- Home

- »

- Pharmaceuticals

- »

-

Allergy Immunotherapy Market Size & Share Report, 2030GVR Report cover

![Allergy Immunotherapy Market Size, Share & Trends Report]()

Allergy Immunotherapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment Type (Subcutaneous Immunotherapy) By Type, By Allergy Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-550-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Allergy Immunotherapy Market Summary

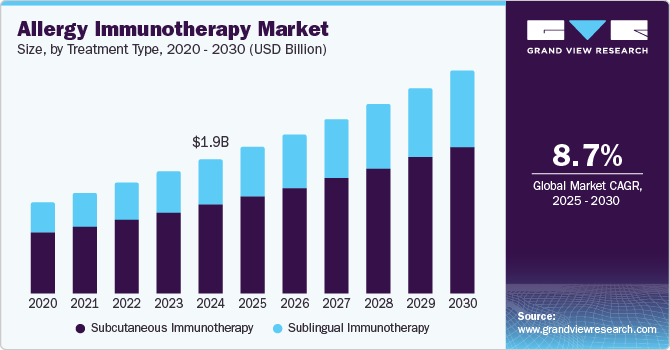

The global allergy immunotherapy market size was estimated at USD 1,922.7 million in 2024 and is projected to reach USD 3,193.3 million by 2030, growing at a CAGR of 8.7% from 2025 to 2030. The industry is driven by the rising prevalence of allergic conditions, increased awareness and education about immunotherapy, advancements in treatment methods, and supportive regulatory frameworks.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2019.

- Country-wise, Mexico is expected to register the highest CAGR from 2020 to 2027.

- In terms of segment, subcutaneous immunotherapy accounted for a revenue of USD 1,062.5 million in 2019.

- Sublingual immunotherapy is the most lucrative treatment type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,922.7 Million

- 2030 Projected Market Size: USD 3,193.3 Million

- CAGR (2025-2030): 8.7%

- Europe: Largest market in 2019

In addition, growing healthcare spending and the trend toward personalized medicine contribute to market growth. Therefore, these factors enhance the accessibility and effectiveness of allergy management solutions.

The rising prevalence of allergic rhinitis and asthma can be attributed to several factors, including urbanization, which leads to higher pollution and poor air quality. In addition, lifestyle changes increase indoor allergen exposure, while the hygiene hypothesis suggests that reduced early exposure to pathogens hinders immune development. Moreover, climate change is impacting pollen seasons and allergen distribution, further exacerbating the issue. Therefore, genetic predisposition also significantly increases susceptibility, collectively contributing to an important public health concern and amplifying the demand for effective allergy treatments such as immunotherapy.

A study in January 2022 by Frontiers in Public Health indicates that urbanization is linked to rising rates of allergic rhinitis and asthma, largely due to increased exposure to air pollutants. For instance, cities, including Beijing, exemplify this trend, where deteriorating air quality has led to a notable rise in asthma prevalence. Specifically, self-reported asthma rates in Beijing increased from 11.1% to 17.6% over six years. This suggests that urban environments characterized by pollution significantly impact respiratory health. As cities grow, addressing air quality becomes crucial for managing allergic conditions.

Treatment Type Insights

The Subcutaneous Immunotherapy (SCIT) segment dominated the market, with a revenue share of 66.4% in 2024, driven by its proven effectiveness, it has a long history of clinical success in effectively treating various allergies. In addition, it is well-documented for its ability to desensitize patients to specific allergens, leading to significant symptom relief. Moreover, SCIT offers comprehensive allergen coverage, targeting various causes, including pollen, dust mites, and pet dander, making it particularly suitable for patients with multiple sensitivities. Therefore, its proven effectiveness and broad applicability significantly contribute to its prominence in allergy treatment.

Sublingual immunotherapy is projected to witness the fastest CAGR of 8.8% over the forecast period, driven by significant convenience, Sublingual Immunotherapy (SLIT) is administered in the form of tablets or drops that dissolve under the tongue, encouraging greater patient adherence. In addition, SLIT reduces the need for regular clinical visits, allowing patients to take treatment at home after an initial consultation, which lessens the burden on healthcare systems. Moreover, its favorable safety profile, with a lower risk of severe allergic reactions compared to Subcutaneous Immunotherapy (SCIT), makes it particularly appealing for patients, especially those with a history of anaphylaxis. Therefore, these factors collectively contribute to SLIT's growing popularity in the allergy treatment landscape.

