- Home

- »

- Automotive & Transportation

- »

-

Aircraft Seating Market Size, Share & Growth Report, 2030GVR Report cover

![Aircraft Seating Market Size, Share & Trends Report]()

Aircraft Seating Market Size, Share & Trends Analysis Report By Component, By Class, By Aircraft, By Standard (16G, 21G), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-437-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Aircraft Seating Market Size & Trends

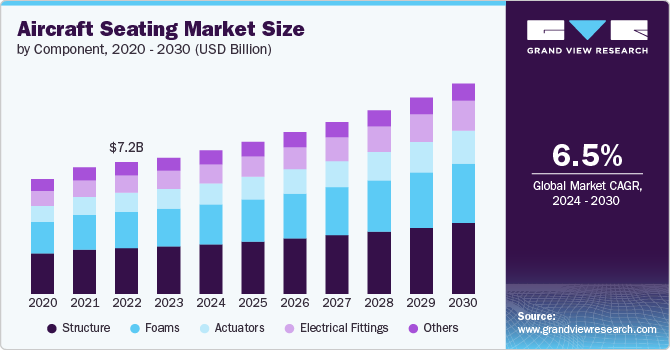

The global aircraft seating market size was estimated at USD 7.42 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The number of air passengers has been steadily increasing due to factors such as globalization, rising disposable incomes, and the expansion of low-cost carriers. As more people travel by air, airlines are expanding their fleets and increasing the frequency of flights, leading to higher demand for aircraft seating. Moreover, the rise in air travel, particularly in emerging markets such as Asia-Pacific, the Middle East, and Africa, is prompting airlines to acquire new aircraft and retrofit existing ones, which is significantly contributing to the market growth.

Airlines are investing heavily in new aircraft to meet growing demand and replace aging fleets. Major aircraft manufacturers such as Boeing and Airbus have substantial order backlogs, with many of these new aircraft requiring advanced seating solutions. This is creating positive growth prospects for the market. These companies are also focusing on upgrading the interiors of their existing fleets to enhance passenger comfort and align with modern standards. This includes the replacement of older, less efficient seats with newer models that offer better ergonomics, reduced weight, and enhanced in-flight entertainment systems.

The market growth is being further driven by the use of advanced materials such as carbon fiber and composite materials in seat construction is a major technological trend. These materials help reduce the overall weight of the aircraft, leading to lower fuel consumption and operating costs for airlines. The demand for lightweight seating solutions is therefore increasing. Furthermore, modern aircraft seats are increasingly designed with features that improve passenger comfort and experience. These include adjustable headrests, lumbar support, and more legroom, especially in premium cabins. The integration of in-seat power outlets, USB ports, and high-definition in-flight entertainment systems are also becoming standard, driving demand for technologically advanced aircraft seating.

The aviation industry is increasingly focusing on incorporating sustainable aircraft design, lightweight and environmentally friendly seating solutions that contribute to lower fuel consumption and emissions are witnessing heightened demand. The use of recyclable, biodegradable, and low-emission materials in seat manufacturing is becoming more common as airlines seek to improve their environmental credentials. This trend is driving innovation in materials science and seat design, creating new opportunities for market growth.

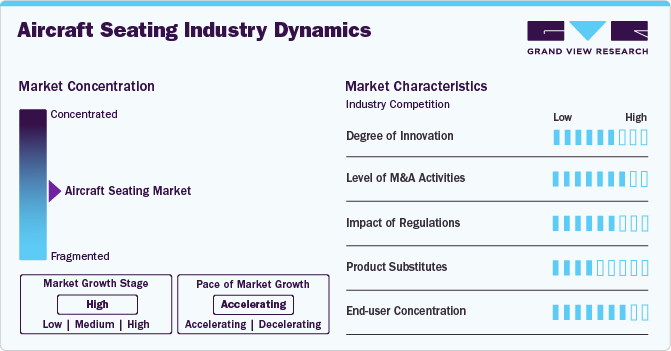

Market Concentration & Characteristics

The market is characterized by high growth at an accelerating pace. The degree of innovation is high with rapid technological advancements that span across materials, design, functionality, and integration with smart technologies.

