- Home

- »

- Sensors & Controls

- »

-

Aircraft Sensors Market Size, Share & Growth Report, 2030GVR Report cover

![Aircraft Sensors Market Size, Share & Trends Report]()

Aircraft Sensors Market Size, Share & Trends Analysis Report By Aircraft Type (Commercial, Military, General Aviation), By Sensor Type, By Connectivity, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Aircraft Sensors Market Size & Trends

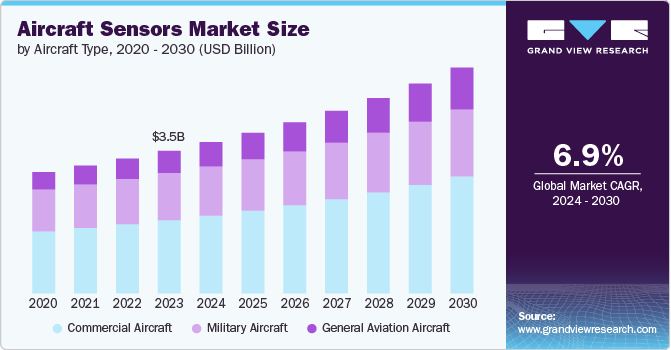

The global aircraft sensors market size was valued at USD 3.48 billion in 2023 and is anticipated to grow at a CAGR of 6.9% from 2024 to 2030. Technological advancements, such as smart sensors and miniaturization, are pivotal in the market, enhancing real-time data provision and predictive maintenance while maintaining optimal aircraft performance. The surge in aircraft production, fueled by growing passenger traffic and defense modernization programs, further propels market growth. Additionally, stringent safety regulations mandated by authorities like the FAA and EASA necessitate the adoption of high-quality sensors for continuous monitoring and data recording, ensuring compliance and operational safety. The expanding use of UAVs and retrofitting older aircraft with modern sensors also contribute to market expansion.

The market presents significant opportunities, especially in emerging regions like Asia-Pacific, where rapid aviation sector growth is evident. Integrating IoT and AI technologies with aircraft sensors is transforming the industry, enabling real-time data collection, advanced analytics, and predictive capabilities, thereby enhancing operational efficiency. The development of electric and hybrid aircraft, driven by sustainability initiatives, opens new avenues for specialized sensor technologies needed for battery management, power distribution, and propulsion systems. Advancements in autonomous flight technology and sensor fusion further stimulate innovation, ensuring accurate and reliable navigation and flight control. A heightened focus on passenger experience, with sensors improving cabin environment control and in-flight entertainment systems, adds another layer of market potential.

The market is experiencing significant growth, driven by various factors shaping demand and innovation within the industry. Technological advancements, particularly in smart sensors and miniaturization, are revolutionizing the market by offering enhanced capabilities such as self-diagnosis and real-time data analytics. These smart sensors enable predictive maintenance and reduce downtime, while miniaturization allows for integration into various aircraft components without adding significant weight, thus improving overall safety and efficiency. Increasing aircraft production is another major driver, with commercial aviation witnessing a surge in demand due to rising global passenger traffic. Airlines are investing in modern fleets equipped with advanced sensor technologies to ensure enhanced safety, efficiency, and passenger comfort. Similarly, military aviation is propelled by defense budgets and modernization programs, necessitating advanced sensors for monitoring weapon systems, flight controls, and environmental conditions.

Stringent safety regulations imposed by aviation safety authorities like the FAA and EASA further drive the demand for high-quality sensors. These regulations mandate continuous monitoring and data recording for safety-critical systems, compelling airlines and aircraft manufacturers to adopt reliable and accurate sensors to comply with safety standards. The growth in the use of unmanned aerial vehicles (UAVs) for military, commercial, and recreational purposes is also a significant driver. UAVs require sophisticated sensors for navigation, obstacle detection, flight control, and environmental monitoring, increasing the demand for advanced sensor technologies.