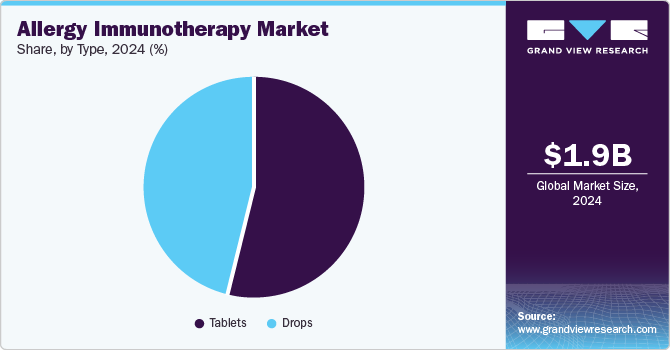

Type Insights

The tablets segment dominated the market with the largest revenue share of 54.4% in 2024, driven by the increasing adoption of Sublingual Immunotherapy (SLIT) products, as they offer a convenient and non-invasive alternative to traditional allergy shots. In addition, SLIT tablets allow for self-administration at home, reducing the need for frequent healthcare visits, which enhances patient comfort. Moreover, growing awareness of SLIT's benefits, including fewer systemic allergic reactions compared to injections, has led to a surge in prescriptions by allergists. Therefore, these factors collectively contribute to the Tablets segment's leading position in the allergy immunotherapy landscape. For instance, a study published in Frontiers in Public Health has demonstrated that patients using House Dust Mite (HDM) sublingual immunotherapy tablets reported high levels of satisfaction with the self-administration method at home.

The drops segment is projected to grow at a CAGR of 8.9% over the forecast period, fueled by the straightforward self-administration of allergy drops. Patients can take their treatment at home without the complications associated with tablets, such as ensuring proper dissolution under the tongue. In addition, this ease of use enhances patient comfort and adherence to treatment procedures. Moreover, drops provide greater flexibility in dosing, allowing healthcare providers to tailor the amount based on individual patient needs or sensitivities. Therefore, this adaptability is particularly beneficial for those with varying allergy triggers, contributing to the growing preference for drops in allergy immunotherapy.

Allergy Type Insights

The allergic rhinitis segment dominated the market with the largest revenue share of 71.6% in 2024, driven by increasing urbanization, pollution, and climate change, allergic rhinitis has seen a rapid increase in prevalence, with greater exposure to allergens like pollen, dust mites, and pet dander in urban environments. In addition, the condition is being diagnosed more frequently as awareness of allergies grows globally, which drives demand for effective treatments. Furthermore, climate change and longer pollen seasons have exacerbated symptoms, particularly in seasonal allergic rhinitis. Therefore, combining these factors has significantly contributed to the growing need for allergy immunotherapy.

The other segment is projected to grow at a CAGR of 10.7% over the forecast period, attributed to the increasing recognition of a broader range of allergic conditions beyond allergic rhinitis and asthma. This includes food allergies, insect stings, latex, and drug allergies, which are becoming more prevalent due to changes in diet and lifestyle. In addition, as this segment encompasses a diverse range of allergic reactions, the demand for targeted immunotherapy treatments has risen. Moreover, the growing awareness and availability of treatments across multiple allergy categories have further fueled the expansion of this market segment. Therefore, the combination of rising prevalence, greater recognition, and innovative treatment options is driving the rapid growth of the other allergy type segment.

Distribution Channel Insights

The hospital pharmacy segment dominated the market with the largest revenue share of 39.4% in 2024, driven by established relationships with pharmaceutical suppliers, and hospital pharmacies ensure a consistent supply of the latest allergy immunotherapy products. In addition, they have direct access to allergists and immunologists who can prescribe personalized treatment plans tailored to each patient's specific allergy profile. Moreover, hospital pharmacies offer various immunotherapy options, ensuring patients receive the most up-to-date therapies. Therefore, these factors contribute to the dominant role of hospital pharmacies in the allergy immunotherapy market.

The online pharmacy segment is projected to grow at a CAGR of 9.1% over the forecast period, fueled by the increasing adoption of e-commerce and digital health platforms, patients can now easily access allergy immunotherapy products from the comfort of their homes. In addition, online pharmacies offer the convenience of home delivery, simplifying patient treatment management. Moreover, these platforms provide competitive pricing and discounts, making immunotherapy products more affordable. Furthermore, the trend of self-medication and remote consultations with healthcare professionals has accelerated the shift toward online pharmacies. Therefore, due to these factors, online pharmacies rapidly emerge as a strong mode in the allergy immunotherapy distribution channel.

