- Home

- »

- Organic Chemicals

- »

-

Aircraft De-icing Market Size, Share & Growth Report, 2030GVR Report cover

![Aircraft De-icing Market Size, Share & Trends Report]()

Aircraft De-icing Market (2023 - 2030) Size, Share & Trends Analysis Report By Fluid Type (Type I, Type II), By Method (Spray, Chemical), By Application (Commercial, Military), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-146-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aircraft De-icing Market Size & Trends

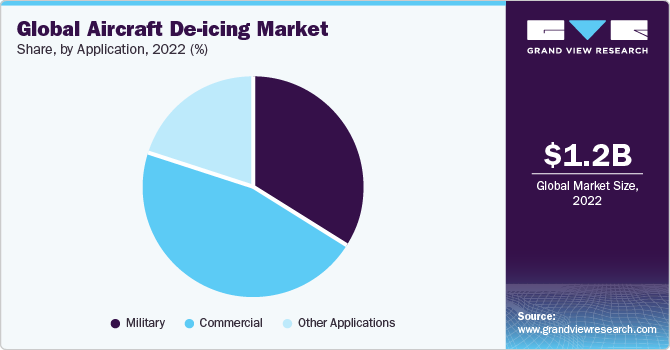

The global aircraft de-icing market size was estimated at USD 1.18 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The growth of the product market is attributed to the rising safety concerns as accumulation of snow and ice on the aircraft’s surface can significantly impact its performance. Moreover, regulatory requirements implemented by aviation authorities such as the Federal Aviation Administration (FAA) necessitate being compliant with de-icing guidelines. Such factors are expected to advance the product demand over the forecast period.

Regions with cold climates and frequent snowfall require de-icing to ensure the safe operation of flights. The increasing number of flights and the expansion of the aviation industry are further aiding the growth in demand for the product market. For instance, according to the International Trade Administration, the air passenger activity witnessed a growth of 70% in 2022 with international aviation witnessing growth of 150% compared to that of pandemic time.

Moreover, the COVID-19 pandemic had a significant impact on the market. Disruptions due to the pandemic, including reduced air travel, travel restrictions, and the overall economic downturn, affected the demand for aircraft de-icing services. As per the International Civil Aviation Organization (ICAO), the global aviation industry experienced a loss of USD 372 billion and USD 324 billion in 2020 and 2021 respectively, on account of travel restrictions by national governments.

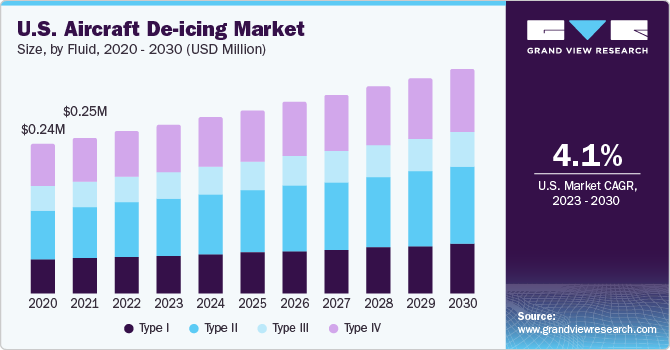

The U.S. is the leading product consumer in North America, accounting for a revenue share of more than 68% in 2022. This is owing to the steadily rising number of flights and air travel in the country. As more people choose to travel by plane, especially during the winter months, the need to ensure safe operations by removing ice and snow from aircraft surfaces becomes crucial. According to the Airlines for America association, commercial aviation in the country contributed to 5% of the GDP, which amounts to USD 1.25 trillion in 2022. Thus, the progressing aviation sector is expected to drive product demand in the U.S. during the projection period. Moreover, the country experiences diverse climatic conditions, including regions with cold temperatures and heavy snowfall. This necessitates the usage of de-icing techniques to maintain the safety and performance of the aircraft. In addition, regulatory requirements set by aviation authorities in the U.S. mandate compliance with de-icing guidelines, further driving the demand for the product in the country.

