- Home

- »

- Automotive & Transportation

- »

-

Aircraft Engine Market Size, Share And Growth Report, 2030GVR Report cover

![Aircraft Engine Market Size, Share & Trends Report]()

Aircraft Engine Market (2024 - 2030) Size, Share & Trends Analysis Report By Engine (Turboprop, Turbofan, Turboshaft, Piston Engine), By Aircraft (Commercial, Military, Business & General Aviation), By Point Of Sale (OEM, Aftermarket), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft Engine Market Summary

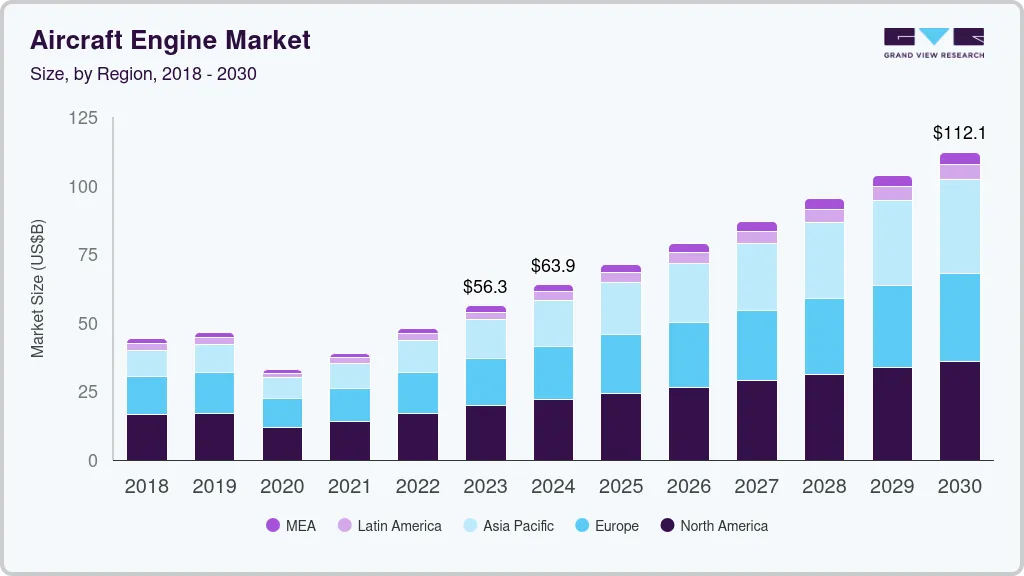

The global aircraft engine market size was estimated at USD 56.28 billion in 2023 and is projected to reach USD 112.10 billion by 2030, growing at a CAGR of 9.81% from 2024 to 2030. There is an increasing demand for fuel-efficient, environmentally friendly engines.

Key Market Trends & Insights

- The North America for aircraft engines accounted for the largest revenue share of 35% in 2023.

- The aircraft engine market in the U.S. is expected to grow at a notable CAGR of 8% from 2024 to 2030.

- By engine, the turbofan engines segment accounted for 71% of the revenue share in 2023.

- By aircraft, the military aircraft segment is expected to register the fastest CAGR from 2024 to 2030.

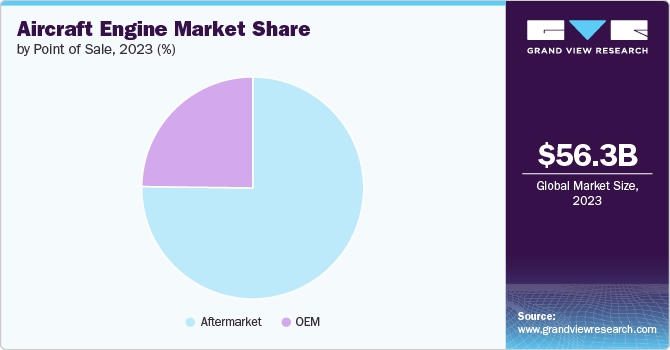

- By point of sale, the aftermarket point of sale segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 56.28 Billion

- 2030 Projected Market Size: USD 112.10 Billion

- CAGR (2024-2030): 9.81%

- North America: Largest market in 2023

As airlines strive to reduce operational costs and meet stringent emissions regulations, there is a growing preference for engines that offer better fuel efficiency and lower carbon emissions per flight hour. Additionally, advancements in technology, such as efficient turbine designs and lightweight materials, are pushing innovation in the industry. The growth of the market is further boosted by an increase in air travel demand globally, necessitating more reliable and powerful engines to support the expanding fleet of commercial and military aircraft.

