- Home

- »

- Consumer F&B

- »

-

Algae Protein Market Size, Share & Growth Report, 2030GVR Report cover

![Algae Protein Market Size, Share & Trends Report]()

Algae Protein Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Spirulina, Chlorella), Source (Freshwater Algae, Marine Algae), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-893-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Algae Protein Market Summary

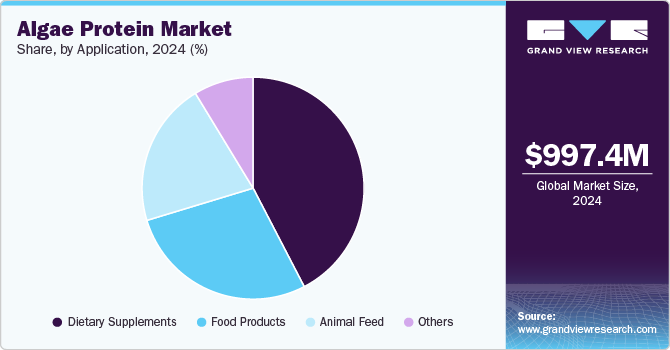

The global algae protein market size was estimated at USD 997.4 million in 2024 and is projected to reach USD 1,327.8 million by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The market has been witnessing significant growth, driven primarily by the increasing demand for plant-based protein sources and the rising focus on sustainable food solutions.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Argentina is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, spirulina accounted for a revenue of USD 563.7 million in 2024.

- Chlorella is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 997.4 Million

- 2030 Projected Market Size: USD 1,327.8 Million

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

Algae proteins are derived from various algae types, such as spirulina and chlorella, which are known for their high protein content, essential amino acids, and rich nutrient profile. As consumer preferences shift toward health-conscious and eco-friendly dietary options, algae protein has gained popularity as an alternative to traditional animal-based and other plant-based proteins.

One of the primary drivers behind the market's growth is the surge in vegan and vegetarian populations globally. According to various surveys, a substantial percentage of consumers are actively reducing or eliminating animal products from their diet due to concerns about health, sustainability, and animal welfare. Algae protein, being rich in essential nutrients, offers a complete protein source for these consumers, supporting the market's expansion. Furthermore, the ingredient's versatility makes it a popular choice in applications such as dietary supplements, functional foods, and beverages.

The market is also benefiting from increased research and development activities aimed at enhancing the nutritional profile and scalability of algae protein production. Several companies are investing in advanced extraction technologies and exploring new algae strains to improve protein yields and optimize costs. Innovations in production methods have made it easier to incorporate algae proteins into various products without compromising taste or texture, thereby broadening its acceptance in mainstream food and beverage categories.

In addition, the push for sustainability in food production has accelerated the adoption of algae protein. Algae cultivation has a significantly lower environmental footprint compared to traditional agriculture and animal farming, as it requires minimal land, water, and resources. This aligns well with global trends emphasizing sustainable practices and the need to reduce the food industry's carbon footprint. As a result, the algae protein market is expected to continue its upward trajectory, driven by the convergence of health, environmental, and technological factors.

Type Insights

The spirulina segment accounted for a revenue share of 53.6% of the global market in 2024. This dominance is primarily due to its rich nutritional profile, which includes high protein content, essential amino acids, vitamins, and antioxidants, making it a popular choice among health-conscious consumers. Spirulina's versatility has also made it a key ingredient in various applications such as dietary supplements, food additives, and functional beverages, further supporting its market growth.

The growing adoption of spirulina is also linked to its extensive use in the nutraceutical industry, where it is valued for its immune-boosting and anti-inflammatory properties. Additionally, as the demand for plant-based protein alternatives rises, spirulina's ability to provide a complete protein source has made it a preferred option among consumers seeking sustainable and nutrient-dense products. This has led to its widespread incorporation into protein powders, energy bars, and fortified snacks.

Another factor contributing to spirulina's leading revenue share is its relatively easier cultivation and higher yield compared to other algae types. The algae can be grown in controlled environments, including open ponds and photobioreactors, allowing producers to optimize production and ensure consistent quality. Companies have been leveraging this advantage to scale up production and meet the increasing demand for algae protein across various industries.

The chlorella segment is projected to grow at a CAGR of 4.9% from 2025 to 2030. This growth can be attributed to the rising awareness of the nutritional benefits associated with chlorella, which includes a high concentration of vitamins, minerals, and proteins. Known for its immune-boosting and detoxifying properties, chlorella is gaining popularity as a functional food ingredient and dietary supplement, catering to the growing demand for health and wellness products.

