- Home

- »

- Consumer F&B

- »

-

Almond Powder Market Size, Share & Growth Report, 2030GVR Report cover

![Almond Powder Market Size, Share & Trends Report]()

Almond Powder Market Size, Share & Trends Analysis Report By Distribution Channel (B2B, B2C), By Application (Bakery Products, Snacks), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-347-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Almond Powder Market Size & Trends

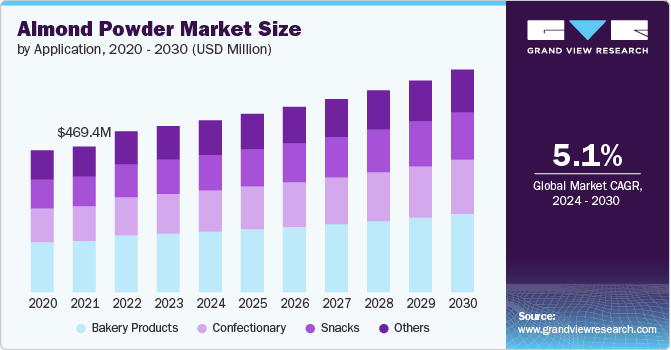

The global almond powder market size was estimated at USD 504.2 million in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. Increasing consumer awareness about health globally is a key factor propelling the market. Almonds are widely recognized for their exceptional nutritional benefits, providing abundant healthy fats, protein, vitamins, and minerals. Almond powder, specifically valued for its low carbohydrate content and high fiber, emerges as a favored choice among health-conscious individuals seeking nutritious dietary options.

Consumers are increasingly seeking out foods that provide health benefits beyond basic nutrition. Almond powder fits well into this category, being linked to improved heart health, weight management, and reduced risk of chronic diseases. The popularity of gluten-free and low-carb diets has substantially boosted the demand for almond powder. Many consumers are either diagnosed with celiac disease or have adopted gluten-free diets for other health reasons. Almond powder serves as an excellent substitute for wheat flour in baking and cooking, catering to this growing demographic. Additionally, the ketogenic diet, which emphasizes low carbohydrate intake and high fat consumption, has driven the adoption of almond powder. Its low carbohydrate content makes it a staple in keto-friendly recipes.

The rising preference for plant-based and vegan diets has significant impact on the market. Almond powder is an excellent alternative to animal-derived ingredients, making it a popular choice among vegans and vegetarians. It is used in plant-based milk, yogurt, and cheese alternatives, as well as in vegan baking and cooking. In addition, consumers are increasingly concerned about the environmental impact of their food choices. Almonds, and by extension almond powder, are often perceived as more sustainable compared to other nuts and dairy products. This perception is reinforced by efforts from almond growers and manufacturers to adopt sustainable farming practices and reduce water usage.

Technological advancements in the production of almond powder have improved its quality, consistency, and availability. Innovations in processing techniques, such as cold milling and freeze-drying, help retain the nutritional value and flavor of almonds in the powder form. These advancements also enhance the shelf life and usability of almond powder. Moreover, there is a growing demand for clean-label products, which are perceived as healthier and more natural. Consumers are increasingly analyzing product labels and opting for foods with minimal and recognizable ingredients. Almond powder, being a single-ingredient product, fits well into this trend.

Application Insights

Bakery products application accounted for a revenue share of 35.4% in 2023. The versatility of almond powder makes it a preferred choice in various bakery products such as breads, cakes, cookies, muffins, and pastries. Its fine texture and mild flavor make it an ideal ingredient that can enhance the nutritional profile of baked goods without altering their taste significantly. The rise in gluten-free and low-carb diets has propelled the use of almond powder in bakery products. It serves as an excellent gluten-free flour alternative, which is crucial for consumers with celiac disease or those who prefer gluten-free diets. Additionally, its low carbohydrate content makes it suitable for ketogenic and other low-carb diets. Such peculiarities further boost the growth of the bakery segment.

The snacks application segment is expected to grow at a CAGR of 5.7% from 2024 to 2030. Modern consumers are increasingly seeking snacks that are not only convenient but also healthy. Almond powder is used in a variety of snack products such as protein bars, energy bites, and snack mixes. Its high nutritional value, including high protein and fiber content, makes it an attractive ingredient for healthy snacks. Manufacturers are introducing innovative snack products that incorporate almond powder. This includes flavored almond snacks, protein bars, and meal replacement bars. These products cater to the growing demand for on-the-go nutrition. The innovation in flavor profiles and product formats has broadened the appeal of almond powder-based snacks.

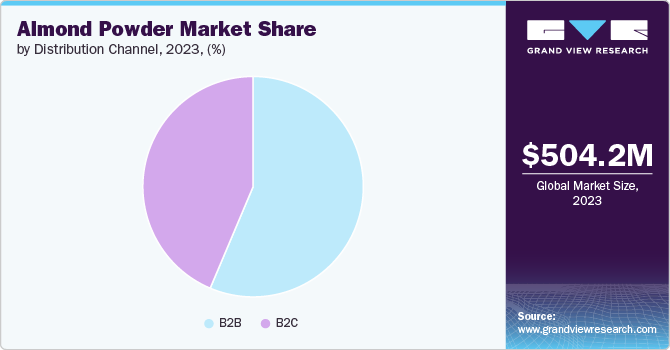

Distribution Channel Insights

Sales through the B2B channel accounted for a revenue share of 56.4% in 2023. The wide use of almond powder in industrial and commercial applications, including large-scale baking, confectionery production, and food service increases its demand in bulk quantities that further drives the segment’s growth. The B2B market involves bulk purchases of almond powder by food manufacturers, bakeries, and confectioneries. Moreover, these industries require large quantities of almond powder for mass production, contributing to the significant market share held by the B2B segment.

