- Home

- »

- Consumer F&B

- »

-

Almond Oil Market Size, Share, And Growth Report, 2030GVR Report cover

![Almond Oil Market Size, Share & Trends Report]()

Almond Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sweet Oil, Bitter Oil), By Application (Personal Care And Cosmetics, Pharmaceuticals, Food industry), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-502-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Almond Oil Market Size & Trends

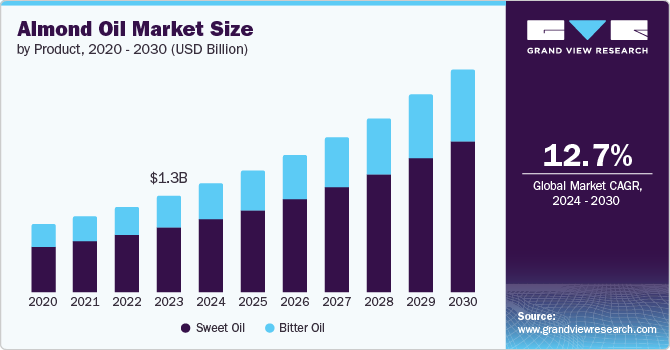

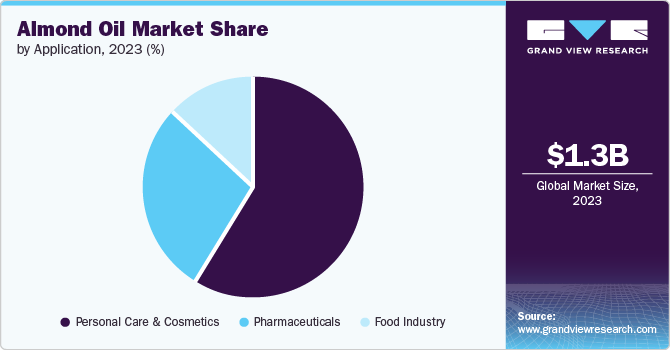

The global almond oil market size was valued at USD 1.29 billion in 2023 and is expected to expand at a CAGR of 12.7% from 2024 to 2030. Almond oil is an edible oil derived from almonds and has been found to contain vitamin E, magnesium, proteins, and healthy fats. Also, organic sources of vitamins and proteins with nourishing properties align perfectly with the growing consumer preference for natural and organic skincare and cooking products.

Modern lifestyle is characterized by growing stress, pollution levels, irregular eating habits, and the use of products containing harmful chemicals. It causes skin and hair-related issues, leading consumers to look for natural remedies that work for them. Among the rich and versatile oils, almond oil, with its rich nutritional and curative values, is becoming the most preferred choice. Thus, the rise in the natural cosmetics sector has led to increased incorporation of almond oil in various beauty and personal care formulations. This trend reflects a broader shift towards sustainability and eco-consciousness among consumers.

With the increasing trend of consumers embracing plant-based diets, the use of almond oil as a cooking oil that enhances the flavor of food items and increases their nutritional value has received a boost. The expansion of e-commerce platforms has made almond oil more accessible to consumers worldwide, facilitating greater market penetration and convenience in purchasing. In addition, the increasing disposable income, particularly in developing economies, has significantly impacted consumer spending habits. Increasing spending power is further expected to fuel the demand for high-quality products like almond oil.

Product Insights

The sweet oil segment dominated the market and accounted for a revenue share of 67.5% in 2023. It can be attributed to its numerous health benefits, versatility across culinary and cosmetic applications, growing consumer awareness about natural products, increased demand from emerging markets, sustainability trends, and e-commerce growth facilitating access to these products. As consumers become more health conscious and aware of the ingredients in their products, there has been a shift towards natural alternatives over synthetic options. Sweet almond oil fits perfectly into this trend as it is considered safer and healthier.

The bitter oil segment is expected to grow at a significant CAGR from 2024 to 2030. The cosmetic industry increasingly incorporates bitter almond oil into skincare products due to its anti-inflammatory and antioxidant properties. It helps with skin issues, making it attractive for manufacturers looking to create natural and organic products. Bitter almond oil is also a flavoring agent in various food products, particularly confectionery and bakery items. As consumers seek unique flavors and artisanal food experiences, the demand for bitter almond oil as a natural flavor enhancer is rising.

Application Insights

The personal care and cosmetics segment dominated the market and accounted for the largest revenue share in 2023 due to increasing consumer trends favoring natural ingredients alongside its multiple benefits across various product categories from skincare essentials such as moisturizer to specialized applications such as hair treatments or makeup removers. There is a growing consumer preference for natural and organic products in personal care and cosmetics. Almond oil, being a natural extract, aligns perfectly with this trend. Consumers are increasingly avoiding synthetic chemicals due to concerns about skin sensitivity and long-term health effects.

The pharmaceuticals segment is expected to grow at a significant CAGR during the forecast period. Almond oil possesses numerous therapeutic benefits, including anti-inflammatory, antioxidant, and emollient properties. These characteristics make it suitable for various pharmaceutical applications such as skin care formulations, ointments, and creams to treat conditions such as eczema, psoriasis, and dry skin. Moreover, almond oil is also used in baby products due to its gentle and hypoallergenic nature.

