- Home

- »

- Renewable Energy

- »

-

Alkaline Water Electrolysis Market Size & Share Report, 2030GVR Report cover

![Alkaline Water Electrolysis Market Size, Share & Trends Report]()

Alkaline Water Electrolysis Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (< 10 m3/h, < 30 m3/h, < 50 m3/h, < 80 m3/h, >= 80 m3/h), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-386-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Alkaline Water Electrolysis Market Summary

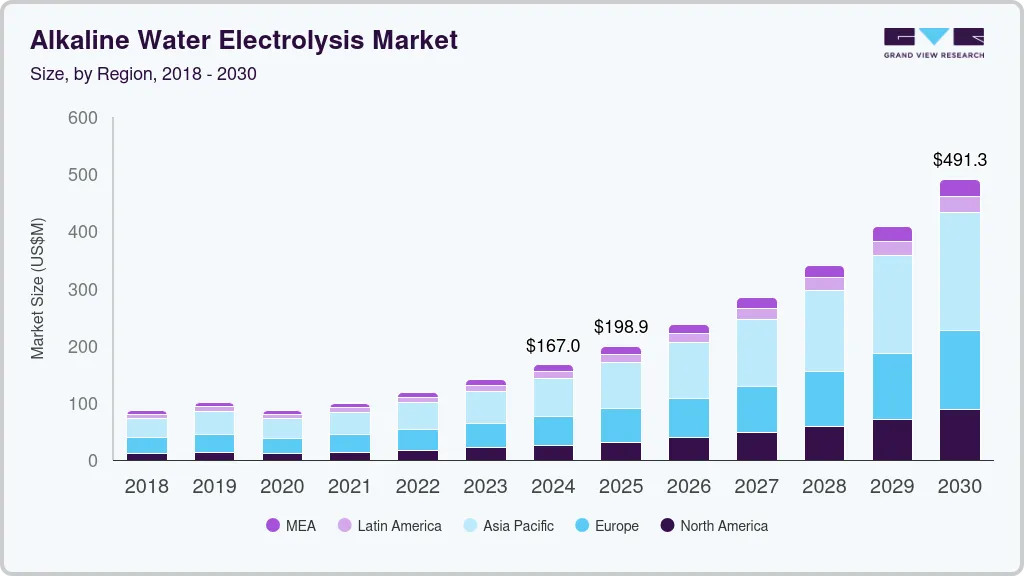

The global alkaline water electrolysis market size was estimated at USD 167.0 million in 2023 and is projected to reach USD 491.3 million by 2030, growing at a CAGR of 19.8% from 2024 to 2030. The market is primarily driven by the increasing demand for clean and sustainable energy solutions, particularly the production of green hydrogen.

Key Market Trends & Insights

- Europe dominated the global alkaline water electrolysis market and accounted for the largest revenue share of over 39.6% in 2023

- Based on Type, < 50 m3/h held the market with the largest revenue share of 30.0% in 2023.

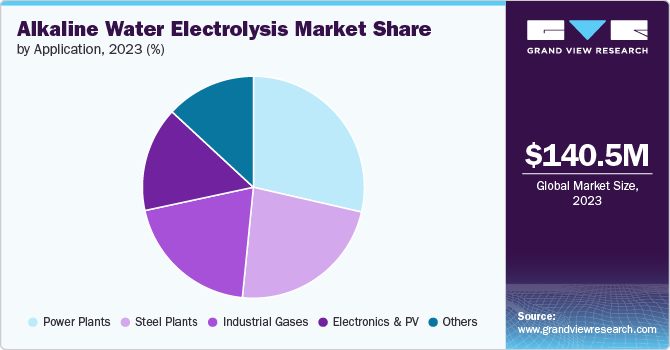

- Based on Application, Power Plants held the market with the largest revenue share of 28.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 167.0 Million

- 2030 Projected Market Size: USD 491.3 Million

- CAGR (2024-2030): 19.8%

- Europe: Largest market in 2023

As global efforts intensify to reduce carbon emissions and combat climate change, hydrogen is gaining prominence as a clean fuel alternative across various sectors, including transportation, power generation, and industrial processes.

The rising need for decarbonization solutions in industries, coupled with the growing recognition of hydrogen's versatility as an energy carrier, positions alkaline water electrolysis as a crucial technology in the quest for sustainable energy systems, thus driving significant market expansion in the coming years.

Drivers, Opportunities & Restraints

The alkaline water electrolysis market is characterized by its growing significance in the production of green hydrogen, driven by the global shift towards sustainable energy solutions. This market features a diverse range of applications, including power generation, industrial gases, and the automotive sector, particularly in fuel cell technologies. The technology primarily utilizes nickel-based catalysts, which offer cost efficiency and durability, making it suitable for both large-scale and small-scale hydrogen production.

The supportive government policies and investments in renewable energy infrastructure are fostering market growth. The rising interest in hydrogen as a key component of energy transition strategies further amplifies the potential for market expansion, positioning alkaline water electrolysis as a critical technology for achieving decarbonization goals.