The market is witnessing a high level of merger and acquisition (M&A) activities by the leading market players aimed at expanding their global footprint, and enhancing technological capabilities, to gain a competitive edge in the industry.

The competition from product substitutes is relatively low, but there are emerging factors and technologies that could pose a challenge to traditional aircraft seating. Innovations like stand-up seats, modular cabin designs, and alternative modes of transportation could influence the future demand for traditional aircraft seating. However, due to regulatory, comfort, and safety considerations, the widespread adoption of these substitutes is likely to be limited or focused on specific market segments, such as short-haul or low-cost carriers.

Regulations have a profound impact on the global market, influencing everything from design and materials to safety standards and passenger comfort. These regulations are typically set by aviation authorities such as the Federal Aviation Administration (FAA) in U.S., the European Union Aviation Safety Agency (EASA) in Europe, and other international bodies.

End-user concentration is high in the market with major global airlines accounting for a significant portion of demand in the global market. These airlines operate large fleets and frequently update their aircraft, making them key customers for seating manufacturers.

Component Insights

Based on component, the structure segment led the market with the largest revenue share of 34.74% in 2023, owing to the advancements in materials such as carbon fiber composites and lightweight alloys, leading to the development of more durable and lighter seating structures. These materials help reduce the overall weight of the aircraft, which in turn improves fuel efficiency and reduces operational costs. Moreover, aircraft seating designs are now incorporating modular components that can be easily customized or reconfigured, stimulating the demand for innovative structural solutions, thereby favoring the growth of structure segment.

The actuators segment is expected to grow at the fastest CAGR of 7.0% from 2024 to 2030. Actuators are integral to advanced seating features, such as adjustable lumbar support, reclining mechanisms, and seat movement controls. Ongoing enhancements in actuator technology provide smoother, more reliable, and quieter operation, enhancing overall passenger comfort and satisfaction. As airlines are increasingly investing in these technologies to offer a premium travel experience, the segment is expected to witness a significant growth over the coming years.

Standard Insights

Based on standard, the 16G segment led the market with the largest revenue share of 79.09% in 2023, owing to increasing need to comply with stringent regulations established by regulatory agencies such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) regarding crashworthiness and passenger safety. The 16G standard is part of these regulations, driving the demand for seats that meet these requirements. Advances in materials and engineering have made it possible to design and manufacture seats that meet the 16G standard without significantly increasing weight or reducing comfort, which is favoring segmental growth.

The 21G segment is expected to grow at the fastest CAGR from 2024 to 2030, within the market as safety regulations become more rigorous, instigating the demand for seats that comply with higher standards. Moreover, with growing concerns about safety, passengers and airlines alike are prioritizing seats that offer the highest level of protection. The 21G standard provides a greater sense of security, driving demand from both airlines and passengers. These factors are creating lucrative opportunities for the market growth.

Class Insights

Based on class, the economy class segment led the market with the largest revenue share of 28.15% in 2023. The global increase in air travel, particularly in emerging markets, has significantly expanded the demand for economy class seating. As more passengers travel by air, airlines need to accommodate this growing demand with more seats, leading to increased investments in economy class seating solutions. Economy class is a crucial segment for airlines due to its high volume and revenue generation potential, which urges them to optimize seating arrangements to maximize capacity and improve cost efficiency, which is expected to drive the segmental growth over the coming years.

The premium economy class segment is expected to grow at a notable CAGR from 2024 to 2030. As travelers seek more comfort and better service without the high cost of Business Class, airlines are increasingly investing in premium economy seating to meet this demand. Features such as more legroom, wider seats, and improved recline are becoming standard, driving growth in this segment. Moreover, the expansion of long-haul routes and increased international travel, is driving the demand for seating options in Premium Economy that provides a viable solution for passengers seeking comfort on longer flights, which further accelerates the market expansion.