Fluid Insights

Based on fluid type. the type II segment dominated the market in 2022 with a revenue share of over 33%. This growth is attributed to its fast-acting properties, allowing for quick de-icing and turnaround times. This is crucial in busy airports where aircraft need to be de-iced promptly to maintain flight schedules. It is a glycol-based fluid that is heated and sprayed onto the aircraft, leading to the melting of the ice and ensuring a safe flight takeoff. These products are designed to be effective across a range of temperatures, making them suitable for use in different weather conditions.

Moreover, type II fluid is considered less harmful to the environment compared to older de-icing fluids. It is less toxic and biodegradable, reducing its impact on ecosystems and water sources. As environmental sustainability becomes increasingly important, the demand for type II fluid has risen as airlines and aviation authorities prioritize eco-friendly practices.

Type I is another segment anticipated to witness growth over the forecast period. Type I fluids are typically a heated mixture of propylene glycol and water effective in removing ice and frost from aircraft surfaces, ensuring safe takeoff. Moreover, type I fluids have a rapid dilution rate under precipitation conditions, which helps to maintain their effectiveness. They can absorb heat from aircraft surfaces, which aids in preventing ice formation. As the aviation industry continues to prioritize safety and efficient operations, the demand for Type I fluids in aircraft de-icing is increasing.

Method Insights

In terms of method, the spray de-icing segment dominated the global market with a revenue share of over 35% in 2022. This is attributed to the fact that this method offers versatility in various weather conditions. It is a technique used in aircraft de-icing where a heated de-icing fluid is sprayed onto the aircraft surface to remove ice and frost. The heated fluid is sprayed under pressure, allowing for efficient and thorough coverage of the aircraft's wings, tail, and control surfaces. It can be used in a wide range of temperatures and climates, making it suitable for different regions and seasons. This adaptability contributes to the growing demand for this method in the market.

Infrared heating is another method anticipated to witness growth over the forecast period. It is a technique for removing ice from aircraft surfaces by utilizing infrared radiation. During this process, infrared heaters are used to emit heat energy, which is then absorbed by the ice, leading it to melt and slide off the surface of the aircraft. As opposed to other methods that use de-icing fluids, the infrared heating technique is a chemical-free approach. This eliminates the need for the application and subsequent removal of de-icing fluids, reducing environmental concerns and simplifying the ice removal process.

Application Insights

The commercial aviation segment dominated the market in 2022 with a revenue share of over 46%. This strong share is attributed to the fact that aviation regulatory bodies, such as the Federal Aviation Administration (FAA), have implemented very particular de-icing protocols to ensure the safety of crew and passengers. Airlines must abide by these regulations to maintain their operating licenses and meet stringent safety standards.

Additionally, the diverse weather conditions present in different regions where airlines operate also are a major factor in the growing demand for de-icing services. Winter weather conditions such as snow, freezing rain, and ice can greatly impact aircraft safety and performance. As commercial aviation continues to expand globally, airlines operate in areas with unpredictable winter weather, necessitating the need for efficient and reliable de-icing services. Additionally, consumers expect reliable and safe air travel, regardless of weather conditions. Airlines meanwhile aim to minimize delays and disruptions due to winter weather by introducing efficient de-icing procedures. Meeting passenger expectations and maintaining a positive reputation are key drivers behind the increasing demand for the product market.

Regional Insights

The North America region dominated the market in 2022 with a revenue share of over 32%. This growth is attributed to diverse and often harsh winter weather conditions, including snowstorms, freezing rain, and ice accumulation in the region. These weather conditions pose a significant challenge to the safe operation of aircraft, making effective de-icing procedures crucial.

Regulatory compliance is another crucial factor leading to the strong demand for aircraft de-icing services. Regulatory bodies, such as the Federal Aviation Administration (FAA) in the U.S., have established specific guidelines concerning aircraft de-icing procedures. Airlines need to comply with these regulations to maintain their operating licenses and meet safety standards. A failure to follow these regulations can result in penalties and the potential grounding of aircraft.