The alkaline water electrolysis market faces several restraints, primarily the high cost of electrolysis systems, which can limit adoption, especially in price-sensitive sectors. Additionally, the lack of awareness and understanding of alkaline electrolysis technology among potential users hinders market growth. This is compounded by competition from alternative hydrogen production methods, such as steam methane reforming, which is often more cost-effective. Furthermore, the dependence on a stable and affordable electricity supply poses challenges, as fluctuations in energy prices can impact the economic viability of hydrogen production through electrolysis.

Type Insights & Trends

Based on Type, < 50 m3/h held the market with the largest revenue share of 30.0% in 2023. The <50 m³/h segment of the alkaline water electrolysis market is poised for growth, driven by the increasing demand for small-scale hydrogen production across various applications, including industrial gases and renewable energy integration. This segment is particularly attractive for businesses seeking cost-effective solutions for hydrogen generation, as it enables flexibility and scalability.

Technological advancements are enhancing efficiency and reducing the operational costs of these systems, making them more accessible to smaller enterprises. Additionally, supportive government policies promoting green hydrogen initiatives further bolster market opportunities, positioning the <50 m³/h segment as a critical player in the transition to sustainable energy sources.

Application Insights & Trends

Based on Application, Power Plants held the market with the largest revenue share of 28.6% in 2023. As governments worldwide prioritize decarbonization and renewable energy integration, alkaline water electrolysis is becoming essential for minimizing greenhouse gas emissions in power plants. Additionally, advancements in electrolysis technology are improving efficiency and reducing costs, further driving adoption in the energy sector. This segment is poised for substantial expansion as the transition to sustainable energy solutions accelerates.

The alkaline water electrolysis market for industrial gases is expanding due to the increasing demand for hydrogen in various industries, including chemicals, metallurgy, and electronics. This technology enables efficient hydrogen production, essential for processes like refining and ammonia synthesis. As industries seek sustainable and carbon-free solutions, alkaline water electrolysis offers a viable pathway to meet these needs.

Regional Insights & Trends

The North America alkaline water electrolysis market accounted for 18.0%. The region is witnessing substantial investments in hydrogen infrastructure and technology advancements that enhance the efficiency and cost-effectiveness of alkaline electrolysis systems. Major players, including Thyssenkrupp and Nel Hydrogen, are actively expanding their capabilities to meet the rising demand. Additionally, the automotive industry's shift toward hydrogen fuel cell vehicles further propels market growth. As North America aims for a sustainable energy future, the alkaline water electrolysis market is well-positioned for continued expansion, reflecting the broader global trend towards decarbonization and renewable energy integration.

U.S. Alkaline Water Electrolysis Market Trends

The alkaline water electrolysis market in the U.S. is characterized by its diverse applications. Power plants are a major consumer of hydrogen produced through electrolysis, as it is essential for decarbonization efforts. The steel industry also utilizes hydrogen for refining and other processes, making it a significant application segment. Additionally, the electronics and photovoltaics sectors rely on hydrogen for various manufacturing processes, further driving the demand for alkaline water electrolysis systems.

Europe Alkaline Water Electrolysis Market Trends

Europe dominated the global alkaline water electrolysis market and accounted for the largest revenue share of over 39.6% in 2023. European countries are investing heavily in hydrogen infrastructure, supported by government policies and initiatives aimed at promoting green hydrogen technologies. Major players in the market, such as Thyssenkrupp, Nel Hydrogen, and McPhy, are advancing their technologies to enhance efficiency and reduce costs, making alkaline water electrolysis more competitive against traditional hydrogen production methods.

As Europe continues to prioritize hydrogen as a cornerstone of its energy strategy, the alkaline water electrolysis market is expected to expand rapidly, reflecting a broader global trend towards renewable energy integration and sustainability. The increasing collaboration among industry stakeholders, research institutions, and government entities is also anticipated to drive innovation and accelerate the deployment of alkaline electrolysis technologies across Europe.

The Germany alkaline water electrolysis market is significant, driven by the country's extensive use of hydrogen in industries such as vehicles, petrochemicals, refining, glass purification, and fertilizers. This demand is expected to further boost the market's growth as Germany focuses on decarbonization and renewable energy integration.

Alkaline water electrolysis market in the UK significant focus on renewable energy integration, the market is projected to expand due to investments in hydrogen infrastructure and technology advancements. Key applications include power generation, industrial processes, and transportation, where hydrogen is utilized as a clean fuel alternative. Major players in the market, such as ITM Power and Nel Hydrogen, are actively enhancing their electrolysis technologies to improve efficiency and reduce costs. Additionally, supportive government policies, including funding for hydrogen projects and initiatives promoting sustainable energy, are expected to further bolster market growth in the UK, positioning it as a leader in the European hydrogen economy.

