- Home

- »

- Distribution & Utilities

- »

-

Air Insulated Switchgear Market Size, Industry Report, 2030GVR Report cover

![Air Insulated Switchgear Market Size, Share & Trends Report]()

Air Insulated Switchgear Market (2025 - 2030) Size, Share & Trends Analysis Report, By Installation (Outdoor), By Application (Commercial, Industrial), By Voltage (Low, High), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-414-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Insulated Switchgear Market Summary

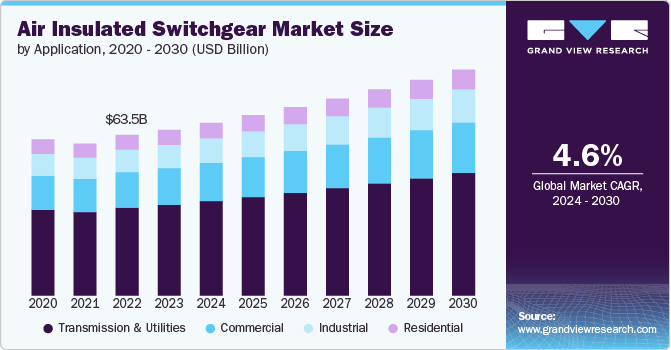

The global air insulated switchgear market size was estimated at USD 68.26 billion in 2024 and is expected to reach USD 89.24 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The air insulated switchgear (AIS) market's growth is primarily driven by increasing investments in power infrastructure, particularly in emerging economies where electrification and urbanization are accelerating.

Key Market Trends & Insights

- North America air insulated switchgear market is driven by a strong demand driven by ongoing grid modernization efforts and the integration of renewable energy sources.

- The air insulated switchgear market in the U.S. is at the forefront in North America.

- By installation, the outdoor segment is anticipated to grow at fastest CAGR over the forecast period ranging from 2024-2030.

- By application, the transmission & utilities segment held the largest revenue share of air insulated switchgear market in 2024.

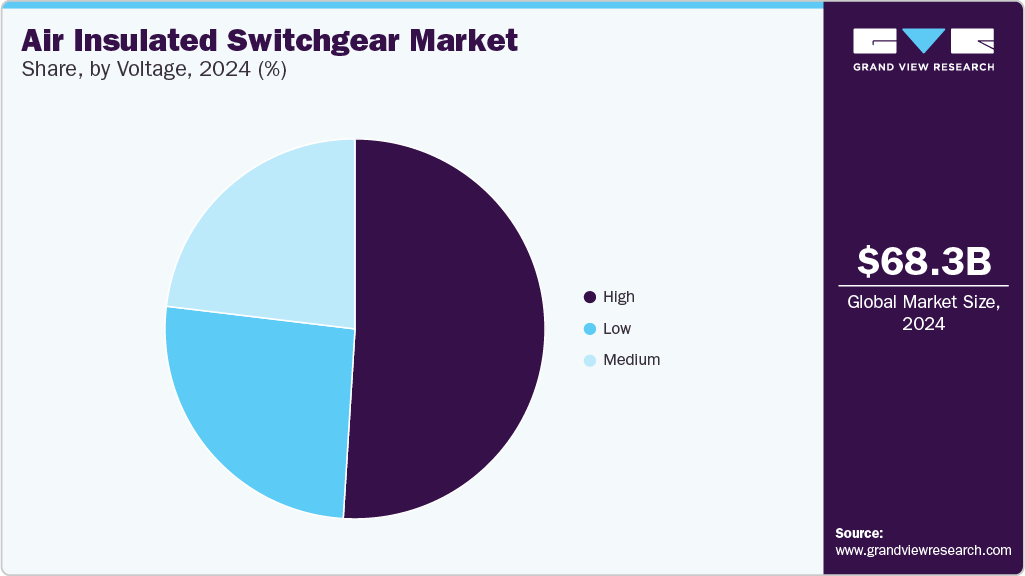

- By voltage, the high voltage segment held the largest revenue share of air insulated switchgear market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 68.26 Billion

