- Home

- »

- Organic Chemicals

- »

-

Alpha Olefin Market Size, Share And Growth Report, 2030GVR Report cover

![Alpha Olefin Market Size, Share & Trends Report]()

Alpha Olefin Market Size, Share & Trends Analysis Report By Product (1-Butene, 1-Octene, 1-Hexene), By Application (Polyethylene, Detergent Alcohol, Synthetic Lubricant), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-356-0

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Alpha Olefin Market Size & Trends

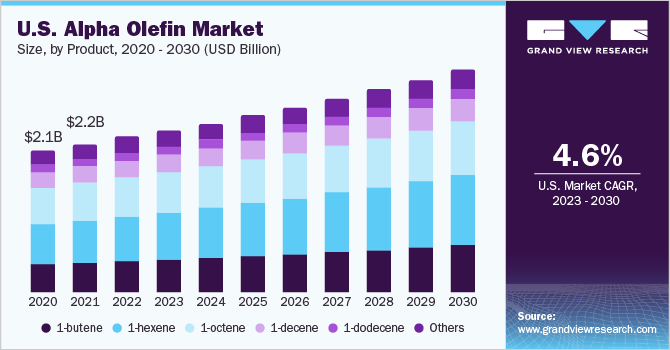

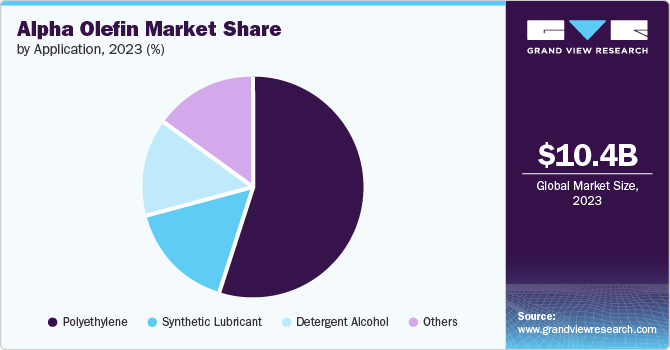

The global alpha olefin market size was estimated at USD 10.42 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The escalating demand for polyethylene, driven by its wide-ranging applications in packaging, industrial processes, consumer goods, and other sectors, is anticipated to be a key driver for market growth. The primary method for producing alpha olefins involves the oligomerization of ethylene, making it the predominant process in use. This process results in the generation of products characterized by even-numbered carbon chains, typically ranging from C4 to C30+.

Oil drilling activities in the United States have emerged as a major driving force for the country's market. The U.S. has experienced a significant surge in oil drilling activities, particularly in regions such as the Permian Basin in Texas and New Mexico, the Bakken Formation in North Dakota, and the Eagle Ford Shale in Texas. These drilling activities have not only bolstered the nation's oil production but have also contributed to the increased availability of ethylene, a key raw material for alpha olefin production.

The abundant supply of ethylene from these oil drilling activities has been instrumental in meeting the growing demand for alpha olefins in the market. For instance, the Permian Basin, one of the most prolific oil-producing regions in the U.S., has witnessed remarkable growth in drilling activities, leading to a surge in crude oil and natural gas production. This surge has resulted in the availability of ethane, a component of natural gas liquids, which serves as a vital raw material for the production of alpha olefins. The presence of ethane from these drilling activities has not only enhanced the raw material supply but has also contributed to the stability of the market in the U.S. Moreover, the expansion of key market participants in the U.S. has been closely linked to the surge in oil drilling activities.

Major companies such as Chevron, ExxonMobil, and ConocoPhillips have significantly expanded their oil and gas operations, leading to increased ethylene production. This expanded ethylene production has, in turn, facilitated the production of alpha olefins, thereby meeting the rising demand for these compounds in various industrial applications. These instances exemplify how the growth of oil drilling activities has directly influenced the market, driving its growth and stability worldwide.

The innovative use of shale rocks as a cost-effective cracker feed for ethylene production has further amplified the impact of oil drilling activities on the market. Shale rocks, which contain hydrocarbons, have been utilized as a feedstock for ethylene production, contributing to increased supply levels and lower market pricing. This innovative approach, coupled with the surge in oil drilling activities, has significantly influenced the supply chain dynamics of alpha olefins, further solidifying the connection between oil drilling activities and the market.

