- Home

- »

- Beauty & Personal Care

- »

-

Alcohol Wipes Market Size, Share And Growth Report, 2030GVR Report cover

![Alcohol Wipes Market Size, Share & Trends Report]()

Alcohol Wipes Market (2024 - 2030) Size, Share & Trends Analysis Report By Fabric Material (Natural, Synthetic), By End-use (Personal & Household, Commercial), By Distribution Channel (Online, Convenience Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-802-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alcohol Wipes Market Summary

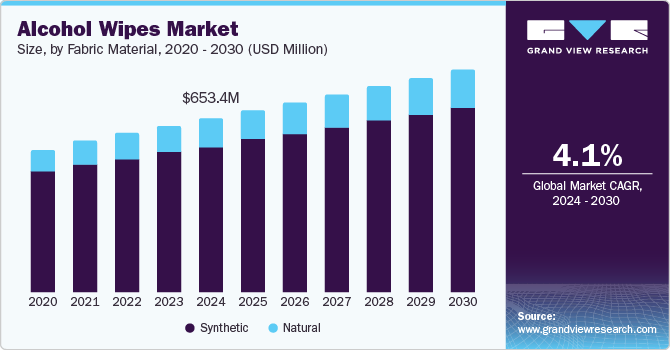

The global alcohol wipes market size was valued at USD 653.4 million in 2023 and is expected to reach USD 870.6 million by 2030, registering a CAGR of 4.1% from 2024 to 2030. The growth is attributed to the versatile application and high demand for the product from the healthcare industry.

Key Market Trends & Insights

- The North America dominated the global market with 40.2% share in 2023.

- By fabric material, synthetic segment dominated the market with 83.8% share in 2023.

- By end-use, the commercial segment dominated the market in 2023.

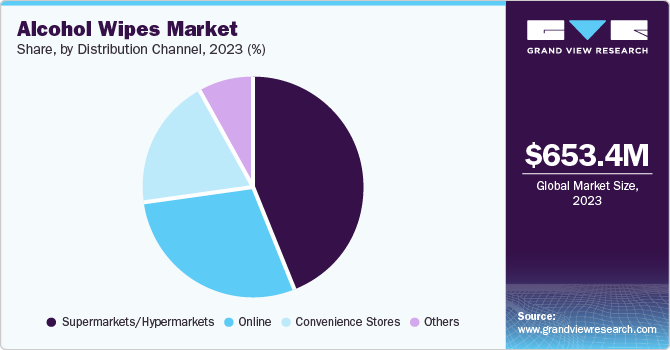

- By distribution channel, supermarkets/hypermarkets segment dominated the market with a share of 44.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 653.4 Million

- 2030 Projected Market Size: USD 870.6 Million

- CAGR (2024-2030): 4.1%

- North America: Largest market in 2023

Alcohol is an excellent solvent that easily dissolves dirt, oil, and microorganisms. It is an effective disinfectant that provides instant drying. These properties are anticipated to collectively drive market adoption in wipes manufacturing.Furthermore, the heightened awareness has led to a sustained demand for alcohol wipes, which have been increasingly valued for their effectiveness in eliminating bacteria, viruses, and other pathogens. The healthcare sector, in particular, has witnessed a significant uptick in the use of alcohol wipes for sanitizing medical equipment and preparing skin for injection, underscoring their critical role in infection control. These wipes in hospitals are widely used to clean and sanitize patient rooms, ICUs, medical equipment, and more. Alcohol wipes aid in disinfection and avoid the spreading of bacteria and Hospital Acquired Infections (HAIs). Furthermore, the increased adoption of alcohol wipes in basic routines such as makeup removal, skin cleansing, furniture cleaning, and more has propelled a significant market surge.

Another significant factor propelling the market is the convenience and portability of alcohol wipes. These products are easy to carry and use, making them ideal for on-the-go disinfection needs. This convenience has broadened their application beyond healthcare settings to everyday use in households, offices, and public spaces. The versatility of alcohol wipes in disinfecting various surfaces, from smartphones to door handles, has made them a staple in maintaining personal and public hygiene.