Retrofitting and upgrading existing aircraft with modern sensors is another trend driving the market. Airlines and military forces are investing in extending the operational life of older aircraft and enhancing their performance and safety through sensor upgrades. Emerging markets, particularly in the Asia-Pacific region, are experiencing rapid aviation sector growth, presenting substantial opportunities for sensor manufacturers. Countries like China and India are seeing increased air travel and new airline launches, driving the demand for new aircraft and sensor technologies. Similarly, Latin America and the Middle East are witnessing aviation growth, supported by economic development and increased connectivity.

The integration of Internet of Things (IoT) technology with aircraft sensors is transforming the industry by enabling real-time data collection and analysis, improving operational efficiency and predictive maintenance. IoT connectivity allows seamless communication between sensors and control systems, enhancing overall aircraft performance. Additionally, artificial intelligence (AI) enhances sensor functionality by enabling advanced data analytics and predictive capabilities. AI algorithms can analyze sensor data to identify patterns and predict potential failures, providing insights that improve maintenance schedules and reduce operational disruptions.

Sustainability initiatives are driving the development of electric and hybrid aircraft, which require advanced sensor technologies for battery management, power distribution, and propulsion systems. Innovations in these areas open new opportunities for specialized sensors that support the unique requirements of electric and hybrid propulsion. Research and development in autonomous flight technology also necessitate advanced sensors for navigation, obstacle detection, and flight control. Sensor fusion, which combines data from multiple sensors, enhances the accuracy and reliability of autonomous systems, providing new opportunities for sensor integration in next-generation aircraft.

Aircraft Type Insights

Based on aircraft type, the commercial aircraft segment dominated the market in 2023, capturing more than 51% of the global revenue. The segment leads the market, driven by robust growth in global air passenger traffic and fleet expansion initiatives by major airlines. These aircraft rely extensively on a variety of sensors to ensure safety, operational efficiency, and passenger comfort throughout their operational lifespan. Key technological advancements such as smart sensors and miniaturization play crucial roles in enabling real-time monitoring, predictive maintenance, and enhanced data analytics. These advancements not only optimize operational costs through improved maintenance schedules but also ensure compliance with stringent aviation safety regulations imposed by authorities like the FAA and EASA.

As airlines continue to modernize their fleets with fuel-efficient and technologically advanced aircraft, the demand for sensors in commercial aviation remains strong. The integration of IoT and AI technologies further enhances sensor capabilities, enabling airlines to achieve higher levels of operational efficiency and passenger satisfaction. Future growth in this segment is expected to be driven by the expansion of low-cost carriers in emerging markets and the ongoing replacement of older aircraft with newer models equipped with state-of-the-art sensor technologies.

The general aviation aircraft segment is positioned to witness the fastest growth through the forecast period. The general aviation aircraft segment is experiencing rapid growth, fueled by increasing private and business aviation activities globally. This segment encompasses a diverse range of aircraft used for personal travel, business aviation, flight training, and specialized missions such as aerial surveying and medical evacuation. Sensors in general aviation aircraft play critical roles in navigation, engine monitoring, weather detection, and flight control, ensuring safe operations under varying environmental conditions. Technological advancements in sensor capabilities, including improved accuracy, reliability, and data integration, support the segment's growth by enhancing safety and operational efficiency. The market dynamics are shaped by rising disposable incomes, growing corporate travel demands, and expanding air taxi services, driving the adoption of advanced sensor solutions tailored to meet specific operational needs.

As regulatory frameworks evolve to accommodate new technologies and safety standards, the demand for advanced sensors in general aviation is expected to continue rising. Innovations in miniaturization and IoT integration are poised to further enhance situational awareness and operational efficiency for general aviation operators, while the emergence of unmanned aerial vehicles (UAVs) and air taxis presents new opportunities for sensor innovation and market expansion in the years ahead.

