- Home

- »

- Advanced Interior Materials

- »

-

Aircraft Seating Materials Market Size & Trends Report, 2030GVR Report cover

![Aircraft Seating Materials Market Size, Share & Trends Report]()

Aircraft Seating Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type, By Aircraft, By Application, By End Use, By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-436-9

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Seating Materials Market Trends

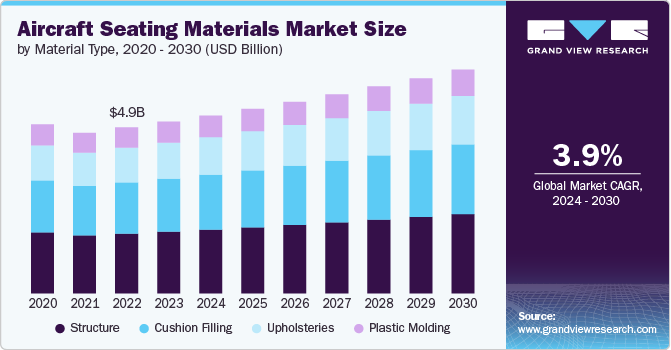

The global aircraft seating materials market size was estimated at USD 5.09 billion in 2023 and is projected to grow at a CAGR of 3.9% over the forecast period. Owing to the rise in global air travel, which is a significant driver for the market growth. According to the International Air Transport Association (IATA), global air passenger traffic is predicted to double by 2037, reaching 8.2 billion people per year. This growth in demand for air travel requires more aircraft and, consequently, more aircraft seating, propelling the need for advanced seating materials.

One of the key drivers of the market growth is the rising focus on passenger experience and customization. Airlines are increasingly recognizing the importance of offering differentiated seating options to attract and retain customers. This trend has led to a growing demand for premium seating solutions, including business and first-class seats that feature advanced materials and ergonomic designs. Innovations in in-flight entertainment systems and connectivity options further enhance the passenger experience, making modern seating solutions a crucial aspect of airline competitiveness. As a result, manufacturers are investing in research and development to create innovative seating materials that not only improve comfort but also comply with stringent safety regulations.

The aircraft seating materials industry faces several significant restraints that could impact its growth trajectory. One of the primary challenges is the high cost of aircraft seats, which includes substantial development and manufacturing expenses. The intricate design and engineering required to meet stringent safety and regulatory standards such as crashworthiness and fire safety add to these costs, limiting the flexibility of manufacturers in terms of innovation and product introduction. In addition, the market is influenced by limited resources, particularly in terms of raw materials and skilled labor, which can hinder production capabilities and lead to delays in meeting demand.

Material Type Insights

Based on material type, the market is segmented into structure, cushion filling, upholsteries, and plastic molding, among others. The structure segment accounted for the largest revenue share of 35.9% in 2023 and is expected to grow at the fastest rate over the forecast period, owing to its higher safety, durability, and comfort. Manufacturers utilize advanced materials such as aluminum alloys and composite materials to create lightweight yet robust seat frames that can withstand significant mechanical loads and impact forces during flight.

Moreover, continuous fiber-reinforced thermoplastics are increasingly popular due to their ability to provide strength while minimizing weight, thus contributing to overall fuel efficiency. The design of the seat structure must also comply with stringent safety regulations, including crashworthiness standards, which require that the seats can endure high g-forces during sudden stops or turbulence. Innovations in seat assembly structures, such as those that integrate torsion bars and anchoring points, enhance the stability and safety of the seating system, making them essential for modern aircraft design.

Aircraft Insights

Based on aircraft, the market is segmented into business jets, narrow-body aircraft, wide-body aircraft, general aviation, regional transportation, and helicopters, among others. Among these, the business jets segment accounted for the largest revenue share of 45.5% in 2023, and it is further expected to grow at the fastest CAGR over the forecast period.

The business jet segment caters to the unique needs of private and corporate aviation. These aircraft prioritize luxury, comfort, and customization, driving the demand for high-end seating materials. Manufacturers in this segment focus on using premium upholstery fabrics, fine leathers, and advanced cushioning systems to create a first-class travel experience. Lightweight composite materials are also popular in business jet seating to optimize fuel efficiency without compromising on comfort.

Narrow-body aircraft, also known as single-aisle aircraft, are the most common type of commercial passenger jet. This segment is a significant driver of market growth, as narrow-body aircraft account for a large portion of the global commercial fleet. Seating materials for narrow-body aircraft must balance weight, durability, and cost-effectiveness to meet the needs of airlines operating on short—to medium-haul routes. Manufacturers in this segment focus on using lightweight aluminum alloys for structural components and fire-resistant textiles for upholstery to comply with safety regulations while minimizing fuel consumption.

End-use Insights

Based on end use, the market is segmented into OEM, MRO, and aftermarket. OEM dominated the market with a revenue share of 62.7% in 2023 and is further expected to grow at a significant rate over the forecast period. The OEM segment is a critical driver of market growth, as it involves the production of new aircraft seats that meet stringent safety and comfort standards. This segment is characterized by significant investments from major aircraft manufacturers like Boeing and Airbus, who are continually innovating to incorporate advanced materials and technologies into their seating designs.