Aircraft Insights

Based on aircraft, the narrow body aircraft segment led the market with the largest revenue share of 53.97% in 2023. Narrow-body aircraft are widely used for short- to medium-haul flights, which have seen a surge in passenger traffic, urging airlines to optimize their seating to accommodate more passengers and improve passenger comfort. Moreover, airlines are increasingly focusing on enhancing the in-flight experience for passengers on narrow-body aircraft through new seating configurations that offer better comfort and convenience, such as adjustable headrests, improved recline options, and personal entertainment systems. Such developments are, in turn, creating remunerative opportunities for the market growth.

The business jet segment is expected to grow at a notable CAGR from 2024 to 2030. The business jet segment has seen increased demand due to a growing preference for private travel among corporate executives, high-net-worth individuals, and government officials. This demand drives the need for luxurious, customized seating solutions that provide superior comfort and convenience. Business jets are often equipped with high-end, customizable seating that caters to the specific needs and preferences of their owners. Features such as fully reclining seats, integrated massage functions, and premium materials are in high demand, which supports market expansion.

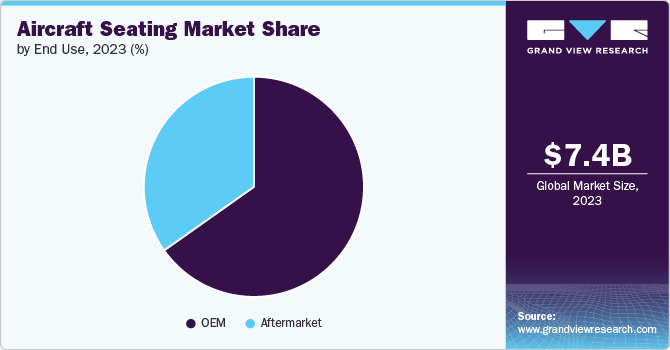

End Use Insights

Based on end use, the OEM segment led the market with the largest revenue share of 65.2% in 2023, owing to increasing global demand for new aircraft is rising due to the expansion of airline fleets. Airlines are ordering new planes to meet the growing demand for air travel and to replace aging fleets. This surge in aircraft production directly fuels the demand for OEM aircraft seating, as each new plane requires a complete set of seats. Moreover, the OEMs are integrating the latest seating technologies into new aircraft designs to improve passenger comfort, safety, and efficiency, which is further contributing to the segmental growth.

The aftermarket segment is expected to grow at the fastest CAGR from 2024 to 2030. Airlines are increasingly investing in modernizing and upgrading their existing fleets to extend the life of their aircraft and enhance passenger experience. This includes retrofitting older planes with newer, more advanced seating that offers better comfort, functionality, and efficiency. These factors are contributing to the segmental growth as airlines seek to keep their fleets competitive without incurring the additional cost of purchasing new aircraft.

Regional Insights

North America dominated the aircraft seating market with the largest revenue share of 34.67% in 2023. The region has a well-established air travel infrastructure and a high frequency of both domestic and international flights, driving continuous demand for new and upgraded aircraft seating. Moreover, several major airlines in the region are initiating fleet renewal programs, accompanied by the adoption of modern seating that aligns with the latest industry standards, including enhanced safety features and passenger comfort. These factors underline the dominance of North America market.

U.S. Aircraft Seating Market Trends

The aircraft seating market in U.S. is estimated to witness at a significant CAGR from 2024 to 2030, as the country has one of the largest and most mature aviation markets globally, with a high volume of air travel which fuels the demand for continuous upgrades in aircraft seating.

Asia Pacific Aircraft Seating Market Trends

The aircraft seating market in Asia Pacific is expected to grow at a notable CAGR of 8.70% from 2024 to 2030. The region is one of the fastest-growing regions in terms of air passenger traffic, driven by the rising middle class, increasing disposable incomes, and a growing preference for air travel over other modes of transportation. Countries, including China, India, and Southeast Asian nations, are witnessing a surge in both domestic and international flights, necessitating the expansion of airline fleets, proliferating the market growth.

The India aircraft seating market is estimated to grow at a notable CAGR from 2024 to 2030. The growth is attributed to increasing demand for aircraft seating driven by increasing air travel amid ongoing urbanization and expansion of business hubs in the country. Besides, increasing disposable incomes and a growing middle-class population in the country is further creating ample growth opportunities for the market.

