- Home

- »

- Next Generation Technologies

- »

-

Aircraft MRO Market Size, Share And Growth Report, 2030GVR Report cover

![Aircraft MRO Market Size, Share & Trends Report]()

Aircraft MRO Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Engine Overhaul, Airframe Maintenance), By Organization Type, By Aircraft Type, By Aircraft Generation, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-997-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft MRO Market Summary

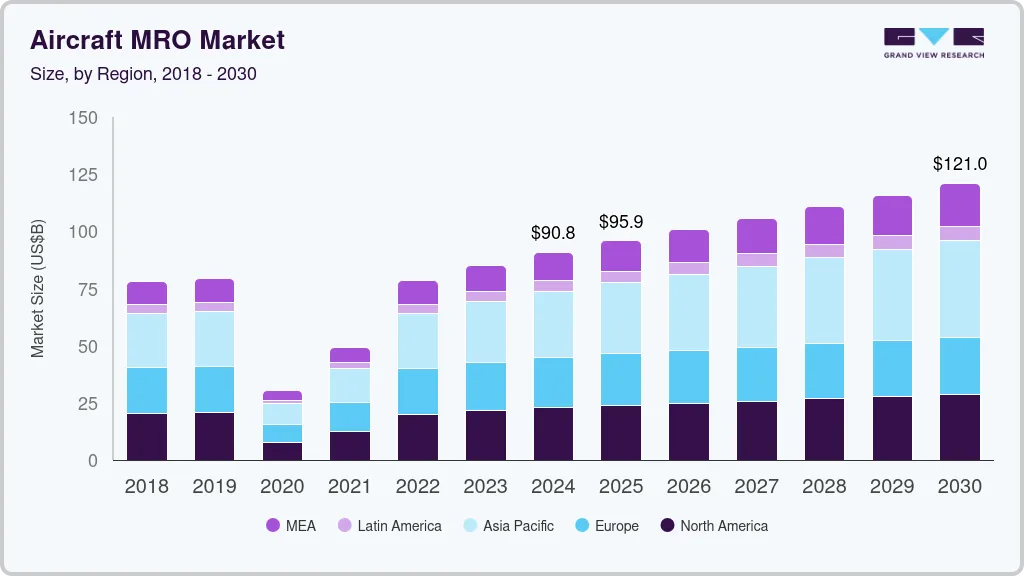

The global aircraft MRO market size was estimated at USD 90.85 billion in 2024 and is projected to reach USD 120.96 billion by 2030, growing at a CAGR of 4.75% from 2025 to 2030. Digital technologies are revolutionizing aircraft MRO processes. The integration of advanced data analytics, artificial intelligence (AI), and machine learning is enabling predictive maintenance, which can reduce downtime and enhance operational efficiency.

Key Market Trends & Insights

- North America aircraft MRO market dominated with a revenue share of over 25% in 2024.

- The U.S. Aircraft MRO market is expected to grow at a CAGR from 2025 to 2030.

- Based on service, the engine overhaul segment led the market in 2024, accounting for over 41% of the global revenue.

- By organization type, the independent MRO segment accounted for the largest market revenue share in 2024.

- By aircraft type, the narrow body segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 90.85 Billion

- 2030 Projected Market Size: USD 120.96 Billion

- CAGR (2025-2030): 4.75%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Airlines and MRO providers are increasingly utilizing cloud-based systems to streamline operations and improve data accessibility. This shift not only reduces costs but also enhances decision-making capabilities through real-time insights. Furthermore, the implementation of digital twin technology allows for more precise simulations of aircraft performance, leading to optimized maintenance schedules.

As environmental concerns grow, the aviation industry is prioritizing sustainability in MRO operations. MRO providers are adopting green practices, such as reducing waste and utilizing eco-friendly materials in repairs and maintenance processes. The shift towards more sustainable aviation fuels (SAFs) also impacts maintenance strategies, necessitating adjustments in materials and technologies. Regulatory bodies are increasingly emphasizing sustainability metrics, prompting MROs to innovate in waste management and resource utilization. This trend not only enhances corporate social responsibility but also aligns with the broader industry goal of reducing carbon emissions.

There is a notable trend towards outsourcing MRO services, as airlines seek to focus on core competencies and reduce operational costs. Collaborative models between airlines and MRO providers are gaining traction, allowing for shared resources and expertise. This approach enhances flexibility and enables MROs to scale operations according to demand fluctuations. Additionally, strategic partnerships are emerging between OEMs and MROs to streamline maintenance processes and ensure compliance with regulatory standards. By leveraging external expertise, airlines can improve service quality while optimizing their maintenance budgets.

