- Home

- »

- Automotive & Transportation

- »

-

All-wheel Drive Market Size, Share & Growth Report, 2030GVR Report cover

![All-wheel Drive Market Size, Share & Trends Report]()

All-wheel Drive Market (2024 - 2030) Size, Share & Trends Analysis Report By Propulsion (ICE, Electric), By Vehicle (Passenger Vehicle, Commercial Vehicle), By System (Automatic, Manual), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

All-wheel Drive Market Size & Trends

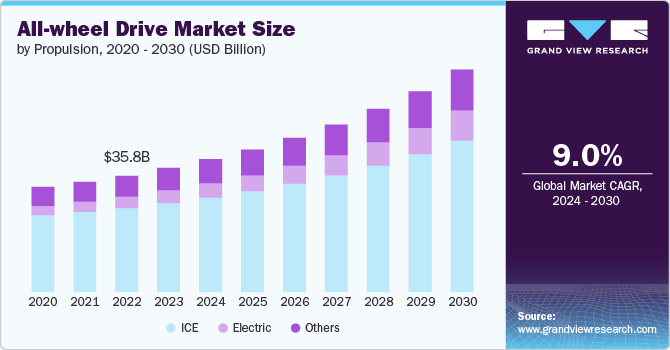

The global all-wheel drive market size was estimated at USD 38.19 billion in 2023 and is anticipated to grow at a CAGR of 9.0% from 2024 to 2030. The market has seen significant due to technological advancements, changing consumer preferences, and evolving industry trends. Besides, increasing demand for enhanced vehicle safety and performance is further driving the growth of the market. All-wheel drive provides better traction and stability, making a vehicle highly desirable in regions with adverse weather conditions, such as snow and heavy rain. As consumers become more aware of the safety benefits associated with wheel-drive vehicles, their preference for these systems has intensified, contributing to market expansion.

Technological innovation has played a crucial role in propelling the market growth. Modern wheel drive systems are more efficient than their predecessors, incorporating advanced electronics and software to optimize performance. For instance, the integration of torque vectoring technology allows for more precise control of power distribution between wheels, improving handling and driving dynamics. These technological advancements have made AWD systems more appealing to a broader range of consumers, including those who prioritize performance and driving experience.

Furthermore, the rise of electric and hybrid vehicles has also had a significant impact on the market. Manufacturers are increasingly incorporating all-wheel drive systems into their electric and hybrid models to enhance their appeal and performance. Electric motors can independently power each wheel, providing instantaneous torque and improving traction. This integration of all-wheel drive in the electric and hybrid vehicle has not only expanded the market but also demonstrated its compatibility with the future of automotive technology. As the industry moves towards electrification, the demand for all-wheel drive systems in electric and hybrid vehicles is expected to grow.

Consumer preferences are shifting towards larger vehicles such as SUVs and crossovers, which are often equipped with all-wheel drive systems. These vehicles offer a blend of comfort and off-road capability, making them popular choices among families and adventure enthusiasts. The increasing popularity of SUVs and crossovers has, in turn, driven the demand for all-wheel drive systems as manufacturers strive to offer these vehicles with the best possible traction and stability features. This trend has been particularly pronounced in markets like North America and Europe, where SUVs dominate sales.

Moreover, the expansion of ridesharing and mobility services is a contributing factor to the growth of the all-wheel drive market. Companies offering these services are increasingly opting for all-wheel drive vehicles to ensure reliability and safety in various driving conditions. all-wheel drive vehicles are better suited for the diverse range of environments that ride-sharing vehicles encounter, from urban streets to rural roads. As the ridesharing market continues to expand globally, which will have cascading effects on the growth of all-wheel drive equipped vehicles.

Propulsion Insights

The ICE segment accounted for the largest market share of 71.7% in 2023. Manufacturers have invested heavily in optimizing ICE all-wheel drive technology, resulting in improved fuel efficiency, performance, and overall vehicle durability. The familiarity and proven track record of ICE all-wheel drive vehicles continue to appeal to a broad range of consumers, from off-road enthusiasts to those needing reliable transportation in adverse weather conditions.Additionally, the extensive availability of fueling infrastructure for gasoline and diesel engines makes ICE all-wheel drive vehicles a preferred choice for many consumers.