Moreover, wet wipes with alcohol concentration above 60% fall under the category of alcohol wipes. Consumers use the product for pain relief in case of insect bites, minor burns, and scratches as alcohol disinfects the affected area and eases the pain. Ingredients such as isopropyl help prevent the growth of various microorganisms, such as diarrhea virus, hepatitis B and C, mycobacterium tuberculosis, and Human HIV-1. The wipes are used for cleaning dust in homes and offices and to cleanse the skin of acne-causing bacteria.

In addition, innovations such as eco-friendly wipes made from recycled materials and those with added skin-friendly ingredients including aloe vera have catered to the growing consumer demand for sustainable and gentle products. These advancements enhance the functionality of alcohol wipes and align with the increasing consumer preference for environmentally responsible products.

Fabric Material Insights

Synthetic alcohol wipes dominated the market with 83.8% share in 2023. These wipes are made from polyester, polypropylene, rayon, and specialty materials such as bi-component fibers and nanofibers which offer superior durability, absorbency, and softness. These material properties make synthetic fabrics ideal for alcohol wipes, ensuring they are effective in cleaning and disinfecting while being gentle on the skin. The durability of synthetic materials provides a reliable and consistent user experience. The softness of the fabric plays a major role in driving the commercial application of the product, especially for cleaning screens, delicate glass equipment, and gadgets. In addition, compared to natural materials, synthetic options are generally more affordable to produce, which helps manufacturers keep production costs low and maintain competitive pricing in the market

Natural alcohol wipes are expected to grow at the fastest CAGR during the forecast period owing to their biodegradability and environmental impact. Growing preference for green products is anticipated to encourage manufacturers to develop biodegradable and environmentally friendly products. Additionally, the demand for disposable wipes is anticipated to witness growth owing to stringent government regulations to boost the usage of biodegradable wipes. Furthermore, compared to synthetic materials, natural fabrics do not emit toxic gases when burned, which makes them safe for use.

End-use Insights

The commercial segment dominated the market in 2023. The market surge can be attributed to rising demand from businesses across various sectors, including hospitality, retail, and transportation. These industries have widely adopted alcohol wipes to align with stringent cleaning protocols and ensure the safety of employees and consumers. Furthermore, the high adoption of these wipes from hospitals and clinics to maintain hygiene in critical areas such as Intensive Care Units (ICUs) and Operation Theaters (OTs) is anticipated to bode well for the segment growth.

The personal and household segment is projected to grow at a CAGR of 3.7% during the forecast period owing to the heightened awareness about hygiene and sanitation among consumers. This increased awareness has led to a surge in demand for alcohol wipes for everyday makeup removal routine, and household cleaning tasks, such as disinfecting surfaces, cleaning electronic devices, and maintaining personal hygiene. The portability and ready-to-use nature of these wipes enable easy storage. In addition, major companies such as The Clorox Company, 3M, and others have launched a variety of products, manufactured with natural ingredients and added fragrances to improve their market penetration.

Distribution Channel Insights

Supermarkets/hypermarkets dominated the market with a share of 44.4% in 2023. The market growth is attributable to the convenience and availability of a wide range of alcohol wipes in these retail outlets. This extensive product range caters to diverse consumer preferences, from different brands to various packaging sizes, making it easier for shoppers to find products that meet their specific needs. Additionally, the frequent promotional offers, discounts, and loyalty programs provided by supermarkets and hypermarkets make alcohol wipes more affordable and appealing to a broader consumer base.