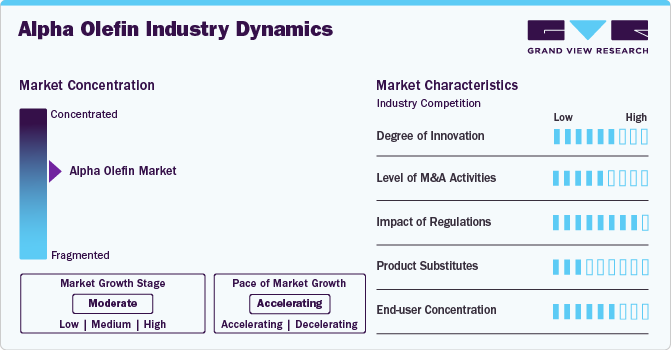

Market Concentration & Characteristics

The market demonstrates a moderate level of consolidation, which is shaped by a variety of factors, including applications, end users, regulatory conditions, and market dynamics. Alpha olefins are widely used in polyolefin co-monomers, surfactants and intermediates, lubricants, fine chemicals, plasticizers, and oil field chemicals. The broad spectrum of applications contributes to the market's moderate consolidation, as major players prioritize the provision of top-quality alpha olefins tailored to meet the specific requirements of diverse industries.

The global market is predominantly led by the North America region, with substantial consumption emanating from countries such as the U.S. and Canada. This regional supremacy, coupled with the varied end-user industries, plays a pivotal role in shaping the moderate consolidation of the market. Companies strategically prioritize addressing the specific requirements and demands of these key industries. For instance, the prominent presence of major polyolefin manufacturers in North America, including Chevron Phillips Chemical Co., Shell plc, and ExxonMobil, has significantly contributed to the region's noteworthy market growth and consolidation.

The progress in nanoparticle-based nutrients and the potential introduction of bio-based alpha olefins in the research and development phase present lucrative investment prospects for manufacturers, exerting an impact on the consolidation dynamics. Furthermore, the market is marked by increasing research and development investments aimed at developing alpha olefins from diverse sources, which are anticipated to serve as market opportunities in the foreseeable future.

Product Insights

The 1-Hexene dominated the market with a revenue share of 29.8% in 2023. This is attributed to the widespread use of 1-hexene, as it serves as a synthetic lubricant ingredient, further accelerating market growth. The utilization of 1-hexene as a common monomer for the production of high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE) polymers is expected to augment the segment's growth, particularly within the packaging industry. The presence of major polyolefin manufacturers in North America, such as Chevron Phillips Chemical Co., Shell plc, and ExxonMobil, has also contributed to the significant market growth and consolidation of 1-hexene.

Another significant segment in the market is 1-dodecene. Its use as an additive in synthetic lubricants is projected to enhance market growth. The demand for 1-dodecene from industrial and household cleaners, coupled with its expanding application in the personal care industry, is expected to aid this product segment, given its role in the production of detergent alcohols. The projected increase in the consumption of bio-based detergent alcohols and alkyl aromatics is expected to supplant the usage of 1-dodecene.

The rising demand for synthetic lubricants based on polyalphaolefin (PAO) is a critical driver propelling the expansion of the market. In addition, the escalating demand for polyethylene, driven by its widespread use in various products and processes such as consumer goods, packaging, and industrial applications, has accelerated the market's growth. Furthermore, the positive projection for oilfield drilling activities suggests further expansion in the demand for alpha-olefins in the foreseeable future, indicating a favorable outlook for 1-octene. The unique properties of 1-octene-based Linear Low-Density Polyethylene (LLDPE), such as greater resistance to external stress, lower density, and greater stiffness, make it the preferred choice for lightweight yet durable packaging materials for consumer goods and equipment manufacturing.

Application Insights

Polyethylene dominated the market with a share of 55.0% in 2023. The construction industry stands as the primary market for polyethylene compounds, with its wide-ranging applications. In addition, polyethylene finds extensive utilization in the packaging sector and serves as a valuable material for prototype development on Computer Numerical Control (CNC) machines and 3D printers. On the other hand, low-density polyethylene emerges as a favored choice within specific applications, driven by its cost-effectiveness in production, heat sealability, exceptional clarity, and elongation, as well as its soft and pliable nature.