B2C almond powder market is expected to grow with a CAGR of 5.4% from 2024 to 2030. Growing consumer awareness about the health benefits of almond powder is driving demand in the market. Consumers are becoming more knowledgeable about the nutritional advantages of almond powder and are incorporating it into their diets. The rise of e-commerce has significantly impacted the B2C segment. Online platforms offer consumers easy access to a wide variety of almond powder products, including organic and specialty options. The convenience of online shopping and home delivery services has boosted the B2C market.

Regional Insights

The North America almond powder market accounted for a revenue share of 37.2% in 2023. The popularity of gluten-free and low-carb diets in the region is another major factor driving the market. Almond powder serves as an excellent alternative to wheat flour for those following gluten-free diets due to celiac disease or gluten intolerance. It also fits well into low-carb and ketogenic diets, which have gained substantial traction in the region. The gluten-free products market in North America is projected to grow significantly, further bolstering the demand for almond powder.

U.S. Almond Powder Market Trends

The U.S. almond powder market has a strong culture of convenience and snacking. Almond powder is used extensively in the production of healthy snacks such as protein bars, energy bites, and meal replacement shakes. The convenience factor, combined with the nutritional benefits of almond powder, makes it a preferred ingredient in the rapidly growing snack segment.

Europe Almond Powder Market Trends

The almond powder market in Europe is expected to grow at a CAGR of 4.8% from 2024 to 2030.European consumers are increasingly adopting healthier eating habits and lifestyle changes, which include the consumption of nutrient-rich ingredients like almond powder. The European market is characterized by a strong demand for functional foods that offer health benefits beyond basic nutrition. Almond powder, with its high nutritional profile, fits well into this category.

Asia Pacific Almond Market Trends

The Asia Pacific almond powder market is expected to grow at a CAGR of 5.8% from 2024 to 2030. There is a growing awareness of health and wellness in this region. Consumers are becoming more knowledgeable about the nutritional benefits of almonds and almond powder. This increased awareness drives the demand for almond powder in various applications, from traditional sweets to modern baked goods. The health-conscious trend is particularly strong in countries like China, Japan, and India.

Key Almond Powder Company Insights

The market is characterized by the presence of numerous well-established and emerging players. These companies are continuously investing in research and development to introduce new and improved almond powder products. They are also leveraging marketing strategies, such as endorsements by health experts and collaborations with chefs, to enhance their market presence.

Key Almond Powder Companies:

The following are the leading companies in the almond powder market. These companies collectively hold the largest market share and dictate industry trends.

- Royal Nut Company

- ADM

- TREEHOUSE ALMONDS

- Olam International

- Blue Diamond Growers

- Russell Stover Chocolates, LLC

- OLOMOMO Nut Company.

- Bob’s Red Mill Natural Foods.

- Rolling Hills Nut Company

- Jonny Almond Nut Company

Recent Developments

-

In April 2024, Bob's Red Mill revealed its collaboration with the non-profit Zero Foodprint. This partnership focuses on promoting regenerative farming practices among selected growers, aiming to enhance soil health and biodiversity while sequestering carbon, ultimately contributing to a more resilient food system.

-

In January 2023, Blue Diamond Growers introduced three innovative 360-degree creative marketing campaigns across their product range, including Snack Almonds, Almond Breeze, and Almond Flour. These campaigns represent an enhanced investment by Blue Diamond to highlight their diverse almond-based products in fresh and creative manners. The campaigns aim to engage consumers through various media and shopping platforms, showcasing the benefits of Blue Diamond Almonds

-

In January 2021, Harris Woolf California Almonds passed B Labs’ rigorous B Impact Assessment and became a Certified B Corporation. This formally recognizes the company’s commitment to inclusive, equitable, and regenerative practices. The company has prioritized sustainable relationships with growers, with over 95% using advanced water-saving technologies and maintaining the largest Bee Better Certified almond acreage globally.

Almond Powder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 523.8 million

Revenue forecast in 2030

USD 704.1 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

7.6Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Royal Nut Company; ADM; TREEHOUSE ALMONDS; Olam International; Blue Diamond Growers; Russell Stover Chocolates, LLC; OLOMOMO Nut Company; Bob’s Red Mill Natural Foods; Rolling Hills Nut Company; Jonny Almond Nut Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Almond Powder Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global almond powder market report based on the application, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery Products

-

Confectionary

-

Snacks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global almond powder market size was estimated at USD 504.2 million in 2023 and is expected to reach USD 523.8 million in 2024.

b. The global almond powder market is expected to grow at a compounded growth rate of 5.1% from 2024 to 2030 to reach USD 704.1 million by 2030.

b. The bakery products market dominated the almond powder market with a share of 35.27% in 2023. The rise in gluten-free and low-carb diets has propelled the use of almond powder in bakery products driving the demand for almond powder in bakery products application.

b. Some key players operating in almond powder market include Royal Nut Company; ADM; TREEHOUSE ALMONDS; Olam International; Blue Diamond Growers; Russell Stover Chocolates, LLC; OLOMOMO Nut Company; Bob’s Red Mill Natural Foods; Rolling Hills Nut Company; Jonny Almond Nut Company.

b. Increasing consumer awareness about health globally is a key factor propelling the almond powder market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."