- Home

- »

- Advanced Interior Materials

- »

-

Air Handling Units Market Size, Share, Industry Report, 2030GVR Report cover

![Air Handling Units Market Size, Share & Trends Report]()

Air Handling Units Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Single Flux, Double Flux), By Type (Packaged, Modular), By Capacity (Up To 5,000 m3/h), By Application (Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-345-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Handling Units Market Summary

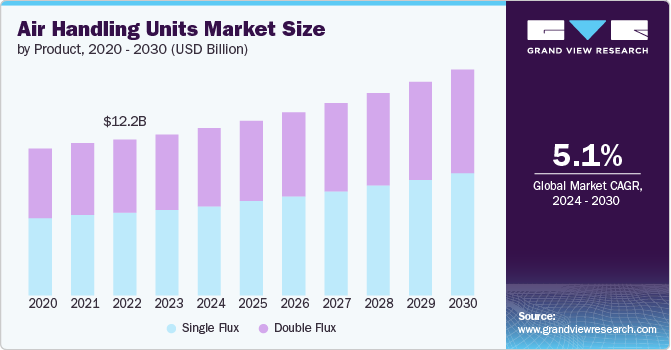

The global air handling units market size was estimated at USD 13.05 billion in 2024 and is projected to reach USD 17.63 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The demand for air handling units (AHUs) is rising due to increasing urbanization, growing construction activities, and the need for energy-efficient HVAC systems.

Key Market Trends & Insights

- The Asia Pacific dominated the market, accounting for 46.8% of the global air handling units market.

- China air handling units market held a significant share in the Asia Pacific air handling units market.

- By product, the single-flux product segment led the market and accounted for 53.2% of the global market revenue share in 2024.

- By type, the packaged air handling units type segment led the market and accounted for 58.9% of the global market revenue share in 2024.

- By capacity, the up to 5,000 m3/h capacity segment led the market, accounting for 32.6% of the global market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.05 Billion

- 2030 Projected Market Size: USD 17.63 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

According to the World Health Organization (WHO), approximately 55% of the global population currently lives in urban areas, and this figure is expected to increase to 68% by 2050, driving the demand for commercial and residential buildings that require AHUs. Government initiatives like the "National Infrastructure Program" in India boost construction projects, further fueling the need for AHUs. Additionally, the growing awareness of the benefits of AHUs, such as maintaining fresh air quality and thermal comfort in indoor spaces, contributes to their popularity. Furthermore, the growing global population is increasing the requirements for affordable housing units and enhanced commercial infrastructure. According to the United Nations, the global population is expected to reach 9.7 billion in 2050, exhibiting a growth of 2 billion in the next 30 years. This significant increase in the worldwide population is facilitated by the improving standard of living of the masses, increasing lifespan, decreasing mortality rate, and ongoing technological advancements. The growing global population also pressures the real estate sector to provide affordable housing. As such, new housing projects are being launched worldwide. This is expected to positively impact the growth of the market over the forecast period.

Moreover, governments worldwide provide monetary support to customers by introducing various housing schemes. For instance, the Government of Canada announced through the 2023 Fall Economic Statement a new loan funding worth USD 15 billion, USD 9 billion more than the previous funding. With the increasing support from the governments of different countries and the requirement for affordable housing, the residential construction industry is flourishing worldwide. This is expected to surge the demand for market over the forecast period.

Market Concentration & Characteristics

The air handling units industry presents a moderately fragmented competitive landscape, featuring a mix of well-established global manufacturers and emerging regional players. Leading companies such as Johnson Controls, Daikin Industries, Trane Technologies, Carrier Global Corporation, and Systemair AB maintain strong market positions through comprehensive product offerings and expansive global operations. Simultaneously, local manufacturers play a vital role by addressing region-specific demands and ensuring compliance with local building codes and environmental standards.

