- Home

- »

- Organic Chemicals

- »

-

Alpha-methylstyrene Market Size And Share Report, 2030GVR Report cover

![Alpha-methylstyrene Market Size, Share & Trends Report]()

Alpha-methylstyrene Market (2024 - 2030) Size, Share & Trends Analysis Report By Purity (>99.5%, 95%-99%), By End-use (Automotive, Electronics, Chemical Manufacturing, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-244-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alpha-methylstyrene Market Size & Trends

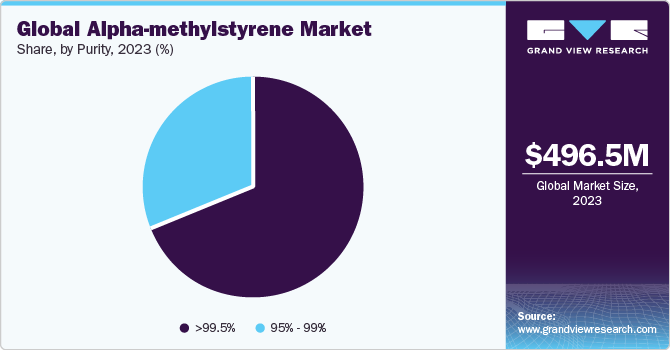

The global alpha-methylstyrene market size was estimated at USD 496.5 million in 2023 and is expected to grow at a CAGR of 3.1% from 2024 to 2030. This growth can be attributed to the increasing demand from end-user industries such as automotives and electronics for its heat resistant properties. The growing demand for automotives around the world due to increasing disposable income as well as widening scope for electronics equipment in varied applications is expected to drive market growth in the forecast period.

A notable trend shaping the China alpha methyl styrene market is the growing adoption of alpha methyl styrene (AMS) in the manufacturing of para-cumyl phenol, adhesives, and coatings. The compound's versatility and wide range of applications across diverse industries, including plastics, adhesives, and chemicals, are contributing to its market growth. The growing demand for alpha methyl styrene in the production of para-cumyl phenol, adhesives, and coatings highlights its significance in various manufacturing processes located in the U.S.

The growth in demand for Acrylonitrile Butadiene Styrene (ABS) has emerged as a major driver of the market. ABS resins used in the production of exterior frames of automobiles, electronic appliance housings, and protective coatings. The global automotive industry has seen significant growth in recent times, led by the increase in consumption in growing economies such as India and Brazil. For instance, as per Indian Brand Equity Foundation, the country is expected to become one of the leading automotive markets in the world, with an annual production of 22.93 million vehicles in 2022. The growth of electric vehicles market, expected to drive the automotive market around the globe in coming years.

Growing demand for consumer goods from emerging economies, presenting an opportunity for market growth. The rising demand for consumer goods, particularly from emerging economies, is contributing to the growth of the market. The high levels of growth for alpha methyl styrene are attributed to its numerous applications in the manufacturing of other chemicals, primarily from developing countries. This trend is particularly significant in countries with rapidly growing consumer industries, such as Indonesia and Vietnam, where the demand for consumer goods is on the rise.

Market Concentration & Characteristics

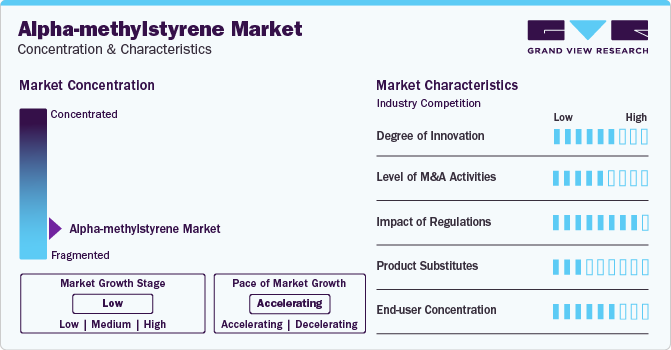

The market is fragmented in nature, which is evident in the distribution of market share among a large number of firms. This fragmentation is driven by several factors, including the degree of innovation within the industry. The presence of numerous firms in the alpha methyl styrene market creates a competitive environment that encourages innovation and the development of new products and processes. For instance, the continuous expansion in the automotive and electronics sectors has led to a boost in demand for acrylonitrile butadiene styrene (ABS) resins, thereby driving the demand for alpha methyl styrene.