Engine manufacturers are at the forefront of developing cutting-edge technologies such as high-bypass ratio turbofans and geared turbofans. These innovations not only enhance fuel efficiency, reduce noise levels, and lower emissions to meet stringent environmental regulations set by organizations like the International Civil Aviation Organization (ICAO), but also drive airlines to adopt more sustainable technologies. Consequently, manufacturers are introducing eco-friendly engine designs that promise reduced operating costs throughout their lifespan.

Advancements in materials science and digital technologies further improve engine performance and maintenance, with predictive maintenance and data analytics playing pivotal roles in monitoring engine health, minimizing downtime, and enhancing reliability. This dynamic landscape is marked by fierce competition among industry leaders such as Rolls-Royce, GE Aviation, Pratt & Whitney, and Safran Aircraft Engines, who continuously invest in research and development to stay ahead and meet evolving customer demands. Additionally, strategic partnerships and international collaborations are increasingly common, facilitating shared expertise, cost reduction, and market access, particularly in rapidly growing aviation markets worldwide.

Governments globally are also investing significantly in next-generation military aircraft equipped with advanced engines. These engines are designed to enhance operational capabilities with improved thrust-to-weight ratios, adaptability to diverse mission profiles, and reduced lifecycle costs. Heightened security threats worldwide are driving increased defense expenditures, particularly in aircraft and associated technologies. Turbofan and turboshaft engines are crucial components for military helicopters, transport aircraft, and fighter jets, supporting a wide range of operational requirements. Military engine manufacturers are focusing on developing engines with higher thrust, increased fuel efficiency, and enhanced durability. Future-focused innovations like variable cycle engines and adaptive propulsion systems are being actively pursued to meet the evolving needs of military applications.

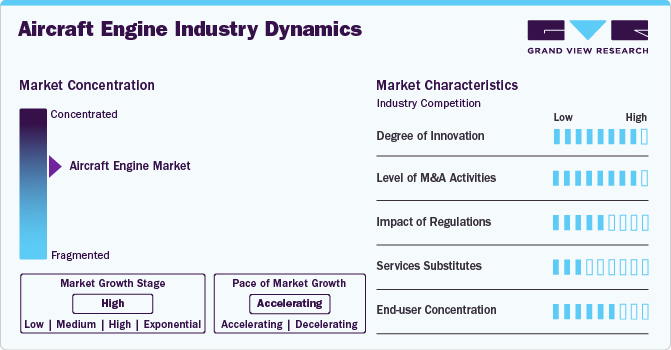

Market Concentration & Characteristics

The aircraft engine market is characterized by a high degree of innovation. The market growth stage is medium to high, and the pace of the market growth is accelerating. This surge is propelled by various factors across both commercial and military sectors around the globe. As the demand for air travel surges, particularly in emerging markets, coupled with increased defense spending in various regions, there's a heightened need for engines that are not only more efficient and reliable but also incorporate cutting-edge technologies.

The market for aircraft engine is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. This underscores the industry's evolving landscape, characterized by strategic moves to consolidate market positions, expand technological capabilities, and leverage partnerships for enhanced competitiveness and innovation.

The market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. This fits into the narrative of the industry's evolving landscape, where companies aim to solidify their market positions, expand their technological prowess, and harness collaboration to boost competitiveness and spur innovation.

The aircraft engine faces minimal competition from product substitutes in the market. This further underscores the unique position and significance of this sector within the broader industry landscape. This aspect enhances the strategic focus of companies on innovation and technological advancements, aiming to leverage their competitive edge in a niche market with limited direct alternatives.

