- Home

- »

- Consumer F&B

- »

-

Allulose Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Allulose Market Size, Share & Trends Report]()

Allulose Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Powder, Liquid), By Application (Bakery & Confectionery, Beverages, Dairy & Frozen Desserts, Pharmaceuticals, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-395-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Allulose Market Summary

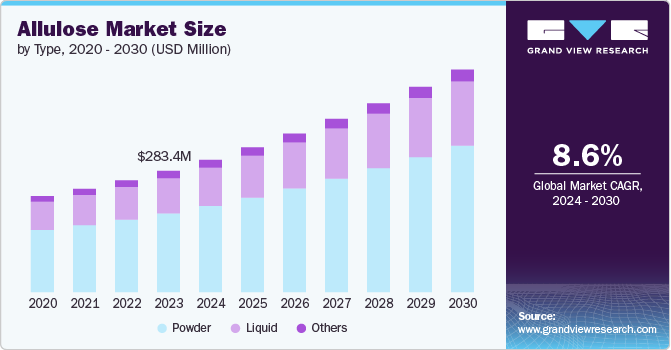

The global allulose market size was estimated at USD 283.4 million in 2023 and is projected to reach USD 509.3 million by 2030, growing at a CAGR of 8.6% from 2024 to 2030. The market is being driven by several key factors, with consumer health consciousness being a primary driver.

Key Market Trends & Insights

- North America dominated the global allulose market with the largest revenue share in 2023.

- By type, the powdered allulose segment led the market, holding the largest revenue share of 65.34% in 2023.

- By application, the beverages segment is expected to grow at the fastest CAGR of 9.0% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 283.4 Million

- 2030 Projected Market Size: USD 509.3 Million

- CAGR (2024-2030): 8.6%

- North America: Largest market in 2023

Increasing awareness of the adverse health effects of excessive sugar consumption, such as obesity, diabetes, and cardiovascular diseases, has led consumers to seek healthier alternatives. Allulose, a low-calorie sweetener with a taste and texture similar to sugar but with 90% fewer calories, is gaining popularity among health-conscious consumers. Its negligible impact on blood glucose levels makes it particularly appealing for individuals managing diabetes or following low-carb and ketogenic diets.

Moreover, the food and beverage industry is responding to this consumer demand by incorporating allulose into a wide range of products. From beverages and baked goods to dairy and confectionery, manufacturers are exploring allulose to create low-calorie, reduced-sugar options without compromising on taste and texture. Regulatory approvals and positive safety assessments from food safety authorities in various regions further support the adoption of allulose, enhancing its market penetration. Additionally, the trend towards clean-label and natural ingredients boosts allulose's appeal, as it is derived from natural sources like figs and raisins.

Additionally, technological advancements in the production and extraction processes of allulose are also contributing to market growth. Improved methods have led to more cost-effective production, making allulose a more viable ingredient for large-scale food manufacturing. Investments in research and development are driving innovations, ensuring that allulose can be used effectively in diverse applications without altering the sensory qualities of food products.

Type Insights

Powdered allulose accounted for a share of 65.34% of global revenues in 2023 due to its versatile application in various food and beverage products. Its fine texture allows for easy blending and incorporation into recipes, making it ideal for baking, beverages, and processed foods. Additionally, powdered allulose's high solubility and ability to mimic the sweetness and texture of sugar without the calories or glycemic impact appeal to health-conscious consumers and food manufacturers seeking low-calorie sweetener alternatives.

Liquid allulose is anticipated to grow at a CAGR of 8.5 % from 2024 to 2030. Liquid form allows for seamless blending in formulations, enhancing its appeal to manufacturers aiming to create low-calorie, sugar-free options without compromising on taste or texture. This convenience, coupled with the growing demand for healthier alternatives, has propelled liquid allulose to the forefront of the market

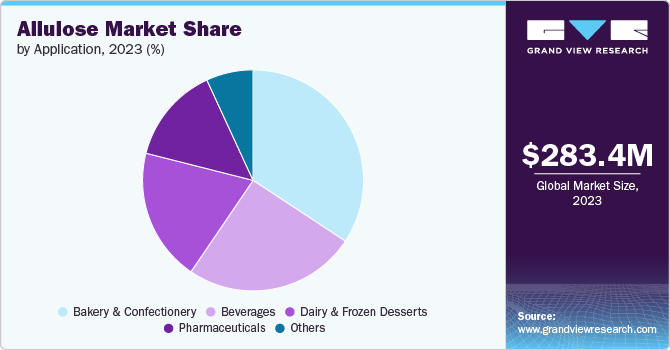

Application Insights

Allulose application in bakery & confectionery accounted for a share of 34.27% of the global revenues in 2023. Allulose provides a unique set of benefits as a low-calorie sweetener with similar taste and texture to sugar but with minimal impact on blood glucose levels. This makes it highly attractive for producing reduced-sugar and sugar-free baked goods and confections, catering to the growing consumer demand for healthier options without sacrificing taste. Additionally, allulose exhibits excellent heat stability, allowing it to be used in various baking and cooking processes without compromising product quality. Its ability to mimic the functional properties of sugar, such as caramelization and browning reactions, further enhances its versatility in creating a wide range of bakery and confectionery products, including cookies, cakes, chocolates, and ice creams.