- 2030 Projected Market Size: USD 89.24 Billion

- CAGR (2025-2030): 4.6%

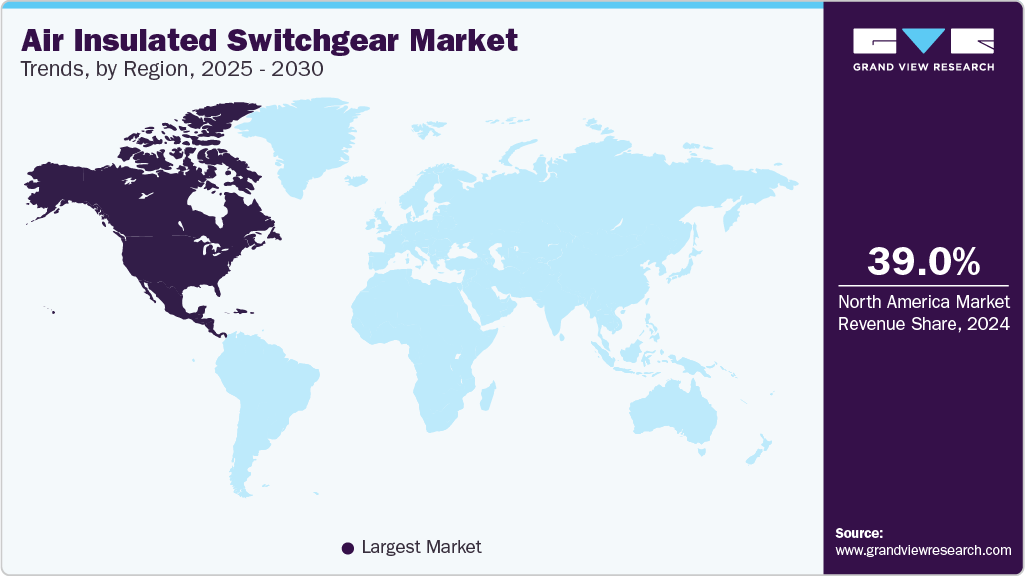

- North America: Largest market in 2024

As governments and utilities worldwide aim to modernize and expand their electricity networks, the demand for reliable, cost-effective switchgear solutions like AIS is on the rise. The growing focus on renewable energy integration and grid modernization further bolsters the demand for AIS, especially in regions undergoing significant infrastructure upgrades.

AIS is favored for its affordability, ease of installation, and reliability in diverse environmental conditions, making it an essential component in both urban and rural electrification projects. Unlike gas-insulated switchgear (GIS), AIS offers the advantage of lower initial capital costs, which is particularly appealing in budget-sensitive projects and developing markets. However, AIS's larger footprint and exposure to environmental conditions such as pollution and moisture necessitate innovations to enhance its performance and longevity in challenging environments.

Drivers, Opportunities & Restraints

The market thrives on the global push for electrification, notably in Asia Pacific and Africa, where massive investments in power infrastructure are fueling economic growth. India's "Power for All" initiative, aiming for a universal, reliable power supply, significantly boosts AIS demand in transmission and distribution. The shift towards renewable energy, with AIS playing a key role in wind and solar farm power management, coupled with a focus on green energy and smart grids, opens up substantial opportunities for AIS manufacturers. This is driven by the global agenda to cut carbon emissions and enhance grid reliability.

The market is poised for growth with the shift towards smart grids and renewable energy, driven by the rising adoption of sources such as wind and solar. This shift underlines its role in efficiently managing renewable inputs. Europe's ambitious goal for 40% renewable electricity by 2030 is accelerating grid modernization efforts, including adaptable air insulated switchgear systems. Moreover, the move towards decentralized power generation necessitates reliable AIS in areas facing extreme conditions, benefiting from its durability and low maintenance.

The market is struggling, especially in high-pollution areas where its performance falters, leading to increased failures. The shift towards the more reliable, though costlier, gas insulated switchgear in such conditions is challenging AIS manufacturers to enhance their products' durability or risk losing market share.

Installation Insights & Trends

Indoor air insulated switchgear is predominantly used in urban and industrial settings where space constraints and environmental protection are critical factors. For example, it is commonly deployed in commercial buildings, data centers, and factories, where it provides reliable power distribution in a controlled environment. The segment is expected to see steady growth due to the increasing urbanization and industrialization in emerging markets.

Outdoor air insulated switchgear is widely used in transmission and distribution networks, particularly in rural and semi-urban areas where space is less of a concern. It is valued for its robustness and ease of maintenance, making it a preferred choice for utility companies managing extensive power networks. The demand for outdoor AIS is expected to grow as countries continue to expand their power grids to remote areas, enhancing electricity access and supporting economic development.