Another significant utilization of alpha olefin lies in synthetic lubricants, where demand is anticipated to be aided by the enforcement of rigorous regulations aimed at pollution control. Furthermore, increased investment in research and development is poised to have a substantial influence on the surge in demand for synthetic lubricants. In addition, the extensive range of applications for these lubricants is projected to provide further strength to the market.

Regional Insights

The North America alpha olefin market dominated globally with a revenue share of 39.3% in 2023. The surge in shale gas production in the U.S. has led to an increase in ethylene production, subsequently driving the production of alpha olefins. Furthermore, the ongoing oil exploration activities in the Gulf of Mexico are poised to boost market growth further. Similarly, the rise in crude oil production in Canada is expected to drive alpha olefin production even further in the region.

U.S. Alpha Olefin Market Trends

The alpha olefin market in the U.S. is mainly driven by the packaging sector's needs and developments in polymer technology. This reflects the country's robust industrial foundation and technological progress. The industry is largely led by major players like Chevron Phillips Chemical Co., The Dow Chemical Company, and ExxonMobil, who play a significant role in the market's growth.

Europe Alpha Olefin Market Trends

The alpha olefins market in Europe is the second largest market in 2023. The region's focus on sustainable production methods and the rising trend of bio-based alpha olefins are shaping the market. In addition, the growing emphasis on specialty chemicals and performance products is contributing to the market's expansion.

The Germany alpha olefin market is influenced by the country's emphasis on technological innovation and sustainability. Key players such as Shell plc contribute to the consolidation and overall competitive landscape in the country. It is driven by factors such as the growing demand for synthetic lubricants, plasticizers, and cosmetics, reflecting Germany's position as a hub for technological advancements and innovation in the chemical industry.

The alpha olefin market in the UK is driven by demand from industries such as coatings and paper, pharmaceuticals, cosmetics, and the automobile sector. Moreover, the easy availability of raw materials and the presence of vast natural resources are expected to drive market growth in the UK.

Asia Pacific Alpha Olefin Market Trends

The Asia Pacific alpha olefins market is expected to grow significantly from 2024 to 2030. The market is witnessing substantial growth due to the burgeoning packaging industry, rapid industrialization, and the expansion of the automotive sector. The region's strategic investments in research and development and the growing focus on specialty chemicals are also contributing to the market's progress.

The alpha olefin market in China is characterized by the participation of domestic companies like Sinopec and PetroChina, who play a key role in producing alpha olefins within the country. The rising use of alpha olefins in products like polyethylene and detergent alcohol has grown with the expansion of China's industrial and manufacturing sectors, leading to a growing need for top-notch olefins in the nation.

The India alpha olefin market is growing due to increasing demand for polyethylene. The rising demand for alpha olefins in the automobile sector is predicted to drive the market growth. The market also faces threats such as the cost involved in raw materials and manufacturing, which is considered a major threat to the market for linear alpha olefins.

Central & South America Alpha Olefin Market Trends

The alpha olefin market in Central & South America is anticipated to witness significant growth from 2024 to 2030. Key drivers in the region include the abundant availability of raw materials, such as ethylene, and the presence of major players like Braskem and Petrobras. The growing emphasis on renewable and environmentally friendly solutions is shaping the market in Central and South America.

The Brazil alpha olefin market is shaped by aspects like the country's emphasis on sustainable growth and the rising need for specialty chemicals and plasticizers. Major producers like Braskem are concentrating on delivering top-notch alpha olefins to meet the varied requirements of the Brazilian market. The market is also fueled by the growing requirement for synthetic lubricants and adhesives.

Middle East & Africa Alpha Olefin Market Trends

The alpha olefin market in MEA is expected to grow at a significant rate during the forecast period. The market in the region is witnessing significant growth due to the region’s robust petrochemical industry and its focus on diversifying the economy. The region's strategic investments in advanced polymer technologies and the development of innovative production methods are driving market expansion.

The Saudi Arabia alpha olefin market has seen significant growth driven by the country's plentiful natural resources and the prominent role of key companies like SABIC. The increasing need for alpha olefins in the oil and gas industry, owing to Saudi Arabia's significant position in the global petrochemical sector, is a major driver. Moreover, the market is boosted by the country's efforts to enhance its chemical and petrochemical manufacturing, leading to a rising demand for alpha olefins in the area.