The increasing adoption of chlorella in various applications, such as functional foods, beverages, and dietary supplements, is further propelling market expansion. With consumers becoming more health-conscious and seeking natural sources of nutrition, chlorella has emerged as a preferred ingredient in plant-based products due to its complete protein profile and micronutrient density. Moreover, its versatility and compatibility with other ingredients make it an attractive option for manufacturers looking to develop innovative and nutrient-rich products.

Source Insights

Freshwater algae accounted for a market share of 68.5% of global revenues in 2024. This dominance can be attributed to the presence of widely popular alga types such as spirulina and chlorella, both of which are cultivated primarily in freshwater environments. These alga types are known for their high protein content, essential amino acids, and rich nutrient profiles, making them a preferred choice for various applications across the food, nutraceutical, and animal feed industries.

The superior nutritional value and easier cultivation of freshwater algae contribute significantly to their widespread adoption. Compared to marine algae, freshwater algae can be grown in controlled environments with relatively low production costs and fewer contamination risks, allowing manufacturers to maintain product quality and consistency. This has enabled the large-scale production of algae protein, meeting the increasing global demand for plant-based and sustainable protein sources.

The marina algae market is projected to grow at a CAGR of 4.6% from 2025 to 2030. This growth is driven by increasing recognition of the unique nutritional and functional benefits offered by marine algae varieties such as nori, kelp, and dulse. These algae are rich in essential nutrients like omega-3 fatty acids, dietary fiber, and bioactive compounds, making them a valuable addition to health supplements, food products, and cosmetics.

The rising demand for sustainable food ingredients and plant-based alternatives is fueling the adoption of marine algae across various industries. Marine algae are known for their unique composition, which includes high levels of iodine, antioxidants, and specific polysaccharides, contributing to health benefits such as improved thyroid function and enhanced immunity. As a result, manufacturers are increasingly incorporating marine algae into functional food and beverage products to cater to the growing health-conscious consumer base.

In addition, marine algae are gaining popularity in the cosmetics industry due to their skin-nourishing properties. The presence of bioactive compounds and antioxidants makes marine algae extracts ideal ingredients for anti-aging and skin-repair formulations, further driving their demand. The segment’s steady growth is supported by expanding research and development efforts to explore new applications and improve extraction techniques for marine algae.

Application Insights

The application of algae protein in dietary supplements accounted for a market share of 42.4% of global revenues in 2024. This strong market position is driven by the growing consumer demand for natural and plant-based protein sources in supplement form and the increasing focus on holistic health and wellness. Algae proteins, especially those derived from spirulina and chlorella, are valued for their high protein content, rich nutrient profile, and bioavailability, making them a preferred ingredient in the dietary supplement industry.

The popularity of algae-based dietary supplements is primarily attributed to their ability to provide a complete source of protein along with essential vitamins, minerals, antioxidants, and omega-3 fatty acids. Consumers seeking to enhance their nutritional intake are increasingly turning to algae supplements to support immune health, energy levels, and overall wellness. Additionally, algae protein supplements are widely consumed by athletes, fitness enthusiasts, and individuals following vegetarian or vegan diets, further driving their demand.

The application of algae protein in the food products market is projected to grow at a CAGR of 5.0% from 2025 to 2030. Algae protein is gaining traction in the food industry due to its high nutritional value, rich protein content, and sustainable production. As consumer preferences continue to shift toward healthier and eco-friendly dietary options, the inclusion of algae protein in various food formulations is becoming more prevalent.

One of the primary factors fueling this growth is the expanding vegan and flexitarian consumer base, which is seeking high-quality plant-based proteins to replace or supplement traditional protein sources. Algae protein is considered a complete protein, offering all essential amino acids, making it an ideal ingredient for a variety of food applications, such as protein bars, snacks, baked goods, and dairy alternatives. The increasing focus on protein fortification and clean-label products is pushing manufacturers to explore algae protein as an alternative that aligns with these consumer trends.

Furthermore, innovations in food processing technologies have enabled the use of algae protein in diverse food categories without compromising taste, texture, or visual appeal. For instance, algae protein’s neutral flavor profile allows it to be easily blended into plant-based meat alternatives and functional foods, enhancing its nutritional value while maintaining sensory attributes. As a result, food manufacturers are leveraging algae protein to create high-protein, nutrient-rich products that appeal to health-conscious consumers.

Regional Insights

The algae protein market in North America accounted for a share of 29.7% of the global market in 2024. The North American market is experiencing significant growth due to the rising consumer awareness of health and wellness, coupled with the increasing demand for sustainable and plant-based protein sources. Additionally, the trend toward veganism and the growing popularity of functional foods has bolstered the demand for algae proteins in a wide range of food and beverage applications. As a result, North America is one of the leading regions in terms of both production and consumption of algae protein products.