The aircraft seating market in China accounted for a significant revenue share in 2023, as airlines in the country are rapidly expanding their fleets to meet the growing passenger demand, necessitating the procurement of new seating solutions. Adoption of smart seating technologies, including in-seat power, connectivity, and entertainment systems, enhances passenger experience and drives the market growth further.

The Japan aircraft seating market is expected to witness at a notable CAGR from 2024 to 2030, owing to the presence of dense and efficient domestic air travel network connecting major cities and remote regions, driving consistent demand for aircraft seats that enhance passenger comfort and operational efficiency.

Europe Aircraft Seating Market Trends

The aircraft seating market in Europe accounted for a notable revenue share of in 2023 and is expected to grow at a significant CAGR during the forecast period. European airlines are increasingly expanding and modernizing their fleets to accommodate growing passenger demand, particularly in low-cost and regional carriers. This drives the need for new and more efficient seating solutions. There is a rising demand for premium economy and business class seating, especially on long-haul flights. European airlines are investing in high-quality, comfortable seating to effectively cater to customer demand and enhance the overall market outlook.

The UK aircraft seating market is expected to witness at a significant CAGR over the forecast period, owing to increasing demand for domestic and international air travel, leading to a surge in airline fleet expansion and upgrades. The country being a major hub for global travel, drives airlines to invest in modern, comfortable, and efficient seating to enhance passenger experience.

The aircraft seating market in Germany is estimated to grow at a notable CAGR from 2024 to 2030. Germany is one of the leading countries in the global aerospace industry and is home to major aircraft manufacturers, suppliers, and engineering firms, which drives demand for advanced and innovative seating solutions, favoring the market growth in the country.

Middle East & Africa (MEA) Aircraft Seating Market Trends

The aircraft seating market in the Middle East and Africa (MEA) region is estimated to grow at a considerable CAGR from 2024 to 2030. The region has seen a substantial increase in air travel, driven by growing economies, rising disposable incomes, and a surge in tourism. Countries like the UAE, Qatar, and Saudi Arabia have become major international travel hubs, further boosting the demand for new aircraft and, consequently, aircraft seating. The rapidly expanding airline fleets to accommodate the rising passenger traffic is creating significant demand for aircraft seats, thereby contributing to market growth.

The Saudi Arabia aircraft seating market is expected to witness at a significant CAGR during the forecast period, driven by increased product demand on account of the ongoing expansion of existing airports, the development of new ones, and a considerable rise in national carriers.

Key Aircraft Seating Company Insights

Some of the key players operating in the market include RTX Corporation, Airbus, Safran Group, and RTX Corporation among others.

-

Safran Group is a global high-technology group that provides solutions to the aerospace, defense, and security markets. The company’s product portfolio comprises of air conditioning systems, aircraft electronic equipment and critical software, boosters, cockpit solutions, elastomer products, electrical distribution systems, engineering services, fuel management systems, and helicopter engines

-

Collins Aerospace, an RTX Corporation company, designs and delivers advanced solutions for the aerospace and defense sector. The company offers its products under various categories including avionics, advanced structures, connected aviation solutions, interiors, power and control systems and mission systems. Its key products comprise cabin management and content systems, landing systems, engineered aerospace structures, lavatories and de-icing, engine controls, and air management control units

Some of the emerging players operating in the market include Mirus Aircraft Seating Ltd, RECARO Aircraft Seating GmbH & Co. KG, Iacobucci HF Aerospace S.p.A. among others.

-

Mirus Aircraft Seating Ltd. designs and manufactures aircraft seating. Mirus combines expertise from the automotive and aerospace sectors to create innovative, high-performance products. It offers aircraft seats designed to improve ergonomics and enhance living space for passengers, while also reducing CO2 emissions

-

Iacobucci HF Aerospace manufactures galley inserts and seating products. The company is engaged in design, certification, production, and distribution of Standard Units and Seats for commercial and business aviation as well as Espresso Makers, Water Heaters, Coffee Makers, Trash compactors, Induction Ovens, Cooking stations, etc

Key Aircraft Seating Companies:

The following are the leading companies in the aircraft seating market. These companies collectively hold the largest market share and dictate industry trends.