The MRO sector faces a significant skills gap due to an aging workforce and the rapid evolution of technology. Companies are increasingly investing in training and development programs to equip their personnel with the necessary skills to work with advanced technologies. Collaborations with educational institutions are also on the rise, aiming to attract new talent to the industry. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) in training processes is enhancing learning outcomes by providing immersive experiences. This focus on workforce development is crucial for maintaining high safety standards and operational efficiency in MRO services.

The growing complexity of aircraft systems has led to a heightened focus on component maintenance and repair. As aircraft become more sophisticated, the need for specialized MRO services for individual components is increasing. This trend is particularly evident in the rise of third-party component repair specialists that offer tailored services to airlines. Additionally, advancements in technologies such as 3D printing are enabling rapid prototyping and production of replacement parts, reducing lead times and costs. As a result, airlines are increasingly prioritizing component maintenance strategies to ensure optimal performance and safety standards in their fleets.

Service Insights

The engine overhaul segment led the market in 2024, accounting for over 41% of the global revenue. This growth is driven by increasing demand for aircraft maintenance and repair services, as well as the growing number of aging aircraft in operation. The engine overhaul service market involves the repair and maintenance of aircraft engines, which is critical for ensuring the safety and reliability of aircraft operations. Some of the key players in the engine overhaul service market include GE Aviation, Pratt & Whitney, Rolls-Royce, and Honeywell International, among others. These players are investing in R&D activities to develop innovative engine overhaul solutions to cater to the evolving needs of the aircraft MRO market.

The modification segment is predicted to foresee the highest growth in the coming years. Modification services involve making changes to the aircraft's structure or systems to improve its performance, efficiency, or safety. The increasing demand for air travel, coupled with the aging fleet of aircraft, has led to a growing need for modification services to extend the service life of older aircraft. Moreover, the adoption of new technologies in aircraft manufacturing has created a demand for retrofitting services to upgrade existing aircraft systems. Furthermore, the increasing demand for fuel-efficient aircraft and the adoption of new technologies in aircraft manufacturing are expected to drive the growth of this market segment.

Organization Type Insights

The independent MRO segment accounted for the largest market revenue share in 2024. Independent MROs are investing heavily in advanced technologies to improve service efficiency and quality. The adoption of data analytics and predictive maintenance is enabling these providers to anticipate maintenance needs, thereby reducing unscheduled downtime. Additionally, independent MROs are leveraging technologies such as 3D printing for rapid parts production and augmented reality (AR) for training and repair procedures. This technological integration not only enhances operational efficiency but also allows independent MROs to compete effectively with OEMs. By staying at the forefront of technology, independent providers are positioning themselves as viable alternatives for airlines seeking modern maintenance solutions.

The OEM MRO segment is predicted to foresee the fastest growth in the coming years. OEM MRO organizations benefit from their deep understanding of aircraft systems, access to proprietary data, and close relationships with manufacturers. Increasing complexity in aircraft technologies has led operators to seek specialized expertise, favoring OEMs with their intricate knowledge of their own products. Additionally, OEMs often offer integrated solutions, including both parts and services, streamlining operations for operators. Market growth is further propelled by rising air traffic, necessitating more frequent maintenance activities. Furthermore, technological advancements such as predictive maintenance and digitalization are enhancing the capabilities of OEM MRO services, improving efficiency, and reducing downtime.

Aircraft Type Insights

The narrow body segment accounted for the largest revenue share in 2024. The increasing demand for air travel, particularly in emerging economies, has led to a significant expansion of narrow-body fleets operated by airlines globally. As these aircraft accrue flight hours, the need for regular maintenance and repair services escalates, fostering growth in the MRO sector. Additionally, advancements in narrow-body aircraft technology, such as the introduction of more fuel-efficient engines and enhanced avionics systems, necessitate specialized maintenance expertise. Regulatory requirements mandating stringent safety standards and regular inspections further contribute to the demand for MRO services in this segment. Furthermore, the ongoing trend towards outsourcing maintenance activities by airlines to third-party MRO providers has also fueled market expansion.