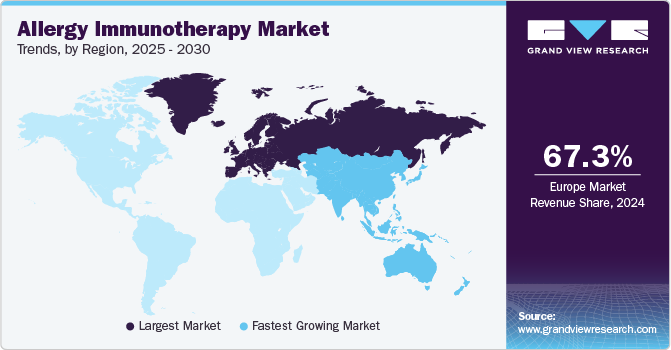

Regional Insights

North America allergy immunotherapy market held a substantial market share in 2024, fueled by significant individuals suffering from allergic diseases, including allergic rhinitis, asthma, and food allergies, affecting millions. For instance, a report published by the American Academy of Allergy, Asthma, and Immunology in June 2021 indicated that over 50 million Americans experience allergies annually. Moreover, this high prevalence drives a growing demand for effective treatment options, particularly immunotherapy, as patients seek long-term relief from symptoms. Furthermore, increased awareness of available treatments fuels this demand. Therefore, the allergy immunotherapy market in North America continues to expand to meet the needs of this large population.

U.S. Allergy Immunotherapy Market Trends

The U.S. allergy immunotherapy market dominates North America, attributed to the highest rates of allergic diseases globally, with millions affected by conditions such as allergic rhinitis, asthma, and food allergies. Moreover, this substantial prevalence creates a significant demand for effective treatment options, including immunotherapy. A notable government initiative is the "Allergy Awareness Campaign," launched by the Centers for Disease Control and Prevention (CDC) in May 2021, which aims to raise awareness about allergic conditions and promote effective management strategies, including immunotherapy. Therefore, such public health efforts contribute to increased knowledge and accessibility of treatments, driving demand in the market.

Europe Allergy Immunotherapy Market Trends

Europe allergy immunotherapy market dominated the global market with a revenue share of 67.3% in 2024, driven by the increasing number of people affected by allergic diseases. Moreover, conditions such as allergic rhinitis, asthma, and other allergies contribute to this upward trend. According to a study published in the European Journal of Allergy and Clinical Immunology in June 2021, nearly 30% of the European population suffers from allergic rhinitis. Therefore, this substantial prevalence drives the demand for effective treatment options, particularly immunotherapy.

The allergy immunotherapy market in Germany is expected to grow in the forecast period and has seen a collaboration between the German Society for Allergology and Clinical Immunology (DGAKI) and several leading pharmaceutical companies, including ALK-Abelló and Stallergenes Greer, to promote sublingual immunotherapy (SLIT) products. Moreover, this initiative, reported in the Allergy journal in January 2023, aims to enhance patient access to SLIT treatments, making them more widely available for individuals with allergic conditions. Furthermore, the partnership focuses on increasing awareness among healthcare professionals about the benefits and efficacy of SLIT.

Asia Pacific Allergy Immunotherapy Market Trends

Asia Pacific allergy immunotherapy market anticipates registering the fastest CAGR of 12.0% over the forecast period, driven by rising rates of allergic diseases influenced by urbanization and environmental changes. Moreover, growing awareness and education regarding allergies among the public and healthcare professionals contribute to this trend. Furthermore, a study published in the Asia Pacific Allergy journal in March 2022 highlighted initiatives promoting sublingual immunotherapy, which have gained traction in various countries, improving patient access and acceptance of treatment options. Therefore, these factors position the region as a crucial player in the global allergy immunotherapy landscape.

China allergy immunotherapy market is witnessing a rapidly increasing prevalence of allergic diseases, including allergic rhinitis and asthma, making it a major market for allergy immunotherapy. Moreover, government initiatives to improve healthcare access and promote allergy management significantly contribute to this market growth. For instance, in March 2021, the National Health Commission of China launched a nationwide campaign focused on enhancing public awareness of allergic diseases and improving access to treatment options. Therefore, this initiative aims to educate the public on recognizing symptoms and seeking appropriate care, further driving demand for effective allergy management solutions.