Sensor Type Insights

Temperature sensors dominated the market in 2023.Temperature sensors are pivotal in the market, dominating due to their critical role in monitoring and regulating various aircraft systems. These sensors are essential for measuring temperature levels in engines, avionics, cabin environments, and cargo compartments. By providing real-time temperature data, these sensors enable proactive maintenance and ensure optimal performance and safety. They are integral to engine health monitoring systems, helping detect overheating or anomalies early to prevent potential failures and operational disruptions. In cabin environments, temperature sensors contribute to passenger comfort by maintaining consistent and comfortable temperatures throughout flights.

Additionally, in cargo compartments, they monitor temperature-sensitive goods to ensure compliance with stringent regulatory requirements. The reliability, accuracy, and widespread application of temperature sensors across diverse aircraft systems underscore their dominance in the market. As aviation safety standards evolve and operational efficiency remains paramount, the demand for advanced temperature sensing technologies is poised to grow further.

The radar sensors segment is anticipated to demonstrate strong growth over the forecast period. Radar sensors represent the fastest-growing segment in the market, driven by their critical role in enhancing situational awareness and safety in aviation. These sensors utilize electromagnetic waves to detect and track objects, making them essential for collision avoidance systems and weather detection. Radar sensors enable Traffic Collision Avoidance Systems (TCAS) and Ground Proximity Warning Systems (GPWS), which alert pilots to potential hazards such as other aircraft or terrain, enabling timely corrective actions to prevent accidents. They are also crucial for weather radar systems, detecting and monitoring weather conditions like thunderstorms and turbulence, which pose risks to flight safety. In airport operations, radar sensors support ground surveillance during taxiing and landing, providing precise positioning information to pilots and ground control personnel to prevent runway incursions and improve operational efficiency.

The rapid adoption of radar sensors is driven by continuous technological advancements that enhance sensor range, resolution, and data processing capabilities. As aviation stakeholders prioritize safety, efficiency, and regulatory compliance, the demand for advanced radar sensor solutions is expected to expand significantly, cementing their pivotal role in the future of aircraft sensor technology.

Connectivity Insights

The wired sensors segment dominated the market in 2023. Wired sensors hold a dominant position in the aircraft sensors market due to their established reliability and critical role in aerospace applications. These sensors are hardwired directly to aircraft systems, ensuring secure and continuous data transmission without susceptibility to signal interference or latency issues often associated with wireless communication. In commercial aviation, wired sensors are essential for monitoring vital parameters such as engine performance, temperature, pressure, and fuel levels, contributing significantly to operational safety and efficiency. Similarly, in military aircraft, where reliability and precision are paramount, wired sensors are integral to functions like weapons targeting, navigation, and environmental monitoring.

Advancements in wired sensor technology have enhanced their durability and performance under extreme conditions, making them suitable for use in challenging aerospace environments. As the aviation industry continues to prioritize safety and reliability, wired sensors are expected to maintain their dominance, providing stable and consistent data flow crucial for flight operations.

The wireless sensors segment is estimated to emerge as the fastest-growing segment during the forecast period. Wireless sensors represent the fastest-growing segment in the market, driven by advancements in IoT connectivity and the demand for enhanced data accessibility and flexibility in aerospace applications. Unlike wired sensors, wireless counterparts facilitate remote monitoring and data transmission, eliminating the need for physical wiring and reducing installation complexity and weight on aircraft. In commercial aviation, wireless sensors are increasingly adopted for real-time monitoring of aircraft health, performance metrics, and operational parameters. They play a critical role in structural health monitoring, cabin environment control, and cargo monitoring, supporting proactive maintenance strategies and optimizing operational efficiency.

In military aviation, wireless sensors enhance situational awareness and operational flexibility in UAVs and unmanned systems, enabling seamless communication between onboard systems and ground control stations. The growth of wireless sensors is bolstered by ongoing advancements in miniaturization, battery longevity, and data encryption technologies, ensuring robust performance and data security in aerospace environments. As aerospace technologies evolve towards digitalization and connectivity, wireless sensors are poised to play a pivotal role in transforming aircraft operations, enhancing safety, efficiency, and mission effectiveness across both commercial and military sectors.

