- Home

- »

- Plastics, Polymers & Resins

- »

-

Airless Packaging Market Size, Share & Growth Report, 2030GVR Report cover

![Airless Packaging Market Size, Share & Trends Report]()

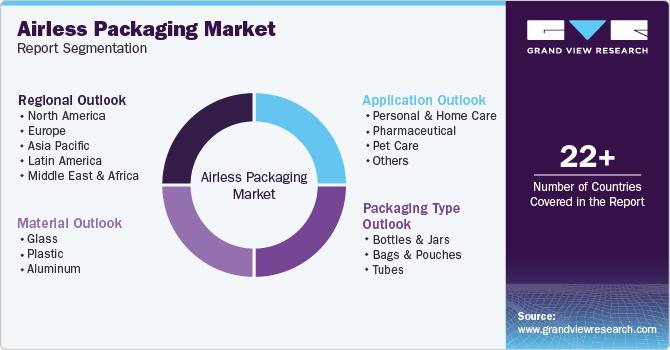

Airless Packaging Market Size, Share & Trends Analysis Report By Application (Personal & Home Care), By Packaging Type (Bags & Pouches, Bottles & Jars), By Material (Glass, Aluminum), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-924-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Airless Packaging Market Size & Trends

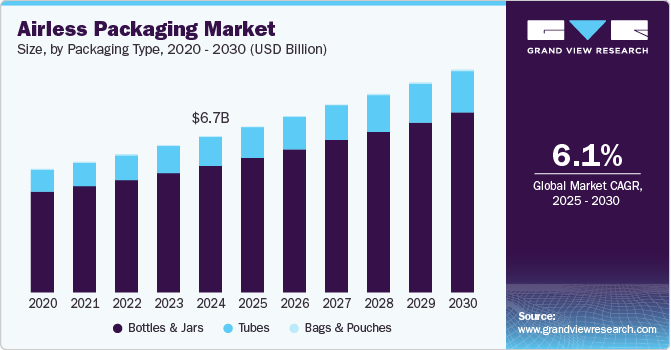

The global airless packaging market size was valued at USD 6.69 billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2030. This growth is attributed to the rising consumer awareness of hygiene and contamination-free packaging solutions significantly boosts demand, particularly in the personal care and cosmetics sectors. In addition, airless packaging extends product shelf life and prevents wastage, appealing to brands focused on quality and sustainability. Furthermore, the growing preference for compact and portable packaging and technological advancements enhance its adoption across various industries, including healthcare and food & beverages.

Airless packaging has emerged as a premium solution primarily utilized in the beauty, cosmetics, and medical sectors, where it is often associated with luxury products. The integration of airless technology into squeezable plastic tubes is rising, which is expected to stimulate further demand for natural, organic, and high-end skincare items. This trend is particularly notable in developing countries, where the growing appetite for upscale products propels the airless packaging market forward. Airless packaging enhances product longevity and reduces waste by preventing air from coming into contact with the formulations inside.

The rising global demand for prestige products has further accelerated the growth of the airless packaging market, particularly within the personal care sector. In regions such as Africa and the Middle East, there has been a notable increase in sales of beauty and haircare items, which is expected to continue driving market expansion. Furthermore, modernization and rising per capita incomes in developing nations fuel interest in homecare products, thereby increasing the demand for airless packaging technology. Factors such as the need for improved packaging solutions and the growing adoption of airless systems are key drivers of market growth.

Airless packaging extends product shelf life and offers numerous benefits, including enhanced protection, formula stability, controlled dispensing, and a premium brand image. Using high-quality materials like plastics and glass for manufacturing these packages has significantly improved product quality. As consumers increasingly seek sustainable options, the features provided by airless packaging are anticipated to boost its market presence in various industries further.