The wide body segment is predicted to foresee the fastest growth in the coming years. The increasing demand for long-haul travel has led to the expansion of wide-body fleets among airlines globally. As these fleets age, there is a growing need for comprehensive maintenance, repair, and overhaul services to ensure their continued airworthiness and operational efficiency. Additionally, advancements in aircraft technology, such as composite materials and advanced avionics, require specialized expertise for maintenance and repair, and further driving demand for MRO services. Moreover, regulatory requirements regarding safety and maintenance standards continue to evolve, necessitating ongoing updates and inspections for wide-body aircraft.

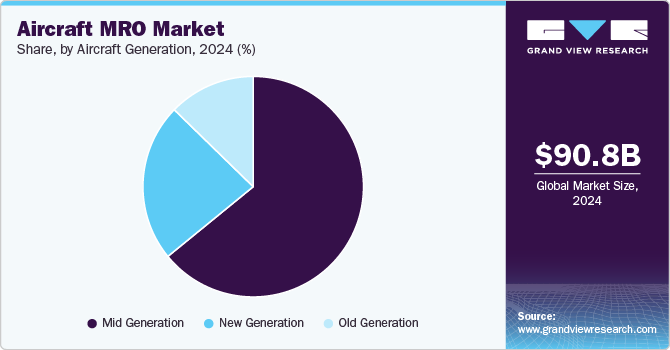

Aircraft Generation Insights

The mid generation segment accounted for the largest market revenue share in 2024. Predictive maintenance is becoming a cornerstone of MRO strategies for mid-generation aircraft. By utilizing data analytics and sensor technologies, MRO providers can anticipate maintenance needs based on the aircraft's operational history and real-time performance data. This proactive approach minimizes unplanned downtimes and extends the life of aircraft components, significantly improving operational efficiency. Airlines are increasingly adopting predictive maintenance frameworks to enhance safety and reduce maintenance costs. As a result, this trend is fostering a shift from reactive to proactive maintenance strategies within the industry.

The new generation segment is anticipated to exhibit the fastest CAGR over the forecast period. The concept of digital twins is gaining momentum in the MRO landscape for new generation aircraft. A digital twin is a virtual representation of an aircraft that simulates its performance and maintenance needs based on real-time data. This technology allows MRO providers to conduct detailed analyses and monitor the health of aircraft systems continuously. By utilizing digital twins, airlines can optimize maintenance strategies, reduce operational costs, and improve overall fleet management. The adoption of this technology not only enhances maintenance precision but also contributes to the longevity and reliability of new generation aircraft.

Regional Insights

North America aircraft MRO market dominated with a revenue share of over 25% in 2024. The North America market is increasingly leveraging advanced technologies, such as predictive maintenance and data analytics, to optimize operational efficiency. The focus on regulatory compliance and safety standards drives MRO providers to invest in workforce training and certifications. Additionally, sustainability initiatives are gaining importance, prompting MROs to adopt greener practices and reduce their environmental footprint.

U.S. Aircraft MRO Market Trends

The U.S. Aircraft MRO market is expected to grow at a CAGR from 2025 to 2030. The U.S. market is characterized by its strong focus on innovation, with advanced technologies like AI and machine learning driving operational improvements. There is a heightened emphasis on workforce development to address the skills gap, ensuring that technicians are equipped to handle modern maintenance challenges. Collaborative relationships between airlines and MRO providers are also on the rise, fostering integrated maintenance solutions that enhance reliability and efficiency.

Europe Aircraft MRO Market Trends

The Europe aircraft MRO market is expected to witness significant growth over the forecast period. In Europe, sustainability is a key trend as MRO providers respond to regulatory pressures and public demand for environmentally friendly practices. Collaborative partnerships among airlines, MROs, and OEMs are becoming more prevalent, facilitating streamlined maintenance processes and improved service quality. The region also emphasizes compliance with stringent safety regulations, leading to the adoption of advanced technologies like digital twins and AI-driven analytics.

Asia Pacific Aircraft MRO Market Trends

The aircraft MRO market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The Asia Pacific region is experiencing rapid growth in the MRO sector, fueled by rising air travel demand and significant investments in MRO infrastructure. Modernization is a critical trend, with providers increasingly adopting technologies such as IoT and big data analytics to enhance maintenance efficiency. This region is also becoming a hub for specialized MRO services, catering to a diverse range of aircraft, including narrow-body and wide-body jets.

Key Aircraft MRO Company Insights

Some key players in the aircraft MRO market are actively working to expand their customer base and gain a competitive advantage through various strategic initiatives. Companies like AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Lufthansa Technik; and Raytheon Technologies Corporation are pursuing partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach enables them to enhance their market presence and drive innovation in response to evolving industry needs.

