Aliphatic Hydrocarbon Market Size, Share & Trends Analysis Report By Product (Saturated, Unsaturated), By Application (Paints & Coatings, Adhesives & Sealants, Polymer & Rubber, Surfactant, Dyes, Others), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-334-0

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Aliphatic Hydrocarbon Market Size & Trends

The global aliphatic hydrocarbon market size was estimated at USD 3,960 million in 2023 and is expected to grow at a CAGR of 4.8% from 2024 to 2030. The growth can be attributed to the increasing product demand in different applications including paints & coatings, aerosol, oil & gas, adhesive & sealants, mining and water treatment. The global demand for aliphatic hydrocarbon has surged in recent years due to increased global automobile production and sales. This product is predominantly used in large quantities for manufacturing lubricants and solvents in the automotive industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), the production of cars and commercial vehicles rose by 16.72% in 2023 compared to the production levels in 2021.

Aliphatic hydrocarbons constitute a significant portion of crude oil. These molecules are characterized by their linear or branched open-chain structures, including n-alkanes, isoalkanes, cycloalkanes (naphthenes), terpenes, and steranes. Aliphatic hydrocarbons can be saturated or unsaturated with double carbon bonds. They are primarily obtained through processes such as distillation, cracking, and refining crude oil, targeting specific boiling point fractions.

Increasing the focus on renewable energy sources and sustainability is driving the demand away from fossil fuels, negatively impacting the product market. In addition, stringent environmental regulations and laws aim to reduce the pollution and emissions caused by hydrocarbon production and use. Compliance with these regulations can increase the operational costs.

Bio-based aliphatic hydrocarbons originate from renewable sources like plant oils, biomass, and microorganisms. In contrast to conventional petroleum-derived counterparts, these alternatives offer several benefits such as reduced carbon footprint, biodegradability, and lesser environmental impact. Companies like AkzoNobel have developed eco-friendly coatings using these aliphatic hydrocarbons, aiming to surpass

Product Insights

The saturated hydrocarbon segment dominated the market with a revenue share of 59.2% in 2023 owing to their wide application in products like waxes, lubricants, and paints & coatings. Saturated hydrocarbons are known as alkanes and are organic compounds consisting solely of carbon and hydrogen atoms with a single bond between them.

Saturated hydrocarbons are the simplest form of hydrocarbon and are often referred to as paraffins. They are the main components of liquified petroleum gas and natural gas. Many industrial lubricants and greases rely on saturated hydrocarbon to reduce the friction and wear between moving parts.

Application Insights

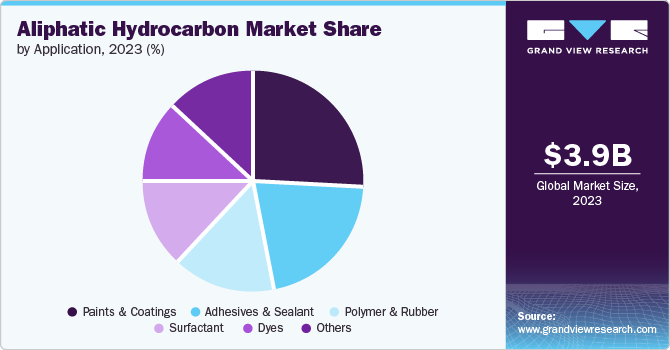

Paints and coating applications dominated the market with a revenue share of 26.3% in 2023 owing to increasing demand for paints and coatings from the construction and automotive industry. The product is widely used as a solvent and a thinner in paints and coating to adjust the viscosity of the paints making it easier to apply and ensure a smooth finish. Some of the commonly used aliphatic hydrocarbons in paints and coating include hexane, heptane, mineral spirits, and naphtha.

Moreover, the product is used in adhesives and sealants in order to provide the tackiness, adhesion, and durability to bond various materials securely. Aliphatic hydrocarbon resins are specific types of hydrocarbon used in adhesives, to improve the tackiness or grab of the adhesives. This allows for better initial bond strength, especially important for pressure sensitive adhesives like those on labels and tapes. In addition, they also provide resistance to degradation from factors like UV light, moisture and extreme temperatures. This allows adhesives to maintain their strength and effectiveness over a longer period.

Aliphatic hydrocarbons play an important role in the polymer and rubber industries, for instance, certain aliphatic hydrocarbons such as ethylene and propylene serve as an important building block for creating various polymers. Polyethylene is the most commonly used plastic globally. Polyethylene finds application in packaging films, bottles, pipes, and textiles. Another highly versatile plastic polypropylene is used in food containers, fibers for carpets and clothing, and automotive parts.

Regional Insights

The product market in North America. is expanding at a significant rate owing to positive market fundamentals for commercial real estate and a strong economy along with rising state and federal funding for institutional buildings and public works. In March 2023, the U.S. government unveiled a $2 trillion investment plan in response to the coronavirus pandemic, aimed at enhancing infrastructure such as hospitals, roads, and other critical facilities. Thus, it will subsequently affect the demand for the product in the region owing to increasing demand for paints and coatings.

Asia Pacific Aliphatic Hydrocarbon Market Trends

Asia Pacific dominated the market segment with a revenue share of 36.0% in 2023. In Asia Pacific, the paints and coatings market is expected to witness considerable growth over the forecast period owing to rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea.