Market growth is primarily influenced by rising environmental concerns and stringent regulations focused on improving energy efficiency and indoor air quality. Governments and regulatory bodies are increasingly mandating the use of energy-efficient HVAC systems in new constructions and retrofits, driving the adoption of advanced AHUs. These policy measures are not only stimulating demand but also encouraging innovation in design and functionality.

Technological progress is a key driver shaping the AHU industry, with advancements such as energy recovery systems, smart controls, and variable air volume (VAV) technology enhancing the performance and efficiency of AHUs. These innovations enable units to better adapt to changing indoor climate needs and reduce overall energy consumption, making them more suitable for modern, sustainable buildings.

Regionally, North America commands a significant share of the market due to robust commercial and residential construction activity and supportive regulatory frameworks promoting energy-efficient solutions. Europe follows closely, driven by strong sustainability targets and renovation initiatives. Meanwhile, the Asia-Pacific region is witnessing rapid growth, supported by urbanization, infrastructure expansion, and increasing awareness of indoor air quality in major economies like China and India.

Drivers, Opportunities & Restraints

The air handling units several factors, including the increasing focus on energy efficiency, stringent building codes and standards, and the growing need for improved indoor air quality, drive the market. The rising adoption of smart and connected HVAC systems also contributes to market growth. For instance, the U.S. Environmental Protection Agency has introduced indoor air quality standards and policies through its Indoor Air Quality Division. The EPA also introduced the Clean Air in Buildings Challenge, publishing a best practice guide for improving indoor air quality. The federal government provided USD 350 billion for state and local governments and USD 122 billion for schools through the American Rescue Plan to improve indoor air quality in public buildings and schools

Moreover, advancements in AHU technologies, such as integrating IoT and smart sensors, are providing significant growth opportunities. The increasing demand for modular and customized AHUs to cater to specific application requirements drives the market. For instance, incorporating IoT with HVAC systems allows companies to scrutinize exterior data such as the number of occupants in the room, humidity level, and ambient temperature, among other things. Smart HVAC systems utilize this data to set optimal temperature, fan speed, and energy consumption. Furthermore, IoT enables predictive maintenance for clients and HVAC companies, which helps decrease maintenance costs and prevent system failure.

The price range for air handling units varies widely depending on factors such as size, capacity, features, and application. However, the high initial cost of AHUs and the complexity of installation and maintenance may pose challenges to market growth. Additionally, the availability of alternative HVAC solutions and the need for skilled personnel for AHU operations can also impact the market.

Product Insights

The single-flux product segment led the market and accounted for 53.2% of the global market revenue share in 2024. The need for efficient and cost-effective HVAC solutions in various applications drives the demand for single-flux and double-flux air handling units. Single-flux AHUs are commonly used in smaller commercial and residential spaces, providing a simple and economical way to condition the air. For example, single-flux AHUs are often installed in small offices, retail stores, and single-family homes.

Double-flux AHUs, on the other hand, are designed for larger and more complex buildings, as they offer improved energy efficiency and better control over indoor air quality. These units are frequently used in hospitals, schools, and large commercial complexes where precise temperature and humidity control are essential. The growing construction of commercial and residential buildings, particularly in developing regions, is fueling the demand for single-flux and double-flux air handling units to meet the increasing need for comfortable and healthy indoor environments.

Type Insights

The packaged air handling units type segment led the market and accounted for 58.9% of the global market revenue share in 2024. Packaged AHUs are pre-assembled units with ease of installation, cost-effectiveness, and compact design. The increasing demand for energy-efficient and space-saving HVAC solutions in commercial and residential applications is driving the growth of packaged AHUs.

The modular air handling units segments are expected to grow significantly due to their flexibility, scalability, and ability to meet specific application requirements. Modular air handling units are increasingly used in commercial and industrial applications due to their flexibility, efficiency, and ability to maintain high indoor air quality. They are commonly found in office buildings, shopping malls, hospitals, hotels, and other large facilities requiring precise temperature and humidity control. These factors above are anticipated to drive the demand for air handling units industry over the forecast period.