The availability of alternative materials and chemicals that can serve similar purposes to alpha methyl styrene contributes to market fragmentation. For instance, the market is bifurcated into applications such as ABS, para-cumylphenol, adhesives, coatings, and waxes, indicating the diverse range of products that can potentially substitute for alpha methyl styrene in various applications. The existence of substitutes creates a competitive environment, with multiple firms vying for market share across different applications, leading to a fragmented market landscape.

Economic regulations such as antitrust laws and competition acts are in place to maintain market competition and prevent the formation of monopolies. These regulations require firms to report their market share and limit the degree of market concentration that is allowed. The diverse applications of alpha methyl styrene, including ABS manufacture, plastic additives, adhesives, and chemical intermediates, lead to a dispersed end user concentration. This dispersion results in an industry landscape with multiple end users across various industries, contributing to the fragmented nature of the industry.

End-use Insights

Based on end-use, the automotive segment led the market with the largest revenue share of 38.3% in 2023. The automotive industry stands as a prominent end user of alpha methylstyrene (AMS) due to its significant application in the production of acrylonitrile butadiene styrene (ABS) resins. ABS resins, reinforced by AMS, are widely utilized in various automotive components such as bumpers, interior trim, and other interior and exterior parts owing to their exceptional impact resistance, toughness, and heat stability.

The rising trend of electric vehicles (EVs) has further augmented the demand for AMS in the production of lightweight components and battery casings, highlighting the pivotal role of the automotive industry in shaping the AMS market. The automotive industry's continued focus on innovation and technological advancements has led to a surge in the utilization of ABS resins, thereby driving the demand for AMS.

The electronics segment is a significant end user of alpha methylstyrene (AMS) due to its crucial role in the production of acrylonitrile butadiene styrene (ABS) resins, which find extensive applications in electronic appliances and consumer electronic devices. The increasing demand for consumer electronics such as smartphones, laptops, and home appliances has propelled the need for ABS resins, thereby driving the demand for AMS. The thickening of the electronics industry, coupled with the surging demand for consumer goods from developing economies, acts like an opportunity for the market growth.

Purity Insights

Based on purity, the >99.5% segment led the market with the largest revenue share of 68.9% in 2023. AMS with a purity above 99.5% is used as a heat stabilizer for acrylonitrile butadiene styrene (ABS), as a solvent in the plastics industry, and in other applications such as adhesives and coatings. The increasing demand for high-purity AMS in these industries is a key factor contributing to the growth of this segment. AMS with high purity is also used as a solvent in the plastics industry and as a dye and paint adhesive agent in adhesives, coatings, waxes, and tackifiers. In addition, AMS finds applications in the beauty and food industry as an antioxidant, refined polyester, and alkyd resin.

The 95-99.5% segment is an essential component of the industry, catering to various applications where ultra-high purity is not required. It is utilized in the production of ABS resins, which are widely used in automotive components, electronic enclosures, and various consumer goods. The properties of AMS in this purity range make it suitable for enhancing the performance and durability of these products. In addition, AMS with a purity of 95%-99.5% is utilized in the production of synthetic rubbers and specialty chemicals, further highlighting its significance in diverse industrial applications.

Regional Insights

The alpha-methylstyrene market in North America is second-largest regional market in 2023.The increasing use of AMS in these sectors, particularly in the production of ABS resins, contributes to the growth of the industry. Rising government investments and initiatives further boost the demand for AMS in North America, positioning the region as a key player in the global AMS market.

U.S. Alpha-methylstyrene Market Trends

The alpha-methylstyrene market in U.S. is estimated to grow at the significant CAGR from 2024 to 2030. It is primarily driven by its use in the production of acrylonitrile-butadiene-styrene (ABS) resins, which find extensive applications in the automotive and electronic appliances industries.

