- Home

- »

- Next Generation Technologies

- »

-

Aircraft Turbocharger Market Size And Share Report, 2030GVR Report cover

![Aircraft Turbocharger Market Size, Share & Trends Report]()

Aircraft Turbocharger Market Size, Share & Trends Analysis Report By Platform (Commercial Aircraft, Military Aircraft), By Type (Variable Geometry Turbochargers, Intercooled Turbochargers), By Component, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-391-3

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Aircraft Turbocharger Market Size & Trends

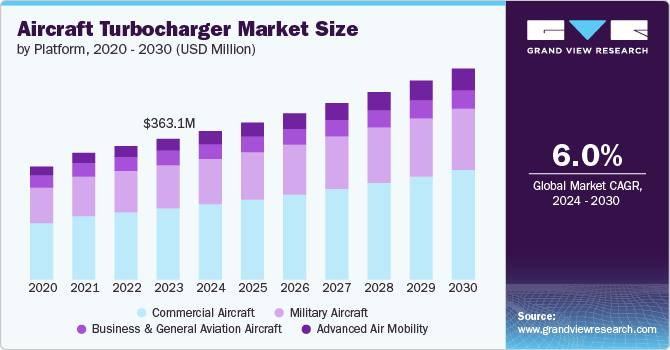

The global aircraft turbocharger market size was estimated at USD 363.1 million in 2023 and is expected to grow at a CAGR of 6.04% from 2024 to 2030. The rising demand for new aircraft and replacements for aging fleets amid increased demand for air travel across the globe is necessitating turbochargers, thereby bolstering the market growth. For instance, in July 2024, Boeing projected a 3% rise in aircraft deliveries over the coming 20 years, with the demand for commercial airplanes reaching nearly 44,000 by 2043.

Moreover, stringent environmental regulations mandating improved fuel efficiency and reduced emissions also create significant growth opportunities for the market, as turbochargers play a crucial role in meeting these standards by optimizing engine performance. The technological advancements and design improvements in components are further propelling the growth of the aircraft turbochargers market. Continuous research and development have led to more efficient and durable turbocharger designs. Moreover, the use of advanced materials has reduced turbocharger weight and improved performance. Besides, turbochargers are being increasingly integrated with other engine technologies, such as hybrid propulsion systems, to enhance overall efficiency, favoring product adoption and leading to market expansion.

A considerable rise in defense expenditures and the modernization of aircraft fleets with advanced capabilities across several countries is creating remunerative growth avenues for the aircraft turbochargers market. For instance, in April 2024, the U.S. Air Force awarded USD 13 billion contract to Sierra Nevada Corporation for developing a successor to the E-4B or Doomsday plane known for its ability to survive a nuclear war. Such initiatives are expected to drive the demand for turbochargers as military aircraft require high-performance engines capable of operating in demanding conditions. In this regard, turbochargers serve as critical components in these aircraft, contributing to enhanced performance, fuel efficiency, and power output.

Market Concentration & Characteristics

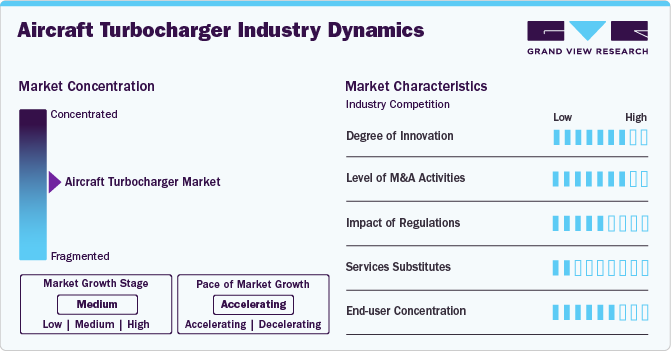

The aircraft turbocharger market is characterized by a high degree of innovation, driven by the advancements in technology, catering to commercial, military, and private sectors. The ongoing expansion of commercial aviation, coupled with increasing military expenditure on aircraft, is instigating the demand for turbochargers.

The number of merger and acquisition (M&A) activities in the market is increasing with the growing inclination of market players toward gaining greater market share, expanding their customer base, and strengthening their product portfolios.

Regulations have a profound impact on the market. These regulations drive innovation, shape market trends, and influence the design and development of turbochargers. Moreover, regulatory norms that promote fuel efficiency are stimulating the development of turbochargers that optimize engine performance and reduce fuel consumption.

Aircraft turbochargers face minimal competition from product substitutes in the market. While there are no direct substitutes for turbochargers in terms of their core function of compressing air for internal combustion engines, advancements in engine technology and alternative propulsion systems pose potential competitive threats.

