein ingredients market is projected to grow at a CAGR of 14.9% from 2025 to 2030. The market is gaining momentum, driven by a combination of sustainability concerns, health-conscious consumer trends, and the rising demand for affordable and diverse protein sources. With growing awareness of the environmental impact of traditional animal-based protein production, South African consumers and manufacturers are increasingly turning to plant-based proteins, insect protein, and emerging options like mycoprotein and algae-based protein.

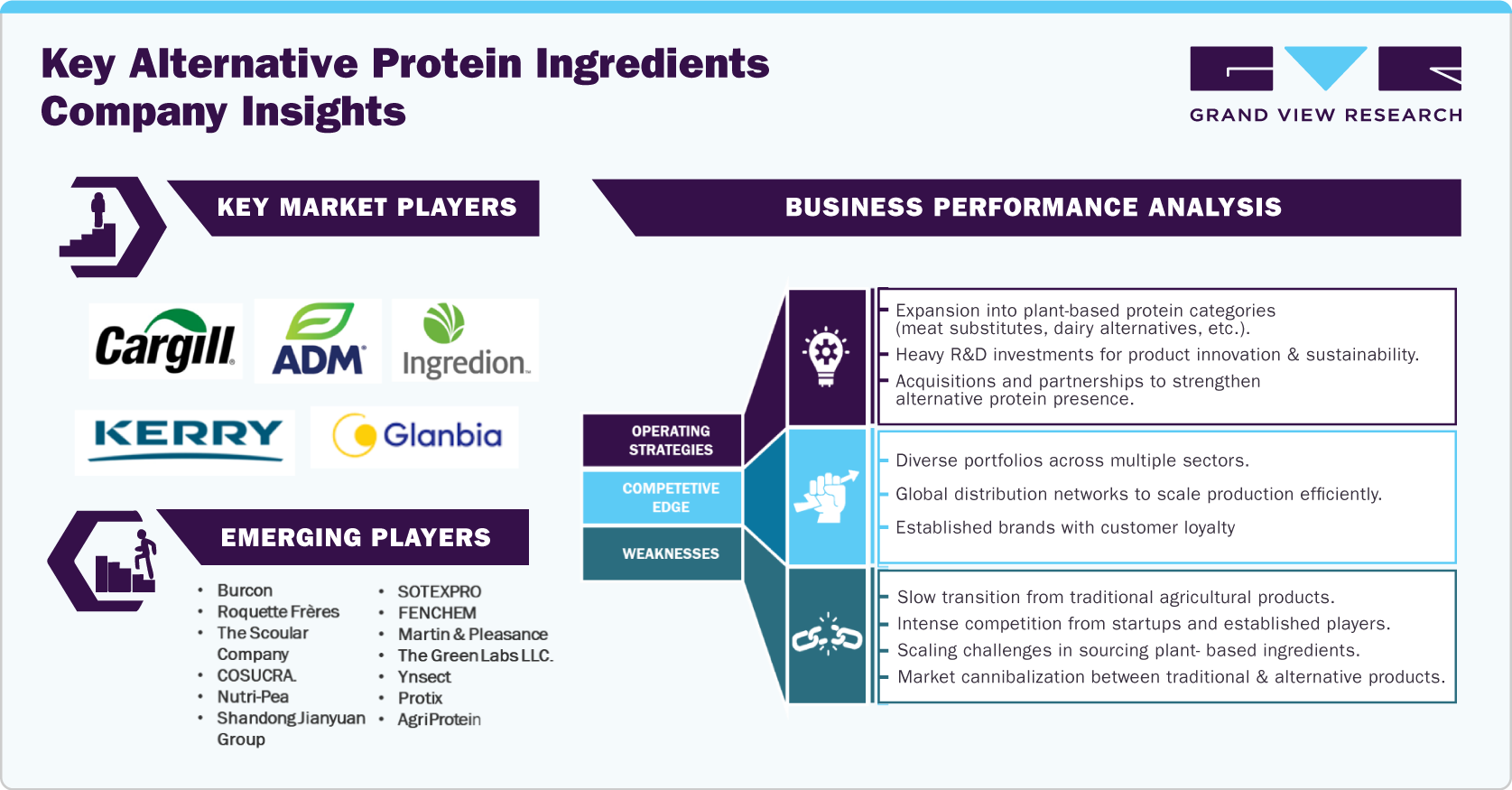

Key Alternative Protein Ingredients Company Insights

The global alternative protein ingredients market share by the company provides the market positioning of the major players in the industry. Industry players are focusing on research & development activities and on diversifying their portfolio to launch new and innovative alternative protein products.

Key Alternative Protein Ingredients Companies:

The following are the leading companies in the alternative protein ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Cargill Inc.

- Lightlife Foods, Inc.

- Impossible Foods Inc.

- International Flavors & Fragrances, Inc.

- Ingredion Inc.

- Kerry Group

- Glanbia plc

- Bunge Limited

- Axiom Foods Inc.

- Tate & Lyle PLC

- SunOpta Inc.

- Glanbia plc

- AGT Food and Ingredients

- Emsland Group

- Burcon

- Roquette Frères

- The Scoular Company

- COSUCRA.

- Nutri-Pea

- Shandong Jianyuan Group

- SOTEXPRO

- FENCHEM

- Martin & Pleasance

- The Green Labs LLC.

- Ynsect

- Protix

- AgriProtein

- EnviroFlight

- Hexafly

Recent Developments

-

In August 2024, Corbion purchased the bread improver business from Novotech Food Ingredients in India to enhance its footprint in the Asia Pacific region. This acquisition will enrich Corbion's range of functional solutions tailored to local market demands and improve collaboration with global customers based in India.

-

In May 2024, Goterra partnered with Skretting Australia to incorporate Australian insect protein into aquaculture feeds. This collaboration aims to validate the use of Goterra's insect meal in local aquaculture species. Skretting, part of Nutreco's aquaculture division, is committed to developing novel ingredients for sustainable aquaculture. Goterra's innovative insect robot technology converts food waste into insect protein and fertilizer, which Skretting views as a viable protein source.