Application Insights & Trends

The transmission & utilities segment held the largest market share in 2023, driven by the ongoing expansion and modernization of power grids globally. AIS is a key component in substations and distribution networks, where it provides reliable power distribution and helps maintain grid stability. The commercial segment, including offices, retail centers, and data centers, is also a significant driver of AIS demand, as businesses seek reliable and efficient power solutions to support their operations.

The industrial segment, which includes factories and manufacturing plants, is expected to see strong growth due to the increasing adoption of automation and the need for reliable power supply to support continuous operations. The residential segment is also expanding, particularly in emerging markets where electrification initiatives are driving demand for low voltage AIS to support household power needs.

Voltage Insights & Trends

Air insulated switchgear is classified based on voltage into low, medium, and high voltage segments. Low voltage air insulated switchgear is crucial for residential and small-scale commercial applications, where it provides safe and efficient power distribution. This segment is driven by the ongoing expansion of residential and commercial construction projects worldwide.

Medium voltage AIS is widely used in industrial settings and urban power distribution grids, ensuring reliable electricity supply to factories, data centers, and other critical infrastructure. High voltage AIS plays a vital role in long-distance power transmission, facilitating the efficient transfer of electricity over vast distances with minimal loss. The high voltage segment is expected to grow rapidly due to increasing investments in transmission infrastructure to support renewable energy integration and interregional power exchanges.

Regional Insights

North America air insulated switchgear market is driven by a strong demand driven by ongoing grid modernization efforts and the integration of renewable energy sources. The region is heavily investing in advanced technologies to enhance grid resilience and reliability. For instance, the deployment of smart grid technologies such as advanced metering infrastructure (AMI) and distribution automation is significantly boosting the demand for high-performance air insulated switchgears in this region.

U.S. Air Insulated Switchgear Market Trends

The air insulated switchgear market in the U.S. is at the forefront in North America, with substantial investments in smart grid technologies and infrastructure upgrades. The Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) enforce rigorous standards to maintain grid reliability and prevent disruptions. Recent initiatives such as the Grid Modernization Initiative (GMI) by the U.S. Department of Energy aim to enhance the efficiency, reliability, and resilience of the national grid. In addition, the resurgence of the manufacturing sector and efforts to integrate renewable energy sources nationwide highlight the need for advanced air-insulated switchgear solutions.

Asia Pacific Air Insulated Switchgear Market Trends

Asia Pacific air insulated switchgear market is undergoing fast urbanization and industrialization, significantly boosting the demand for AIS due to massive investments in power infrastructure. Notably, China's "Belt and Road Initiative" and India's "Power for All" program are driving this demand to support economic growth and ensure universal electricity access. Consequently, the region is set to witness the fastest increase in AIS demand, fueled by efforts to enhance electricity access and incorporate renewable energy sources into the grid.

Europe Air Insulated Switchgear Market Trends

The air insulated switchgear market in Europe is focused on renewable energy and electrifying transport. Driven by the EU’s aim for climate neutrality by 2050, there's a significant push for renewable infrastructure and power grid updates. The move to electric vehicles boosts demand for AIS, necessary for charging stations and grid stability. Germany and the Netherlands are at the forefront, spurring demand for advanced AIS solutions in Europe.

Key Air Insulated Switchgear Company Insights

Some of the key players operating in the market include Siemens, ABB, and Schneider Electric.

-

Siemens is a leading provider of AIS solutions, offering a wide range of products for both indoor and outdoor applications. The company emphasizes innovation and sustainability, with a strong focus on developing AIS technologies that meet the demands of modern power grids.

-

ABB is another major player, known for its extensive portfolio of AIS products and services. The company has a strong presence in emerging markets, where it is leveraging its expertise to support the expansion of power infrastructure.

-

Schneider Electric is also a key player in the AIS market, offering innovative solutions that combine efficiency, reliability, and sustainability. The company is particularly focused on digitalization and smart grid technologies, which are driving demand for advanced AIS solutions in both developed and developing markets.