The market has a significant end-user concentration as a limited number of major aircraft manufacturers, such as Airbus and Boeing, account for a sizeable share of the industry. These OEMs are the primary customers for turbocharger manufacturers, purchasing components for new aircraft production.

Platform Insights

The commercial aircraft segment accounted for the largest revenue share of more than 50.0% in 2023. The ongoing expansion of the airline sector, driven by rising air travel and increasing emphasis on the expansion of air fleets, is leading to heightened demand for aircraft and required components. Besides, airlines are also focusing on replacing older, less fuel-efficient aircraft with newer models equipped with advanced turbochargers. Besides, commercial aviation is subject to strict emissions regulations, and turbochargers play a crucial role in meeting these standards, creating remunerative growth opportunities for the segment.

The advanced air mobility segment is expected to record the highest CAGR of over 9.0% from 2024 to 2030. The growing significance of advanced air mobility solutions due to their potential to address traffic congestion and faster delivery times is expected to create ample growth opportunities for the aircraft turbochargers market.Turbochargers are essential for enhancing engine performance, providing the necessary power for vertical take-off and landing (VTOL) capabilities. The high usability of turbochargers in these vehicles will positively influence market growth in the upcoming years.

Type Insights

The variable geometry turbochargers (VGT) segment accounted for the largest revenue share in 2023. VGTs' ability to enhance engine performance, fuel efficiency, and emissions reduction has made them a preferred choice for aircraft manufacturers and operators. These turbochargers provide optimal performance across a wider engine speed range, improving low-speed torque as well as high-speed power output. Moreover, VGTs allow for precise control of airflow, resulting in improved combustion efficiency and reduced fuel consumption, which drives their demand, thereby enhancing the market outlook.

The intercooled turbochargers segment is expected to record the highest CAGR from 2024 to 2030. The growth is attributed to the increasing demand for these turbochargers as they offer several advantages in terms of engine performance, emissions reduction, and fuel efficiency. In addition, inter-cooled turbochargers allow for higher engine power output by cooling the compressed air before it enters the combustion chamber, which reduces the risk of detonation. The increasing preference for these turbochargers among aircraft manufacturers is expected to propel segmental growth over the coming years.

Component Insights

The compressor segment accounted for the largest revenue share in 2023. The compressor is a critical component in enhancing fuel efficiency by increasing the density of air entering the combustion chamber. Stringent emissions regulations necessitate improved fuel efficiency, impelling the demand for efficient compressors. Moreover, advancements in compressor design, such as variable geometry turbines, enhance performance and efficiency, which is driving the component demand and contributing to segmental growth. In addition, compressors contribute to increased engine power and thrust that enhance the aircraft performance, stimulate their demand, and accelerate segmental growth.

The turbine segment is expected to record the highest CAGR from 2024 to 2030. The segment growth is ascribed to the increasing demand for turbines as they play a critical role in extracting energy from exhaust gases and converting it into mechanical power to drive the compressor. Efficient turbine designs contribute to better fuel combustion, reducing fuel consumption and emissions. Besides, technological advancements, such as the adoption of advanced materials such as titanium and nickel alloys and improved turbine blade design and aerodynamics to enhance performance and reduce fuel consumption, are further favoring segmental growth.

End-use Insights

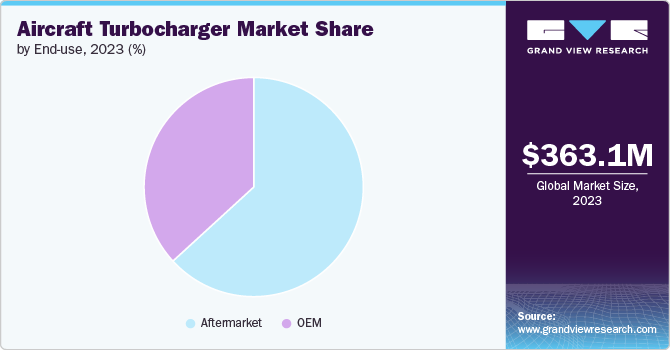

The aftermarket segment accounted for a significant revenue share in 2023. Older aircraft require frequent maintenance and replacement parts. Besides, components are also subjected to continuous operation and degradation over time, necessitating replacements. Expansion of fleets by airlines requires additional components for maintenance and spare parts, creating considerable demand for aftermarket. Moreover, disruptions in the supply chain that often lead to shortages of certain components also stimulate the demand for aftermarket alternatives. These factors significantly contribute to segmental growth.