Packaging Type Insights

Bottles & Jars led the market and accounted for the largest revenue share of 81.3% in 2024. Their versatility and aesthetic appeal primarily drive this growth. These highly customizable containers offer options such as spray paint, foil stamping, and frosted finishes, which enhance the visual appeal of high-end cosmetic products. In addition, their ability to maintain product integrity while preventing contamination makes them a preferred choice for premium skincare and cosmetic items. Furthermore, the rising demand for luxurious packaging further drives this segment's expansion as brands seek to elevate consumer experience and satisfaction.

The bags & Pouches segment is expected to grow at a CAGR of 6.7% over the forecast period. Consumers increasingly favor lightweight, portable, and convenient packaging solutions. In addition, airless pouches are particularly appealing because they minimize product waste and extend shelf life by preventing air exposure. Furthermore, this segment benefits from the trend toward sustainable packaging, as many pouches are made from recyclable materials. Moreover, the adaptability of bags and pouches for various product types, including liquids and powders, enhances their market presence, catering to the evolving preferences of consumers in the personal care and food sectors.

Material Insights

Plastic materials dominated the market and accounted for the largest revenue share of 63.4% in 2024. This growth is attributed to their lightweight, cost-effective, and versatile nature. Plastic, particularly resins like PE, PET, and PMMA, is favored for its ease of molding and durability, making it suitable for various applications in cosmetics and pharmaceuticals. In addition, the increasing demand for convenience and travel-friendly packaging further propels the use of plastic, as it helps maintain product integrity while extending shelf life by preventing oxidation. Furthermore, the trend towards preservative-free formulations aligns with plastic's ability to isolate products from external contaminants.

Aluminum materials are expected to grow at a CAGR of 6.4% over the forecast period, owing to their recyclability and sustainability benefits. As consumers become more environmentally conscious, aluminum packaging offers an attractive alternative to traditional plastic options. In addition, its lightweight nature reduces transportation costs and carbon footprints while maintaining product protection against light and air. Innovations in aluminum airless systems, such as those aimed at achieving 100% recyclability, also cater to the growing demand for sustainable packaging solutions. Furthermore, this shift is supported by regulatory initiatives promoting reduced environmental impact, further driving the adoption of aluminum in airless packaging applications.

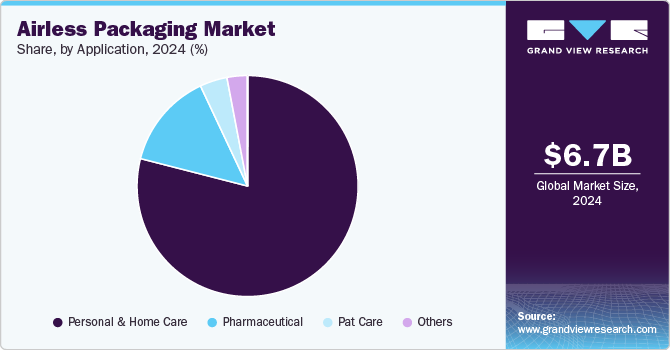

Application Insights

Personal & Home Care applications led the market and accounted for the largest revenue share of 78.8% in 2024. This growth is attributed to increasing consumer demand for hygiene and product integrity. Airless packaging effectively protects formulations from contamination and oxidation, enhancing the longevity and efficacy of personal care products like lotions, creams, and hair care items. In addition, the rise in premium skincare and cosmetic products fuels this segment, as brands seek innovative packaging solutions that convey luxury and quality. Furthermore, the convenience of airless dispensers also appeals to consumers looking for efficient, user-friendly options in their daily routines.

The pet care applications are expected to grow at the fastest CAGR of 6.9% over the forecast period, owing to a rising awareness of pet health and wellness. Pet owners increasingly seek high-quality grooming products and supplements that require effective preservation against air exposure. Furthermore, as the pet care market expands with premium offerings, brands are adopting airless solutions to enhance their product appeal and meet consumer expectations for safety and efficacy in pet care formulations.