End-user concentration is a significant factor in the aircraft engine market. This is because a limited number of aircraft manufacturers require engines, leading to a high concentration of end users. Given the low competition from product substitutes within this sector, the unique positioning and critical significance of the market are further emphasized.

Engine Insights

The turbofan engines segment accounted for 71% of the revenue share in 2023. This can be attributed to the increasing demand for commercial and military aircraft worldwide. Turbofan engines are favored for their fuel efficiency, lower noise levels, and ability to operate efficiently across various flight conditions. Manufacturers are focusing on developing advanced turbofan technologies, including high-bypass ratio engines and geared turbofans, to meet stringent environmental regulations and enhance aircraft performance. Continued fleet expansion and technological innovation are key factors propelling growth in this segment.

The turboshaft engines segment is expected to register a CAGR of 11% from 2024 to 2030, driven by expanding applications in helicopters and other rotorcraft. Turboshaft engines are critical for vertical lift and rotor propulsion, supporting missions in military, medical, and commercial sectors. Advances in engine design, such as improved power-to-weight ratios and fuel efficiency, are enhancing their performance and reliability. Increasing demand for helicopters for emergency medical services, offshore operations, and military missions further stimulates growth in this specialized segment of the aerospace industry.

Aircraft Insights

The commercial aircraft segment accounted for the largest revenue share in 2023. The growth of this segment is driven by expanding air travel demand worldwide. Airlines are increasingly investing in new, fuel-efficient aircraft equipped with advanced engine technologies to enhance operational efficiency and reduce environmental impact. Manufacturers are focusing on developing high-thrust engines with improved fuel efficiency and lower emissions to meet stringent regulatory standards. Additionally, fleet modernization initiatives and increasing air connectivity further propel growth in this segment, ensuring sustained demand for new engine installations.

The military aircraft segment is expected to register the fastest CAGR from 2024 to 2030. Global defense modernization efforts and geopolitical tensions spur the growth. Governments are investing in next-generation military aircraft equipped with advanced propulsion systems for enhanced performance, stealth capabilities, and operational flexibility. Engine manufacturers are innovating with high-thrust engines tailored for military applications, focusing on reliability, durability, and maintenance efficiency. Additionally, technological advancements in engine design, such as adaptive cycle engines and improved fuel efficiency, are driving growth in this strategic aerospace sector.

Point Of Sale Insights

The aftermarket point of sale segment accounted for the largest market revenue share in 2023. This can be attributed to the increasing global air traffic and the aging of existing aircraft fleets. Airlines and operators are focusing on efficient engine maintenance and repair services to maximize operational uptime and reduce costs. Technological advancements in predictive maintenance and data analytics are enhancing aftermarket services, offering tailored solutions for engine health monitoring and performance optimization. This sector's expansion underscores its critical role in supporting the longevity and reliability of aircraft engines worldwide.

The OEM point-of-sale segment is expected to have a moderate CAGR from 2024 to 2030. The growth is due to rising global demand for new aircraft. Original Equipment Manufacturers (OEMs) are innovating with advanced engine technologies that prioritize fuel efficiency, reliability, and environmental sustainability. Increasing aircraft orders from airlines and leasing companies drive this growth, supported by technological advancements in engine design and manufacturing processes. OEMs' strategic partnerships and investments in research and development further enhance their market position, ensuring competitiveness in a dynamic aerospace industry.

Regional Insights

North America Aircraft Engine Market Trends

The North America for aircraft engines accounted for the largest revenue share of 35% in 2023, owing to increasing air travel demand, fleet expansion, and the demand for fuel-efficient engines. Technological advancements such as lightweight materials, advanced engine designs such as geared turbofans, and enhanced maintenance practices are contributing to the market growth in the region. Regulatory changes in terms of emission reductions and noise abatement are compelling aircraft engine manufacturers to invest in innovation in engine efficiency, further increasing he market outlook in the region.