Regional Insights

North America almond oil market held a significant revenue share in 2023 due to the growing consumer consciousness about the health benefits of natural products along with the growing use of almond oil in cosmetics, food processing, drug, nutraceuticals, aromatherapy, and household products industries. Along with the well-developed distribution channels, the availability of e-commerce platforms has made it convenient for the consumer to purchase almond oil products directly from the manufacturer or a specialty store. Internet shopping enables the consumer to compare and locate organic or specialty foods that may not be available nearby.

U.S. Almond Oil Market Trends

The U.S. almond oil market held a significant market share in North America in 2023. The increase in the popularity of gourmet cooking and baking, with almond oil being favored for its unique flavor profile, is driving the market's growth. Chefs and home cooks increasingly use almond oil for salad dressings, marinades, and finishing oil due to its nutty taste and health benefits. Increasing awareness about the health benefits of almond oil through social media and television shows is driving the demand for almond oil. In addition, the increasing use of almond oil in pharmaceuticals and cosmetic products is driving the demand for almond oil.

Europe Almond Oil Market Trends

Europe almond oil market dominated the market with the largest revenue share of 34.1% in 2023 due to growing restaurant businesses with an increasing tourism sector, growing awareness about health benefits, and use in cosmetics & personal care products. Almond oil is a staple ingredient in skincare and haircare products due to its moisturizing, anti-inflammatory, and antioxidant properties. Almond oil is used in creams, lotions, face oils, hair masks, and bath products, propelling the demand for almond oil in cosmetic manufacturing.

UK almond oil market held a substantial market share in 2023. The growing trend towards health consciousness and healthy food habits is driving the demand for almond oil in food products. Thus, consumers are showing an increasing preference for products derived from natural sources. Almond oil, being a natural oil, has gained popularity in various sectors, such as food and beverages, pharmaceuticals, cosmetics, and personal care.

Asia Pacific Almond Oil Market Trends

The Asia Pacific almond oil market is expected to grow at the fastest CAGR of 13.2% from 2024 to 2020. This is attributed to a large population base, increasing focus on health and wellness, the influence of social media and health-conscious communities, increasing vegan diet preferences, and the rise of e-commerce. Moreover, increasing urbanization and accessibility of almond oil through stores and specialty stores have propelled the demand for almond oil in the region. Rising disposable income in developing countries such as India and China is allowing consumers to buy premium products.

India almond oil market is expected to grow significantly due to the Increasing awareness about the health benefits of almond oil, including its rich nutrient profile, growing middle class in India has increased spending power, leading to higher demand for premium and health-focused products like almond oil. Moreover, almond oil has been used in Ayurveda practices for centuries, and its traditional use continues to influence consumer preferences.

Key Almond Oil Company Insights

Some of the key companies in the almond oil market are Caloy Company, LP., Blue Diamond Growers., Jiangxi Baicao Pharmaceutical Co., Ltd, Bajaj Consumer Care Ltd., Dabur.com, Frontier Co-op., and others. Organizations are focusing on innovative almond oil-based offerings to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Caloy Company, tree nut oil manufacturer operates in California’s central valley where most of the world’s almonds and walnuts are harvested. It collaborates with distributors worldwide, supplying nut oils for cosmetic, pharmaceutical, and culinary applications.

-

Bajaj Consumer Care Ltd specializes in hair care products. Its prominent product Bajaj Almond Drops Hair Oil, enriched with almond oil and vitamin E, is offered for nourishment and to avoid hair fall. Strong marketing strategies and brand reputation led this company to occupy a large market share in the same category.

Key Almond Oil Companies:

The following are the leading companies in the almond oil market. These companies collectively hold the largest market share and dictate industry trends.

- Caloy Company, LP

- Blue Diamond Growers.

- Jiangxi Baicao Pharmaceutical Co., Ltd

- Bajaj Consumer Care Ltd.

- Dabur.com

- Frontier Co-op.

- Eden Botanicals

- Ashwin fine Chemicals & Pharmaceuticals

- TSBE

- Indian Natural Oils

Recent Developments

-

In August 2023, Bajaj Consumer Care Ltd. announced the launch of a new product Anti Hair fall Shampoo which includes almond oil and vitamin E. Considering increasing demand for organic and natural ingredient products in the market company aims to expand its portfolio.

-

In June 2022, In June 2022, Bajaj Consumer Care Ltd. announced plans to expand its Bajaj Almond Drops brand by launching new products in haircare and skincare. The company recently introduced a moisturizing soap under this umbrella and aims to diversify its portfolio to reduce reliance on its flagship hair oil. Managing Director Jaideep Nandi highlighted that the brand, used by six crore households, will see more product launches in the coming quarters, driven by consumer response and demand.

Almond Oil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.45 billion

Revenue forecast in 2030

USD 2.98 billion

Growth Rate

CAGR of 12.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in kilo tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Brazil, South Africa, UAE, Saudi Arabia

Key companies profiled

Caloy Company, LP; Blue Diamond Growers.; Jiangxi Baicao Pharmaceutical Co., Ltd; Bajaj Consumer Care Ltd.; Dabur.com; Frontier Co-op.; Eden Botanicals; Ashwin fine Chemicals & Pharmaceuticals; TSBE and Indian Natural Oils

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Almond Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global almond oil report based on product, application, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Sweet Oil

-

Bitter Oil

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Personal Care and Cosmetics

-

Pharmaceuticals

-

Food industry

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.