The electric segment is experiencing robust growth due to rapid advancements in electric vehicle (EV) technology and the increasing consumer demand for sustainable transportation solutions. Besides, environmental awareness, stringent emissions regulations, and substantial investments in EV technology by major automakers further foster the growth of the electric all-wheel drive segment. Technological advancements in battery efficiency and electric drivetrains have significantly improved the range, performance, and reliability of electric all-wheel drive vehicles. Innovations such as regenerative braking, sophisticated battery management systems, and the integration of high-performance electric motors on each axle contribute to enhanced vehicle dynamics and driving experience.

Vehicle Insights

The passenger vehicle segment held the largest market share of 60.6% in 2023. The all-wheel drive systems provide superior traction and stability, especially in adverse weather conditions such as rain, snow, and ice, making them highly attractive to drivers seeking greater control and confidence on the road. Additionally, the rising popularity of sport utility vehicles (SUVs) and crossovers, many of which come equipped with all-wheel drive as either a standard or optional feature, has significantly contributed to the market share of passenger all-wheel drive vehicles. These vehicles offer a blend of comfort, utility, and off-road capability, appealing to a wide range of consumers, from urban commuters to adventure enthusiasts. Furthermore, advancements in all-wheel drive technology have led to more efficient and lightweight systems, which has resulted in reducing the fuel consumption. This has made them more accessible and practical for everyday use, further boosting their popularity in the passenger vehicle segment. and maintenance, ensuring a reliable service that meets the demand of urban commuters.

The tremendous growth of commercial all-wheel vehicles is a reflection of the evolving needs and demands within the commercial sector. As businesses and industries seek to enhance operational efficiency and ensure reliable transportation across diverse terrains, the advantages of All-wheel Drive systems have become increasingly evident. Commercial all-wheel drive vehicles offer superior traction, stability, and off-road capability, making them indispensable for sectors such as construction, agriculture, and logistics, where vehicles often operate in challenging environments. The expansion of e-commerce and last-mile delivery services has also fuelled demand for all-wheel drive vans and trucks, which can navigate urban and rural landscapes with equal ease, ensuring timely and efficient delivery of goods.

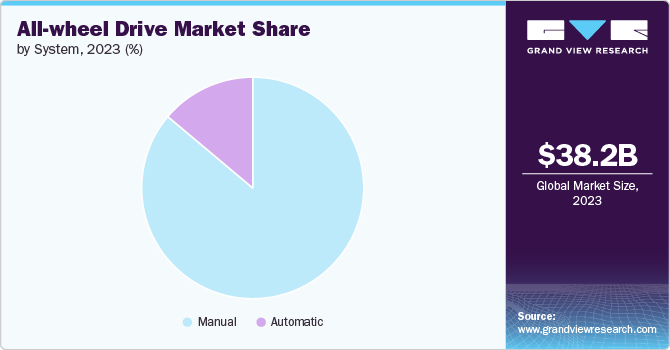

System Insights

The manual segment held the largest market of 86.1% in 2023.The enduring popularity of manual all-wheel drive vehicles is due to better driving experience, providing drivers with a greater sense of control over gear selection and power distribution. Manual all-wheel drive vehicles are often preferred in rugged terrains and challenging driving conditions due to their robustness and reliability. Additionally, manual all-wheel drive vehicles have less total cost of ownership and maintenance expenses which drives the growth of the manual segment in the market.

The automatic all-wheel drive segment has seen tremendous growth driven by advancements in technology and shifting consumer preferences. Modern automatic all-wheel drive offers seamless power distribution and enhanced traction control without the need for driver intervention. This convenience appeals to a broad spectrum of drivers, including those who prioritize ease of use and comfort. The integration of advanced driver assistance systems (ADAS) and improved fuel efficiency in automatic all-wheel drive vehicles has further accelerated their adoption.

Regional Insights

North America All-wheel Drive Market Trends

TheNorth America marketis expected to grow at a CAGR of 9.2% from 2024-2030. The harsh weather conditions in many parts of the region, including snow and rain, have made all-wheel drive vehicles a popular choice among consumers seeking better traction and stability. Technological advancements in All-wheel Drive systems have also contributed to market growth, with manufacturers offering more efficient and responsive all-wheel drive solutions.