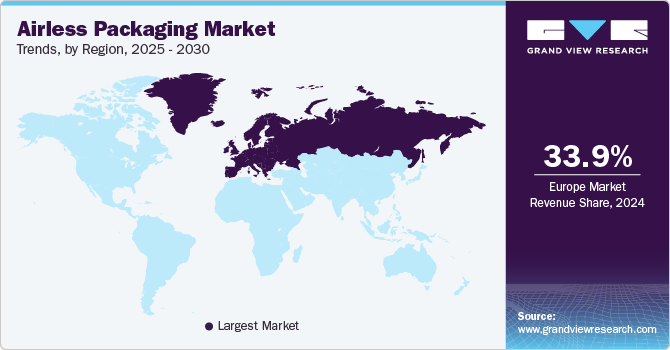

Regional Insights

The airless packaging market in Europe dominated the global market and accounted for the largest revenue share of 33.9% in 2024. This growth is attributed to the booming beauty and cosmetics industry and increasing consumer demand for sustainable and luxury packaging solutions. In addition, manufacturers focus on reducing product waste and enhancing shelf life, aligning with the rising trend of environmentally conscious consumerism. Furthermore, innovative designs and advanced technology in airless packaging attract investments from leading cosmetic brands to capture market share effectively.

Germany airless packaging market dominated the European market and accounted for the largest revenue share in 2024, owing to its strong pharmaceutical and cosmetic sectors. In addition, the country is home to several leading manufacturers who are investing in high-quality airless solutions that prevent contamination and extend product longevity. The German consumer base also shows a growing preference for eco-friendly packaging options, further fueling demand. Moreover, emphasizing reducing waste and enhancing product usability aligns well with Germany's sustainability goals, making it a key player in the European airless packaging landscape.

Asia Pacific Airless Packaging Market Trends

The airless packaging market in the Asia Pacific is expected to grow at a CAGR of 6.7% from 2025 to 2030. This growth is attributed to the rising disposable incomes and changing consumer preferences towards premium products. In addition, countries like India and Japan are increasingly adopting airless technologies in cosmetics and personal care items, driven by a younger demographic that values quality and sustainability. Moreover, heightened awareness about environmental issues prompts manufacturers to innovate with recyclable materials in their packaging solutions, thus fostering regional market expansion.

China airless packaging market dominated the Asia Pacific market and accounted for the region’s largest revenue share of 36.0% in 2024, driven by its vast cosmetics industry. In addition, the growing demand for high-quality skincare products has led to increased adoption of airless packaging solutions that ensure product integrity and longevity. Furthermore, Chinese consumers are becoming more environmentally aware, pushing brands to adopt sustainable practices in their packaging choices. This shift enhances brand loyalty and aligns with global trends towards eco-friendly products.

North America Airless Packaging Market Trends

The airless packaging market in North America is expected to grow significantly over the forecast period, owing to a robust demand for luxury cosmetic products and heightened environmental awareness among consumers. In addition, the region’s focus on sustainability has led manufacturers to develop innovative airless solutions that minimize waste while maximizing product preservation. Furthermore, significant investments from leading cosmetic brands in research and development are enhancing the functionality of airless packages, making them more appealing to consumers who prioritize quality and eco-friendliness.

U.S. Airless Packaging Market Trends

The growth of the U.S. airless packaging market is driven by a strong emphasis on personal care and cosmetic products. In addition, increasing female workforce participation and rising interest in natural skincare products are driving demand. Furthermore, U.S. consumers are increasingly seeking products that offer convenience without compromising on quality or sustainability. Moreover, this trend has prompted brands to shift towards airless technologies that enhance user experience while reducing environmental impact.

Key Airless Packaging Company Insights

Some of the key companies in the market include AptarGroup Inc., Silgan Holdings Inc., Quadpack, and others. These companies adopt various strategies, including new product development, strategic partnerships, definitive agreements, and others, to enhance their market presence and gain a competitive edge in the market. Furthermore, the companies also focus on mergers and acquisitions of different other firms to enhance their brand image and expand within the market.