Allulose application in beverages is anticipated to grow at a CAGR of 9.0% from 2024 to 2030. Its stability under various processing conditions and compatibility with other sweeteners and flavors enhance its appeal to beverage manufacturers looking to create products that meet both taste and nutritional preferences of modern consumers. Allulose dissolves easily in liquids and exhibits good solubility, which simplifies the formulation process for beverage manufacturers. Its ability to improve mouthfeel and provide a clean, sweet taste without the unwanted aftertaste associated with some other sweeteners.

Regional Insights

The allulose market in North America is expected to grow at a CAGR of 8.5% from 2024 to 2030. As health-conscious consumers seek to reduce sugar consumption and manage weight, allulose presents an attractive option for food and beverage manufacturers looking to reformulate their products. Regulatory approvals and growing awareness about its benefits further support market expansion, making allulose a key ingredient in the evolving landscape of healthier food choices in North America.

U.S. Allulose Market Trends

The U.S. allulose market is expected to grow at a CAGR of 8.9% from 2024 to 2030. The rising popularity of the keto diet and other low-carb diets in the U.S. is fueling demand for allulose, as it can be used as a sugar replacement in keto-friendly foods and beverages.

Asia Pacific Allulose Market Trends

The allulose market in Asia Pacific held a share of over 18.22% of the global market in 2023. The market is fueled by increasing diabetes prevalence and rising awareness of sugar-related health issues. Governments and health organizations promoting healthier lifestyles further boost the demand for low-calorie sweeteners like allulose. Additionally, the region's burgeoning food and beverage industry drives the incorporation of allulose into a wide array of products catering to diverse consumer preferences.

Europe Allulose Market Trends

Europe allulose market is expected to grow at a CAGR of 8.2% from 2024 to 2030. Policies such as sugar taxes and strict limits on sugar content in food and beverages have incentivized manufacturers to seek alternative sweeteners like allulose that can help them meet regulatory requirements while maintaining product taste and quality. Moreover, increasing consumer awareness of the health risks associated with high sugar intake has fueled demand for allulose as a natural, low-calorie sugar substitute across various food and beverage categories in the European market.

Key Allulose Company Insights

The market for allulose is highly competitive, with a range of companies offering various forms. Many big players are increasing their focus on new form launches, partnerships, and expansion into new markets to compete effectively.

Key Allulose Companies:

The following are the leading companies in the allulose market. These companies collectively hold the largest market share and dictate industry trends.

- Anderson Advanced Ingredients.

- Apura Ingredients

- Bonumose LLC

- CJ Cheil Jedang

- Heartland Food Products Group

- Icon Foods,

- Ingredion Inc

- Matsutani Chemical Industry Co. Ltd.

- Samyang Corporation

- Tate & Lyle

Recent Developments

-

In March 2024, Scotty's Everyday launched a new natural alternative sweetener called AllSweet, which is derived from allulose and monk fruit. This product aims to provide consumers with a healthier option than traditional sugar, boasting zero calories and a low glycemic index. AllSweet is positioned to cater to health-conscious consumers looking to reduce their sugar intake without sacrificing taste or texture in their foods and beverages. The launch aligns with growing consumer demand for natural, low-calorie sweeteners amid increasing awareness of sugar-related health issues.

-

In April 2023, Daesang, a leading food ingredient company, launched a new low-calorie sweetener called allulose. Allulose is a rare sugar that occurs naturally in small amounts in certain fruits and foods. It has 90% fewer calories than regular sugar and does not spike blood sugar levels, making it a suitable alternative for people with diabetes or those looking to reduce their sugar intake. Daesang's new allulose product aims to provide a healthier sweetening option for food and beverage manufacturers.

Allulose Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 310.4 million

Revenue forecast in 2030

USD 509.3 million

Growth rate

CAGR of 8.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Germany; U.K.; France; Spain; Italy; France; China; India; Japan; Australia; South Korea Brazil; South Africa; Saudi Arabia

Key companies profiled

Anderson Advanced Ingredients.; Apura Ingredients; Bonumose LLC; CJ Cheil Jedang; Heartland Food Products Group; Icon Foods; Ingredion Inc; Matsutani Chemical Industry Co. Ltd.; Samyang Corporation; Tate & Lyle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Allulose Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global allulose market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million: Volume, Kilotons, 2018 - 2030)

-

Powder

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million: Volume, Kilotons, 2018 - 2030)

-

Bakery & Confectionery

-

Beverages

-

Dairy & Frozen Desserts

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million: Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The allulose market size was valued at USD 283.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030 to reach USD 509.3 million by 2030.

b. The global allulose market is expected to grow at a compounded growth rate of 8.6% from 2024 to 2030 to reach USD 509.3 million by 2030.

b. Powdered allulose accounted for a share of 65.34% of the global revenues in 2023 due to its versatile application in various food and beverage products. Its fine texture allows for easy blending and incorporation into recipes, making it ideal for baking, beverages, and processed foods. Additionally, powdered allulose's high solubility and ability to mimic the sweetness and texture of sugar without the calories or glycemic impact appeal to health-conscious consumers and food manufacturers seeking low-calorie sweetener alternatives.

b. Some key players operating in the allulose market are Anderson Advanced Ingredients., Apura Ingredients, Bonumose LLC, CJ Cheil Jedang, Heartland Food Products Group, Icon Foods, Ingredion Inc, Matsutani Chemical Industry Co. Ltd., Samyang Corporation, Tate & Lyle

b. The market for allulose is being driven by several key factors, with consumer health consciousness being a primary driver. Increasing awareness of the adverse health effects of excessive sugar consumption, such as obesity, diabetes, and cardiovascular diseases, has led consumers to seek healthier alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.