- Home

- »

- Consumer F&B

- »

-

Alcohol Ingredients Market Size And Share Report, 2030GVR Report cover

![Alcohol Ingredients Market Size, Share & Trends Report]()

Alcohol Ingredients Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Enzymes, Yeast, Colorants, Flavors & Salts), By Application (Beer, Spirits, Wine), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-078-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Alcohol Ingredients Market Summary

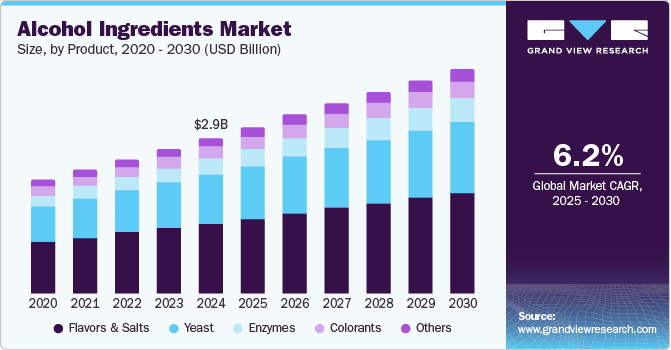

The global alcohol ingredients market size was valued at USD 2.91 billion in 2024 and is projected to reach USD 4.21 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The increasing global alcohol consumption, particularly in emerging economies, is a major driver.

Key Market Trends & Insights

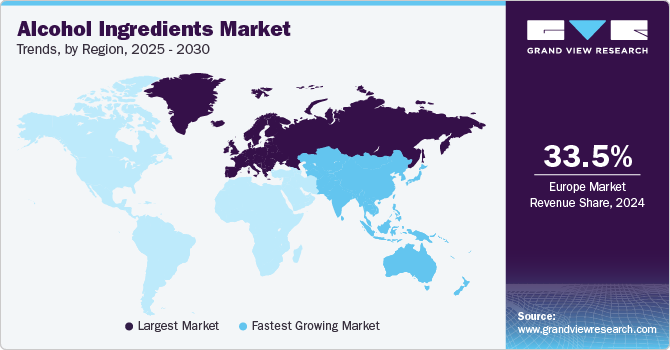

- Europe dominated the market with a revenue share of 33.5% in 2024.

- Based on product, flavors & salts dominated the market with the largest revenue share of 45.4% in 2024.

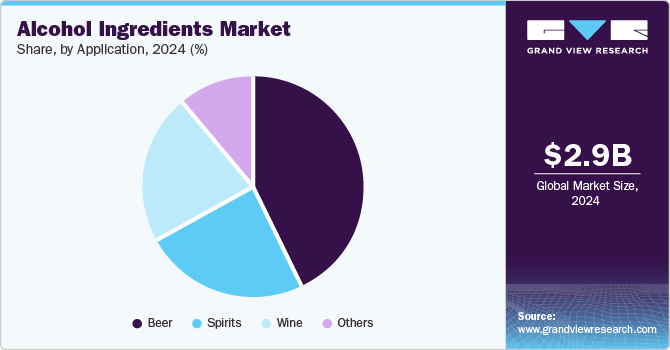

- Based on application, beer dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.91 Billion

- 2030 Projected Market Size: USD 4.21 Billion

- CAGR (2025-2030): 6.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

As more people adopt Western lifestyles and urbanization accelerates, the demand for alcoholic beverages rises. The growing popularity of craft beer and premium spirits also caters to evolving consumer tastes and preferences. The expansion of the hospitality sector, including pubs, bars, and breweries, also contributes to the market growth. Furthermore, advancements in ingredient technology, such as the development of new flavors and sustainable production methods, enhance the appeal of alcoholic beverages.

There is a growing interest in unique and exotic flavors, prompting manufacturers to experiment with new ingredients and formulations. The rise of health-conscious consumers has led to a demand for low-calorie, low-alcohol, and alcohol-free beverages, spurring growth in natural and organic ingredients. Additionally, technological advancements in production processes, such as precision fermentation and sustainable sourcing methods, contribute to market expansion. The influence of social media and digital marketing also plays a significant role in promoting new alcohol products and ingredients, reaching a broader audience, and driving market growth.

Product Insights

Flavors & salts dominated the market with the largest revenue share of 45.4% in 2024. The increasing demand for unique and exotic flavors in alcoholic beverages, such as craft beers and specialty cocktails, has significantly boosted the market. Flavors and salts are essential in enhancing beverages' taste profiles and overall sensory experience, making them highly sought after by both manufacturers and consumers. Additionally, the growing trend of premiumization in the alcohol industry, where consumers are willing to pay more for high-quality and innovative products, further supports the dominance of this segment.

Enzymes is expected to grow at the fastest CAGR of 7.4% over the forecast period. Enzymes play a crucial role in the production process of alcoholic beverages, aiding in fermentation and improving efficiency. It helps break down complex molecules into simpler ones, enhancing the final product's flavor, texture, and clarity. The increasing demand for high-quality, consistent, and flavorful alcoholic beverages has led to greater adoption of enzymes in the production process. Additionally, advancements in enzyme technology, leading to more effective and specific enzyme formulations, further boost their application in the alcohol industry.

