Air Purifier Market Size, Share & Trends Analysis Report By Technology (HEPA, Activated Carbon), By Application (Commercial, Residential), By Coverage Range, By Sales Channel, By Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-406-2

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Air Purifier Market Size & Trends

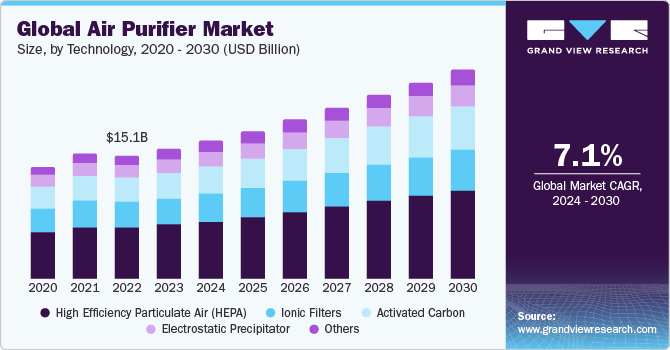

The global air purifier market size was estimated at USD 15.94 billion in 2023 and is expected to grow at a CAGR of 7.1% from 2024 to 2030. The growth is driven by rising instances of airborne diseases and pollution levels in urban areas. For instance, according to the Centre for Research on Energy and Clean Air, China experienced a rise in its national average PM2.5 level year-on-year in 2023 since the commencement of the campaign on pollution in the country. Moreover, factors such as growing health awareness, improving standard of living, and rising disposable income of the masses are expected to fuel the market growth. The rising adoption of air pollution control equipment, especially in developing regions of the world, is also anticipated to drive the growth of the air purifier industry over the forecast period.

High-Efficiency Particulate Air (HEPA) filters, primarily composed of submicron glass fibers, represent a category of extended surface mechanical filters with a texture resembling blotter paper. These filters boast a substantial surface area, facilitating the removal of approximately 99.7% of particles equal to or larger than 0.3 microns. Noteworthy is their efficiency in filtering particles of varying sizes, making them highly effective in enhancing air quality.

According to the 2023 report of the Organization for Economic Co-operation and Development (OECD) titled The Economic Consequences of Outdoor Air Pollution, outdoor air pollution can lead to approximately 6-9 million premature deaths by 2060 and result in a cost equivalent to 1% of the global GDP. Moreover, the report forecasts that the annual global welfare costs associated with premature deaths (PD) from outdoor air pollution will escalate from USD 3 trillion in 2015 to approximately USD 18-25 trillion by 2030.

Moreover, the rising number of stringent regulations such as the Clean Air Act (42 U.S.C. §7401 et seq. (1970), National Ambient Air Quality Standards (NAAQS), Directive 2008/50/EC, EN 1822-1:2019, ISO 16890-2:2016, Air filters for general ventilation, among others have made the adoption of air purifiers mandate. These factors are expected to drive the demand for air purifiers over the forecast period.

Furthermore, the UK is actively implementing government policies and initiatives aimed at preserving indoor air quality. For instance, in April 2023, the Department for Environment, Food & Rural Affairs (Defra) released the Air Quality Strategy, which outlines the actions to be undertaken by the local authorities in the UK to achieve long-term air quality objectives. These objectives include reducing PM2.5 levels to 10 µg/m³ by 2040 and enhancing indoor air quality through the dissemination of ventilation guidance and best practices.

Moreover, ensuring optimal indoor air quality within schools, offices, and other workplaces is paramount for the well-being and comfort of students and employees alike. Substandard indoor air quality can lead to fatigue, headaches, and irritation of the eyes, throat, lungs, and nose, thereby hindering workers' productivity. Certain air pollutants have the potential to induce diseases like asthma, while prolonged exposure to substances such as asbestos and radon can increase the risk of cancer. Contributing factors to poor indoor air quality encompass insufficient ventilation, inadequate temperature regulation, and extremes in humidity levels.

Market Concentration & Characteristics

The air purifier market has witnessed a notable shift in end-user concentration, with a rising emphasis on residential consumers. As awareness regarding indoor air quality rises, individuals are increasingly investing in air purifiers for their homes. This trend is fueled by health consciousness and the desire for cleaner living spaces. While commercial and industrial segments still contribute significantly, the surge in residential adoption signifies a prominent shift in end-user preferences within the air purifier industry. Manufacturers are adapting to meet this demand, focusing on designing compact, efficient models tailored for home use.

The focus on product substitutes has intensified in this market, with companies strategically acquiring or developing alternative solutions to traditional purifiers. This concentration is driven by a growing awareness of diverse air quality concerns and the demand for specialized substitutes such as advanced filtration systems, natural air purifying methods, and smart home technologies. The industry's emphasis on these substitutes reflects a nuanced approach to addressing specific consumer needs, fostering innovation, and ultimately shaping a more versatile and responsive market for air purification solutions.

The market for air purifiers is navigating a landscape characterized by increased regulatory attention, with governments globally implementing stringent standards and guidelines. These regulations focus on ensuring product safety, performance efficacy, and environmental impact. As the demand for air purifiers rises, compliance with air quality standards becomes paramount, influencing product development and market strategies. Industry players are proactively adapting to these regulatory frameworks, emphasizing the importance of adherence to standards in promoting consumer confidence, fostering innovation, and shaping a responsible and sustainable air purification market.