The OEM (original equipment manufacturer) segment is expected to record the highest CAGR from 2024 to 2030. The considerable rise in air travel and growing need to expand aircraft fleet is pushing airlines to replace older aircraft with newer, more fuel-efficient models, creating lucrative growth prospects for the segment. Moreover, stringent emission norms mandating the development and production of components that can reduce the environmental impact of airline companies are impelling the demand for fuel-efficient components, driving the demand for turbochargers, and favoring segmental growth.

Regional Insights

The aircraft turbocharger market in North America accounted for the largest revenue share of around 35.0% in 2023 as the region boasts a robust commercial aviation industry; airlines are constantly expanding their fleets to accommodate growing passenger numbers. Moreover, the presence of a strong aerospace manufacturing base in the region supports the production and supply of turbochargers. In addition, established supply chains for aircraft components contribute to the timely delivery of turbochargers to aircraft manufacturers, thereby fueling the growth of the regional market.

U.S. Aircraft Turbocharger Market Trends

The U.S. aircraft turbochargers market is estimated to witness a considerable growth rate of nearly 5.0% from 2024 to 2030 on account of the mature commercial aviation sector creating significant demand for aircraft and components, such as turbochargers.

Asia Pacific Aircraft Turbocharger Market Trends

The aircraft turbocharger market in Asia Pacific is expected to record its highest growth rate of over 8% from 2024 to 2030. The ongoing expansion of the aviation sector amid increasing air travel and substantial investments in airport infrastructure and air traffic management systems is driving the demand for more aircraft, leading to heightened demand for turbochargers. Moreover, increasing defense expenditure and significant investments in military aircraft in China, India, and South Korea are also providing positive growth prospects for the regional market.

India aircraft turbocharger market is estimated to record a notable growth rate from 2024 to 2030. The expansion and presence of several major aircraft and components manufacturers in the country offer significant growth potential for the market.

The aircraft turbocharger market in China accounted for a significant revenue share in 2023. The government has prioritized the development of the aerospace industry and the required infrastructure which is supporting turbocharger manufacturing.

Japan aircraft turbocharger market is expected to witness a notable CAGR from 2024 to 2030 owing to increasing government investment in military aircraft fleets to strengthen defense capabilities.

Europe Aircraft Turbocharger Market Trends

The aircraft turbocharger market in Europe accounted for a significant revenue share in 2023 and is expected to witness notable growth from 2024 to 2030. Europe has been at the forefront of implementing strict emission standards for aircraft engines. Turbochargers play a crucial role in reducing emissions, making them essential components for compliance. The rising number of air passengers and cargo shipments has led to a growing demand for aircraft, including those equipped with turbochargers. Airlines are expanding their fleets to meet increased demand, driving the need for new aircraft and associated components, such as turbochargers.

The UK aircraft turbocharger market accounted for a sizeable revenue share in 2023. A strong focus on research and development in aerospace technology, including turbochargers, is offering lucrative opportunities for the market.

The aircraft turbocharger market in Germany is estimated to record a considerable growth rate from 2024 to 2030. Germany is a major center for aircraft manufacturing and has an established supply chain for aerospace components facilitating the production of turbochargers.

Middle East and Africa (MEA) Aircraft Turbocharger Market Trends

The MEA aircraft turbochargers market is estimated to register a notable CAGR from 2024 to 2030.Factors such as the development of new airports, expansion of aviation infrastructure, and growing tourism industry are driving demand for aircraft and, subsequently, turbochargers. Moreover, several countries in the region are making significant investments in fighter aircraft to strengthen their military capabilities, thereby creating ample growth opportunities for the market.

The aircraft turbocharger market in Saudi Arabia accounted for a notable revenue share in 2023 owing to increasing product demand driven by a substantial rise in air travel, both domestic and international.

Key Aircraft Turbocharger Company Insights

Some key players operating in the market include ABB Ltd., BorgWarner Inc., and Honeywell International, Inc., among others.

-

ABB Ltd. is a technology company dedicated to automation and electrification for sustainable development. The company’s operating business segments include electrification products, robotics and motion, industrial automation, and power grids. The company’s industrial automation division provides products, services, and systems to enhance business processes.

-

BorgWarner Inc. is dedicated to developing clean and efficient technology solutions for combustion, hybrid, and electric vehicles. The company’s products enable improvements in vehicle performance, stability, propulsion efficiency, and air quality. The Company manufactures and sells these products worldwide, primarily to OEMs of light and commercial vehicles.

-

Honeywell International, Inc. is a multinational conglomerate that operates in various industries, including aerospace, building technologies, performance materials, and safety and productivity solutions. The company is known for its innovative technologies and solutions that cater to a wide range of applications, from industrial automation to smart home devices, and offers a diverse portfolio of sensor products that are used in industrial automation, HVAC systems, transportation, and more.

Airmark Overhaul, Inc., and Hartzell Engine Technologies LLC are some emerging market participants in the market.