U.S. Algae Protein Market Trends

The U.S. algae protein market is projected to grow at a CAGR of 3.9% from 2025 to 2030. The market is characterized by high adoption rates of plant-based and alternative proteins, supported by a strong focus on nutritional supplements and health foods. Consumers are increasingly seeking high-quality, complete protein sources, propelling the demand for algae proteins derived from spirulina and chlorella. The dietary supplement segment holds a dominant share of the market, driven by the country's large nutraceutical sector and consumer preference for natural and sustainable protein options. Moreover, the growing trend toward personalized nutrition and clean-label products is encouraging manufacturers to incorporate algae proteins into diverse product formulations.

Europe Algae Protein Market Trends

The algae protein market in Europe is projected to grow at a CAGR of 4.7% from 2025 to 2030. In Europe, the algae protein market is expanding steadily, fueled by stringent regulations promoting sustainable and environmentally friendly food production. Consumers in the region are highly attuned to health and sustainability issues, making algae proteins an attractive choice for both dietary supplements and food applications. Countries like Germany, the UK, and France are at the forefront of this trend, with increasing investments in research and development to optimize algae cultivation and protein extraction. The European Union’s emphasis on sustainability and support for alternative protein research has also accelerated the commercialization of algae protein across multiple sectors, including food, beverages, and animal feed.

The UK algae protein market accounted for a revenue share of 21.8% of the European market in 2024. The UK market is witnessing robust growth, driven by the rising adoption of plant-based diets and the increasing popularity of veganism. With a large segment of consumers actively seeking sustainable and nutrient-rich protein sources, algae proteins are gaining traction in both the dietary supplement and functional food markets. The country’s well-developed health food sector and the growing trend of incorporating algae into innovative food products have further supported market expansion. Additionally, the push for reducing the environmental impact of food production aligns well with the sustainability credentials of algae protein, making it a preferred choice among UK consumers.

The algae protein market in Germany is projected to grow at a CAGR of 4.4% from 2025 to 2030. Germany is emerging as a key player in the European algae protein market, supported by a strong focus on innovation and sustainability. The country has a well-established plant-based food sector and is home to several startups and research institutions dedicated to developing alternative protein solutions. German consumers are known for their preference for high-quality, sustainable, and health-oriented products, making algae protein an appealing option. The country's commitment to environmental sustainability and reduction of carbon footprints in food production has further encouraged the adoption of algae-based proteins in dietary supplements, functional foods, and beverages.

Asia Pacific Algae Protein Market Trends

The Asia Pacific algae protein market accounted for a revenue share of 22.4% of the global market in 2024. The Asia Pacific market is poised for rapid growth, driven by the region's increasing focus on health and wellness, coupled with a strong tradition of algae consumption in various forms. Countries like China and Japan have long histories of incorporating algae into their diets, which has facilitated the acceptance of algae proteins in modern applications such as supplements and functional foods. The rising disposable incomes, growing health consciousness, and a shift towards plant-based diets are further boosting the demand for algae protein in the region. In addition, the expanding food and beverage industry in key markets is creating new opportunities for algae protein manufacturers to introduce innovative product formulations.

The algae protein market in China accounted for a share of 34.3% of the Asia Pacific market in 2024. China is one of the fastest-growing markets for algae protein in the Asia Pacific region, supported by a well-developed aquaculture industry and a strong emphasis on health and wellness. The country’s large population, combined with increasing consumer spending on health supplements and functional foods, has created a fertile ground for the growth of algae protein products. Moreover, the Chinese government’s push for sustainable and eco-friendly food solutions has spurred investments in algae cultivation and protein production, making China a key player in the global algae protein market. The country is also a significant producer and exporter of spirulina and chlorella, further strengthening its position in the industry.

Japan algae protein market is projected to grow at a CAGR of 4.7% from 2025 to 2030. Japan has a longstanding tradition of algae consumption, which has paved the way for the acceptance and growth of algae protein in modern food and nutraceutical applications. The country’s algae protein market is supported by high consumer awareness of the health benefits associated with algae, including its high protein content and rich nutrient profile. Spirulina and chlorella are widely used in dietary supplements, functional foods, and beverages, catering to the health-conscious aging population. Additionally, Japanese companies are investing in research and development to explore new applications of algae protein in cosmetics and personal care products, further broadening the market’s scope.

