- Home

- »

- Medical Devices

- »

-

Alginate Dressing Market Size, Share & Growth Report, 2030GVR Report cover

![Alginate Dressing Market Size, Share & Trends Report]()

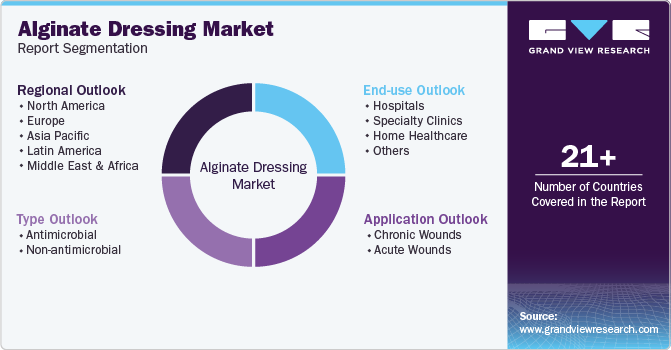

Alginate Dressing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Antimicrobial, Non-antimicrobial), By Application, By End-use (Hospitals, Specialty Clinics, Home Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-966-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alginate Dressing Market Size & Trends

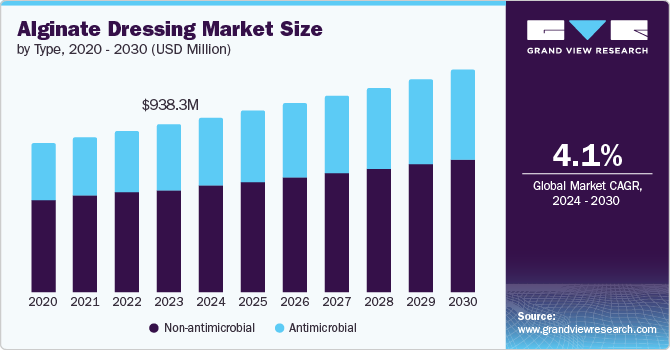

The global alginate dressing market size was valued at USD 938.3 million in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. The rising incidence of chronic and acute wounds is the major factor driving the industry. For instance, according to recent estimates published in NCBI (2022), the annual incidence rate of diabetic foot ulcers globally was expected to be between 9.1 million to 26.1 million. Similarly, as per the Independent Diabetes Trust in the U.K. asserted in its report (2019) that while 278,000 people are treated for venous leg ulcers, around 115,000 people annually develop diabetic foot ulcers.

In addition, the rising incidence of serious burn injuries may boost market expansion. According to the Undersea and Hyperbaric Medical Society, in the U.S., there are more than 2 million burn injuries reported each year, and 14,000 people pass away, whereas, about 20,000 have injuries that necessitate admission to a burn unit. Moreover, each year, around 75,000 individuals need to be hospitalized, and 25,000 of them stay there for more than two months. Furthermore, it is anticipated that the rising rates of burns, trauma and auto accidents will fuel the expansion of the industry.

As per the estimates of the National Fire Protection Association (NFPA), 1,504,500 fires led to 13,250 injuries and 3,790 civilian deaths in 2022. Additionally, 96 on-duty firefighter deaths were reported in the same year. According to data from the WHO, road traffic accidents claim the lives of almost 1.3 million people annually. Similar to this, between 20 and 50 million non-fatal injuries are caused by automobile accidents each year, according to the Brake organization. These incidents frequently cause serious bleeding and other injuries, demanding immediate medical attention and surgical procedures to provide patients with immediate relief. Furthermore, there are several advantages of using an alginate dressing for advanced wound care, including durability, faster healing, reduced pain, lower risk of infection, adherence only to surrounding skin, ease of use, and cost-effectiveness.

Type Insights

Non-antimicrobial dominated the market in 2023. The segment’s dominance can be credited to the availability of products that are being used predominantly. In addition, the majority of companies provide low-cost products. However, with the development in technology, silver alginate dressing is gaining popularity, and thus, the use of non-antimicrobial alginate dressing is expected to decrease.