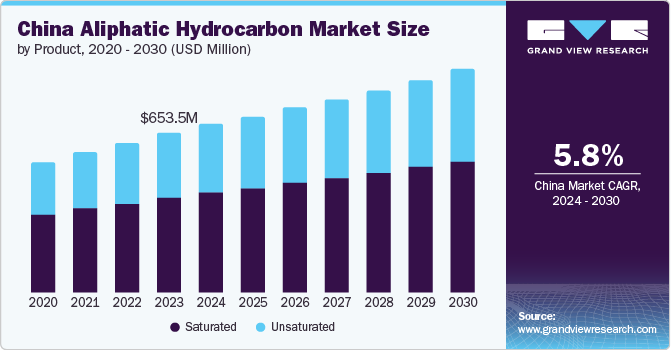

The aliphatic hydrocarbon market in China is experiencing significant growth. This is primarily driven by the expanding industrial sectors that rely heavily on these hydrocarbons, such as automotive, construction, and manufacturing. The demand is fueled by applications in lubricants, solvents, and various chemical processes

Europe Aliphatic Hydrocarbon Market Trends

The expanding construction sector in various countries, including the UK, Netherlands, Germany, France, Italy, and Spain is expected to propel product demand over the forecast period. Increased funding from the EU, complemented by supportive measures like subsidies, tax incentives, and other governmental initiatives, is expected to boost expansion within the construction sector across the region. This growth in construction activities is anticipated to drive up the demand for paints and coatings, consequently leading to increased consumption of aliphatic hydrocarbons.

Key Aliphatic Hydrocarbon Company Insights

Some of the key players operating in the market include ExxonMobil Corporation, BASF SE, Shell Global, BP Plc, LyondellBasell Industries N.V., Total S.A., Reliance Industries Limited, Chevron Phillips Chemical and Mitsubishi Chemical Corporation.

- Exxon Mobil Corporation is a U.S.-based company that is involved in the exploration and production of crude oil and natural gas along with the manufacturing, trading, transporting, and selling of petroleum products, petrochemicals, and a wide variety of specialty products including hydrocarbons,

- Chevron Corporation operates as a fully integrated oil and gas company involved in both upstream and downstream activities through its subsidiaries. Upstream operations encompass the exploration and production of oil and natural gas. Downstream operations involve the manufacturing and distribution of chemicals, lubricants, and additives.

Key Aliphatic Hydrocarbon Companies:

The following are the leading companies in the aliphatic hydrocarbon market. These companies collectively hold the largest market share and dictate industry trends.

- ExxonMobil Corporation

- BASF SE

- Shell Global

- BP Plc

- LyondellBasell Industries N.V.

- Total S.A.

- Reliance Industries Limited

- Chevron Phillips Chemical

- Mitsubishi Chemical Corporation

- Sasol

- Ineos Group Limited

- Dow

Recent Developments

-

In October 2023, Sumitomo Chemical started the construction of a pilot facility to establish a process for producing propylene directly from ethanol, which is attracting attention as a sustainable chemical raw material. The development of this technology is one of the projects supported by the NEDO* Green Innovation (GI) Fund. The Company will work to complete the construction of the pilot facility at the Sodegaura site of its Chiba Works in Japan by the first half of 2025 and step up efforts to quickly implement the technology in society.

-

In June 2023, Borealis, a prominent supplier of advanced and circular polyolefin solutions, announced the acquisition of Rialti S.p.A., an Italian company specializing in polypropylene recycling. This strategic move will enhance Borealis' circular portfolio by adding 50,000 tons of recycled compounding capacity, allowing them to meet increasing customer needs for sustainable solutions.

-

In January 2022, INVISTA, a Koch company and affiliate of Flint Hills Resources, acquired the Flint Hills Resources propylene business effectively. This includes chemical facilities in Houston and Longview, Texas.

Aliphatic Hydrocarbon Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4,177.2 million |

|

Revenue forecast in 2030 |

USD 5,539.7 million |

|

Growth rate |

CAGR of 4.8% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

ExxonMobil Corporation; BASF SE; Shell Global BP Plc; LyondellBasell Industries N.V.; Total S.A.; Reliance Industries Limited; Chevron Phillips Chemical; Mitsubishi Chemical Corporation; Sasol; Ineos Group Limited; Dow |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aliphatic Hydrocarbon Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aliphatic hydrocarbon Market report based on product, application & region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Saturated

-

Unsaturated

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesives & Sealant

-

Polymer & Rubber

-

Surfactant

-

Dyes

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aliphatic hydrocarbon market size was estimated at USD 3,960 million in 2023 and is expected to reach USD 4,177.2 million in 2024.

b. The global aliphatic hydrocarbon market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 5,539.7 million by 2030.

b. Asia Pacific dominated the aliphatic hydrocarbon market with a share of 36.0% in 2023. This is attributable to owing to rising construction activities and growing demand from the automotive sector in emerging countries such as India, Japan, and South Korea

b. Some key players operating in the aliphatic hydrocarbon market include ExxonMobil Corporation, BASF SE, Shell Global BP Plc, LyondellBasell Industries N.V., Total S.A., Reliance Industries Limited, Chevron Phillips Chemical, Mitsubishi Chemical Corporation, Sasol, Ineos Group Limited, Dow

b. Key factors that are driving the market growth include increasing product demand in different applications including paints & coatings, aerosol, oil & gas, adhesive & sealants, mining, and water treatment

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."