-

In March 2024, Ingredion Incorporated, a provider of ingredient solutions for the food and beverage industry, announced that it had been recognized as one of the 2024 World’s Most Ethical Companies by Ethisphere. This recognition marked the company's 10th appearance on the list, highlighting its commitment to ethical business practices.

-

In December 2022, Bunge announced a USD 550 million investment to construct a fully integrated soy protein concentrate (SPC) and textured soy protein concentrate (TSPC) facility. The facility will be built adjacent to and integrated with Bunge's soybean processing plant in Indiana, U.S. The construction is set to commence in the first quarter of 2023, with a commissioning date expected in mid-2025. This initiative will create approximately 70 full-time jobs and is projected to process an additional 4.5 million bushels of soybeans. The primary goal of this facility is to address the growing demand for key ingredients in plant-based foods, processed meat, pet food, and feed products.

-

In August 2022, ADM announced a partnership with Benson Hill, an agricultural technology company, to scale its soy ingredients to cater to the growing demand for plant-based proteins. As part of the partnership, ADM processed and commercialized its proprietary ingredients derived from Benson Hill's Ultra-High Protein soybeans through an exclusive North American licensing partnership. The collaboration scaled innovative ingredients enabled by Benson Hill genetics, featuring less-processed proteins with significant water and carbon sustainability benefits. The collaboration was aimed at creating a pathway toward commercial-scale production of higher-value alternative protein products.

-

In September 2021, Ingredion Incorporated announced the launch of pulse-based ingredient solutions with excellent taste, nutrition, and functionality to help manufacturers deliver on increasing consumer demand for delicious plant protein-rich food in the U.S. and Canada. The product line included VITESSENCE Prista P 155 pea protein concentrate and VITESSENCE Prista P 360 faba bean protein concentrate. Through the launch, the company aimed to expand its plant-based protein segment.