Online distribution channels are projected to grow during the forecast period. This market growth can be credited to the rising adoption of online selling and growth in the e-commerce sector. Online channels help consumers easily browse, compare, and purchase alcohol wipes from the comfort of their homes. The ability to access a wide range of products and brands online has empowered consumers to make informed purchasing decisions, further boosting the demand for alcohol wipes through this channel. Companies have increasingly leveraged online platforms to reach a broader audience, utilizing targeted advertisements, social media campaigns, and influencer partnerships to promote their products. Additionally, the integration of user reviews and ratings on e-commerce websites provides valuable feedback to potential buyers, enhancing their confidence in purchasing these products online.

Regional Insights

The North America alcohol wipes market dominated the global market with 40.2% share in 2023 owing to the growing product demand for personal hygiene and household cleaning. The rising awareness regarding cleanliness and hygiene has resulted in increased demand for disinfectant products such as alcohol wipes, surface disinfectants, and more. Furthermore, increased usage of alcohol wipes in hospitals to clean rooms and equipment aid in the market growth.

U.S. Alcohol Wipes Market Trends

Key factors driving the alcohol wipes market in the U.S. include robust retail infrastructure in the country, i.e. a wide network of supermarkets, hypermarkets, and online retail platforms. These distribution channels have made alcohol wipes easily accessible to consumers, contributing to their widespread adoption. The convenience of purchasing alcohol wipes both in-store and online has played a crucial role in driving market growth.

Asia Pacific Alcohol Wipes Market Trends

The Asia Pacific (APAC) alcohol wipes market held 39.5% share in 2023. The growth can be attributed to rising consumer awareness and development of the healthcare industry. Increasing healthcare expenditure in both public and private sectors is projected to bode well for the regional demand for alcohol wipes. Moreover, increasing per capita incomes in developing economies such as India and China have significantly supported regional market growth.

Europe Alcohol Wipes Market Trends

The Europe alcohol wipes market held 15.4% of the market share in 2023 due to the growth in the healthcare sector and rising awareness regarding hygiene and disinfection. Hospitals have increasingly used alcohol wipes to avoid bacteria contamination and HAIs. The increased adoption of alcohol wipes in households has further aided in the market growth in this region. Additionally, European manufacturers have continually developed new formulations with eco-friendly and biodegradable wipes and packaging solutions to enhance the efficacy and user experience of alcohol wipes.

Key Alcohol Wipes Company Insights

The global alcohol wipes market is fragmented. Some of the major companies in the market are Cardinal Health, CleanFinity Brands, Pal International, and others. These companies have primarily focused on R&D activities to improve product quality for better market penetration. They have focused on expanding their product portfolio with the integration of biodegradable ingredients, mergers & acquisitions, and collaborations.

-

Pal International specializes in single-use hygiene and infection control products. The company has grown to become a market leader in providing high-quality wipes, workwear, and other hygiene solutions for the healthcare, food and beverage, and industrial sectors. They are committed to innovation and sustainability, passing ISO standards and starting work on a new production facility.

Key Alcohol Wipes Companies:

The following are the leading companies in the alcohol wipes market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- CleanFinity Brands

- Pal International

- Vernacare Ltd.

- The Clorox Company

- GAMA Healthcare Ltd.

- Whitminster International

- Diamond Wipes International Inc

- Clarisan

- 3M

Recent Development

-

In May 2022, GOJO Industries announced its surface hygiene portfolio’s further expansion by introducing PURELL Healthcare Surface Disinfecting Wipes. These are hospital-grade wipes and offer quick kill times and broad-spectrum efficacy.

Alcohol Wipes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 684.4 million

Revenue forecast in 2030

USD 870.6 million

Growth Rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fabric material, end-use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Argentina, South Africa, UAE.

Key companies profiled

Cardinal Health; CleanFinity Brands; Pal International; Vernacare Ltd.; The Clorox Company; GAMA Healthcare Ltd.; Whitminster International; Diamond Wipes International Inc; Clarisan; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alcohol Wipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alcohol wipes market report based on fabric material, end-use, distribution channel, and region.

-

Fabric Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal & Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Convenience Stores

-

Supermarkets/Hypermarkets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.