- Home

- »

- Plastics, Polymers & Resins

- »

-

Alkyd Resin Market Size, Share And Trends Report, 2030GVR Report cover

![Alkyd Resin Market Size, Share & Trends Report]()

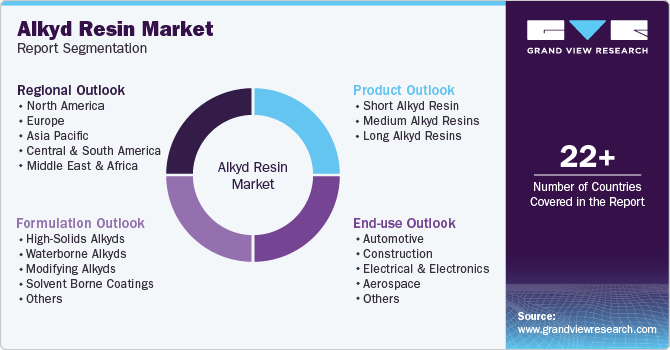

Alkyd Resin Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Short, Medium, Long), By Formulation (High-solids, Waterborne, Modifying), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-322-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alkyd Resin Market Summary

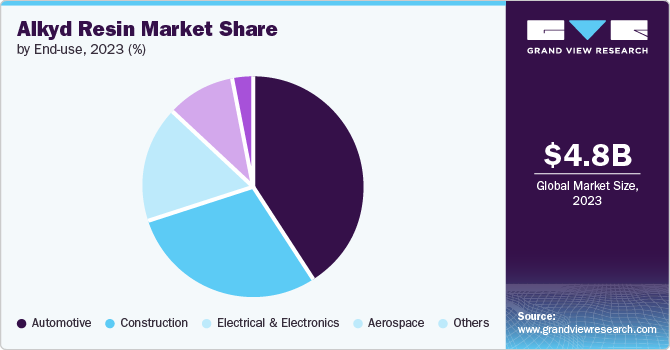

The global alkyd resin market size was estimated at USD 4.79 billion in 2023 and is projected to reach USD 6.41 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030. Increasing demand from paints & coatings in the automobile and architecture industry is anticipated to significantly drive the market growth during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the global alkyd resin market with the largest revenue share in 2023.

- The alkyd resin market in China led the Asia Pacific market and held the largest revenue share in 2023.

- By product, the short alkyd resin segment led the market, holding the largest revenue share of 47.8% in 2023.

- By formulation, the high-solids alkyds segment held the dominant position in the market and accounted for the leading revenue share in 2023.

- By end use, the electrical & electronics segment is expected to grow at the significant CAGR from 2024 to 2033.

Market Size & Forecast

- 2023 Market Size: USD 4.79 Billion

- 2030 Projected Market Size: USD 6.41 Billion

- CAGR (2024-2030): 4.2%

- Asia Pacific: Largest market in 2023

The growing automotive industry is expected to drive the market. According to the International Organization of Motor Vehicle Manufacturers, the global production of automotive vehicles in 2023 increased by 10% reaching 93.5 million units. In the automotive sector, these resins are highly valued for their durability, excellent gloss retention, and strong adhesion properties. As automobile manufacturers seek high-quality coatings that can withstand harsh environmental conditions and provide a sleek finish, alkyd resins offer an effective solution. This increasing adoption in automotive coatings is anticipated to contribute significantly to market growth.

Similarly, the architecture industry is experiencing a growing need for reliable and cost-effective coatings. Alkyd resins are widely used in architectural paints due to their ability to provide a tough, weather-resistant finish that protects buildings from the elements. With the ongoing construction boom and the need for renovation in many regions, the demand for high-performance architectural coatings is expected to rise. This trend is likely to drive the growth of the alkyd resins market, as these resins play a crucial role in delivering the desired quality and durability in architectural applications.

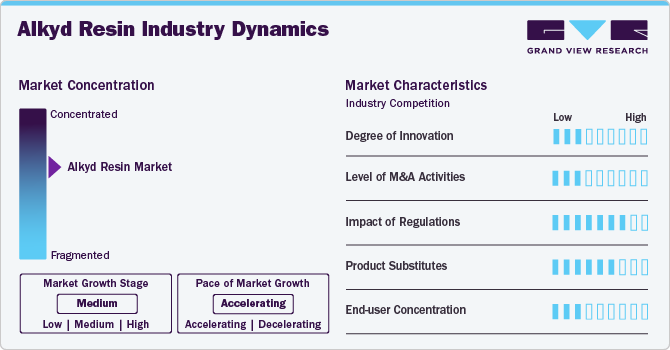

Industry Characteristics

The market space is moderately consolidated with the presence of key companies, such as Dow, BASF SE, and Sika AG. These companies adopt various strategic initiatives, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their presence in the market. Additionally, companies are increasingly focusing on sustainable solutions by incorporating bio-based materials in order to comply with regulatory norms. For instance, In March 2022, Groupe Berkem launched its 100% bio-based alkyd resins for the construction paint and coatings industry.