Alternative Protein Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.92 billion

Revenue forecast in 2030

USD 50.22 billion

Growth rate

CAGR of 14.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilogram, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia & New Zealand; Brazil; South Africa

Key companies profiled

ADM; Cargill Inc.; Lightlife Foods, Inc.; Impossible Foods Inc.; International Flavors & Fragrances, Inc.; Ingredion Inc.; Kerry Group; Glanbia plc; Bunge Limited; Axiom Foods Inc.; Tate & Lyle PLC; SunOpta Inc.; Glanbia plc; AGT Food and Ingredients; Emsland Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Alternative Protein Ingredients Market Report Segmentation

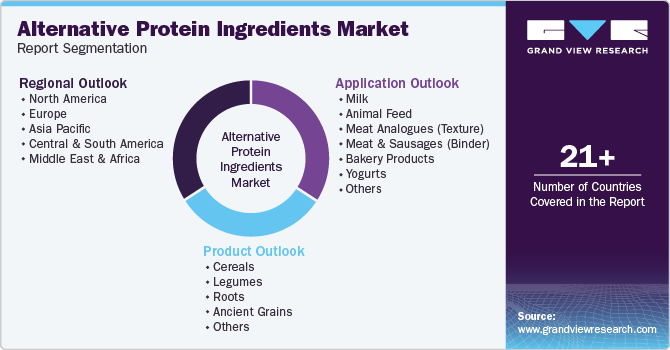

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alternative protein ingredients market report based on product, application, and region:

-

Product Outlook (Volume, Kilogram; Revenue, USD Million, 2018 - 2030)

-

Plant Proteins

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

-

Ancient Grains

-

Hemp

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Millet

-

Others

-

-

Nuts & Seeds

-

Canola

-

Canola Protein Isolates

-

Hydrolyzed Canola Protein

-

-

Almonds

-

Flaxseeds

-

Others

-

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

Precision Fermentation Protein

-

Dairy Proteins (Casins or Whey)

-

Egg Proteins

-

Others

-

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

Application Outlook (Volume, Kilogram; Revenue, USD Million, 2018 - 2030)

-

Instant Nutritional Drinks

-

Ready to Drink Nutritional Drinks

-

Meat Analogues (Texture)

-

Meat and Sausages (Binder)

-

Ice Cream

-

Yogurts

-

Other Desserts

-

Bakery Products

-

High Protein Bars/ Cereals

-

Mayonnaise & Salad Dressings

-

Sauces and Gravies

-

Animal Feed

-

Feed - Cattle, Pig, Chicken

-

Feed - Fish

-

Others

-

-

Milk

-

Others

-

-

Regional Outlook (Volume, Kilogram; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alternative protein ingredients market size was estimated at USD 22.95 billion in 2024 and is expected to reach USD 25.92 billion in 2025.

b. The global alternative protein ingredients market is expected to grow at a compounded growth rate of 14.1% from 2025 to 2030 to reach USD 50.22 billion by 2030.

b. Plant-based protein ingredients accounted for a share of 69.3% of the global revenue in 2024. Plant-based proteins ingredients are being investigated for their role in managing chronic conditions, supporting immune health, and addressing specific nutritional deficiencies.

b. Some key players operating in alternative protein ingredients market include AADM; Cargill Inc.; Lightlife Foods, Inc.; Impossible Foods Inc.; International Flavors & Fragrances, Inc.; Ingredion Inc.; Kerry Group; Glanbia plc; Bunge Limited; Axiom Foods Inc.; Tate & Lyle PLC; SunOpta Inc.; Glanbia plc; AGT Food and Ingredients; Emsland Group

b. Key factors that are driving the market growth include rising demand for plant-based alternatives ingredients in food and beverages reflects a shifting trend toward plant-centric diets, with innovative product offerings

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.