For instance, the increasing demand for lightweight materials, such as composite structures and fire-resistant textiles, is driven by the need for fuel efficiency and compliance with safety regulations. As airlines expand their fleets and modernize existing aircraft, the OEM segment is expected to maintain a dominant market share, reflecting the ongoing trend toward enhanced passenger comfort and operational efficiency.

The MRO segment plays a vital role in the market by ensuring the longevity and safety of existing aircraft seats. This segment encompasses routine maintenance, refurbishment, and repair services that are essential for compliance with aviation safety standards. As airlines seek to extend the lifespan of their fleets while minimizing costs, MRO services become increasingly important.

The aftermarket segment focuses on providing replacement parts and upgrades for existing aircraft seats. This segment is gaining traction as airlines and operators seek to enhance passenger comfort and meet evolving industry standards without investing in entirely new seats. The aftermarket includes the supply of high-quality materials such as replacement foams, upholstery, and safety components that comply with regulatory requirements.

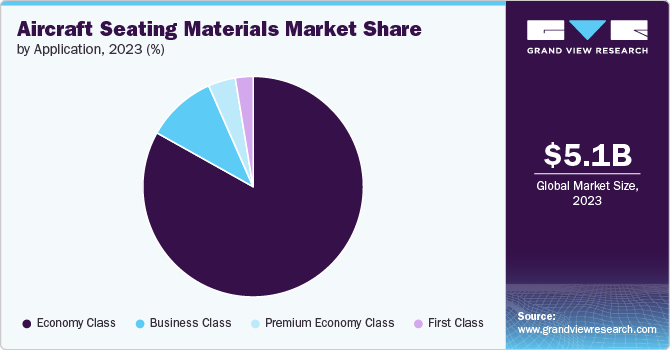

Application Insights

In terms of application, the market is segmented into first class, business class, economy class, and premium economy class. Among these, economy class held the largest revenue share of 83.2% in 2023 and is further expected to grow at the fastest CAGR over the forecast period, owing to its widespread adoption on commercial flights.

Economy class seats are designed to maximize space and accommodate a high number of passengers while maintaining comfort and safety. Manufacturers focus on lightweight materials and efficient designs to help airlines reduce fuel consumption and operational costs. For instance, RECARO Aircraft Seating emphasizes the use of innovative materials and intelligent design in their economy class seats, which not only enhance passenger comfort but also contribute to ecological flying by lowering kerosene usage. As air travel demand continues to grow, the economy class segment remains vital for airlines, driving the need for effective and cost-efficient seating solutions.

The premium economy class segment is experiencing significant growth, driven by increasing consumer demand for enhanced comfort at a reasonable price point. This class offers more spacious seating and additional amenities compared to standard economy, making it an attractive option for both leisure and business travelers. Premium economy seats often incorporate higher-quality materials, such as upgraded upholstery and improved cushioning, to provide a more comfortable experience. Airlines are investing in this segment to differentiate themselves and capture a broader market share. For example, airlines like Air New Zealand and Virgin Atlantic have successfully introduced premium economy offerings that include features such as greater legroom, better recline options, and enhanced in-flight services, appealing to passengers looking for a balance between cost and comfort.

Regional Insights

North America aircraft seating materials market dominated globally in 2023 with a revenue share of 47.4% and it is further expected to grow at a significant CAGR over the forecast period. The product market in North America is characterized by a blend of innovation, regulatory adherence, and evolving consumer preferences. This region, a key player in the global aviation industry, is seeing significant advancements in seating materials driven by the need for lighter, more durable, and environmentally friendly solutions. Advanced composites and high-strength alloys are increasingly being used to enhance fuel efficiency and reduce overall aircraft weight, aligning with broader industry goals of sustainability.

U.S. Aircraft Seating Materials Market Trends

The aircraft seating materials market in the U.S., in particular, is the fastest-growing market in the North America region, driven by the country's focus on implementing stringent regulatory standards and prioritizing technological innovation in aircraft seating. For instance, in July 2021, United Airlines announced a 270-plane order of Boeing 737 Max and Airbus A320s, emphasizing passenger comfort as a primary consideration. The rising demand for new, modern-generation aircraft from North America is expected to propel market growth as airlines invest in retrofitted aircraft seats and seat refurbishment services.

Europe Aircraft Seating Materials Market Trends

The aircraft seating materials market in Europe is expected to grow at a moderate rate, with the presence of prominent key players and original equipment manufacturers (OEMs) such as Lufthansa Technik, Safran SA, and STELIA Aerospace. These companies have a strong global presence in the market and extensive product portfolios, focusing on innovative product development. The European market will benefit from the increase in passenger air traffic and the growing investment by airlines in modifying aircraft seats. The European market, with its strong presence of leading seat manufacturers, is expected to grow significantly during the forecast period.

Asia Pacific Aircraft Seating Materials Market Trends

The Asia Pacific aircraft seating materials market’s growth is attributed to the rapidly increasing demand for air travel in emerging economies such as India and China. The region has witnessed remarkable growth in air travel over the past decades, driven by economic expansion, rising population, and increasing global connectivity. Airlines in Asia Pacific are investing heavily in expanding and modernizing their fleets, leading to a surge in demand for new, modern-generation aircraft seats.