Capacity Insights

The up to 5,000 m3/h capacity segment led the market, accounting for 32.6% of the global market revenue share in 2024, owing to the increasing adoption of AHUs in small and large-scale applications such as warehouses, industrial facilities, kitchens, and food service properties. Moreover, smaller capacity AHUs are generally more cost-effective than larger units, making them attractive options for residential and small commercial projects with limited budgets. Their lower upfront costs contribute to their widespread adoption.

The demand for air handling units (AHUs) with capacities ranging from 30,001 to 50,000 m³/h is witnessing steady growth, primarily driven by the expansion of large commercial, industrial, and institutional facilities such as airports, hospitals, data centers, and manufacturing plants. These mid-to-large capacity AHUs are increasingly preferred for their ability to deliver high airflow volumes while integrating advanced energy-saving technologies like energy recovery systems, variable frequency drives (VFDs), and smart control systems. Growing emphasis on indoor air quality and compliance with stringent ventilation and energy efficiency regulations also propels demand, particularly in regions with robust infrastructure development and retrofitting initiatives.

Application Insights

The commercial application segment accounted for 46.7% of the revenue share in 2024. The growing number of commercial spaces such as shopping malls, offices, theatres, and hotels is anticipated to fuel the product demand in commercial applications. Many factors are considered while choosing commercial air handling units, such as air quality, building design, and energy efficiency. The budget and the lifespan of the system are additional factors to consider.

The demand for AHUs is rising in industrial applications due to the need for precise temperature and humidity control and efficient air filtration and circulation. For instance, in the pharmaceutical industry, AHUs are critical for maintaining clean room environments required for manufacturing sterile drugs and medical devices. These units filter the air to remove particulates, control temperature and humidity, and provide the necessary air changes per hour to meet stringent clean room standards.

Regional Insights

The North America air handling units market is driven by a strong focus on energy efficiency and sustainable construction practices. Increasing indoor air quality awareness prompts upgrades in commercial and residential HVAC systems. Smart building technologies are being integrated with AHUs to optimize performance. Government policies are encouraging the adoption of low-emission systems. The region sees continued growth in both new projects and retrofits.

U.S. Air Handling Units Market Trends

In the U.S., the modernization of infrastructure and the increasing investments in smart buildings are key drivers of demand for AHUs. A push toward energy conservation in the public and private sectors supports the market. Moreover, end-users are seeking customized solutions tailored to regional climate needs. Adoption is also growing in educational, healthcare, and industrial facilities.

The Canada AHU market benefits from a growing emphasis on green buildings and air quality in colder climates. Commercial and institutional sectors actively invest in HVAC upgrades for efficiency and comfort. Regional climate challenges are pushing demand for systems with high thermal efficiency. There's a strong preference for systems that can handle varied seasonal demands. Local regulations continue to shape the direction of system design and usage.

Europe Air Handling Units Market Trends

Stringent environmental regulations and strong energy efficiency goals drive the AHU market in Europe. Demand is high for systems that comply with building performance standards and support decarbonization. Retrofitting old buildings with modern HVAC systems is a major trend. The push for healthier indoor environments is also influencing design choices. Innovation and sustainability are central to market strategies across the region.

The Germany air handling units market is shaped by its commitment to green building practices and energy-efficient technologies. The country places a high value on systems with low noise, compact design, and smart control capabilities. Demand is robust in industrial and commercial construction, especially in cities prioritizing sustainability. Regulatory incentives support the adoption of modern HVAC solutions. Local manufacturers focus on engineering precision and environmental compliance.

The UK air handling units market is driven by a growing focus on indoor air quality and climate-conscious design. Upgrades in the healthcare and education sectors drive demand for advanced ventilation systems. Energy performance certificates and green building codes are key regulatory drivers. There's rising interest in AHUs integrated with smart building management systems. The retrofit market is particularly active due to the older building stock.