Antimicrobial is expected to register the fastest CAGR during the forecast period due to recent product launches and various studies on antimicrobial alginate dressing. For instance, in February 2022, Winner Medical received U.S. FDA market access for its silver alginate dressing. This is expected to help the company expand its business in the North America region, and thereby promote antimicrobial alginate dressing. As per the NCBI, antimicrobial alginate dressings are especially useful for managing severely leaking wounds because the addition of silver ions provides antibacterial properties, thereby healing wounds quickly. Therefore, the aforementioned factors are expected to help the segment grow.

Application Insights

Chronic wounds dominated the market in 2023. The rising incidence of diabetes and diabetic foot ulcers is a major factor driving the segment growth. For instance, according to ScienceDirect, more than 25% of diabetic patients may develop diabetic foot ulcers, and 20% of patients may require foot amputation. Moreover, as per the National Diabetes Statistics Report by the CDC, 37.3 million i.e., 11.2% of the U.S. population had diabetes. As per the CDC, nearly, about 96 million U.S. residents aged more than 18 years or older were expected to have prediabetes. Moreover, as per a similar source, 26.4 million people aged more than 65 years & above were estimated to have prediabetes. The use of alginate wound dressings helps such ulcers to heal, thus, with an increasing number of patients suffering from diabetes, and a rise in the prevalence of diabetic foot ulcers, the segment is expected to impel during the forecast period.

Acute wounds are projected to grow at the fastest CAGR over the forecast period. The surgical & traumatic wounds segment held the largest share in 2023. A rise in the number of surgical site infections is one of the major driving factors for the segment growth. Surgical wounds majorly occur due to Surgical Site Infections (SSIs). For instance, according to the Agency for Healthcare Research and Quality, SSIs occur in 2 to 4% of the total number of patients undergoing inpatient surgical procedures. In addition, according to a study by Wounds International, the incidence rate of SSIs in general surgery was found to be 11.7%, which resulted in 19.2% of patients being readmitted throughout the study period. Furthermore, the rising incidence of trauma is contributing to the segment growth.

For instance, as per a study by ResearchGate, in 2020, around 6.6% of mortality occurs due to trauma every year. Due to the increasing frequency of burn injuries, the burns segment is estimated to experience a considerable growth rate over the projection period. Around 90% of all fire-related trauma cases happen in low- to moderate-income nations. Moreover, according to the Joye Law Firm, there are roughly 3,500 fatal burn accidents each year in the U.S. and 450,000 burn injuries that need medical attention. Therefore, the rising prevalence of traumatic wounds and SSI & burn injuries are among the key factors anticipated to boost the segment growth over the forecast period.

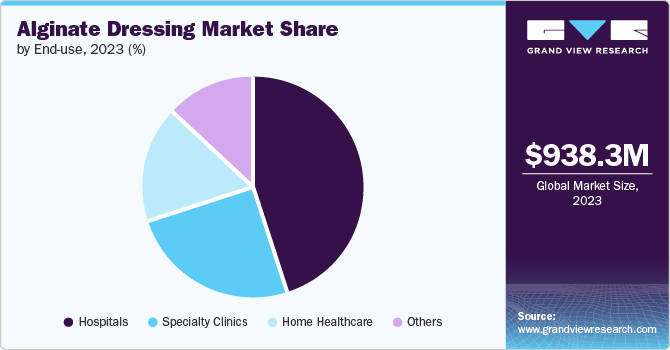

End-use Insights

Hospitals dominated the market in 2023. The dominance of this segment can be attributed to an increase in the patient population and a rise in the number of hospitals worldwide. For instance, as per Smith & Nephew, patients with wounds occupy between 25 and 40% of beds in a normal hospital setting. Moreover, an increase in the number of surgical procedures is further driving the segment growth. For instance, as per the latest statistics published by a research article in NCBI, a total number of 31,02,674 surgical procedures were carried out in England & Wales in 2020. Alginate dressings are commonly used for surgical incisions, thereby their adoption is likely to increase with the rising number of surgeries.

