Airborne SATCOM Market Size, Share & Trends Analysis Report By Installation (New Installation, Retrofit), By End-use (Commercial, Military & Defense), By Component, By Platform, By Frequency, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Airborne SATCOM Market Size & Trends

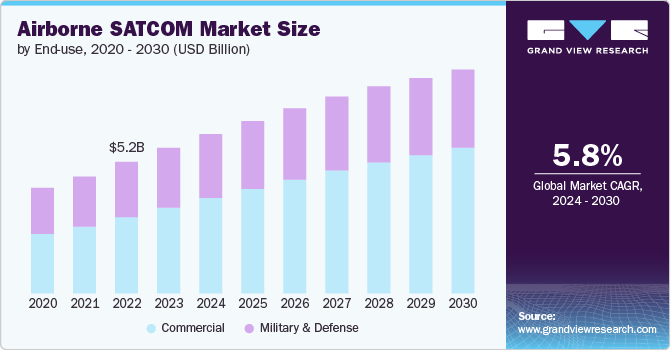

The global airborne SATCOM market size was estimated at USD 5.75 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The market growth is attributed to the rising demand for advanced communication systems to enhance passenger experience and operational efficiency amid the global expansion of commercial aviation, with more aircraft being added to fleets. Moreover, the increasing demand for reliable, high-speed internet access during flights for entertainment, work, and communication drives the demand for satellite communications (SATCOM) systems among airlines. In addition, the growing demand for these systems to enhance communication for flight crews and improve coordination with ground control teams is further propelling the market growth.

Market growth is further driven by the increasing number of military and defense applications. Defense organizations increasingly adopt airborne SATCOM systems to establish critical communication links for command and control, intelligence, surveillance, and reconnaissance (ISR) missions. Moreover, these systems offer the ability to transmit real-time data between airborne assets and ground control stations during military missions, further driving their demand and contributing to the market growth.

In addition, airborne SATCOM is crucial during disaster management when terrestrial communication infrastructure is damaged or nonexistent. Moreover, government agencies also use SATCOM systems for surveillance, border patrol, and other security operations that require real-time communication and data transfer. The growing usability of these systems across various industries and government organizations is expected to accelerate market growth over the foreseeable future.

The market is undergoing rapid technological advancements that improve existing capabilities and create avenues for new applications. Several market players focus on developing innovative solutions, which are expected to drive market growth significantly over the coming years. For instance, in July 2024, TURKSAT-6A, Turkey’s first communication satellite, equipped with X-Band and Ku-Band communication payloads by Aselsan S.A., was launched from Florida, U.S. This new initiative is a major milestone for Turkey as it has placed the country within the league of countries capable of developing their communication satellites.

Market Concentration & Characteristics

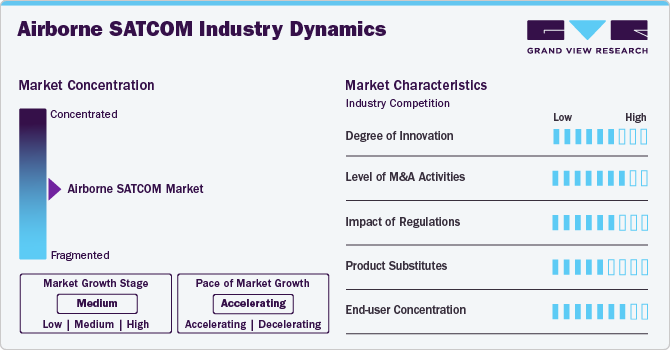

The market growth stage is medium, and the pace of growth is accelerating. Growing inclination of businesses toward satellite communication and increased investments to expand space infrastructure is substantiating the market growth. This market is largely influenced by a high degree of innovation, instigating the demand for SATCOM solutions and network infrastructure and attracting significant investments from government and private players.

The market is witnessing an increasing number of merger and acquisition (M&A) activities, especially among public and private players. These players are forming strategic alliances that have become pivotal in fostering research & development activities, innovation, and expanding market reach.

Regulatory compliance and standards play a key role in the market as the government bodies regulate the allocation of radio frequency spectrum used for satellite communication. This can impact the availability of frequencies for airborne SATCOM systems and influence the cost of acquiring licenses.

End-user concentration is a significant factor in the market. Several industries, including mining, construction, oil & gas, energy & utilities, agriculture, transportation, etc., largely rely on satellite communication to remotely monitor on-site activities, increasing safety and enhancing maintenance procedures.

The threat of substitutes is relatively low for the market. While emerging technologies potentially threaten airborne SATCOM, it cannot be entirely replaced soon. Instead, they may develop a more diverse communication landscape with solutions catering to specific needs.