- Safran Group

- RECARO Aircraft Seating GmbH & Co. KG

- Jamco Corporation

- Thompson Aero Seating

- Hong Kong Aircraft Engineering Company Limited

- Airbus

- RTX Corporation

- Expliseat S.A.S.

- ZIM Aircraft Seating GmbH

- Geven SPA

- Adient Aerospace LLC

- Aviointeriors s.p.a.

- Mirus Aircraft Seating Ltd

- Iacobucci HF Aerospace S.p.A.

Recent Developments

-

In August 2024, RECARO Aircraft Seating received a contract from IndiGo Airlines (InterGlobe Aviation Limited) to install R5 seats into the business class cabins of their A321neo aircraft featuring 12 business class seats and 208 economy class seats. The RECARO R5 seats provide robust functionality and advanced comfort with a 38-inch pitch and a customized, lightweight design

-

In May 2024, Collins Aerospace, an RTX Corporation company launched the main cabin seat named Helix for narrow body aircraft at the 2024 Aircraft Interiors Expo. This new aircraft seat has been engineered to reduce weight while providing improved living space and ergonomic comfort. The seat back is optimized to integrate numerous in-flight entertainment solutions, full-sized meal trays and literature pockets

-

In May 2024, Jazz Aviation LP signed a purchase agreement with Expliseat S.A.S.to deloy TiSeat 2 V sets to renew the cabins of its 25 Dash 8-400 aircrafts. These seats come in two different finishes and trims for preferred economy and standard economy class. It comprises a personal electronic device holder, 3D generous cushion, and recline for an enhanced passenger experience

Aircraft Seating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.82 billion

Revenue forecast in 2030

USD 11.44 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, class, aircraft, standard, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Safran Group; RECARO Aircraft Seating GmbH & Co. KG; Jamco Corporation; Thompson Aero Seating; Hong Kong Aircraft Engineering Company Limited; Airbus Atlantic SAS; RTX Corporation; Expliseat S.A.S.; ZIM Aircraft Seating GmbH; Geven SPA; Adient Aerospace LLC; Aviointeriors s.p.a.; Mirus Aircraft Seating Ltd; Iacobucci HF Aerospace S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Seating Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global aircraft seating market report based on component, class, aircraft, standard, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Structure

-

Foams

-

Actuators

-

Electrical Fittings

-

Others

-

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Business Class

-

Economy Class

-

Premium Economy Class

-

First Class

-

Pilot & Crew Seating

-

-

Aircraft Outlook (Revenue, USD Million, 2018 - 2030)

-

Narrow Body Aircraft

-

Wide Body Aircraft

-

Business Jets

-

Regional Transport Aircraft

-

-

Standard Outlook (Revenue, USD Million, 2018 - 2030)

-

9G

-

16G

-

21G

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft seating market size was estimated at USD 7.42 billion in 2023 and is expected to reach USD 7.82 billion in 2024.

b. The global aircraft seating market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 11.44 billion by 2030.

b. The North America region dominated the industry with a revenue share of 34.7% in 2023. This can be attributed to the rising demand for new and upgraded aircraft seating driven by the well-established air travel infrastructure and a high frequency of both domestic and international flights in the region.

b. Some key players operating in aircraft seating market include Safran Group, RECARO Aircraft Seating GmbH & Co. KG, Jamco Corporation, Thompson Aero Seating, Hong Kong Aircraft Engineering Company Limited, Airbus, RTX Corporation, Expliseat S.A.S., ZIM Aircraft Seating GmbH, Geven SPA, Adient Aerospace LLC, Aviointeriors s.p.a., Mirus Aircraft Seating Ltd, and Iacobucci HF Aerospace S.p.A.

b. Key factors that are driving aircraft seating market growth include increased air travel across the globe, investment in new aircrafts and retrofitting of existing ones, advancements in aircraft seating material, and integration of high-end in-flight entertainment features.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."