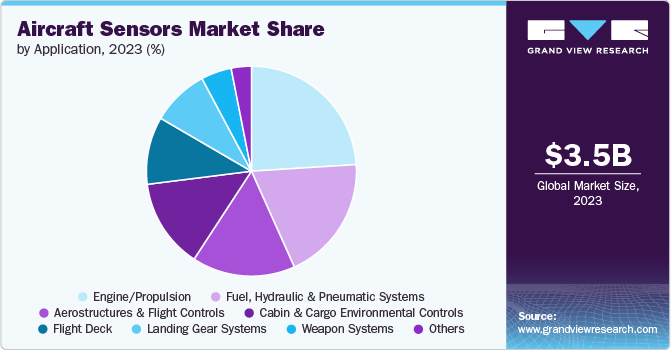

Application Insights

The engine/propulsion segment accounted for the largest share in 2023 and is anticipated to retain its leading position throughout the forecast period. The engine/propulsion segment of the market holds a dominant position due to its critical role in ensuring the safe and efficient operation of aircraft engines. This segment relies on a range of sophisticated sensors that monitor key parameters such as temperature, pressure, and flow within the engine systems. Temperature sensors, for instance, are essential for monitoring exhaust gas temperatures and turbine conditions, ensuring that engine components operate within safe limits to prevent overheating and potential failures. Pressure sensors monitor oil and fuel pressures, as well as air pressures within the engine, providing vital data for precise control and adjustment of fuel and air mixture ratios. Flow sensors measure the rates of fuel, air, and other fluids entering the engine, optimizing combustion processes for enhanced fuel efficiency and reduced emissions. With the increasing global fleet of aircraft and advancements in engine technology aimed at improving performance and reducing operational costs, the demand for advanced sensor solutions in the engine/propulsion segment remains robust. Regulatory requirements for engine performance monitoring and emissions control further drive the adoption of high-quality sensors, ensuring compliance with stringent aviation standards.

The flight deck segment is projected to emerge as the fastest growing segment over the forecast period. The flight deck segment is the fastest-growing sector within the aircraft sensors market, fuelled by advancements in avionics technology and the increasing complexity of cockpit systems. Sensors in the flight deck play a crucial role in providing essential data to pilots for precise navigation, flight control, and situational awareness throughout all phases of flight. Key sensors include attitude and heading reference systems (AHRS), which provide real-time information on aircraft orientation, altitude, and heading, essential for autopilot systems and flight path stabilization. Air data sensors measure parameters such as airspeed, altitude, and air pressure, providing critical inputs for accurate navigation and flight performance monitoring. Navigation sensors, such as GPS receivers, enable precise positioning and navigation capabilities, enhancing flight safety and efficiency.

The shift toward more automated flight operations and the integration of digital displays and intuitive interfaces in modern cockpit designs are driving the demand for advanced sensor technologies in the flight deck segment. Airlines and aircraft manufacturers are increasingly investing in cockpit instrumentation that enhances pilot situational awareness and reduces workload, contributing to the segment's rapid growth. Moreover, stringent regulatory standards set by aviation authorities necessitate continuous advancements in sensor capabilities and reliability to ensure compliance and safety in commercial and military aviation operations.