The industry is characterized by high degree of innovation. Rising awareness about sustainable solutions among the consumer, leading to a shift in consumer preferences is propelling innovation in the market. In addition, stringent regulations shape the demand and supply dynamics in the alkyd resins market. Stricter regulations on volatile organic compounds (VOCs) and hazardous substances can limit the use of certain raw materials and formulations. This is expected to bring a shift in market preferences towards eco-friendly and compliant products. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires comprehensive data on the safety of chemical substances, pushing manufacturers to innovate and produce safer alkyd resin formulations.

Product substitutes for alkyd resins include acrylic resins, epoxy resins, and polyurethane resins. Acrylic resins are popular for their fast drying times, UV resistance, and excellent color retention, making them suitable for both interior and exterior applications. Epoxy resins offer superior durability, chemical resistance, and strong adhesion, often used in industrial and protective coatings. Polyurethane resins provide exceptional flexibility, abrasion resistance, and durability, making them ideal for high-wear surfaces such as floors and automotive finishes. These alternatives are chosen based on specific performance needs and environmental considerations, often driven by industry standards and regulatory requirements.

Product Insights

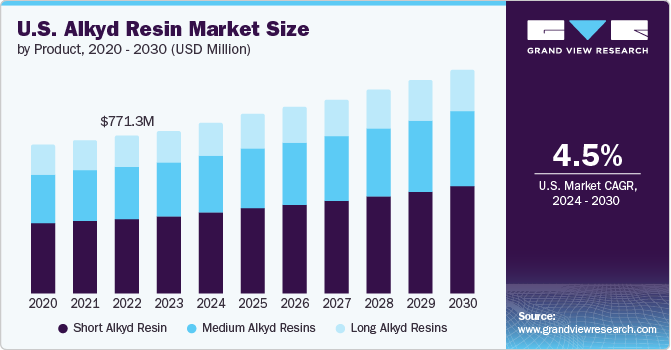

Based on product, the short alkyd resin segment held the largest share of 47.8% in 2023. This can be attributed to the increasing demand for high-performance coatings in various industries. Short alkyd resins are known for their rapid drying times and excellent hardness, making them ideal for high-performance coatings. Industries requiring durable, fast-drying finishes, such as automotive and industrial sectors, are increasingly adopting these resins to improve efficiency and product quality.

The medium alkyd resin segment is expected to witness the fastest growth over the forecast period owing to the growth in the architectural coatings sector. The architectural coatings sector is a major consumer of medium alkyd resins due to their excellent durability, weather resistance, and ease of application. The ongoing construction boom, coupled with increasing renovation and maintenance activities, is driving the demand for high-quality architectural coatings, thereby boosting the medium alkyd resin market.

Formulation Insights

Based on formulation, the high-solids alkyds led the market in 2023 in terms of revenue. Stricter environmental regulations aimed at reducing volatile organic compound (VOC) emissions are a significant driver for the segment. High-solids alkyds contain a higher percentage of solid components and lower solvent content, resulting in lower VOC emissions. This compliance with environmental standards makes them an attractive choice for manufacturers seeking to meet regulatory requirements.

The waterborne alkyds is expected grow at a substantial rate through the forecast period. Modern waterborne alkyds offer enhanced durability, better gloss retention, and quicker drying times, which make them competitive with traditional solvent-based alkyds. These technological advancements are expanding their application range and boosting market adoption.

End use Insights

Based on end use, automotive segment held the largest market share in 2023. Increasing demand for durable and high-performance coatings is expected to drive the segment. Automotive manufacturers require coatings that provide superior durability, protection, and aesthetic appeal. Alkyd resins are known for their excellent adhesion, hardness, and weather resistance, making them suitable for automotive applications. The need for high-performance coatings that can withstand harsh environmental conditions and mechanical wear is driving the demand for alkyd resins in the automotive industry.

The electrical & electronics segment is expected to grow at a significant CAGR over the forecast period. Alkyd resins are widely used in electrical and electronic applications due to their excellent insulating properties. As the demand for electrical and electronic devices grows, so does the need for reliable insulating materials that can protect components from electrical currents and environmental factors. This demand drives the use of alkyd resins in the manufacturing of insulating varnishes, coatings, and encapsulation materials.

Regional Insights

The alkyd resin market is poised to grow over the forecast period owing to the rapid construction and infrastructure development in the U.S. and Mexico. The construction industry in the region is expected to witness significant growth over the coming years, owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges.

U.S. Alkyd Resin Market Trends

The U.S. dominated the North America alkyd resin market in 2023 with a share of 63.2%. Rising demand for alkyd resin for paints & coatings, construction, electrical & electronics, composites, and adhesive applications in the U.S. is expected to drive market growth over the forecast period.