Home healthcare is expected to register the fastest CAGR during the forecast due to patients' increasing preference shift from hospital to home care settings for personalized wound care. Most of the surgeries require a prolonged recovery period, leading to frequent changing of dressings. Moreover, the geriatric population suffering from wounds prefers home care over hospital stays. The increasing geriatric population across the globe is expected to impel industry growth. For instance, as per the United Economic and Social Commission for Asia and the Pacific, the geriatric population is expected to reach 1.3 billion in 2050, from 630 million in 2020.13.6% of the Asian population is aged more than 65 years, which is expected to be one-quarter of the total geriatric population in 2050. Conditions, such as diabetic foot ulcers, venous leg ulcers, and surgical wounds typically necessitate extended hospital stays, which can be difficult for senior patients. Thereby boosting industry growth. Furthermore, due to the rising healthcare expenses, a growing number of individuals with chronic conditions prefer to obtain treatment at home. This trend is expected to surge the demand for alginate dressings, as they are used to treat, diagnose, and monitor a variety of chronic and acute wounds.

Regional Insights

North America's alginate dressing market held the largest share in 2023. The region’s dominance can be attributed to the increasing prevalence of chronic wounds, higher treatment costs, and the availability of appropriate reimbursement programs in the U.S. and Canada. According to an article published by the NCBI, the prevalence of diabetic foot ulcers among the population in the U.S. was roughly 13%. Moreover, it was also estimated that the yearly economic burden for venous leg ulcers in the U.S. was roughly USD 14.90 billion. Due to the large patient population suffering from chronic wounds, there is an increasing need for advanced wound care products, such as alginate dressings, thereby helping the region dominate the global industry.

U.S. Alginate Dressing Market Trends

The U.S. alginate dressing market dominated North America market in 2023. The growing elderly population prone to chronic wounds such as pressure ulcers and diabetic foot ulcers is driving the market growth.

Asia Pacific Alginate Dressing Market Trends

Asia Pacific is estimated to witness the fastest CAGR over the forecast period. The region is steadily increasing, offering several opportunities for the introduction of new products. Furthermore, medical tourism in this region is increasing, which is boosting the number of surgeries performed. For instance, as per a study conducted by the Indian Institute of Public Administration, in 2019, around 697,453 foreign tourists visited India for medical treatments. The market in this region is also expanding as a result of increased government backing as well as a focus by the leading players in the developing Asian nations. However, price sensitivity & lack of knowledge have significantly inhibited the expansion of advanced wound care management.

The India alginate dressing market held a substantial market share in 2023 driven by the increasing medical tourism in this region, which is boosting the number of surgeries performed. For instance, in 2023, around 635 thousand foreign tourists visited India for medical treatments.

Europe Alginate Dressing Market Trends

Europe's alginate dressing market was identified as a lucrative region in 2023. The main driving force is the aging population in the region, which is more prone to chronic wounds like pressure ulcers and diabetic foot ulcers. Moreover, the increasing number of long-term illnesses, such as diabetes and circulatory issues, highlight the need for successful wound care options.

Key Alginate Dressing Company Insights

Some of the key companies in the alginate dressing market include Cardinal Health, Smith & Nephew, Coloplast, Corp.,B. Braun SE, and other companies. To obtain a competitive advantage in the market, businesses are concentrating on growing their customer base. A

-

Smith & Nephew provides various alginate dressings. These dressings, made of seaweed-derived fibers, are used in wound care for their hemostatic, absorbent, and exuding abilities. Moreover, offers different formulas for a variety of wound types and stages of healing.

Key Alginate Dressing Companies:

The following are the leading companies in the alginate dressing market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- Smith & Nephew

- 3M

- Coloplast Corp.

- Convatec Inc.

- PAUL HARTMANN AG

- B. Braun SE

- Hollister Incorporated

- Mölnlycke Health Care AB.

- Medline Industries, Inc.

Alginate Dressing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 975.8 million

Revenue forecast in 2030

USD 1,244.7 million

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Cardinal Health; Smith & Nephew;3M; Coloplast Corp.; Convatec Inc.; PAUL HARTMANN AG; B. Braun SE; Hollister Incorporated; Mölnlycke Health Care AB.; and Medline Industries, Inc.;

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alginate Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alginate dressing market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Antimicrobial

-

Non-antimicrobial

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.