-

AptarGroup Inc. specializes in developing and manufacturing dispensing systems for various applications, including beauty, personal care, pharmaceuticals, and food. Operating across multiple segments, the company focuses on enhancing product performance while ensuring sustainability through its airless technology, which protects formulations from contamination and extends shelf life. Their commitment to innovation positions them as a key player in the airless packaging market.

-

Quadpack offers a diverse range of products, including its CANVAS Airless line, which allows for customizable shapes while minimizing material usage. The company operates in cosmetics and personal care, focusing on sustainable and innovative packaging solutions catering to evolving consumer demands. Their advancements in airless packaging not only enhance product protection but also contribute to reduced environmental impact through the use of recyclable materials.

Key Airless Packaging Companies:

The following are the leading companies in the airless packaging market. These companies collectively hold the largest market share and dictate industry trends.

- AptarGroup Inc.

- Silgan Holdings Inc.

- Quadpack

- HCP Packaging

- APackaging Group

- LUMSON S.p.A

- Hangzhou ABC Packaging Co. Ltd.

- Albéa Group

- PrimePac

- The Packaging Company

- O.Berk

- SR Packaging

- Evergreen Resources

- Eurovetrocap

- Cosme Packaging

Recent Developments

-

In October 2023, Lumson announced the launch of its innovative airless packaging solutions designed to meet the evolving needs of the cosmetics industry. The new range emphasizes sustainability and user convenience, featuring advanced technology that prevents product contamination and extends shelf life. The company’s airless packaging enhances the preservation of formulations and reduces waste, aligning with current trends toward eco-friendly practices. This initiative reinforces Lumson's commitment to providing cutting-edge packaging solutions in the beauty sector.

-

In October 2023, Quadpack unveiled its innovative refillable airless pen, designed to enhance the beauty packaging landscape. This new product features an airless dispensing system that ensures optimal preservation of formulations while minimizing waste. The refillable design promotes sustainability and offers consumers a convenient and eco-friendly option for their beauty products. Quadpack's commitment to advancing airless packaging technology positions it as a leader in providing sustainable solutions for the cosmetics industry.

Airless Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.11 billion

Revenue forecast in 2030

USD 9.55 billion

Growth Rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, packaging type, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa,

Country scope

U.S., Canada, China, India, Japan, Germany, UK, France, Argentina and Brazil.

Key companies profiled

AptarGroup Inc.; Silgan Holdings Inc.; Quadpack; HCP Packaging; APackaging Group; LUMSON S.p.A; Hangzhou ABC Packaging Co. Ltd.; Albéa Group; PrimePac; The Packaging Company; O.Berk; SR Packaging; Evergreen Resources; Eurovetrocap; Cosme Packaging.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Airless Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global airless packaging market report based on material, packaging type, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

Aluminum

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles & Jars

-

Bags & Pouches

-

Tubes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal & Home Care

-

Pharmaceutical

-

Pet Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

India

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global airless packaging market size was estimated at USD 5,055.3 million in 2019 and is expected to reach USD 5,298.8 million in 2020.

b. The airless packaging market is expected to grow at a compound annual growth rate of 6.0% from 2020 to 2027 to reach USD 8,061.2 million by 2027.

b. Plastic dominated the airless packaging market with a share of 63.29% in 2019, owing to its light in weight, easy to mold, and cost-effective properties.

b. Some of the key players operating in the airless packaging market include AptarGroup, Inc., Silgan Holdings Inc., Quadpack, ALBEA S.A., and HCP Packaging.

b. The key factors that are driving the airless packaging market include growing premium cosmetics products such as natural skin care creams, foundations, and serums, among others. The demand is also driven by the growing demand for airless packaging from dermal drug manufacturers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."