Regional Insights

North America aircraft sensors market dominated the global industry in 2023, accounting for a nearly 36% revenue share of the global market. North America leads the aircraft sensors market, driven by several critical factors. The region boasts major aircraft manufacturers like Boeing and a strong adoption of advanced aviation technologies. The U.S. government's substantial defense spending and aerospace investments further bolster this dominance. Additionally, extensive research and development activities in sensor technologies contribute to the region's market leadership. High demand for new-generation aircraft, along with upgrades and retrofitting of existing fleets, drives market growth. The increase in air travel and cargo transportation also plays a significant role. Key players in the region include Honeywell International Inc., Collins Aerospace, TE Connectivity, and AMETEK Inc. Trends indicate a rising focus on the safety and reliability of aircraft systems, the adoption of IoT and advanced sensors for predictive maintenance, and growing investments in unmanned aerial vehicles (UAVs). North America's position as a technological hub ensures its continued dominance in the aircraft sensors market, with continuous advancements and innovations.

U.S. Aircraft Sensors Market Trends

The aircraft sensors market in the U.S. is growing as major aircraft manufacturers and a strong ecosystem of advanced technology adoption contribute to the market's strength. Significant defense spending and aerospace investments by the U.S. government create a favorable environment for growth and innovation. Intensive research and development focus on cutting-edge sensor technologies that enhance aircraft safety, reliability, and efficiency. High demand for new-generation aircraft, alongside the trend of upgrading and retrofitting existing fleets, drives market expansion. Growth in air travel and cargo transportation further supports the demand for advanced sensors. Key market players, including Honeywell International Inc., Collins Aerospace, TE Connectivity, and AMETEK Inc., play crucial roles in leveraging their expertise and innovation capabilities. Current trends highlight an increasing focus on IoT and advanced sensors for predictive maintenance and growing investments in unmanned aerial vehicles (UAVs). The U.S. market is characterized by its technological advancements, strong industry players, and a supportive regulatory environment, ensuring its continued leadership and growth in the global aircraft sensors market.

Asia Pacific Aircraft Sensors Market Trends

The aircraft sensors market in Asia Pacific is the fastest-growing market, fueled by rapid economic growth and an expanding middle-class population, which leads to increased air travel. Significant investments in aviation infrastructure and the emergence of regional aircraft manufacturers like COMAC further stimulate market expansion. Countries such as China and India have increasing defense budgets, which contribute to the rising demand for aircraft sensors. The proliferation of low-cost carriers (LCCs) and regional airlines also drives market growth. Government initiatives to develop the aviation sector play a crucial role in this expansion. Key players in the region include Panasonic Corporation, Safran SA, Meggitt PLC, and TE Connectivity, which have a significant presence. Trends in the region focus on modernizing existing aircraft fleets, adopting advanced sensor technologies for operational efficiency, and the growing importance of maintenance, repair, and overhaul (MRO) services. Collaborations between international and local players further enhance market growth, making the Asia Pacific a vital region in the global aircraft sensors market.

Europe Aircraft Sensors Market Trends

The aircraft sensors market in Europe is thriving due to advancements in aerospace technology and rising demand for safer, more efficient aircraft operations. Key players like Safran Electronics & Defense and Honeywell International Inc. drive innovation in sensor technology, crucial for monitoring parameters such as pressure, temperature, and position. Stringent regulatory standards and a growing fleet of commercial and military aircraft further bolster market growth. Challenges include high costs and supply chain disruptions. Despite these obstacles, the market's future looks promising, supported by continuous technological advancements and increased investments in aerospace R&D.

Key Aircraft Sensors Company Insights

Some of the key companies operating in the Market include Honeywell International Inc., Thales Group, among others.

Honeywell International Inc. is one of the global leaders in aerospace technology, leveraging its extensive expertise across multiple sectors. With a robust presence in avionics systems and aircraft engines, Honeywell excels in developing cutting-edge sensor solutions that enhance aircraft efficiency and safety. Their commitment to innovation and global reach solidifies their position as a preferred supplier of aerospace sensors, continuously setting industry standards.

Ametek Inc, and Meggitt PLC are some of the emerging market companies in the target market.