The Canada alpha-methylstyrene market is expected to grow at the significant CAGR during the forecast period, due to applications in the production of resins, plasticizers, adhesives, waxes, coatings, and chemical intermediates.

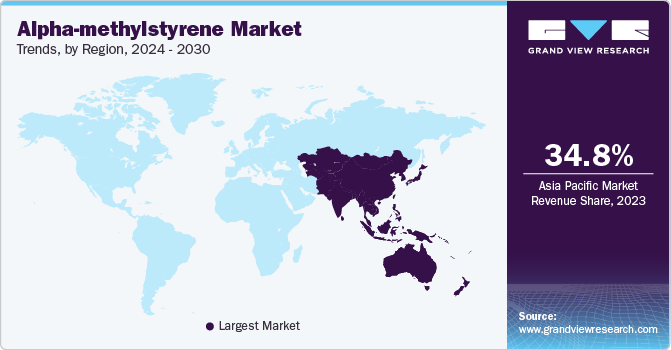

Asia Pacific Alpha-methylstyrene Market Trends

Asia Pacific dominated the alpha-methylstyrene market with a revenue share of 34.8% in 2023. The growth in the region is driven by the increasing use of AMS in the production of acrylonitrile-butadiene-styrene (ABS) resins. The demand for AMS in the region is fueled by various industries, including automotive, electronics, and consumer goods. The increasing application of AMS in plasticizers and automobiles in countries like China, Japan, India, and Australia & New Zealand contributes to the region's market growth.

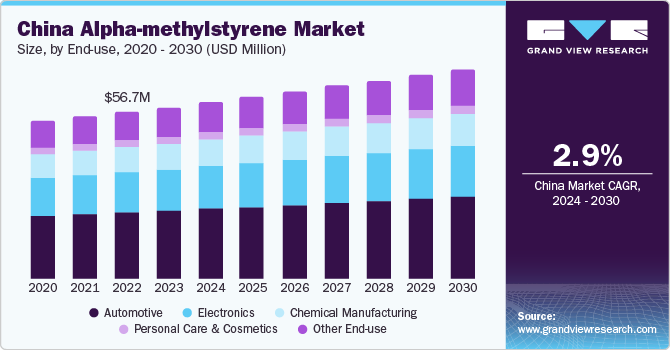

The alpha-methylstyrene market in China accounted with the revenue share of 33.7% in Asia Pacific in 2023. It is attributed primarily due to the increasing use of the product in ABS resin production. The country's leading position in the region is attributed to the rising application of AMS in plasticizers and automobiles.

Europe Alpha-methylstyrene Market Trends

The alpha-methylstyrene market in Europe is expected to grow at the significant CAGR from 2024 to 2030. The region's focus on innovation and sustainability in industries such as automotive, construction, and consumer goods has led to the increased use of AMS in various applications.

The Germany alpha-methylstyrene market held the largest revenue share of the Europe market in 2023, and is mainly driven by stringent regulations and initiatives promoting the use of environmentally friendly materials which have further propelled the demand for AMS in Germany, shaping the industry dynamics for alpha methylstyrene in the region.

The alpha-methylstyrene market in UK is expected to grow at the significant CAGR from 2024 to 2030. Industries in the country such as automotive, construction, and consumer goods has led to the increased use of AMS in various applications.

Central & South America Alpha-methylstyrene Market Trends

The alpha-methylstyrene market in Central & South America is anticipated to witness at the significant CAGR from 2024 to 2030. The use of AMS in the production of resins, rubber, and specialty chemicals plays a key role in shaping the AMS market dynamics in the region.

The Brazil alpha-methylstyrene market is estimated to grow at a significant CAGR over the forecast period. The increasing demand for high-performance materials in various industries further contributes to the market growth in Brazil.

Middle East & Africa Alpha-methylstyrene Market Trends

The alpha-methylstyrene market in Middle East & Africa is growing due to increasing usage in countries such as Saudi Arabia, along with the UAE and Egypt, is expected to be a major contributor to the growth of the regional AMS production, particularly in the production of plasticizers used in the construction industry.