Key Alpha Olefin Company Insights

Companies in the industry are primarily concentrating on creating new products and forming lasting partnerships with raw material suppliers. Key factors driving market growth include the range of products offered, pricing strategies, and manufacturing technology. Many manufacturers are large international firms that are thus involved in research and development to develop innovative and sustainable production methods. These companies are also establishing production facilities in developing countries to capitalize on future opportunities

Some of the key players operating in the market include

-

Chevron Phillips Chemical Company LLC provides a wide range of products, including aromatics, drilling specialties, olefins, performance pipe, polyethylene, and specialty chemicals. The company also offers alpha olefin products within the normal alpha olefin products segment.

-

Evonik Industries AG offers a diverse selection of co- and terpolymers of propene, ethane, and 1-butene under the business segment VESTOPLAST. In addition, the company provides modified versions of amorphous poly-alpha olefins with silane

Jam Petrochemicals (Malaysia) Sdn. Bhd. and INEOS Oligomers are some of the emerging market participants.

-

Jam Petrochemical is an emerging player in the market, providing Butene-1 linear olefin alongside additional products like Butadiene, Methane, Hydrogen, and Fuel Oil.

-

INEOS Oligomers provides a wide range of products, including specialty oligomers for creating lubricant additives, drilling fluids, specialty acids, agricultural chemicals, plastic additives, and more. The company also offers linear alpha olefins utilized as synthetic lubricants, drag-reducing agents, surfactant intermediates, and other applications.

Key Alpha Olefin Companies:

The following are the leading companies in the alpha olefin market. These companies collectively hold the largest market share and dictate industry trends.

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Petrochemicals (Malaysia) Sdn. Bhd.

- INEOS Oligomers

- Mitsubishi Chemical Corporation

- SABIC

- Sasol

- Shell plc

- Jam Petrochemical

- Dow

Recent Developments

-

In September 2023, ExxonMobil Corporation increased the production capacity at its Baytown, Texas facility by adding two new chemical manufacturing plants. This expansion is focused on producing high-value alpha olefin products from the refining facilities on the U.S. Gulf Coast.

-

In November 2022, Chevron Phillips Chemical inaugurated its alpha olefin chemical facility based in Beringen, Belgium. The expansion is expected to help the company leverage the facility’s central position to cater to its European customers, taking leverage from the feedstock availability in the region.

Alpha Olefin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.92 billion

Revenue forecast in 2030

USD 14.63 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Petrochemicals (Malaysia) Sdn. Bhd., INEOS Oligomers, Mitsubishi Chemical Corporation, SABIC, Sasol, Shell plc, Jam Petrochemical plc, Dow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alpha Olefin Market Report Segmentation

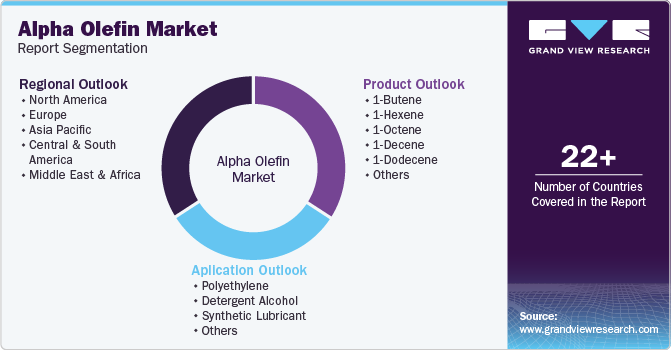

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alpha olefin market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

1-Butene

-

1-Hexene

-

1-Octene

-

1-Decene

-

1-Dodecene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

Detergent Alcohol

-

Synthetic Lubricant

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alpha olefin market size was estimated at USD 10.42 billion in 2023 and is expected to reach USD 10.92 billion in 2024.

b. The global alpha olefin market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 14.63 billion by 2030.

b. 1-hexene emerged as the largest product segment accounting for over 32% of global market share in 2023. Increasing utilization of 1-hexene as a common monomer for manufacturing High-Density Polyethylene (HDPE) and Linear Low-Density Polyethylene (LLDPE) polymers is expected to augment the segment growth.

b. Some of the key players in alpha olefin market include Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Petrochemicals (Malaysia) Sdn. Bhd, INEOS Oligomers, Mitsubishi Chemical Corp., Qatar Chemical Company Ltd (Q-chem)

b. Growing demand for polyethylene, owing to its usage in various applications, such as packaging, industrial processes, consumer goods, and others is expected to drive the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."