Technology Insights

The HEPA technology segment led the market and accounted for 41.7% of the global revenue share in 2023. Smoke, dust, smoke, bio-contaminants, and pollen are examples of airborne particles that HEPA filters are very effective at capturing. The global air purifier industry is projected to see increased product penetration due to the high caliber and dependability of HEPA filters to remove airborne particles.

Filters that contain activated carbon or charcoal are made of tiny bits of carbon that have been specifically treated with oxygen to open the pores of the carbon atoms. As a result, the carbon becomes more porous and has a larger surface area, which improves its capacity to capture airborne particles. With the help of these filters, gases & odors from cooking, mold, chemicals, pets, and smoke can be absorbed.

The ionic filters segment is likely to grow at a significant CAGR over the forecast period. Since ionic filters do not need to be changed frequently, their market share is growing. However, the production of ionized air and ozone during the purification process is to blame for the development of respiratory conditions like asthma, which is likely to restrict the use of the technology.

The market for electrostatic precipitator-based air purifiers is expanding across various sectors, including residential, commercial, and industrial applications. The versatility of ESP technology makes it suitable for diverse settings where the removal of airborne contaminants is essential for creating a healthier environment. While electrostatic and HEPA filtration methods are highly effective, there is consistently strong demand for electrostatic precipitators due to their exceptional ability to filter out minuscule particulates. These aforementioned factors are expected to propel the demand for electrostatic precipitator-based air purifiers in the coming years.

Coverage Range Insights

Air purifiers that cover an area between 250-400 sq. ft. led the market in 2023. These are a popular choice for larger rooms, open concept spaces, and offices. These air purifiers are naturally larger and more powerful than models that cover smaller areas, making them effective at removing pollutants from the air in larger spaces.

These air purifiers have advanced features, such as Wi-Fi connectivity, real-time air quality monitoring, and multiple fan speeds. The increasing use of air purifiers in commercial buildings, including offices and hospitals, to reduce the spread of airborne illnesses, such as colds and flu, is expected to drive the market demand for an air purifier with a coverage range of 250-400 sq. ft. market further.

Air purifiers with a coverage range of below 250 sq. fit. are effective at removing pollutants, such as dust, pollen, and pet danger, from the air, making them a good choice for people with allergies or respiratory issues. These air purifiers are typically portable, compact, and lightweight, making them easy to move from room to room as needed. Some models come with activated carbon filters that can remove odors from the air, making them a good choice for smaller homes with pets or smokers to purify the air.

Sales Channel Insights

The offline sales channel segment led the global air purifier market in 2023. The offline sales channel includes hypermarkets/supermarkets, retail stores, specialty stores, departmental stores, discount stores, and others. The offline sales channel is an important sales channel, with many consumers preferring to ensure product quality by physical examination in person before making a purchase. Consumers can examine the features, compare different models, and ask questions about the product to a sales associate. This can help consumers make a more informed decision and choose a portable air purifier that best suits their needs.

The sales of air purifiers through the online sales channel have been growing rapidly in recent years, with more and more consumers choosing to purchase air purifiers through e-commerce platforms. Online sales channel mainly involves the sales of products through company retail websites and third-party e-commerce channels. With the advancement in technology in recent years, the penetration of online sales channels for daily necessities as well as luxurious goods has significantly increased.

Online retailing giants, such as Amazon, Alibaba, The Home Depot, Flipkart, and eBay, have been introducing new initiatives to capture the untapped markets and reach more consumers. For instance, Amazon introduced AWS Malaysia Region in 2024 to advance Malaysia’s digital vision. The new initiative is expected to boost the presence of companies and their services in the country's digital economy, thereby driving online shopping over the forecast period.

Type Insights

The standalone/portable type segment led the global market in 2023. Standalone or portable air purifiers are designed to filter air, removing airborne particles, such as bacteria, viruses, and dust particles. Standalone or portable air purifiers are independent air purifier units that can be placed in a room or moved around easily. Standalone or portable air purifiers are becoming increasingly popular in commercial buildings, including workspaces, restaurants, and hospitals.

In-duct/fixed air purifiers are units that are mounted on the wall or fixed inside the HVAC duct. In-duct air purifiers are also called in-line air purifiers that are installed within the ductwork of homes or businesses. The installation of these air purifiers benefits HVAC systems, such as air conditioners or furnaces, by neutralizing dust, dander, pollen, dirt, and germs that may damage the components of the HVAC systems. These air purifiers are mostly equipped with UV lamps and air ionization systems to enhance air purification.