End-use Insights

The commercial segment dominated the market with the highest revenue share in 2023 and is expected to record the highest CAGR from 2024 to 2030. This growth is credited to the increasing demand for SATCOM systems among airlines to provide in-flight WiFi and internet access, enhancing the passenger experience by offering in-flight connectivity like that on the ground. Moreover, the airlines are constantly seeking ways to enhance in-flight entertainment options, thereby impelling the adoption of SATCOM, which allows them to offer a wider variety of content, including live TV, streaming services, and on-demand movies. The rising demand for enhanced in-flight connectivity and entertainment is expected to drive segmental growth over the coming years.

The military and defense vehicles segment is expected to grow significantly during the forecast period, owing to rising military budgets across several countries. These budgets are directed toward advanced communication technologies, which, in turn, drive the demand for airborne SATCOM solutions. Modern military operations rely on real-time data exchange and secure communication, stimulating the demand for these solutions as they enable data transmission from drones and other airborne platforms for various critical missions, thereby contributing to segmental growth.

Component Insights

The modems & routers segment accounted for the largest revenue share of nearly 25.0% in 2023. The high significance of these components for translating signals between the aircraft and the satellite network contributes to segmental growth. Moreover, they modulate and demodulate data, ensure efficient communication, and manage data packets. As SATCOM systems become more complex, offering higher bandwidths and supporting diverse applications, the functionality of modems and routers is also expanding, providing positive growth prospects for the segment.

The SATCOM terminals segment is expected to record the highest CAGR of 7.2% from 2024 to 2030. The growth is credited to increasing demand for internet access and various in-flight entertainment options. SATCOM terminals enable airlines to offer high-speed internet for browsing, streaming, and staying connected while offering access to on-demand movies, live TV, and other media. In addition, SATCOM terminals are being increasingly adopted for military operations to provide real-time data transmission, effective situational awareness, and secure command & control functions, further favoring the market expansion.

Platform Insights

The commercial aircraft segment accounted for the largest market share in 2023. SATCOM solutions are witnessing heightened demand in this segment as air travelers demand seamless online experiences for browsing, streaming content, social media, and even remote work. Moreover, SATCOM goes beyond passenger entertainment to facilitate real-time data exchange between ground control and aircraft, providing optimized flight paths for fuel savings and improved on-time performance. These solutions provide in-flight connectivity, significantly enhancing the passenger experience and largely stimulating segmental growth.

The business jet segment is expected to witness the highest CAGR from 2024 to 2030 as they increasingly rely on constant connectivity for collaboration, communication, and access to critical business information. In this regard, SATCOM ensures uninterrupted access to email, cloud storage, video conferencing, and other essential tools, allowing passengers to work productively during flights. The increasing significance of SATCOM in providing reliable connectivity over remote areas and oceans during long-haul international flights and enabling various entertainment options is positively influencing segmental growth.

Frequency Insights

The Ku-Band segment accounted for a significant revenue share in 2023. The increasing usage of Ku-Band (12-18 GHz), which offers a relatively good balance between bandwidth and cost compared to other frequency bands, drives the segmental growth. Moreover, it provides sufficient bandwidth for applications such as in-flight internet access, voice calls, and video streaming at more affordable prices. In addition, as Ku-Band technology is well-established and has been around for decades, Ku-Band SATCOM terminals are easily available, making them easier to deploy. Many existing commercial aircraft are already designed to accommodate Ku-Band SATCOM systems, which drives their adoption rate and further contributes to segmental growth.

The Ka-Band segment is anticipated to record the highest CAGR from 2024 to 2030. The Ka-Band, which operates in a frequency range of 26.5 to 40 GHz, offers more bandwidth compared to other commonly used bands such as Ku-Band or C-Band. This enables much faster data transfer rates, which is essential for applications including in-flight video streaming, WiFi, and real-time data transmission. Besides, with more bandwidth available, this frequency band can facilitate more consistent and reliable connectivity, especially over long distances or in areas with high user demand. The increasing demand for Ka-Band due to its several advantages is driving the market growth.

Installation Insights

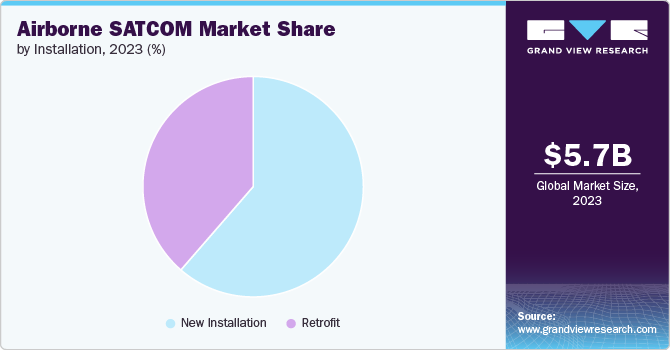

The new installation segment accounted for the largest revenue share in 2023. Newer aircraft are designed with features that make them more compatible with modern SATCOM systems, thereby instigating the demand for new installations. Newer aircraft are being designed with advanced avionics systems that can easily integrate with modern SATCOM technology. On the other hand, retrofitting older aircraft might require significant modifications to accommodate the system. Moreover, new installations allow for more effective data exchange and functionality, which further increases consumer reference for it, contributing the segmental growth.