Application Insights

Beer dominated the market with the largest revenue share in 2024. This dominance is driven by beer's longstanding popularity and widespread global consumption. The craft beer movement has significantly contributed to this growth, with consumers increasingly seeking unique and locally brewed options. The rising trend of premium and flavored beers has expanded the market, appealing to a broader demographic. The presence of major breweries and the continuous innovation in brewing techniques and ingredients also play a crucial role.

The spirit segment is expected to grow at the fastest CAGR over the forecast period. This rapid expansion is driven by the increasing demand for premium and craft spirits, as consumers seek unique, high-quality alcoholic beverages. The rising trend of cocktail culture and mixology, particularly among younger demographics, further boosts the market for spirits. Additionally, the innovation in flavors and the introduction of new and exotic spirit variants appeal to a broad range of consumers. The growing popularity of spirits in emerging markets also contributes to this robust growth.

Regional Insights

Europe's alcohol ingredients market dominated, with a revenue share of 33.5% in 2024. The region's rich tradition in alcoholic beverages, including renowned beer, wine, and spirits, drives the demand for high-quality ingredients. European consumers' preference for premium and craft beverages further boosts the market. Additionally, the presence of major alcohol manufacturers and ingredient suppliers in the region enhances market growth. The trend towards natural and organic ingredients aligns with the European market's emphasis on quality and sustainability.

North America Alcohol Ingredients Market Trends

The North American alcohol ingredients market was identified as a lucrative region in 2024 owing to the rising demand for premium craft spirits, a significant driver as consumers increasingly seek unique and high-quality alcoholic beverages. This trend is fueled by an increase in disposable income and a growing desire for better-quality alcohol. Additionally, brand awareness among consumers and a significant rise in per capita spending contribute to the market's expansion. The craft spirits movement, particularly among younger demographics, is also crucial in driving demand.

The U.S. alcohol ingredients market is expected to grow significantly over the forecast period. The growing preference for craft spirits and artisanal products is a major factor, with consumers showing a keen interest in authenticity and quality. The rise of microbreweries and the increasing inclination towards experiential drinking further stimulate market growth. The trend towards premiumization, where consumers are willing to spend more on high-end products, also contributes to the market's expansion. Additionally, the popularity of ready-to-drink (RTD) alcoholic beverages is boosting demand for alcohol ingredients.

Asia Pacific Alcohol Ingredients Market Trends

Asia Pacific alcohol ingredients market is expected to grow at the fastest CAGR of 6.9% over the forecast period. The region's large population base and increasing acceptance of socializing places such as bars and pubs contribute to the rising alcohol consumption. The growing trend of alcohol consumption among the younger generation is also a key driver. Additionally, rising disposable income and economic development in emerging countries such as China, India, and South Korea fuel market growth. The demand for traditional ingredients like yeast, enzymes, and exotic fruits to cater to regional preferences also drives the market. Health consciousness leads to the growth of low-alcohol and herbal-infused beverages, further expanding the market.

Key Alcohol Ingredients Company Insights

Some key companies in the alcohol ingredients market include Treatt Plc, AngelYeast Co., Ltd., Biospringer, Givaudan Novozymes A/S, and others. Companies are launching new products to meet increasing consumer demand, and many are pursuing new launches, mergers, and acquisitions to stay competitive.

-

Treatt Plc is a leading global supplier of flavor and fragrance ingredients, with a strong presence in the alcohol ingredients market. Its extensive portfolio includes over 3,000 products, ranging from natural extracts and bespoke blends to price-stable synthetics.

-

AngelYeast Co., Ltd. is a prominent player in the yeast and yeast extract industry, offering a wide range of products for the alcohol ingredients market. Its portfolio includes baker's yeast, brewing/distilling yeast, yeast extracts, and biological feeding additives.

Key Alcohol Ingredients Companies:

The following are the leading companies in the alcohol ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Treatt Plc

- AngelYeast Co., Ltd.

- Biospringer

- Givaudan Novozymes A/S

- ADM

- Sensient Technologies Corporation

- Döhler GmbH

- Ashland

- Kerry Group plc.

Recent Developments

-

In September 2024, IFF introduced DIAZYME NOLO, a revolutionary enzyme solution to optimize the production of no- and low-alcohol (NOLO) beverages. This innovation enhances taste and operational efficiency while minimizing capital expenditures.

Alcohol Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.11 billion

Revenue forecast in 2030

USD 4.21 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, South Africa, UAE

Key companies profiled

Treatt Plc; AngelYeast Co., Ltd.; Biospringer; Givaudan Novozymes A/S; ADM; Sensient Technologies Corporation; Döhler GmbH; Ashland; Kerry Group plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alcohol Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global alcohol ingredients market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Yeast

-

Enzymes

-

Colorants

-

Flavors & Salts

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beer

-

Spirits

-

Wine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.