Application Insights

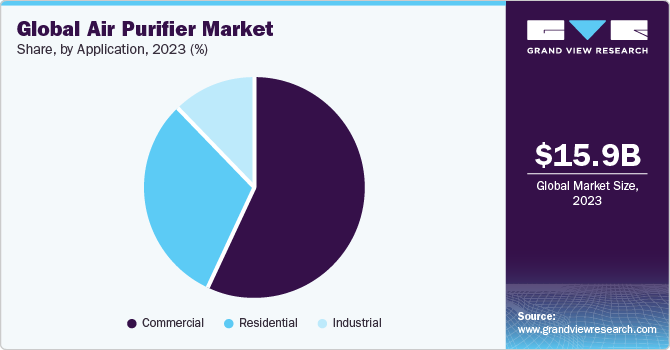

The commercial application segment led the global air purifier industry in 2023. Air purifiers have witnessed a significant surge in adoption within commercial applications, driven by a growing awareness of indoor air quality and its impact on occupants' health and well-being. The emphasis on creating a safe and comfortable indoor environment has led businesses to explore air purifier products, particularly in sectors where the concentration of pollutants can be higher.

Commercial spaces, including offices, retail establishments, and hospitality venues, are recognizing the importance of providing clean and healthy air for employees, customers, and visitors. The prevalence of pollutants such as dust, allergens, volatile organic compounds (VOCs), and airborne pathogens in these environments has prompted the integration of air purifiers to mitigate health risks and enhance overall air quality. For instance, in office settings, where employees spend a significant portion of their day, air purifiers contribute to creating a conducive and productive work environment. By removing pollutants and allergens, these devices can help reduce the risk of respiratory issues and allergies, thereby promoting employee well-being and productivity.

The industrial application segment is likely to grow at a significant CAGR over the forecast period. Air purifiers are used in several industries, including printing, petrochemical, and power plants, food & beverage, chemical, and manufacturing. Air purifiers help eliminate construction dust, asbestos, weld smoke, and other particles that are harmful to employees and adversely impact the environment if untreated.

According to the World Health Organization (WHO), illnesses caused by household air pollution lead to approximately 4 million premature deaths every year. Household air pollution has harmful effects on human health, causing asthma, lung cancer, cardiovascular diseases, and ear & upper respiratory infections, among others. These are the major factors that render air purifiers a necessity in many high pollution regions. Factors such as rising health concerns, deteriorating indoor air quality, changing lifestyle preferences, and increasing awareness among consumers about the advantages of air purifiers are expected to drive product demand in residential applications over the forecast period.

Regional Insights

The air purifier market in North America is propelled by growing air quality policies such as the U.S. Clean Air Act, establishment of national ambient air quality standards by the U.S. Environmental Protection Agency, and comprehensive emission reduction strategies by Environment Canada.

U.S. Air Purifier Market Trends

The air purifier market in the U.S. held over 72.0% share of the North America market. The U.S. Department of Energy has established standards for quality assurance and specifications related to HEPA filters. Similarly, the Association of Home Appliance Manufacturers (AHAM) has established the Clean Air Delivery Rate (CADR), which is a standard used to measure the effectiveness of air purifiers, thereby enabling consumers to compare the performance of air purifiers in eliminating dust, pollen, and tobacco smoke.

Asia Pacific Air Purifier Market Trends

Asia Pacific dominated the market and accounted for 38.9% of the global revenue share in 2023, due to several variables, including a larger population with more disposable income, rapid urbanization, and industrialization. For instance, in recent years, the Association of Southeast Asian Nations (ASEAN) has made rapid progress in raising the Occupational Safety and Health (OSH) standards within Southeast Asia. The efforts of the OSHNET, the platform to drive collaboration among regional OSH centers and agencies, have been important in the region. Mandated policies by agencies for employers to maintain worker safety in industries and commercial places are expected to drive the demand for air purifiers in Southeast Asia.

The China air purifier market held over 39.0% share in Asia Pacific, owing to the high health burden and ongoing air quality challenges in the country. According to the World Health Organization (WHO), air pollution remains a major concern in China, with sources like industry, transportation, and household fuel use contributing to fine particles harmful to human health.

The air purifier market in South Korea held over 22.0% share of Asia Pacific, owing to growing urbanization, political policies, and increasing industrialization.Rising awareness regarding health hazards and diseases caused by exposure to harmful particulates at workplaces or homes is anticipated to have a positive impact on the air purifier market in South Korea over the forecast period.

Europe Air Purifier Market Trends

The air purifier in Europe is driven by the critical need for improved air quality. Growing public awareness about the health risks associated with poor air quality is further driving market growth. Consumers are increasingly looking for ways to protect themselves and their families from harmful pollutants, and air purifiers offer a readily available solution.

The Germany air purifier market held over 17.0% share in Europe, owing to the increasing demand for technologically advanced air purifiers along with the rising prevalence of COVID-19 has forced manufacturers to invest highly in R&D. For instance, Blueair launched an intelligent air purifier for cars based on HEPASilent technology which removes 99.97% of airborne pollutants such as road wear, car exhausts, pollen, PM2.5, smoke, and dust.

The air purifier market in the UK held over 13.0% share of the Europe market. This can be attributed to public health concerns, increasing awareness, and continuous technological advancements. According to the Department for Environment, Food, and Rural Affairs, air pollution is ranked first in causing an environmental risk to human health in the UK and is the fourth greatest threat to public health after obesity, cancer, and heart disease. The actions taken under the ‘Clean Air Strategy’ Act can cut air pollution costs by USD 5.7 Billion every year by 2030.