U.S. Aircraft Engine Market Trends

The aircraft engine market in the U.S. is expected to grow at a notable CAGR of 8% from 2024 to 2030, propelled by robust demand for commercial and military aircraft, fleet modernization initiatives, and increasing air passenger traffic. Technological advancements in engine efficiency, such as higher bypass ratios and improved materials, play a crucial role. Environmental regulations stimulating the development of quieter and more fuel-efficient engines are also significant drivers.

Asia Pacific Aircraft Engine Market Trends

The aircraft engine market in Asia Pacific accounted for a significant revenue share in 2023, driven by the rapid expansion of airline fleets to meet increasing air travel demand. Emerging economies, such as China and India, are major contributors, investing heavily in new aircraft acquisitions. Technological advancements in engine efficiency and the establishment of regional MRO facilities further bolster market growth.

The Japan aircraft engine market is estimated to grow significantly from 2024 to 2030 due to collaborations with international engine manufacturers and advancements in aerospace technology. The country's focus on high-performance and fuel-efficient engines for commercial and defense applications contributes to market expansion.

The aircraft engine market in India is estimated to record a notable CAGR from 2024 to 2030, propelled by the expansion of civil aviation and defense sectors. Initiatives such as "Make in India" encourage local manufacturing of aircraft components, including engines. Increasing air connectivity and investments in airport infrastructure further stimulate demand for new engines and maintenance services.

The China aircraft engine market had the largest revenue share in 2023. The growth is fueled by the country's ambitious plans for indigenous aircraft production and technological self-sufficiency. Government initiatives support the development of domestic engine manufacturing capabilities, reducing reliance on foreign suppliers and enhancing national security.

Europe Aircraft Engine Market Trends

The aircraft engine market in Europe is anticipated to grow at a CAGR of nearly 9% from 2024 to 2030. The market benefits from established aerospace infrastructure and technological innovation. Companies in Germany, the UK, and France lead in engine development, focusing on fuel efficiency, reduced emissions, and noise reduction technologies to meet stringent environmental regulations.

The French aircraft engine market accounted for a significant revenue share in 2023. This growth is propelled by leading manufacturers focusing on eco-friendly engine technologies and advancements in materials science. Collaborative efforts within European aerospace programs strengthen competitiveness in producing efficient engines for global markets.

The aircraft engine market in the UK is estimated to grow at the highest CAGR from 2024 to 2030. The market thrives on its renowned engine manufacturers, developing high-thrust engines and innovative propulsion systems. Strategic partnerships with global aerospace leaders and investments in research and development drive advancements in engine performance and reliability.

The German aircraft engine market is estimated to grow at a moderate CAGR from 2024 to 2030. This growth is driven by the country's strong aerospace industry, which emphasizes technological advancements in engine efficiency and sustainability. Collaboration with European partners enhances research and development capabilities, supporting the production of next-generation engines for commercial and military applications.

Middle East & Africa (MEA) Aircraft Engine Market Trends

The aircraft engine market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. This growth is driven by rapid aviation infrastructure development and increasing air travel demand. Countries like Saudi Arabia invest in expanding their airline fleets and enhancing aerospace capabilities, supported by rising tourism and economic diversification efforts.

The aircraft engine market in Saudi Arabia accounted for a considerable revenue share in 2023, which is further fueled by substantial investments in the defense and commercial aviation sectors. The country's Vision 2030 initiative emphasizes local manufacturing and technology transfer, driving partnerships with global engine manufacturers to develop and maintain advanced engines for military and civilian aircraft.

Key Aircraft Engine Company Insights

Some of the key players operating in the market include Rolls-Royce, General Electric Company, and Pratt & Whitney.

-

Rolls-Royce expanded its footprint in the aircraft engine market through strategic initiatives focused on innovation and global partnerships. They developed advanced engine technologies like the Trent series, renowned for efficiency and reliability. Additionally, collaborations with aircraft manufacturers strengthened their market position, enabling tailored solutions for diverse customer needs.

-

Pratt & Whitney's strategic initiatives in the market included pioneering the development of high-thrust engines such as the PW4000 and PW6000 series, noted for their efficiency and performance. They also focused on enhancing environmental sustainability with innovations like the Geared Turbofan (GTF) engine, reducing fuel consumption and emissions.