U.S. All-wheel Drive Market Trends

The U.S. market is one of the largest automotive markets and has been a major contributor to the growth of the market due increasing popularity of SUVs and crossovers, which have all-wheel drive options. Furthermore, American consumers' growing emphasis on vehicle safety, especially in regions prone to adverse weather conditions, has boosted the demand for all-wheel drive systems in the U.S.

Asia Pacific All-wheel Drive Market Trends

Asia Pacificdominated the market in 2023 and accounted for a 41.73% share of the global revenue. The growth of the all-wheel drive vehicle market is experiencing rapid growth, driven by increasing urbanization, rising disposable incomes, and a growing automotive industry. Countries like China, Japan, and India are at the forefront of this expansion, with consumers in these regions are preferring all-wheel drive vehicles for their superior performance and safety features. The diverse climatic conditions across the Asia Pacific region, from monsoons to mountainous areas, have also spurred the demand for all-wheel drive systems.

European consumers, particularly in countries with mountainous terrain and harsh winters, have shown a strong preference for all-wheel drive vehicles. Additionally, the European automotive market's focus on technological innovation and environmental sustainability has led to the development of more efficient and eco-friendly all-wheel drive systems which propelling market growth in the region.

Key All-wheel Drive Company Insights

The companies are concentrating on several strategic initiatives, such as developing new products, forming partnerships and collaborations, and establishing agreements to achieve a competitive edge over their competitors.

Key All-wheel Drive Companies:

The following are the leading companies in the all-wheel drive market. These companies collectively hold the largest market share and dictate industry trends.

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Magna International Inc.

- Dana Limited

- JTEKT Corporation

- Eaton

- OC Oerlikon Management AG

- American Axle & Manufacturing Inc.

- GKN PLC

- Vitesco Technologies

Recent Developments

-

In March 2024, Volkswagen introduced the new ID. Buzz GTX an electric Bulli featuring a high-performance drive system. It will be available with two different wheelbases, two battery size options, and seating configurations for 5, 6, or 7 passengers. Additionally, it includes standard 4MOTION all-wheel drive, ensuring excellent pulling power and traction in all driving conditions.

-

In December 2023, BorgWarner Inc., an all-wheel drive system manufacturer, announced the completion of its acquisition of Eldor Corporation's Electric Hybrid Systems division. This acquisition notably strengthens BorgWarner's ePropulsion portfolio, especially in the realm of high-voltage power electronics.

All-wheel Drive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.86 billion

Revenue forecast in 2030

USD 68.44 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion, vehicle, system, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

ZF Friedrichshafen AG; BorgWarner Inc.; Magna International Inc.; Dana Limited; JTEKT Corporation; Eaton; OC Oerlikon Management AG; American Axle & Manufacturing Inc.; GKN PLC; Vitesco Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global All-wheel Drive Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global all-wheel drive market report based on propulsion, vehicle, system, and region.

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

Others

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Manual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global all-wheel drive market size was estimated at USD 38.19 billion in 2023 and is expected to reach USD 40.86 billion in 2024.

b. The global all-wheel drive market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 68.44 billion by 2030.

b. The manual segment held the largest market of 86.1% in 2023. The enduring popularity of manual all-wheel drive vehicles is due to better driving experience, providing drivers with a greater sense of control over gear selection and power distribution. Manual all-wheel drive vehicles are often preferred in rugged terrains and challenging driving conditions due to their robustness and reliability.

b. Some key players operating in the all-wheel drive market include ZF Friedrichshafen AG, BorgWarner Inc., Magna International Inc., Dana Limited, JTEKT Corporation, Eaton, OC Oerlikon Management AG, American Axle & Manufacturing Inc., GKN PLC and Vitesco Technologies among others.

b. Key factors that are driving the market growth include technological advancements, changing consumer preferences, and evolving industry trends. Besides, increasing demand for enhanced vehicle safety and performance is further driving the growth of the all-wheel drive market. The all-wheel drive provides better traction and stability, making them highly desirable in regions with adverse weather conditions, such as snow and heavy rain.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.