Central & South America Algae Protein Market Trends

The algae protein market in Central and South America is projected to grow at a CAGR of 5.5% from 2025 to 2030. The algae protein market in Central & South America is gradually expanding, driven by growing health awareness and the rising demand for alternative protein sources. Brazil and Argentina are key markets in the region, with increasing interest in plant-based diets and sustainable food solutions. The region’s diverse climate and availability of natural resources also support the cultivation of algae, providing opportunities for local production. However, the high cost of algae protein compared to traditional protein sources poses a challenge, limiting its widespread adoption. Nevertheless, ongoing efforts to reduce production costs and improve supply chain efficiencies are expected to boost the market in the coming years.

Middle East & Africa Algae Protein Market Trends

The Middle East & Africa algae protein market is projected to grow at a CAGR of 6.3% from 2025 to 2030. The Middle East algae protein market is in its nascent stages but is showing potential for growth due to the region’s focus on food security and sustainability. Countries like the United Arab Emirates and Saudi Arabia are investing in alternative protein solutions, including algae, to address food production challenges and reduce dependency on imports. The region’s interest in algae protein is also fueled by the growing health and wellness trend, with consumers seeking natural and nutrient-rich food options. While the high production costs and limited consumer awareness currently hinder market growth, initiatives to promote sustainable agriculture and local algae production are likely to create new opportunities in the future.

Key Algae Protein Company Insights

The competitive landscape of the market is characterized by the presence of a mix of established players, emerging startups, and regional companies, all vying to capture a share of this rapidly growing segment. The market is driven by increasing consumer demand for sustainable and plant-based protein sources, pushing companies to innovate and diversify their product portfolios to meet evolving preferences.

Companies in the market are focusing on expanding their production capacities and enhancing their R&D efforts to develop innovative products and improve the nutritional profiles of their offerings. Strategic partnerships and collaborations are also common, as companies aim to strengthen their supply chains and optimize production processes. For instance, several players are investing in improving microalgae cultivation techniques and harvesting methods to reduce production costs and ensure consistent product quality.

Key Algae Protein Companies:

The following are the leading companies in the algae protein market. These companies collectively hold the largest market share and dictate industry trends.

- Corbion

- Cyanotech Corporation

- Earthrise Nutritional

- Far East Bio-Tec Co. Ltd.

- E.I.D-Parry Limited

- ENERGY Bit Inc.

- Rainbow Light

- NOW Foods

- Prairie Naturals

- Vimergy LLC

Recent Developments

-

In June 2024, Brevel, Ltd., a company specializing in microalgae protein, inaugurated its first commercial facility. Spanning 27,000 square feet (approximately 2,500 square meters), this new plant is equipped to produce substantial quantities of microalgae protein powder, catering to the rapidly growing global alternative protein market. The protein produced is clean, non-GMO, and environmentally friendly, representing a significant advancement in providing a commercially viable solution for alternative protein sources.

-

On June 4, 2024, Brevel announced the opening of its commercial facility in southern Israel, designed to produce hundreds of tons of neutral-tasting, highly functional algae protein. The company asserts that this product has the potential to rival pea and soy protein. This facility will produce a consistent supply of a white powdered microalgae protein concentrate containing 60-70% protein, along with various high-value co-products. Brevel’s protein offers advantages over soy and pea protein in terms of flavor and color, while also being non-allergenic and significantly more sustainable regarding water and land use, as well as carbon dioxide emissions

Algae Protein Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.05 billion

Revenue forecast in 2030

USD 1.33 billion

Growth Rate

CAGR of 4.8% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD Million/ Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia; Brazil; Argentina; South Africa

Key companies profiled

Corbion; Cyanotech Corporation; Earthrise Nutritional; Far East Bio-Tec Co. Ltd.; E.I.D-Parry Limited; ENERGY Bit Inc.; Rainbow Light; NOW Foods; Prairie Naturals; Vimergy LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Algae Protein Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global algae protein market report based on the type, source, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Spirulina

-

Chlorella

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Freshwater Algae

-

Marine Algae

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Food Products

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global algae protein market size was estimated at USD 997.4 million in 2024 and is expected to reach USD 1,052.4 million in 2024.

b. The global algae protein market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 20230 to reach USD 1.33 billion by 2030.

b. North America dominated the algae protein market, with a revenue share of over 29.5% in 2024. The market is experiencing significant growth due to rising consumer awareness of health and wellness and the increasing demand for sustainable and plant-based protein sources.

b. Some key players operating in the algae protein market include Corbion; Cyanotech Corporation; Earthrise Nutritional; Far East Bio-Tec Co., Ltd.; E.I.D. - Parry Limited; ENERGYbits Inc.; Rainbow Light; NOW Foods; Prairie Naturals; and Vimergy LLC.

b. Key factors that are driving the market growth include increasing consumption of protein products across the world, owing to changing lifestyles and rising health consciousness among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.