Key Air Insulated Switchgear Companies:

The following are the leading companies in the air insulated switchgear market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- General Electric

- Siemens

- Schneider Electric

- Toshiba

- Alfanar Group

- Hitachi Energy

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hubbell

- Larsen & Toubro Limited

- ELATEC POWER DISTRIBUTION GmbH

Recent Developments

-

In July 2024, Mitsubishi Electric Corporation revealed the development of a new 24 kV air-insulated switchgear, which is set to enhance safety and reliability in electrical distribution. This advanced switchgear, featuring a sleek design, incorporates sophisticated monitoring and diagnostic technologies for unmatched performance. It's a key part of Mitsubishi Electric’s initiative towards innovative, sustainable power infrastructure solutions, highlighting their dedication to improving electrical system efficiency and capability.

-

In April 2024, Schneider Electric recently launched its EasySET medium-voltage (MV) switchgear, designed to simplify installation and enhance operational efficiency. EasySET switchgear, known for its user-friendly design and advanced safety features, is perfect for power distribution applications.

-

In October 2024, Schneider Electric launched the Ringmaster AirSeT, a next-generation SF6-free medium-voltage switchgear, at its Leeds site in the UK. The company aims to decarbonize the electricity infrastructure by replacing SF6 with pure air insulation, enhancing safety, sustainability, and grid modernization as part of its ‘Grids of the Future’ programme.

Air Insulated Switchgear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 71.23 billion

Revenue forecast in 2030

USD 89.24 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Installation, voltage, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB; Eaton Corporation; Siemens; Toshiba; Alfanar Group; Schneider Electric; Hitachi Energy; Hubbell; Mitsubishi Electric Corporation; General Electric; ELATEC POWER DISTRIBUTION GmbH; Larsen & Toubro Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Insulated Switchgear Market Segmentation

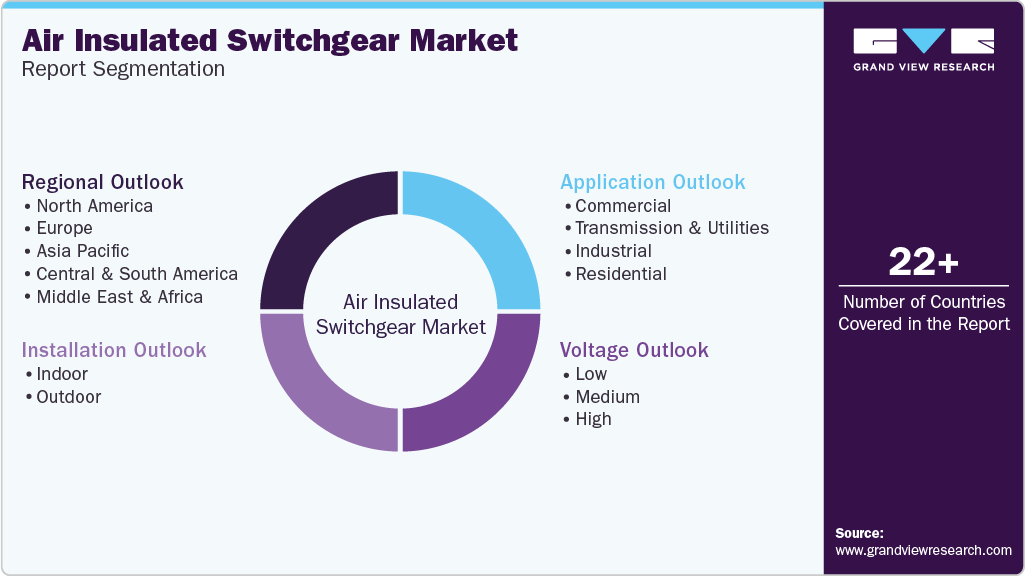

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air insulated switchgear market report on the basis of installation, voltage, application, and region.

-

Installation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Voltage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low

-

Medium

-

High

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Transmission & Utilities

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global air insulated switchgear market size was estimated at USD 68.26 billion in 2024 and is expected to reach USD 71.23 billion in 2025.

b. The global air insulated switchgear market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 89.24 billion by 2030.

b. By voltage, high voltage segment dominated the market with a revenue share of over 50.0% in 2024.

b. .Some of the key vendors in the global air insulated switchgear market are ABB, Eaton Corporation, Siemens, Toshiba, Alfanar Group, Schneider Electric, Hitachi Energy, Hubbell, Mitsubishi Electric Corporation, General Electric, Larsen & Toubro Limited, and ELATEC POWER DISTRIBUTION GmbH.

b. The key factor driving the growth of the global air insulated switchgear market is attributed to the significant growth driven by increasing investments in power infrastructure, particularly in emerging economies where electrification and urbanization are accelerating.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.