Asia Pacific Air Handling Units Market Trends

The Asia Pacific dominated the market, accounting for 46.8% of the global air handling units market. The region is experiencing rapid market expansion due to urbanization and industrial growth. Rising construction activity in residential and commercial sectors creates consistent demand for AHUs. Manufacturers are introducing compact and energy-efficient models to cater to space constraints. Growing environmental awareness is encouraging the adoption of eco-friendly systems. Regional diversity leads to varying requirements across different countries.

China air handling units market held a significant share in the Asia Pacific air handling units market. China's AHU market is influenced by large-scale infrastructure development and urban planning initiatives. Government policies promoting sustainable development are driving the shift toward efficient HVAC systems. The commercial real estate boom continues to fuel installations of modern air handling units. Domestic manufacturers are expanding product lines to compete globally. There's growing demand for integrated systems in smart city projects.

The air handling units market in India is expected to grow at a CAGR of 6.5% from 2025 to 2030. In India, increased urbanization and a booming construction sector are major growth drivers for AHUs. There's rising interest in maintaining indoor air quality in offices, malls, and hospitals. Energy-efficient and cost-effective solutions are gaining traction among developers and facility managers. Demand is also supported by expanding awareness of HVAC system benefits.

Middle East & Africa Air Handling Units Market Trends

The AHU market in the Middle East & Africa is driven by the need for effective cooling systems in harsh climates. High temperatures and a focus on energy use reduction are key market influences. Construction of large commercial, hospitality, and healthcare facilities supports market expansion. Regulatory initiatives are promoting green building certifications. Demand varies widely across the region depending on local development.

The Saudi Arabia AHU market is shaped by large-scale construction and infrastructure projects. Cooling and ventilation needs in extreme temperatures make efficient AHU systems essential. The push toward sustainable cities and energy-efficient buildings supports advanced system adoption. Innovation and automation are key features sought by developers.

Latin America Air Handling Units Market Trends

The AHU market in Latin America is shaped by growing urban development and attention to climate control needs. Energy efficiency and affordability are central to purchasing decisions in the region. Public sector initiatives are encouraging the modernization of ventilation systems in schools and hospitals. There's also increasing demand from the industrial and hospitality sectors.

The Brazil air handling units market shows steady demand for AHUs due to its expanding commercial construction sector and hot climate conditions. The market favors systems that offer both cooling efficiency and low operational cost. There’s increased interest in systems with smart controls and easy maintenance features. Regulatory focus on energy conservation supports the transition to modern HVAC units.

Key Air Handling Units Company Insights

Some of the key players operating in the market include Carrier Corporation, Trane Inc., Rheem Manufacturing Company, Johnson Controls, and LG Electronics, among others.

-

Trane is a member of the Ingersoll Rand family of brands. The company operates its business in two segments, namely climate and industrial. The industrial segment offers products and services that enhance energy efficiency, operations, and productivity. It includes power tools, compressed air & gas systems, fluid management systems, material handling systems, and utility & low-speed consumer vehicles. The climate segment provides energy-efficient products and services, including heating, ventilation, and air conditioning (HVAC) systems. The company is engaged in the manufacturing of residential, industrial, and commercial HVAC systems. It offers products, such as HVAC accessories, thermostat controls, ductless systems, geothermal systems, packaged systems, heat pumps, coils, gas & oil furnaces, air handlers, and air conditioners.

-

Carrier provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors. The company was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Johnson Controls designs, manufactures, and offers solutions that enhance the operational efficiencies of buildings and various systems related to the automotive industry. The company supplies building control systems, automation, HVAC equipment, seating and interior systems, and integrated facility management services. It operates through four business segments, namely building solutions EMEA/LA, building solutions North America, building solutions Asia Pacific, and global products.