Key Allergy Immunotherapy Company Insights

Some key companies operating in the market include DMK Pharmaceuticals, ALK-Abelló A/S, ASIT Biotech, Allergy Therapeutics, and Circassia. Companies are implementing strategic initiatives, including mergers, acquisitions, and product launches, to expand their market presence and address evolving healthcare demands through allergy immunotherapy.

-

ASIT Biotech offers innovative allergy immunotherapy products. These include the ASIT platform, which features peptide-based therapies targeting various allergies, such as gp-ASIT for grass pollen, hdm-ASIT for house dust mites, and pnt-ASIT for peanut allergies. These products aim to provide effective, hypoallergenic treatments that improve patient compliance and comfort compared to traditional methods such as allergy shots. The company is focused on respiratory and food allergies, expanding its portfolio to address significant unmet medical needs in the allergy market.

-

DMK Pharmaceuticals offers a range of products and services in the Allergy Immunotherapy Market, primarily focusing on injections, gels, and capsules designed for treating allergies. Their pipeline includes treatments for anaphylaxis and other allergic reactions, which are critical in managing severe allergic responses. The company supplies these products to various healthcare providers, including hospitals and ambulatory surgery centers, enhancing accessibility for patients in need of allergy management solutions.

Key Allergy Immunotherapy Companies:

The following are the leading companies in the allergy immunotherapy market. These companies collectively hold the largest market share and dictate industry trends.

- DMK Pharmaceuticals

- ALK-Abelló A/S

- Allergy Therapeutics

- ASIT Biotech

- Circassia

- DVB Technologies SA

- DESENTUM OY

- HAL Allergy B.V.

- HollisterStier Allergy

- LETIPharma

Recent Developments

-

In October 2024, Viatris entered an agreement with Lexicon Pharmaceuticals for sotagliflozin, gaining rights to the drug in all markets outside the U.S. and Europe. Sotagliflozin, approved in May 2023, aims to reduce cardiovascular risks in patients with heart failure and type 2 diabetes. The deal includes a USD 25 million upfront payment and potential milestone payments, while Viatris will handle all regulatory and commercialization efforts. Lexicon will provide the necessary clinical and commercial supplies of the drug. This partnership enhances Viatris cardiovascular portfolio and aims to improve global patient access to innovative therapies.

-

In September 2024, Merck and Siemens strengthened their partnership through a Memorandum of Understanding to enhance smart manufacturing, integrating advanced technologies for improved manufacturing processes. This collaboration aims to accelerate product development while prioritizing sustainability and flexibility through modular production. Utilizing the Siemens Xcelerator platform, Merck is expected to leverage innovative software and hardware solutions to streamline operations and reduce time-to-market. A notable outcome of their alliance is a modular GMP production line that meets high safety and quality standards. Overall, this partnership is set to drive innovation and growth across Merck’s healthcare, life science, and electronics sectors.

Allergy Immunotherapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.10 billion

Revenue forecast in 2030

USD 3.19 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment Type,type, allergy type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

DMK Pharmaceuticals; ALK-Abelló A/S; Allergy Therapeutics; ASIT Biotech; Circassia; DVB Technologies SA; DESENTUM OY; HAL Allergy B.V.; HollisterStier Allergy; LETIPharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Allergy Immunotherapy Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global allergy immunotherapy market report based on treatment type, type, allergy type, distribution channel, and region:

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcutaneous Immunotherapy

-

Sublingual Immunotherapy

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Drops

-

-

Allergy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergic Rhinitis

-

Allergic Asthma

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global allergy immunotherapy market size was estimated at USD 1.6 billion in 2019 and is expected to reach USD 1.8 billion in 2020.

b. The global allergy immunotherapy market is expected to grow at a compound annual growth rate of 9.0% from 2019 to 2027 to reach USD 3.1 billion by 2027.

b. Allergic rhinitis dominated the allergy immunotherapy market with a share of 71.9% in 2019. This is attributable to the rising incidence rate coupled with growing environmental pollution.

b. Some key players operating in the allergy immunotherapy market include ASIT Biotech, Circassia, Mylan N.V., Adamis Pharmaceuticals Corporation, Merck KGaA, Stallergenes Greer plc, Allergy Therapeutics, ALK-Abelló A/S, DESENTUM OY, HAL Allergy B.V., HollisterStier Allergy, LETIPharma, and DBV Technologies SA.

b. Key factors driving the allergy immunotherapy market growth include a rise in the prevalence of allergic disorders, technological advancements in the field of allergic immunotherapy, and a strong pipeline of immunotherapy drugs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.