- Ametek Inc., emerges as one of the dynamic player in the aircraft sensors market, specializing in electronic instruments and electromechanical devices. Focused on precision measurement and reliability, Ametek's aerospace segment offers advanced sensor technologies tailored to meet the stringent demands of modern aviation. Through strategic investments in research and development, Ametek is rapidly expanding its footprint in aerospace, positioning itself as a key innovator in sensor solutions that improve aircraft performance and operational effectiveness.

Key Aircraft Sensors Companies:

The following are the leading companies in the aircraft sensors market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity Ltd

- Honeywell International Inc.

- Meggitt PLC

- Ametek Inc.

- THALES

- The General Electric Company

- Raytheon Technologies Corporation

- Curtiss-Wright Corporation

- Safran SA

- Hydra-Electric Company

- PCB Piezotronics Inc

- Avidyne Corporation

- Precision Sensors (United Electric Controls)

Recent Developments

-

In April 2024, Honeywell announced that it was chosen by Lilium, the developer of the first all-electric vertical takeoff and landing (eVTOL) jet, to supply propulsion unit position sensors for the Lilium Jet. These sensors, known as “resolvers,” were specifically designed by Honeywell to meet the unique requirements of the Lilium Jet. They will be crucial in accurately detecting the engine’s position, ensuring the jet can safely achieve the precise position needed for a successful takeoff.

-

In November 2024, Raytheon, an RTX business, successfully completed a live-fire engagement using the advanced, 360-degree Lower Tier Air and Missile Defense Sensor (LTAMDS) in support of the U.S. Army. This achievement marks the latest in a series of ongoing development tests for the radar, which is set to reach operational capability by the end of the year. During the test, a cruise missile surrogate followed a representative threat trajectory. LTAMDS acquired and tracked the target, passed the track data to the Integrated Battle Command System (IBCS) for the launch command, and guided a PAC-3 missile to intercept the target.

Aircraft Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.68 billion

Revenue forecast in 2030

USD 5.50 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Aircraft type, sensor type, connectivity. application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Singapore; Brazil; KSA; UAE; and South Africa

Key companies profiled

TE Connectivity Ltd; Honeywell International Inc.; Meggitt PLC; Ametek Inc.; THALES; The General Electric Company; Raytheon Technologies Corporation; Curtiss-Wright Corporation; Safran SA; Hydra-Electric Company; PCB Piezotronics Inc; Avidyne Corporation; Precision Sensors (United Electric Controls)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Sensors Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft sensors market report based on aircraft type, sensor type, connectivity, application, and region.

-

Aircraft Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aircraft

-

Military Aircraft

-

General Aviation Aircraft

-

-

Sensor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature

-

Pressure

-

Position

-

Flow

-

Torque

-

Radar

-

Accelerometers

-

Proximity

-

Others

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired Sensors

-

Wireless Sensors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel, Hydraulic and Pneumatic Systems

-

Engine/Propulsion

-

Cabin & Cargo Environmental Controls

-

Aerostructures & Flight Controls

-

Flight Deck

-

Landing Gear Systems

-

Weapon Systems

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft sensors market size was estimated at USD 3.48 billion in 2023 and is expected to reach USD 3.68 billion in 2024.

b. The global aircraft sensors market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 5.50 billion by 2030.

b. The North American regional market dominated in 2023, accounting for a nearly 36% revenue share of the global market. North America leads the aircraft sensors market, driven by several critical factors. The region boasts major aircraft manufacturers like Boeing and a strong adoption of advanced aviation technologies.

b. Some key players operating in the aircraft sensors market include TE Connectivity Ltd, Honeywell International Inc., Meggitt PLC, Ametek Inc., THALES, The General Electric Company, Raytheon Technologies Corporation, Curtiss-Wright Corporation, Safran SA, Hydra-Electric Company, PCB Piezotronics Inc, Avidyne Corporation, Precision Sensors (United Electric Controls).

b. Key factors driving market growth includes growing focus on improving aircraft safety and operational efficiency, and stringent safety and environmental regulations

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."