ITP Aero, Engine Alliance, and Advanced Atomization Technologies Inc. are some of the emerging market participants.

-

ITP Aero has strategically positioned itself in the aircraft engine market by focusing on innovation and collaboration. They have developed advanced engine components and systems, contributing to major engine programs such as the Rolls-Royce Trent series and the Eurojet EJ200. Through partnerships with industry leaders and research institutions,

-

Engine Alliance has strategically positioned itself by specializing in high-thrust, fuel-efficient engines like the GP7200, designed for large commercial aircraft. Through a joint venture between General Electric (GE) and Pratt & Whitney, Engine Alliance leverages the expertise of both companies to offer cutting-edge technology and performance.

Key Aircraft Engine Companies:

The following are the leading companies in the aircraft engine market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Atomization Technologies Inc.

- Enjet Aero

- Engine Alliance

- Safran Group

- Pratt & Whitney

- Rolls-Royce

- MTU Aero Engines AG

- CFM International

- General Electric Company

- ITP Aero

- New Hampshire Ball Bearing (MinebeaMitsumi Aerospace)

Recent Developments

-

In April 2024, Rolls-Royce announced that IndiGo had placed an order for 60 Trent XWB-84 engines, marking their first agreement with the prominent Indian airline. The deal included Rolls-Royce's TotalCare service for engine health and maintenance. The engines from this order were intended to support IndiGo's expansion efforts, especially on international routes, bolstering the airline's operational capabilities.

-

In May 2024, Pratt & Whitney inaugurated its new manufacturing facility, Pratt & Whitney Maroc (PWM), dedicated to producing precision machined parts for aircraft engines like the PT6. The investment underscored confidence in Morocco's industrial capabilities, enhancing the country's aeronautical sector with advanced technological capabilities and contributing to its competitive edge in global aerospace manufacturing.

-

In June 2024, Safran Helicopter Engines and MTU Aero Engines collaborated to establish EURA, a 50/50 joint venture named after the European Military Rotorcraft Engine Alliance. The venture aimed to lead a broader program involving industrial and technological partners from multiple European countries. This strategic initiative marked a significant milestone in enhancing European aerospace capabilities through collaborative innovation and industrial cooperation.

Aircraft Engine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.93 billion

Revenue forecast in 2030

USD 112.10 billion

Growth rate

CAGR of 9.81% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Engine, aircraft, point of sale, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Advanced Atomization Technologies Inc.; Enjet Aero; Engine Alliance; Safran Group; Pratt & Whitney; Rolls-Royce Holdings plc; MTU Aero Engines AG; CFM International; General Electric Company; ITP Aero; New Hampshire Ball Bearing (MinebeaMitsumi Aerospace); IAE International Aero Engines AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft Engine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft engine market report based on engine, aircraft, point of sale, and region:

-

Engine Outlook (Revenue, USD Billion, 2018 - 2030)

-

Turboprop

-

Turbofan

-

Turboshaft

-

Piston Engine

-

-

Aircraft Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Aircraft

-

Military Aircraft

-

Business and General Aviation Aircraft

-

-

Point of Sale Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft engine market size was estimated at USD 56.28 billion in 2023 and is expected to reach USD 63.93 billion in 2024.

b. The global aircraft engine market is expected to grow at a compound annual growth rate of 9.81% from 2024 to 2030 to reach USD 112.10 billion by 2030.

b. North America accounted for a market revenue share of 34.0% in 2023, due to increasing air travel demand, fleet expansion, and the need for fuel-efficient engines. Technological advancements such as lightweight materials, advanced engine designs (e.g., geared turbofan), and enhanced maintenance practices also contribute.

b. Some key players operating in the aircraft engine market include Rolls-Royce, General Electric Company, Pratt & Whitney, ITP Aero, Engine Alliance, Advanced Atomization Technologies Inc, and among others

b. Governments globally are also investing significantly in next-generation military aircraft equipped with advanced engines. These engines are designed to enhance operational capabilities with improved thrust-to-weight ratios, adaptability to diverse mission profiles, and reduced lifecycle costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.