-

Lufthansa Technik is a global leader in aircraft MRO services, known for its comprehensive portfolio that includes maintenance, repair, and overhaul of commercial and VIP aircraft. What sets Lufthansa Technik apart is its extensive expertise in integrated aircraft services, which encompasses everything from line and base maintenance to component services and retrofitting solutions. Additionally, the company is recognized for its innovative solutions, such as digital MRO services and the use of advanced technologies like predictive maintenance and data analytics to enhance operational efficiency and safety.

-

Delta TechOps is the MRO division of Delta Airlines and is one of the largest airline maintenance providers in North America. It specializes in a wide range of services, including airframe and engine maintenance, component repair, and line maintenance for both Delta’s fleet and third-party airlines. Delta TechOps is known for its efficiency and innovation, having implemented advanced technologies and streamlined processes that allow for faster turnaround times and reduced operational costs.

Key Aircraft MRO Companies:

The following are the leading companies in the aircraft mro market. These companies collectively hold the largest market share and dictate industry trends.

- AAR Corp.

- Airbus SE

- Delta Airlines, Inc. (Delta TechOps)

- Hong Kong Aircraft Engineering Company Limited

- KLM UK Engineering Limited

- Lufthansa Technik

- MTU Aero Engines AG

- Raytheon Technologies Corporation (Previously United Technologies Corporation)

- Singapore Technologies Engineering Ltd

- TAP Maintenance & Engineering (TAP Air Portugal)

Recent Developments

-

In February 2024, GE Aerospace, the aircraft engine supplier of General Electric Company, invested USD 11 million to establish a Smart Factory in its Singapore-based Aircraft Engine Repair facility. Through this initiative, the company aimed to revolutionize engine repair and expand workforce skills to support new technology.

-

In March 2024, AAR Corp. acquired Triumph Group’s Product Support Business. Through this acquisition, the company aimed to provide specialized repair, maintenance, and overhaul for critical aircraft components in the commercial and defense sectors.

-

In March 2024, C&L Aviation Group purchased two Citation Sovereign and two Citation XLS aircraft for teardown. Two disassembly projects have been completed in the company’s Bangor MRO facility with the other two projects underway. Recognizing the scarcity of aircraft parts in the market, the company aims to inspect the components and sell them for the maintenance and repair of other aircraft.

Aircraft MRO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 95.92 billion

Revenue forecast in 2030

USD 120.96 billion

Growth rate

CAGR of 4.75% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, organization type, aircraft type, aircraft generation, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

AAR Corp.; Airbus SE; Delta Airlines, Inc. (Delta TechOps); Hong Kong Aircraft Engineering Company Limited; KLM UK Engineering Limited; Lufthansa Technik; MTU Aero Engines AG; Raytheon Technologies Corporation (Previously United Technologies Corporation); Singapore Technologies Engineering Ltd; TAP Maintenance & Engineering (TAP Air Portugal)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft MRO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Aircraft MRO market report based on service, organization type, aircraft type, aircraft generation, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Engine Overhaul

-

Airframe Maintenance

-

Line Maintenance

-

Modification

-

Components

-

-

Organization Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airline/Operator MRO

-

Independent MRO

-

OEM MRO

-

-

Aircraft Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Narrow-Body

-

Wide-Body

-

Regional Jet

-

Others

-

-

Aircraft Generation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Old Generation

-

Mid Generation

-

New Generation

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global aircraft MRO market size was estimated at USD 90.85 billion in 2024 and is expected to reach USD 95.92 billion in 2024.

b. The global aircraft MRO market is expected to grow at a compound annual growth rate of 4.75% from 2025 to 2030 to reach USD 120.96 billion by 2030.

b. Asia Pacific dominated the aircraft MRO market with a share of over 25% in 2024. This is attributable to a rise in air traffic in upcoming years, an increase in international trade, and demand for new aircraft.

b. Some key players operating in the aircraft MRO market include AAR Corp; Air-France Industries KLM Engineering & Maintenance; Bombardier Inc.; Delta TechOps; GE Aviation; Hong Kong Aircraft Engineering Co. Ltd.; Lufthansa Technik; MTU Aero Engines AG; and Triumph Group, Inc.

b. Key factors that are driving the aircraft MRO market growth include a surge in aircraft retirement, increasing GDP, and growth in air transportation market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.