Nortek Global HVAC, STULZ GMBH, and Hastings HVAC Inc. are some of the emerging market participants in the air handling units market.

-

Nortek Global HVAC is a leading manufacturer of heating, ventilation, and air conditioning (HVAC) equipment for residential and light commercial applications. The company offers a wide range of products, including air conditioners, heat pumps, furnaces, and air handlers, under well-known brands such as Frigidaire, Maytag, and Westinghouse. Nortek Global HVAC has a strong presence in North America and employs over 1,000 people across its manufacturing facilities and sales offices.

-

Hastings HVAC Inc. is a Canadian company that designs, manufactures, and distributes HVAC equipment for commercial and industrial applications. The company's product range includes air handling units, rooftop units, and custom-engineered solutions. Hastings HVAC serves customers across North America and has a reputation for providing high-quality, energy-efficient products and exceptional customer service. The company operates manufacturing facilities in Canada and the U.S. and employs a team of experienced engineering, sales, and customer support professionals.

Key Air Handling Units Companies:

The following are the leading companies in the air handling unit market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier Corporation

- Rheem Manufacturing Company

- Johnson Controls

- Lennox International Inc.

- LG Electronics

- Midea

- Trane Inc.

- Systemair AB

- Munters AB

- Lowe’s

- Sephora

- Target

- Nortek Global HVAC

- STULZ GMBH

- Hastings HVAC Inc.

- VTS Group

- Evapoler Eco Cooling Solutions

- TROX GmbH

Recent Developments

-

In February 2024, Modine announced that it had entered into a definitive agreement to acquire Scott Springfield Manufacturing, a manufacturer of AHUs. Through this transaction, Modine gained immediate access to a complementary product portfolio and a customer base across several industries, such as telecommunications, hyperscale & colocation data centers, healthcare, and aerospace.

-

In January 2024, Carrier expanded its HVAC product portfolio manufactured in India with the introduction of air handling units (AHUs) and fan coil units (FCUs) tailored to meet the diverse needs of India's commercial buildings. These new additions, designed to provide custom solutions for healthy indoor environments with high-efficiency air filtering, affirm Carrier's more than five-decade presence in India and underscore the company's commitment to the country's growth under the 'Make in India' initiative.

Air Handling Units Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.64 billion

Revenue forecast in 2030

USD 17.63 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, capacity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Carrier Corporation; Rheem Manufacturing Company; Johnson Controls; Lennox International Inc.; LG Electronics; Midea; Trane Inc.; Systemair AB; Munters AB; Nortek Global HVAC; STULZ GMBH; Hastings HVAC Inc.; VTS Group; Evapoler Eco Cooling Solutions; TROX GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Handling Units Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global air handling units market report on the basis of product, type, capacity, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Flux

-

Double Flux

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Packaged

-

Modular

-

-

Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 5,000 m3/h

-

5,001 to 10,000 m3/h

-

10,001 to 30,000 m3/h

-

30,001 to 50,000 m3/h

-

Above 50,001 m3/h

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global air handling unit market size was estimated at USD 13.05 billion in 2024 and is expected to reach USD 13.64 billion in 2025.

b. The air handling unit (AHU) market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 17.63 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 46.8% of the global air handling units (AHU) market. The region is experiencing rapid market expansion due to urbanization and industrial growth. Rising construction activity in residential and commercial sectors is creating consistent demand for AHUs.

b. Some of the key players operating in the air handling unit (AHU) market include Carrier Corporation, Rheem Manufacturing Company , Johnson Controls, Lennox International Inc., LG Electronics, Midea, Trane Inc., Systemair AB, Munters AB, Nortek Global HVAC, STULZ GMBH, Hastings HVAC Inc., VTS Group, Evapoler Eco Cooling Solutions, TROX GmbH

b. The demand for air handling units (AHUs) is rising due to increasing urbanization, growing construction activities, and the need for energy-efficient HVAC systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.