Middle East & Africa Air Purifier Market Trends

The Middle East & Africa air purifier market is expected to witness robust growth over the forecast period, driven by several factors such as rapid urbanization, industrialization, and a growing awareness of the importance of indoor air quality. Initiatives such as the South African Renewables Initiative (SARI), along with the incorporation of green growth goals in the Industrial Action Plan (IPAP2) in South Africa, are anticipated to limit pollution levels over the coming years.

The Saudi Arabia air purifier market held over 20.0% share of the Middle East & Africa market. Current policies and programs, such as the introduction of new limits for companies to manage their emissions, incentives for clean production, and installation of pollution prevention technologies along with the construction of several public transport facilities, have created opportunities for air purifier manufacturers in recent years.

Central & South America Air Purifier Market Trends

The air purifier market in Central & South America is experiencing dynamic growth fueled by growing urbanization, industrialization, and a growing awareness of the importance of indoor air quality. Government campaigns such as “Beat Air Pollution” have created worldwide awareness of air pollution. The national governments of Colombia, Uruguay, and Honduras pledged to find clean air solutions and bring air quality to safe levels by 2030.

The Brazil air purifier market held 37.0% share of Central & South America. Rising levels of pollutants, allergens, and other airborne contaminants in cities like São Paulo and Rio de Janeiro have propelled the demand for air purifier solutions in homes, offices, and public spaces across the country.

Key Air Purifier Company Insights

The global air purifier market is highly competitive due to the presence of both multinational and regional or local manufacturers. The companies offer a wide range of air purifiers sold through various channels, including e-commerce websites, company-operated websites, retailers and their websites, and distributors. For instance, in December 2021, Secure Connection, a Hong Kong-based electronic products manufacturer, announced a new line of Honeywell Branded Air Purifiers. The new air purifier line is segmented into three categories: Value Series, Platinum Series, and Ultimate Series, with features such as UV LED, Ionizer, and Humidifier. They will be offered in a variety of South Asian and Middle Eastern nations through all major shops and online e-commerce platforms.

Market participants compete based on several parameters, such as product performance, quality, technical competence, price, and corporate reputation. New product launches, licensing agreements, distribution network expansion, technological investments, and mergers & acquisitions are some of the key strategies adopted by the companies to strengthen their market position and gain a higher market share. For instance, In February 2023, the company introduced a new carbon air purifier that uses UV technology to promote healthy indoor air quality. This system helps eliminate unwanted odors, gases, and volatile organic compounds from the air inside the home. Additionally, the technology reduces the growth of microorganisms, such as viruses and bacteria, on the evaporator coil.

Key Air Purifier Companies:

The following are the leading companies in the air purifier market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International, Inc.

- IQAir

- Koninklijke Philips N.V

- Unilever PLC

- Sharp Electronics Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics

- Panasonic Corporation

- Whirlpool Corporation

- Dyson

- Carrier

Recent Developments

-

In January 2024, COWAY CO., LTD. launched Airmega 100. It has a 360° air intake and a 3-stage HEPA filtration system that effectively removes harmful pollutants and purifies the air within an 810-square-foot space every hour. The product has a real-time air quality indicator, energy-saving technology, auto mode, and a precise particle sensor, which are some of the important features of this new air purifier.

-

In February 2023, the company introduced a new carbon air purifier that uses UV technology to promote healthy indoor air quality. This system helps eliminate unwanted odors, gases, and volatile organic compounds from the air inside the home. Additionally, the technology reduces the growth of microorganisms, such as viruses and bacteria, on the evaporator coil.

-

In August 2022, IQAir launched a smart slim bionic air purifier Atem X. This air purifier, Atem X was developed to combine four seemingly incompatible characteristics: powerful air purification, quiet operation, low energy consumption, and a slim design.

Air Purifier Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 16.93 billion |

|

Revenue forecast in 2030 |

USD 25.58 billion |

|

Growth rate |

CAGR of 7.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

April 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, coverage range, sales channel, type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Germany; China; Japan; South Korea; Singapore; Malaysia; Brazil; Saudi Arabia |

|

Key companies profiled |

IQAir; Honeywell International, Inc.; LG Electronics, Inc.; Unilever PLC; Koninklijke Philips N.V.;Panasonic Corporation; Hamilton Beach Brands, Inc.; Whirlpool Corporation; Carrier; Camfil; Sharp Electronics Corporation; COWAY Co., Ltd.; Samsung Electronics Co., Ltd.; Dyson; Molekule |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Air Purifier Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global air purifier market report based on technology, application, coverage range, sales channel, type, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Efficiency Particulate Air (HEPA)

-

Activated Carbon

-

Ionic Filters

-

Electrostatic Precipitator

-

Others

-

-

Coverage Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 250 Sq. Ft.

-

250-400 Sq. Ft.

-

401-700 Sq. Ft.

-

Above 700 Sq. Ft.