Key Aircraft Seating Materials Company Insights

Some of the key players operating in the market are Raytheon Technologies Corporation, Safran, RECARO Aircraft Seating GmbH & Co. KG, ZIM Aircraft Seating GmbH, and Stelia Aerospace, among others:

-

Safran SA is a prominent global high-technology group specializing in the aerospace, defense, and security sectors. Safran is particularly recognized for its innovative solutions in aircraft interiors, offering a range of seating options that cater to various classes, from economy to first class. The company also provides engineering, maintenance, repair, and overhaul (MRO) services, ensuring comprehensive support for its clients throughout the lifecycle of their products.

-

In recent years, Safran has made significant strides in enhancing safety and sustainability in aviation. The company is committed to research and development, focusing on creating eco-friendly solutions that improve the passenger experience while reducing the environmental impact of air travel. Noteworthy developments include contracts with major airlines, such as the recent agreement with Japan Airlines to supply fully customized seating for their Airbus A350 fleet, demonstrating Safran's dedication to delivering high-quality, tailored solutions.

-

RECARO Aircraft Seating GmbH & Co. KG is a leading global supplier of premium aircraft seats, renowned for its innovative designs and commitment to passenger comfort. RECARO specializes in manufacturing seating solutions for both business and economy classes, positioning itself as a market leader in economy class seating. The company leverages advanced manufacturing techniques and high-quality materials to produce lightweight yet durable seats that enhance the overall flying experience while contributing to fuel efficiency.

Key Aircraft Seating Materials Companies:

The following are the leading companies in the aircraft seating materials market. These companies collectively hold the largest market share and dictate industry trends.

- Raytheon Technologies Corporation

- Safran

- RECARO Aircraft Seating GmbH & Co. KG

- ZIM Aircraft Seating GmbH

- Stelia Aerospace

- Collins Aerospace

- Thompson Aero Seating

- Acro Aircraft Seating

- Expliseat

- Aviointeriors SpA

- Ipeco Holdings

Recent Developments

-

In February 2024, Recaro Aircraft Seating was selected by Air India to supply premium economy and economy seating for its extensive fleet expansion program, which involves a record-breaking order of 470 aircraft. This partnership not only highlights Recaro's commitment to enhancing passenger comfort but also underscores the growing demand for modern seating solutions in the aviation sector

-

In November 2023, Safran signed contracts worth over $1.2 billion with Emirates to equip their aircraft with advanced seating and cabin equipment, showcasing the company's innovative designs and commitment to enhancing passenger experience. This deal not only includes standard seating solutions but also access to new aircraft seat designs, indicating a trend towards customization and modernization in seating arrangements.

Aircraft Seating Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.27 billion

Revenue forecast in 2030

USD 6.63 billion

Growth Rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material type, aircraft, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Raytheon Technologies Corporation; Safran; RECARO Aircraft Seating GmbH & Co. KG; ZIM Aircraft Seating GmbH; Stelia Aerospace; Collins Aerospace; Thompson Aero Seating; Acro Aircraft Seating; Expliseat; Aviointeriors SpA; Ipeco Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Seating Materials Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft seating materials market report based on material type, aircraft, application, end use, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Structure

-

Aluminum Frames

-

Carbon-Fiber Composites

-

Steel

-

Fiberglass

-

Kevlar

-

Others

-

-

Cushion Filling

-

Polyurethane

-

Neoprene

-

Silicone

-

Polyethylene

-

Others

-

-

Upholsteries

-

Polyester

-

Polyamide/Nylon

-

Leather

-

FR Cotton

-

Wool Blend

-

Others

-

-

Plastic Molding

-

Polycarbonate

-

ABS

-

Decorative Vinyl’s

-

Plastazote

-

Others

-

-

-

Aircraft Outlook (Revenue, USD Million, 2018 - 2030)

-

Business Jets

-

Narrow-Body Aircraft

-

Wide-Body Aircraft

-

General Aviation

-

Regional Transportation

-

Helicopters

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

First Class

-

Business Class

-

Economy Class

-

Premium Economy Class

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

MRO

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft seating materials market size was estimated at USD 5.09 billion in 2023 and is expected to reach USD 5.27 billion in 2024.

b. The global aircraft seating materials market is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030 to reach USD 6.63 billion by 2030.

b. North America accounted for the largest revenue share of 47.3% in 2023. presence of a large number of key players and aircraft manufacturers in the region

b. Some key players operating in the Aircraft Seating Materials Market include Raytheon Technologies Corporation, Safran, RECARO Aircraft Seating GmbH & Co. KG , ZIM Aircraft Seating GmbH, Stelia Aerospace, Collins Aerospace, Thompson Aero Seating, Acro Aircraft Seating, Expliseat , Aviointeriors SpA and Ipeco Holdings among others.

b. One major factor driving the demand for aircraft seating materials in the global market is the rise in global travel via aircraft.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.