Asia Pacific Alkaline Water Electrolysis Market Trends

Key countries such as China, Japan, and India are leading this growth, fueled by government initiatives aimed at reducing carbon emissions and promoting renewable energy technologies. The region's industrial sectors, including steel manufacturing, chemicals, and electronics, are increasingly adopting hydrogen as a cleaner alternative to fossil fuels, enhancing the demand for alkaline water electrolysis systems.

China alkaline water electrolysis market includes major players such as China Shipbuilding Industry Corp and Suzhou Jingli are leading the market, focusing on enhancing the efficiency and scalability of their electrolyzers. The market is characterized by a strong emphasis on alkaline electrolyzer technology, which remains a cost-effective and mature solution for hydrogen production. Additionally, the rising interest in power-to-gas projects and the integration of renewable energy sources further bolster the market's growth potential, positioning China as a key player in the global hydrogen economy.

Alkaline water electrolysis market in India, where the country's commitment to reducing carbon emissions and enhancing energy security is further supported by government initiatives such as the National Hydrogen Mission, which aims to promote hydrogen production and utilization across the country. This initiative is crucial for decarbonizing industries and integrating renewable energy sources, such as solar and wind, into the hydrogen production process.

Central & South America Alkaline Water Electrolysis Market Trends

The alkaline water electrolysis market in Central and South America is emerging as a significant player in the global hydrogen economy, driven by increasing investments in renewable energy and a growing focus on sustainable hydrogen production. As countries in the region, such as Brazil, Argentina, and Colombia, aim to reduce carbon emissions and enhance energy security, the demand for green hydrogen produced through alkaline water electrolysis is expected to rise.

Middle East & Africa Alkaline Water Electrolysis Market Trends

The alkaline water electrolysis market in the Middle East and Africa is emerging as a critical component of the region's efforts to transition towards sustainable energy solutions. This market is primarily driven by the increasing demand for green hydrogen, which is gaining traction as a clean fuel alternative across various sectors, including transportation, industrial applications, and power generation.

Key Alkaline Water Electrolysis Company Insights

The Alkaline Water Electrolysis Market is a highly competitive industry with several key players operating globally.

Key Alkaline Water Electrolysis Companies:

The following are the leading companies in the alkaline water electrolysis market. These companies collectively hold the largest market share and dictate industry trends.

- ITM Power

- NEL Hydrogen

- Cummins

- McPhy Energy

- Thyssenkrupp Uhde Chlorine Engineers

- Asahi Kasei

- Green Hydrogen Systems

- Enaex

- SunHydrogen

- Teledyne CARES

Recent Developments

-

In May 2024, Reliance Industries announced agreement with Nel Hydrogen for procurement of hydrogen electrolysers for production of green hydrogen to promote green energy in India.

-

In February 2024, Bharat Petroleum Corporation Limited announced development of first alkaline electrolyser in India which aligns with India’s vision to produce 5 million tons volume of green hydrogen by 2030.

Alkaline Water Electrolysis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 170.89 million

Revenue forecast in 2030

USD 500.43 million

Growth rate

CAGR of 19.6% from 2024 to 2030

Historical data

2018 – 2022

Base year

2023

Forecast period

2024 – 2030

Quantitative units

Volume in MW, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

ITM Power; NEL Hydrogen; Cummins; McPhy Energy; Thyssenkrupp Uhde Chlorine Engineers; Asahi Kasei; Green Hydrogen Systems; Enaex SunHydrogen; Teledyne CARES

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alkaline Water Electrolysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented alkaline water electrolysis market report based on type, application, and region:

-

Type Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

< 10 m3/h

-

< 30 m3/h

-

< 50 m3/h

-

< 80 m3/h

-

≥ 80 m3/h

-

-

Application Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power Plants

-

Steel Plants

-

Electronics and PV

-

Industrial Gases

-

Others

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global alkaline water electrolysis market size was estimated at USD 140.45 million in 2023 and is expected to reach USD 170.89 million in 2024.

b. The global alkaline water electrolysis market is expected to grow at a compounded annual growth rate of 19.6% from 2024 to 2030 to reach USD 500.43 billion by 2030.

b. The Master valve dominated the alkaline water electrolysis market in terms of revenue with the highest share of 30.00% in 2023. This market is primarily driven by the increasing demand for green hydrogen, which is gaining traction as a clean fuel alternative across various sectors, including transportation, industrial applications, and power generation.

b. Some key players operating in the alkaline water electrolysis market include ITM Power, NEL Hydrogen, Cummins, McPhy Energy, Thyssenkrupp Uhde Chlorine Engineers, Asahi Kasei, Green Hydrogen Systems, Enaex.

b. The alkaline water electrolysis market is primarily driven by the increasing demand for clean and sustainable energy solutions, particularly the production of green hydrogen. As global efforts intensify to reduce carbon emissions and combat climate change, hydrogen is gaining prominence as a clean fuel alternative across various sectors, including transportation, power generation, and industrial processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.