The retrofit segment is expected to grow significantly from 2024 to 2030 with increasing consumer preference as it is generally more cost-effective than buying a new aircraft with pre-installed SATCOM. Moreover, the existing aircraft structures may already be compatible, which reduces the modification costs. Besides, retrofitted systems can be designed with in line with future upgrades, enabling airlines to adapt to the technological advancements without requiring an entirely new aircraft. Such advantages associated with this installation method are favoring segmental growth.

Regional Insights

The airborne SATCOM market in North America accounted for the largest revenue share, nearly 38%, in 2023. The growth is attributed to the heightened demand for SATCOM in the region, driven by increasing military expenditures as government organizations seek to modernize their communication infrastructure. Moreover, the increasing trend of offering internet access for browsing, streaming, and staying connected for work or leisure on airplanes demands in-flight connectivity, creating lucrative growth opportunities for the regional market.

U.S. Airborne SATCOM Market Trends

The airborne SATCOM market in the U.S. dominated the North American market with the highest revenue share in 2023 and is estimated to witness a significant growth rate of 4.6% from 2024 to 2030. Airlines are increasingly demanding in-flight connectivity solutions to enhance their travel experiences, which is expected to support the market growth in this region.

Asia Pacific Airborne SATCOM Market Trends

The airborne SATCOM market in Asia Pacific is expected to record its highest growth rate of 7.9% from 2024 to 2030, owing to increasing initiatives to modernize military capabilities across various countries. The increasing need to strengthen the communication infrastructure amid the increasing focus of defense organizations on national security is driving the demand for SATCOM solutions in the region. Moreover, the expansion of various major satellite communication solutions providers in the region is further enhancing the overall market outlook.

India airborne SATCOM market is estimated to record a notable growth rate from 2024 to 2030 on account of increasing investments by the Indian government in its space program, recognizing the importance of satellite communication for various applications.

The airborne SATCOM market in China accounted for a significant revenue share in 2023, owing to increasing defense expenditure in the country. Besides, the growing space industry in the country offers significant growth opportunities for the market.

Japan airborne SATCOM market is expected to witness a significant CAGR from 2024 to 2030 owing to increasing concern over national security which has led to a significant emphasis on enhancing defense capabilities, including advanced satellite communication solutions. In addition, increasing focus on disaster management and response is also creating ample opportunities for the airborne SATCOM market in the country.

Europe Airborne SATCOM Market Trends

The airborne SATCOM market in Europe accounted for a significant revenue share in 2023 and is expected to witness notable growth over the coming years. This growth is attributed to the presence of several major aerospace and defense companies in the region that are striving the design and deliver enhanced airborne communication solutions that can effectively cater to the demand of military as well as commercial sectors. Moreover, the increasing demand for advanced in-flight communication systems is also driving the growth of the regional market.

The UK airborne SATCOM market is expected to witness significant growth over the coming years with increasing demand for advanced communication systems in the country to facilitate efficient air traffic management and flight operations.

The airborne SATCOM market in Germany is estimated to record a notable CAGR from 2024 to 2030. The growth is attributed to increasing investment in SATCOM systems driven by the expansion of the civil aviation sector and rising demand for in-flight connectivity in the country.

Middle East and Africa (MEA) Airborne SATCOM Market Trends

The airborne SATCOM market in the Middle East and Africa (MEA) region is estimated to record a considerable CAGR from 2024 to 2030 owing to the region's aspiring infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, which involve the development of smart cities. These projects require efficient satellite communication solutions that facilitate effective urban management, traffic control, and public safety. Besides, the strong presence of several major aviation and SATCOM solution providers in the region is creating significant growth opportunities for the market.

Saudi Arabia airborne SATCOM market accounted for a considerable revenue share in 2023 owing to the ongoing expansion of the civil aviation industry driven by the growing travel and tourism sector in the country, which stimulates the demand for efficient SATCOM solutions.

Key Airborne SATCOM Company Insights

Some of the key players operating in the market include General Dynamics Corporation, L3 Harris Technologies, Inc., Northrop Grumman, Aselsan A.S., Thales Group, Viasat, Inc., and Israel Aerospace Industries

-

General Dynamics Corporation is a global aerospace and defense company delivering a wide range of products and services in business aviation, land combat vehicles, ship construction and repair, weapons systems and munitions, and technology solutions. The company has four major business segments: Aerospace, Combat Systems, Marine Systems, and Technologies.