The Saudi Arabia alpha-methylstyrene market is expected to grow at a lucrative CAGR over the forecast period, due to the increasing use of AMS in various industrial applications. The country's contribution to the AMS market in the Middle East & Africa region highlights its influence on the regional market dynamics.

Key Alpha-methylstyrene Company Insights

The competitive landscape of the alpha-methylstyrene market is driven by the strategic initiatives undertaken by leading players to gain a competitive edge and expansion of supply chains. Major companies such as Solvay, INEOS Group and Mitsubishi Chemical Corporation are actively engaged in employing these strategies to aid the advancements in the market, contributing to the overall development and growth of the industry.

Some of the key players operating in the market include:

-

Solvay: Solvay offers alpha methyl-styrene under the aromatics chemical category, under surface treatment segment

-

INEOS Group: INEOS Group offers 99.6% alpha-methylstyrene which can be used in the manufacturing of heat resistant ABS resins. The company has an annual capacity to produce 50 kilotons of alpha-methylstyrene per annum

Altivia, Cepsa and Domo Chemicals are some of the emerging market participants in the global market.

-

Altivia offers alpha-methylstyrene under its petrochemical business segment. The company also offers other chemicals such as specialty phosgene derivatives, oxide chemicals and ketones

-

Cepsa offers alpha-methylstyrene for the manufacturing of acrylonitrile butadiene styrene (ABS). It is offered by the company under its NextPhenol/Acetone/Phenol product segment

Key Alpha-methylstyrene Companies:

The following are the leading companies in the alpha-methylstyrene market. These companies collectively hold the largest market share and dictate industry trends.

- AdvanSix

- Altivia

- Cepsa

- Domo Chemicals

- INEOS Group

- Kraton Corporation

- KUMHO P&B CHEMICALS

- Mitsubishi Chemical Corporation

- Prasol Chemicals Limited

- Solvay

Recent Developments

-

In April 2023,INEOS Phenol announced the acquisition of Mitsui Phenol Singapore Ltd for a sum of USD 330 million. The acquisition included Mitsui Phenols production facility based on Jurong Island in Singapore which produces 20 kilotons of alpha methylstyrene per year apart from phenol, cumene, acetone and bisphenol A. The acquisition is expected to help INEOS expand its asset portfolio and expand production capacity to cater its clients in Southeast Asian nations

-

In April 2022, Kraton Corporation announced an investment in their alpha methyl styrene resins plant based in Niort, France. The investment is expected to help achieve a 15% increase in alpha-methylstyrene production and a 70% decrease in the solvent consumption in the production facility

Alpha-methylstyrene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 508.42 million

Revenue forecast in 2030

USD 610.62 million

Growth rate

CAGR of 3.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume in kilotons, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Purity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

AdvanSix; Altivia; Cepsa; Domo Chemicals; INEOS Group; Kraton Corporation; KUMHO P&B CHEMICALS; Mitsubishi Chemical Corporation; Prasol Chemicals Limited; Solvay

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alpha-methylstyrene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alpha-methylstyrene market report based on purity, end-use, and region.

-

Purity Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

>99.5%

-

95%-99%

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electronics

-

Chemical Manufacturing

-

Personal Care & Cosmetics

-

Other End-use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alpha-methylstyrene market size was estimated at USD 496.5 million in 2023 and is expected to reach USD 508.42 million in 2024.

b. The global alpha-methylstyrene market is expected to grow at a compound annual growth rate of 3.1% from 2024 to 2030 to reach USD 610.62 million by 2030.

b. >99.5 dominated the alpha-methylstyrene market with a share of 68.9% in 2023. This is attributable to its growing use as a heat stabilizer for acrylonitrile butadiene styrene (ABS), as a solvent in the plastics industry, and in other applications such as adhesives and coatings.

b. Some key players operating in the alpha-methylstyrene market include AdvanSix, Altivia, Cepsa, Domo Chemicals , INEOS Group, Kraton Corporation , KUMHO P&B CHEMICALS, Mitsubishi Chemical Corporation, Prasol Chemicals Limited, and Solvay.

b. Key factors that are driving the market growth include the increasing demand from end-user industries such as automotive and electronics for its heat-resistant properties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.