North America is home to several important airports and serves as a hub for domestic and international air travel. As the number of flights and passengers steadily rises in the region, the need for efficient and timely de-icing operations becomes more vital. For instance, as per the Airlines for America (A4A), the U.S. airlines operated over 25,000 flights carrying an excess of 2.5 million passengers from 80 countries and more than 59,000 tons of cargo from over 220 countries daily in 2022. Airlines strive to minimize disruptions and delays due to winter weather conditions by implementing effective de-icing procedures and ensuring on-time departures & arrivals, thus driving product demand.

Key Companies & Market Share Insights

The product market is characterized by the presence of several manufacturers, equipment suppliers, and service providers offering a range of de-icing products and services. These companies compete based on factors such as product quality, efficiency, reliability, and customer service. They invest in research and development to stay ahead of the curve and meet the evolving needs of the aviation industry. In addition, expansions, partnerships, and collaborations between manufacturers, service providers, and airport authorities are common, allowing for a more comprehensive and integrated approach to strengthen their position in the market. For instance, in 2023, Vestergaard Company announced their organizational expansion to manage the growing demand for their products in the North America region. This expansion will help the company fulfill the requirements of its customers in an efficient manner thus, strengthening its customer base.

Key Aircraft De-icing Companies:

- CLARIANT

- Dow

- JBT Corporation

- Kilfrost

- LyondellBasell

- BASF SE

- CRYOTECH

- Vestergaard Company

- Contego Aviation Solutions

- Textron Ground Support Equipment Inc.

Aircraft De-icing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.24 billion

Revenue forecast in 2030

USD 1.74 billion

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fluid type, method, application, region

Key companies profiled

CLARIANT; Dow; JBT Corporation; Kilfrost; LyondellBasell; BASF SE; CRYOTECH; Vestergaard Company; Contego Aviation Solutions; Textron Ground Support Equipment Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aircraft De-icing Market Report Segmentation

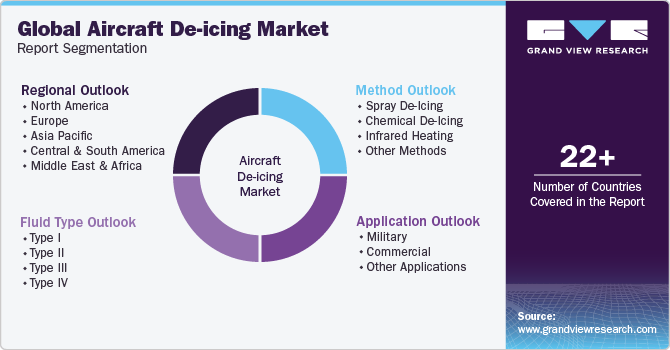

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aircraft de-icing market report based on fluid type, method, application, and region:

-

Fluid Type Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2018 - 2030)

-

Type I

-

Type II

-

Type III

-

Type IV

-

-

Method Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2018 - 2030)

-

Spray De-Icing

-

Chemical De-Icing

-

Infrared Heating

-

Other Methods

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2018 - 2030)

-

Military

-

Commercial

-

Other Applications

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aircraft de-icing market size was estimated at USD 1.18 billion in 2022 and is expected to reach USD 1.24 billion in 2023.

b. The global aircraft de-icing market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 1.74 billion by 2030.

b. North America emerged as the dominating region with a revenue share of over 32% in 2022. This growth is attributed to diverse and often harsh winter weather conditions, including snowstorms, freezing rain, and ice accumulation in the region. These weather conditions pose a significant challenge to the safe operation of aircraft, making effective de-icing procedures crucial.

b. Some key players operating in the aircraft de-icing market include CLARIANT, Dow, JBT Corporation, Kilfrost, LyondellBasell, BASF SE, CRYOTECH, Vestergaard Company, Contego Aviation Solutions, Textron Ground Support Equipment Inc.

b. Key factors that are driving the market growth include the rising safety concerns as snow and ice accumulated on the aircraft’s surface can significantly impact its performance. Moreover, regulatory requirements set by aviation authorities such as Federal Aviation Administration (FAA) necessitate compliance with the de-icing guidelines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.