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Retail Stores

-

Specialty Stores

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone/Portable

-

In-duct/Fixed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Retail Shops (Mercantile)

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport (railway stations, metros, bus stops, airports)

-

Others

-

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global air purifier market size was estimated at USD 15.94 billion in 2023 and is expected to reach USD 16.93 billion in 2024.

b. The global air purifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 25.58 billion by 2030.

b. HEPA technology segment led the market and accounted for 41.7% of the global revenue share in 2023. Smoke, dust, smoke, bio-contaminants, and pollen are examples of airborne particles that HEPA filters are very effective at capturing. The global air purifier industry is projected to see increased product penetration due to the high caliber and dependability of HEPA filters to remove airborne particles.

b. Some of the key players operating in the air purifier market include IQAir, Honeywell International, Inc., LG Electronics, Inc., Unilever PLC, Koninklijke Philips N.V., Dyson, Sharp Electronics Corporation, Samsung Electronics Co., Ltd., Panasonic Corporation, Hamilton Beach Brands, Inc., Whirlpool Corporation, and Carrier among others

b. The growth of the market is driven by rising instances of airborne diseases and increasing pollution levels in urban areas. Moreover, growing health awareness, improving standard of living, and rising disposable income of the masses are expected to fuel the growth of the market over the forecast period.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. GVR’s Internal Database

1.4.3. Secondary Sources

1.4.4. Third-Party Perspectives

1.4.5. Primary Research

1.5. Information Analysis

1.5.1. Data Analysis Models

1.5.2. Market Formulation & Data Visualization

1.5.3. Data Validation & Publishing

1.6. Research Scope & Assumptions

1.6.1. List to Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Air Purifier Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Concentration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material Outlook

3.3.2. Manufacturing & Technology Trends

3.4. Regulatory Framework

3.5. Technology Overview

3.6. Air Purifier Market - Market dynamics

3.6.1. Market Driver Analysis

3.6.2. Market Restraint Analysis

3.6.3. Market Opportunity Analysis

3.6.4. Market Challenge Analysis

3.7. Industry Analysis Tools: Air Purifier Market

3.7.1. Porter’s Analysis

3.7.2. Macroeconomic Analysis

3.7.3. Economic Mega Trends Analysis

3.8. Consumer Behavior Analysis

3.9. Case Study

3.10. Economic Mega Trend Analysis

Chapter 4. Air Purifier Market: Technology Estimates & Trend Analysis

4.1. Air Purifier Market: Technology Outlook

4.2. Air Purifier Market: Technology Movement Analysis, 2023 & 2030

4.3. HEPA (High Efficiency Particulate Air)

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Activated Carbon

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.5. Ionic Filters

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.6. Electrostatic Precipitator

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Air Purifier Market: Coverage Range Estimates & Trend Analysis

5.1. Air Purifier Market: Coverage Range Outlook

5.2. Air Purifier Market: Coverage Range Movement Analysis, 2023 & 2030

5.3. Below 250 Sq. Ft.

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.4. 250-400 Sq. Ft.

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.5. 401-700 Sq. Ft.

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.6. Above 700 Sq. Ft.

5.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. Air Purifier Market: Sales Channel Estimates & Trend Analysis

6.1. Air Purifier Market: Sales Channel Outlook

6.2. Air Purifier Market: Sales Channel Movement Analysis, 2023 & 2030

6.3. Online

6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.4. Offline

6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.2. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Chapter 7. Air Purifier Market: Type Estimates & Trend Analysis

7.1. Air Purifier Market: Type Outlook

7.2. Air Purifier Market: Type Movement Analysis, 2023 & 2030

7.3. Standalone/Portable

7.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.4. In-duct/Fixed

7.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 8. Air Purifier Market: Application Estimates & Trend Analysis

8.1. Air Purifier Market: Application Outlook

8.2. Air Purifier Market: Application Movement Analysis, 2023 & 2030

8.3. Commercial

8.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.2. Commercial air purifier market estimates and forecasts, by application, 2018 - 2030 (USD Million)

8.4. Residential

8.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.5. Industrial

8.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 9. Air Purifier Market: Regional Estimates & Trend Analysis

9.1. Regional Movement Analysis & Market Share, 2023 & 2030

9.2. North America

9.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.2. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.2.3. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.2.4. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.2.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.2.6. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.2.7. U.S.

9.2.7.1. U.S. Macroeconomic Outlook

9.2.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.7.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.2.7.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.2.7.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.2.7.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.2.7.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.2.8. Canada

9.2.8.1. Canada Macroeconomic Outlook

9.2.8.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.8.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.2.8.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.2.8.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.2.8.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.2.8.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.2.9. Mexico

9.2.9.1. Mexico Macroeconomic Outlook

9.2.9.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.9.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.2.9.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.2.9.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.2.9.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.2.9.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.3. Europe

9.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.2. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.3.3. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.3.4. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.3.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.3.6. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.3.7. Germany

9.3.7.1. Germany Macroeconomic Outlook

9.3.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.7.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.3.7.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.3.7.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.3.7.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.3.7.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.3.8. France

9.3.8.1. France Macroeconomic Outlook

9.3.8.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.8.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.3.8.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.3.8.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.3.8.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.3.8.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.3.9. UK