-

Northrop Grumman delivers a broad range of products, services, and solutions to the U.S. and global customers, mainly to the U.S. Department of Defense (DoD) and intelligence community. The company’s major segments include aeronautics systems, defense systems, mission systems, and space systems.

-

Viasat, Inc. operates as a satellite communication solutions provider offering fixed and mobile broadband services, tactical data link systems, and secure networking systems. The company also provides space system design and development systems, antenna systems, semiconductor design for integrated circuit chips, modules and subsystems, network function virtualization, etc.

Norsat International and Cobham Limited are some of the emerging market participants in the airborne SATCOM market.

-

Norsat International operates as a communication solutions provider offering customizable satellite components, portable satellite terminals, satellite networks, and maritime solutions. Its products and services are extensively used by telecom operators, homeland security agencies, military organizations, news organizations, health care providers, and several other large-scale companies.

-

Cobham Limited is an aerospace company that designs and manufactures a variety of equipment, specialized components and systems for industries such as defense, aerospace, electronics, and energy. The company offers control and communications solutions for civil & military aircraft, and satellite communications in the most demanding environments across the globe.

Key Airborne SATCOM Companies:

The following are the leading companies in the airborne satcom market. These companies collectively hold the largest market share and dictate industry trends.

- Cobham Limited

- General Dynamics Corporation

- Honeywell International, Inc.

- L3 Harris Technologies, Inc.

- Northrop Grumman

- RTX Corporation

- Aselsan A.S.

- Thales Group

- Viasat, Inc.

- Israel Aerospace Industries

- Norsat International

- Mitsubishi Electric Corporation

- Teledyne Technologies Incorporated

- Gilat Satellite Networks Ltd.

Recent Developments

-

In June 2024, Gilat Satellite Networks Ltd. secured orders of more than USD 14 million from various prominent system integrators and service providers for its In-Flight Connectivity (IFC) products and solutions, including solid-state power amplifiers (SSPAs), network equipment, and additional IFC auxiliary products.

-

In June 2024, Viasat Inc. strengthened its collaboration with Airbus Defence and Space to integrate GAT-5530, the former’s dual-band (Ku/Ka) broadband terminal into the Spanish C295 MPA fleet to deliver a highly flexible, multi-orbit and multi-band broadband SATCOM capability to support missions utilizing the sovereign SpainSat NG satellites.

-

In Aril 2024, ASELSAN Latin America, the subsidiary of Aselsan A.S., announced regional expansion with the opening of its new office in Santiago, Chile. Through this initiative, the company aims to enable new collaboration opportunities with local government agencies, defence organizations, and stakeholders fostering strategic partnerships, technology transfers, and joint ventures.

Airborne SATCOM Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.29 billion |

|

Revenue forecast in 2030 |

USD 8.84 billion |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, platform, frequency, installation, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Cobham Limited; General Dynamics Corporation; Honeywell International, Inc.; L3 Harris Technologies, Inc.; Northrop Grumman; RTX Corporation; Aselsan A.S.; Thales Group; Viasat, Inc.; Israel Aerospace Industries; Norsat International; Mitsubishi Electric Corporation; Teledyne Technologies Incorporated; Gilat Satellite Networks Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Airborne SATCOM Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global airborne SATCOM market report based on component, platform, frequency, installation, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transceivers

-

Airborne Radio

-

Modems & Routers

-

SATCOM Randoms

-

SATCOM Terminals

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aircraft

-

Military Aircraft

-

Business Jets

-

Helicopters

-

Unmanned Aerial Vehicles (UAV)

-

-

Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

C-Band

-

L-Band

-

Ka-Band

-

Ku-Band

-

UHF-Band

-

Others

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Retrofit

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military & Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global airborne SATCOM market size was estimated at USD 5.75 billion in 2023 and is expected to reach USD 6.29 billion in 2024.

b. The global airborne SATCOM market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 8.84 billion by 2030.

b. The North America region dominated the industry with a revenue share of 37.7% in 2023. This can be attributed to increasing military expenditure as government organizations seek to modernize their communication infrastructure.

b. Some key players operating in the airborne SATCOM market include Cobham Limited, General Dynamics Corporation, Honeywell International, Inc., L3 Harris Technologies, Inc., Northrop Grumman, RTX Corporation, Aselsan A.S., Thales Group, Viasat, Inc., Israel Aerospace Industries, Norsat International, Mitsubishi Electric Corporation, Teledyne Technologies Incorporated, and Gilat Satellite Networks Ltd.

b. Key factors that are driving airborne SATCOM market growth are increasing military expenditure to enhance communication infrastructure, growing demand for in-flight communication among airlines, and ongoing technological developments in satellite communication solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."