-

Airmark Overhaul, Inc. is dedicated to the overhaul and repair of Lycoming and Continental Motors aircraft engines and associated cylinders and accessories. The company has an FAA and EASA approved state-of-the-art facility. It maintains more than 125 engine cores to provide a minimal downtime quick exchange option for the customers.

-

Hartzell Engine Tech manufactures general aviation and military applications. Through its portfolio of brands, such as Plane-Power, Janitrol Aero, Fuelcraft, POWERUP, Sky-Tec, and AeroForce Turbocharger Systems, the company provides engine accessories and heating solutions for the general aviation industry.

Key Aircraft Turbocharger Companies:

The following are the leading companies in the aircraft turbocharger market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Airmark Overhaul, Inc.

- BorgWarner Inc.

- General Electric Company

- Hartzell Engine Technologies LLC

- Honeywell International Inc.

- Kawasaki Heavy Industries, Ltd.

- PBS Group, A.S.

- Rajay Turbo Products

- Victor Aviation Service, Inc.

- Mitsubishi Heavy Industries Engine & Turbocharger Ltd.

- Eaton Corporation plc

- Garrett Motion Inc.

- IHI Corporation

Recent Developments

-

In May 2024, PBS Group, A.S. partnered with ONE3D and HiLASE to sign a contract with Lockheed Martin Corporation. This alliance is aimed at the development and qualification of an advanced manufacturing process for a critical component of the F-35 aircraft. As a part of this initiative, the companies will contribute through their expertise in additive manufacturing, advanced heat treatment in a vacuum furnace, and laser surface treatment as a significant asset to this project.

-

In April 2024, the New Energy and Industrial Technology Development Organization (NEDO) selected IHI Corporation’s initiative aimed at the development of thermal and air management and electric power control systems for the Next-Generation Aircraft Development Project.Under this project, the company intends to develop core aircraft electrification technologies such as powerful aircraft electric turbo compressors and megawatt-class generators.

-

In March 2024, Hartzell Engine Technologies LLC launched POWERUP Aircraft Ignition Systems comprising FAA/PMA-approved aircraft magnetos, Slick, Bendix, and Continental replacement parts, ignition harnesses, and magneto repair kits. It is the largest operation of the company, joining Fuelcraft, Sky-Tec, Janitrol Aero, Plane-Power, and AeroForce Turbocharger Systems.

Aircraft Turbocharger Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 383.0 million

Revenue forecast in 2030

USD 544.5 million

Growth rate

CAGR of 6.04% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, type, component, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB Ltd.; Airmark Overhaul, Inc.; BorgWarner Inc.; General Electric Company; Hartzell Engine Technologies LLC; Honeywell International Inc.; Kawasaki Heavy Industries, Ltd.; PBS Group, A.S.; Rajay Turbo Products; Victor Aviation Service, Inc.; Mitsubishi Heavy Industries Engine & Turbocharger Ltd.; Eaton Corporation plc; IHI corporation; Garrett Motion Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Turbocharger Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global aircraft turbocharger market report based on platform, type, component, end-use, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aircraft

-

Military Aircraft

-

Business and General Aviation Aircraft

-

Advanced Air Mobility

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Stage Turbochargers

-

Two-Stage Turbochargers

-

Variable Geometry Turbochargers (VGT)

-

Intercooled Turbochargers

-

Twin-Turbochargers

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressor

-

Turbine

-

Shaft

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft turbochargers market is expected to grow at a compound annual growth rate of 6.04% from 2024 to 2030 to reach USD 544.5 billion by 2030.

b. The global aircraft turbochargers market size was estimated at USD 363.1 million in 2023 and is expected to reach USD 383.0 million in 2024.

b. The North America region dominated the industry with a revenue share of 34.7% in 2023. This can be attributed to the rising demand for aircraft turbochargers driven by a robust commercial aviation industry in the region with airlines constantly expanding their fleets to accommodate growing passenger numbers.

b. Some key players operating in aircraft turbochargers market include ABB Ltd., Airmark Overhaul, Inc., BorgWarner Inc., General Electric Company, Hartzell Engine Technologies LLC, Honeywell International Inc., Kawasaki Heavy Industries, Ltd., PBS Group, A.S., Rajay Turbo Products, Victor Aviation Service, Inc., Mitsubishi Heavy Industries Engine & Turbocharger Ltd., Eaton Corporation plc, Garrett Motion Inc., and IHI Corporation

b. Key factors that are driving aircraft turbochargers market growth include the rising demand for new aircraft and replacements for aging fleets, stringent environmental regulations mandating improved fuel efficiency and reduced emissions, as well as technological advancements and design Improvements in components.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."