9.3.9.1. UK Macroeconomic Outlook

9.3.9.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.9.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.3.9.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.3.9.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.3.9.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.3.9.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.4. Asia Pacific

9.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.2. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.4.3. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.4.4. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.4.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.4.6. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.4.7. China

9.4.7.1. China Macroeconomic Outlook

9.4.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.7.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.4.7.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.4.7.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.4.7.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.4.7.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.4.8. Japan

9.4.8.1. Japan Macroeconomic Outlook

9.4.8.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.8.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.4.8.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.4.8.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.4.8.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.4.8.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.4.9. South Korea

9.4.9.1. South Korea Macroeconomic Outlook

9.4.9.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.9.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.4.9.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.4.9.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.4.9.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.4.9.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.4.10. Singapore

9.4.10.1. Singapore Macroeconomic Outlook

9.4.10.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.10.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.4.10.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.4.10.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.4.10.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.4.10.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.4.11. Malaysia

9.4.11.1. Malaysia Macroeconomic Outlook

9.4.11.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.11.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.4.11.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.4.11.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.4.11.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.4.11.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.5. Central & South America

9.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.2. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.5.3. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.5.4. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.5.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.5.6. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.5.7. Brazil

9.5.7.1. Brazil Macroeconomic Outlook

9.5.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.7.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.5.7.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.5.7.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.5.7.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.5.7.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.6. Middle East & Africa

9.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.2. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.6.3. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.6.4. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.6.5. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.6.6. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

9.6.7. Saudi Arabia

9.6.7.1. Saudi Arabia Macroeconomic Outlook

9.6.7.2. Market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.7.3. Market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

9.6.7.4. Market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

9.6.7.5. Market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

9.6.7.6. Market estimates and forecasts, by application, 2018 - 2030 (USD Million)

9.6.7.7. Market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Chapter 10. Air Purifier Market: Competitive Analysis

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company Categorization

10.3. Participant’s Overview

10.4. Financial Overview

10.5. Product Benchmarking

10.6. Company Market Positioning

10.7. Company Market Share Analysis

10.8. Company Heat Map Analysis

10.9. Strategy Mapping

10.10. Company Profiles

10.10.1. IQAir

10.10.1.1. Participant’s overview

10.10.1.2. Financial performance

10.10.1.3. Product benchmarking

10.10.1.4. Recent developments

10.10.2. Honeywell International, Inc.

10.10.2.1. Participant’s overview

10.10.2.2. Financial performance

10.10.2.3. Product benchmarking

10.10.2.4. Recent developments

10.10.3. LG Electronics

10.10.3.1. Participant’s overview

10.10.3.2. Financial performance

10.10.3.3. Product benchmarking

10.10.3.4. Recent developments

10.10.4. Unilever

10.10.4.1. Participant’s overview

10.10.4.2. Financial performance

10.10.4.3. Product benchmarking

10.10.4.4. Recent developments

10.10.5. Koninklijke Philips N.V.

10.10.5.1. Participant’s overview

10.10.5.2. Financial performance

10.10.5.3. Product benchmarking

10.10.5.4. Recent developments

10.10.6. Hamilton Beach Brands, Inc.

10.10.6.1. Participant’s overview

10.10.6.2. Financial performance

10.10.6.3. Product benchmarking

10.10.6.4. Recent developments

10.10.7. Panasonic Corporation

10.10.7.1. Participant’s overview

10.10.7.2. Financial performance

10.10.7.3. Product benchmarking

10.10.7.4. Recent developments

10.10.8. Whirlpool Corporation

10.10.8.1. Participant’s overview

10.10.8.2. Financial performance

10.10.8.3. Product benchmarking

10.10.8.4. Recent developments

10.10.9. Carrier

10.10.9.1. Participant’s overview

10.10.9.2. Financial performance

10.10.9.3. Product benchmarking

10.10.9.4. Recent developments

10.10.10. Camfil

10.10.10.1. Participant’s overview

10.10.10.2. Financial performance

10.10.10.3. Product benchmarking

10.10.10.4. Recent developments

10.10.11. Sharp Electronics Corporation

10.10.11.1. Participant’s overview

10.10.11.2. Financial performance

10.10.11.3. Product benchmarking

10.10.11.4. Recent developments

10.10.12. COWAY Co., Ltd

10.10.12.1. Participant’s overview

10.10.12.2. Financial performance

10.10.12.3. Product benchmarking

10.10.12.4. Recent developments

10.10.13. Molekule

10.10.13.1. Participant’s overview

10.10.13.2. Financial performance

10.10.13.3. Product benchmarking

10.10.13.4. Recent developments

10.10.14. Samsung Electronics Co., Ltd.

10.10.14.1. Participant’s overview

10.10.14.2. Financial performance

10.10.14.3. Product benchmarking

10.10.14.4. Recent developments

10.10.15. Dyson

10.10.15.1. Participant’s overview

10.10.15.2. Financial performance

10.10.15.3. Product benchmarking

10.10.15.4. Recent developments

List of Tables

Table 1 Air purifier market estimates and forecasts, by technology, 2018 - 2030 (USD Million)