Asia Pacific Alkyd Resin Market Trends

Asia Pacific region dominated the alkyd resin market and accounted for the largest revenue share in 2023. Rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period. Furthermore, the easy availability of raw materials has provided huge opportunity for the use of alkyd resin-based products in various end use sectors.

Alkyd resin market in China dominated the regional market in 2023. The rising number of infrastructure development projects and growing manufacturing industry are expected to drive market growth over the forecast period. China’s construction market is likely to outperform other Southeast Asian countries, owing to government initiatives and funding to retain its development.

The alkyd resin market in India is expected to witness a substantial growth over the forecast period, owing to the rapidly flourishing construction industry. According to Invest India, as of 2024, India allocated an investment budget of USD 1.4 trillion to infrastructure, with 24% for renewable energy, 18% for highways & roads, 17% for urban infrastructure, and 12% for railways. In addition, the growing electrical & electronics sector and India’s increasing focus on aerospace industry is poised to propel the market.

Europe Alkyd Resin Market

Europe is the second-largest market for alkyd resin, after Asia Pacific. Increasing product demand for various applications, such as paints & coatings, construction, electrical & electronics, and others, is expected to drive the alkyd resin market in Europe over the forecast period.

The alkyd resin market in Germany held the largest market share in 2023. Germany is the manufacturing hub of Europe and is the largest manufacturer of automobiles in the region. Technology advancements, such as EVs and self-driving cars, are anticipated to boost the growth of the automotive industry in the country, which is anticipated to create demand for paints & coatings in the coming years.

UK alkyd resin market is anticipated to grow at a significant CAGR over the forecast period. The presence of major automobile manufacturers, including Jaguar, Land Rover, MINI, Aston Martin, Bentley, Rolls Royce, and Lotus Cars, in the UK is likely to fuel the demand for paints & coatings in the automotive industry in the coming years, which is expected to create demand for alkyd resins. Initiatives toward product development, including driverless cars, are expected to boost investments in the automotive industry.

Central & South America Alkyd Resin Market

The Central & South America alkyd resin market is growing substantial rate. The emergence of construction companies in Chile and Peru is expected to create growth potential for the alkyd resins market over the forecast period. The presence of various paint & coating key players in the region, including The Sherwin-Williams Company, AkzoNobel NV, and RPM International, Inc., is expected to propel the demand for alkyd resins

Middle East & Africa Alkyd Resin Market

The Middle East & Africa alkyd resin market is poised to grow through the forecast period. Industrial manufacturing in the Middle East & Africa has witnessed steady growth in the past few years. A shift in focus toward the non-oil private sector in the region is expected to boost manufacturing and other end use industries, as well as diversify the economy of the region.

Key Alkyd Resin Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In June 2022, Allnex GmbH announced its plans to transition the Liquid Resins & Additives (LRA) and all its alkyds into partially bio-based pentaerythritol, further promoting its Environmental Sustainability Governance Program.

Key Alkyd Resin Companies:

The following are the leading companies in the alkyd resin market. These companies collectively hold the largest market share and dictate industry trends.

- Polynt SpA

- Nord Composites

- Manusca Chemicals Limited

- Dow

- Macro Polymers

- Arkema SA

- Cytech Solvay Group

- BASF SE

- Spolchemie

- D.S.V Chemicals Pvt Ltd.

- Orson Resins and Coatings Private Limited

Alkyd Resin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5,003.33 million

Revenue forecast in 2030

USD 6,412.92 million

Growth rate

CAGR of 4.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan, South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Polynt SpA; Nord Composites; Manusca Chemicals Limited; Dow; Macro Polymers; Arkema SA; Cytech Solvay Group; BASF SE; Spolchemie; D.S.V Chemicals Pvt Ltd.; Orson Resins and Coatings Private Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alkyd Resin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alkyd resin market report based on product, formulation, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Short Alkyd Resin

-

Medium Alkyd Resins

-

Long Alkyd Resins

-

-

Formulation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High-Solids Alkyds

-

Waterborne Alkyds

-

Modifying Alkyds

-

Solvent Borne Coatings

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Electrical & Electronics

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alkyd resin market size was estimated at USD 4.79 billion in 2023 and is expected to reach USD 5 billion in 2024.

b. The global alkyd resin market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 6.41 billion by 2030.

b. Asia Pacific emerged as the largest regional segment and accounted for 35.25% of the market in 2023, owing to rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea.

b. Some of the key players operating in this industry include Polynt SpA; Nord Composites; Manusca Chemicals Limited; Dow; Macro Polymers; Arkema SA; Cytech Solvay Group; BASF SE, among others

b. Increasing demand from paints & coatings in the automobile and architecture industry is anticipated to significantly drive the alkyd resin market growth during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.