Table 2 Air purifier market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 3 Air purifier market estimates and forecasts, by coverage range, 2018 - 2030 (USD Million)

Table 4 Air purifier market estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 5 Air purifier market estimates and forecasts, by type, 2018 - 2030 (USD Million)

Table 6 Air purifier market estimates and forecasts, by region, 2018 - 2030 (USD Million)

Table 7 North America air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 8 North America air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 9 North America air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 10 North America air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 11 North America air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 12 U.S. Macroeconomic Outlook

Table 13 U.S. air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 14 U.S. air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 15 U.S. air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 16 U.S. air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 17 U.S. air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 18 Canada Macroeconomic Outlook

Table 19 Canada air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 20 Canada air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 21 Canada air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 22 Canada air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 23 Canada air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 24 Mexico Macroeconomic Outlook

Table 25 Mexico air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 26 Mexico air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 27 Mexico air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 28 Mexico air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 29 Mexico air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 30 Europe air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 31 Europe air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 32 Europe air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 33 Europe air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 34 Europe air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 35 France Macroeconomic Outlook

Table 36 France air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 37 France air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 38 France air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 39 France air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 40 France air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 41 Germany Macroeconomic Outlook

Table 42 Germany air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 43 Germany air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 44 Germany air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 45 Germany air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 46 Germany air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 47 Asia Pacific air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 48 Asia Pacific air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 49 Asia Pacific air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 50 Asia Pacific air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 51 Asia Pacific air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 52 China Macroeconomic Outlook

Table 53 China air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 54 China air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 55 China air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 56 China air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 57 China air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 58 Japan Macroeconomic Outlook

Table 59 Japan air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 60 Japan air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 61 Japan air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 62 Japan air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 63 Japan air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 64 South Korea Macroeconomic Outlook

Table 65 South Korea air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 66 South Korea air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 67 South Korea air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 68 South Korea air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 69 South Korea air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 70 Malaysia Macroeconomic Outlook

Table 71 Malaysia air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 72 Malaysia air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 73 Malaysia air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 74 Malaysia air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 75 Malaysia air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 76 Singapore Macroeconomic Outlook

Table 77 Singapore air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 78 Singapore air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 79 Singapore air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 80 Singapore air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 81 Singapore air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 82 Central & South America air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 83 Central & South America air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 84 Central & South America air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 85 Central & South America air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 86 Central & South America air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 87 Brazil Macroeconomic Outlook

Table 88 Brazil air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 89 Brazil air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 90 Brazil air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 91 Brazil air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 92 Brazil air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 93 Middle East & Africa air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 94 Middle East & Africa air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 95 Middle East & Africa air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 96 Middle East & Africa air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 97 Middle East & Africa air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

Table 98 Saudi Arabia Macroeconomic Outlook

Table 99 Saudi Arabia air purifier market estimates and forecast by technology, 2018 - 2030 (USD Million)

Table 100 Saudi Arabia air purifier market estimates and forecast by application, 2018 - 2030 (USD Million)

Table 101 Saudi Arabia air purifier market estimates and forecast by coverage range, 2018 - 2030 (USD Million)

Table 102 Saudi Arabia air purifier market estimates and forecast by sales channel, 2018 - 2030 (USD Million)

Table 103 Saudi Arabia air purifier market estimates and forecast by type, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market Snapshot

Fig. 7 Segment Snapshot

Fig. 8 Competitive Landscape Snapshot

Fig. 9 Penetration and Growth Prospect Mapping

Fig. 10 Value Chain Analysis

Fig. 11 Market Dynamics

Fig. 12 Air Purifier Market PORTER’s Analysis

Fig. 13 Air Purifier Market PESTEL Analysis

Fig. 14 Air Purifier Market, By Technology: Key Takeaways

Fig. 15 Air Purifier Market: Technology Movement Analysis & Market Share, 2023 & 2030

Fig. 16 HEPA market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 17 Activated Carbon market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 18 Ionic Filters market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 19 Electrostatic precipitator market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 20 Others market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 21 Air Purifier Market, By Application: Key Takeaways

Fig. 22 Air Purifier Market: Application Movement Analysis & Market Share, 2023 & 2030

Fig. 23 Air Purifier market estimates & forecasts, In Residential Application, 2018 - 2030 (USD Million)

Fig. 24 Air Purifier market estimates & forecasts, In Commercial Application, 2018 - 2030 (USD Million)

Fig. 25 Air Purifier market estimates & forecasts, In Industrial Application, 2018 - 2030 (USD Million)

Fig. 26 Air Purifier Market, By Coverage Range: Key Takeaways

Fig. 27 Air Purifier Market: Coverage Range Movement Analysis & Market Share, 2023 & 2030

Fig. 28 Below 250 sq ft air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 29 250-400 sq ft air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 30 401-700 sq ft air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 31 Above 700 sq ft air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 32 Air Purifier Market, By Sales Channel: Key Takeaways

Fig. 33 Air Purifier Market: Sales Channel Movement Analysis & Market Share, 2023 & 2030

Fig. 34 Online air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 35 Offline air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 36 Offline air purifier market estimates & forecasts, by application, 2018 - 2030 (USD Million)

Fig. 37 Air Purifier Market, By Type: Key Takeaways

Fig. 38 Air Purifier Market: Type Movement Analysis & Market Share, 2023 & 2030

Fig. 39 Standalone/portable air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 40 In-duct/fixed air purifier market estimates & forecasts, 2018 - 2030 (USD Million)

Fig. 41 North America Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 42 North America Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 43 North America Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 44 North America Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 45 North America Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 46 North America Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 47 U.S Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 48 U.S Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 49 U.S Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 50 U.S Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 51 U.S Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 52 U.S Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 53 Canada Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 54 Canada Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 55 Canada Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 56 Canada Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 57 Canada Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 58 Canada Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 59 Mexico Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 60 Mexico Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 61 Mexico Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 62 Mexico Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 63 Mexico Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 64 Mexico Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 65 Europe Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 66 Europe Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 67 Europe Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 68 Europe Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 69 Europe Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 70 Europe Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 71 Germany Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 72 Germany Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 73 Germany Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 74 Germany Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 75 Germany Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 76 Germany Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 77 France Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 78 France Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 79 France Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 80 France Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 81 France Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 82 France Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 83 UK Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 84 UK Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 85 UK Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 86 UK Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 87 UK Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 88 UK Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 89 Asia Pacific Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 90 Asia Pacific Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 91 Asia Pacific Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 92 Asia Pacific Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 93 Asia Pacific Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 94 Asia Pacific Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 95 China Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 96 China Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 97 China Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 98 China Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 99 China Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 100 China Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 101 Japan Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 102 Japan Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 103 Japan Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 104 Japan Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 105 Japan Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 106 Japan Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 107 South Korea Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 108 South Korea Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 109 South Korea Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 110 South Korea Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 111 South Korea Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 112 South Korea Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 113 Malaysia Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 114 Malaysia Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 115 Malaysia Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 116 Malaysia Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 117 Malaysia Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 118 Malaysia Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 119 Singapore Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 120 Singapore Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 121 Singapore Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 122 Singapore Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 123 Singapore Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 124 Singapore Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 125 Central & South America Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 126 Central & South America Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 127 Central & South America Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 128 Central & South America Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 129 Central & South America Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 130 Central & South America Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 131 Brazil Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 132 Brazil Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 133 Brazil Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 134 Brazil Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 135 Brazil Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 136 Brazil Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 137 Middle East & Africa Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 138 Middle East & Africa Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 139 Middle East & Africa Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 140 Middle East & Africa Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 141 Middle East & Africa Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 142 Middle East & Africa Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 143 Saudi Arabia Air Purifier Market Estimates & Forecasts, 2018 - 2030 (USD Million)

Fig. 144 Saudi Arabia Air Purifier Market Estimates & Forecasts, By Technology, 2018 - 2030 (USD Million)

Fig. 145 Saudi Arabia Air Purifier Market Estimates & Forecasts, By Coverage Range, 2018 - 2030 (USD Million)

Fig. 146 Saudi Arabia Air Purifier Market Estimates & Forecasts, By Sales Channel, 2018 - 2030 (USD Million)

Fig. 147 Saudi Arabia Air Purifier Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Million)

Fig. 148 Saudi Arabia Air Purifier Market Estimates & Forecasts, By Application, 2018 - 2030 (USD Million)

Fig. 149 Key Company Categorization

Fig. 150 Company Market Share Analysis, 2023

Fig. 151 Company Market Positioning

Fig. 152 Strategic Framework

Market Segmentation

- Air Purifier Technology Outlook (Revenue, USD Million, 2018 - 2030)

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- Air Purifier Application Outlook (Revenue, USD Million, 2018 - 2030)

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- Air Purifier Market Coverage Range Outlook (Revenue, USD Million, 2018 - 2030)

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

- Air Purifier Market Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- Air Purifier Market Type Outlook (Revenue, USD Million, 2018 - 2030)

- Standalone/Portable

- In-duct/Fixed

- Air Purifier Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- North America Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- North America Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

- North America Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- North America Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- U.S.

- U.S. Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- U.S. Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- U.S. Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft

- U.S. Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- U.S. Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- U.S. Air Purifier Market, By Technology

- Canada

- Canada Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- Canada Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- Canada Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft

- Canada Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- Canada Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- Canada Air Purifier Market, By Technology

- Mexico

- Mexico Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- Mexico Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- Mexico Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft

- Mexico Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- Mexico Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- Mexico Air Purifier Market, By Technology

- North America Air Purifier Market, By Technology

- Europe

- Europe Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- Europe Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- Europe Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

- Europe Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- Europe Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- France

- France Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- France Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- France Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft

- France Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- France Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- France Air Purifier Market, By Technology

- Germany

- Germany Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon

- Ionic Filters

- Electrostatic Precipitator

- Others

- Germany Air Purifier Market, By Application

- Commercial

- Retail Shops

- Offices

- Healthcare Facilities

- Hospitality

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Residential

- Industrial

- Commercial

- Germany Air Purifier Market, By Coverage Range

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft

- Germany Air Purifier Market, By Sales Channel

- Online

- Offline

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

- Germany Air Purifier Market, By Type

- Standalone/Portable

- In-duct/Fixed

- Germany Air Purifier Market, By Technology

- UK

- UK Air Purifier Market, By Technology

- High Efficiency Particulate Air (HEPA)

- Activated Carbon