- Home

- »

- Automotive & Transportation

- »

-

Air Freight Market Size, Share, Trends & Growth Report 2030GVR Report cover

![Air Freight Market Size, Share & Trends Report]()

Air Freight Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Freight, Express, Mail), By Destination (Domestic, International), End Use (Private, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Air Freightair freight Market Summary

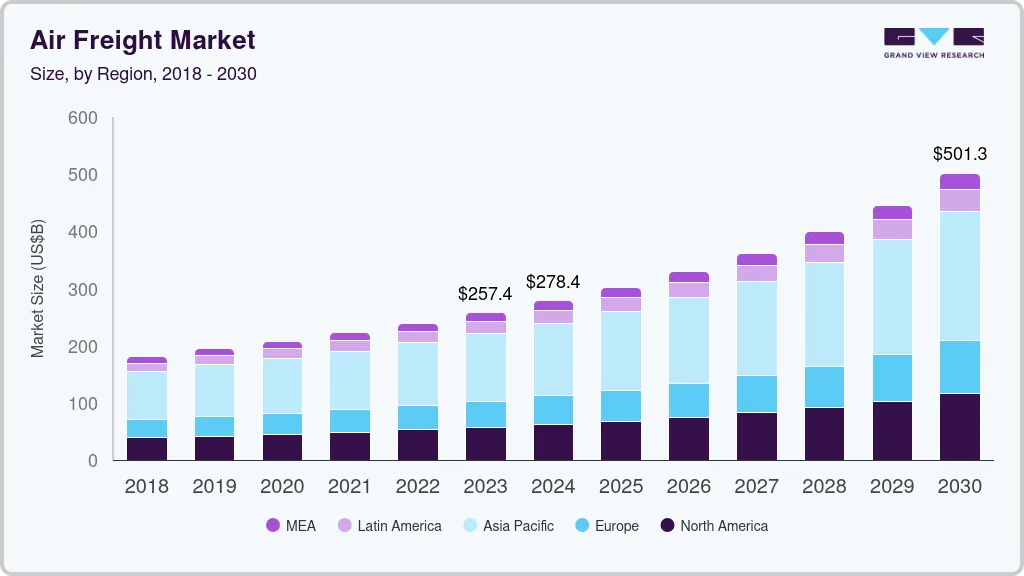

The global air freight market size was estimated at USD 257.44 billion in 2023 and is projected to reach USD 501.32 billion by 2030, growing at a CAGR of 10.3% from 2024 to 2030. Air freight encompasses the transportation of goods via commercial aircraft. It is a critical Destination of the global supply chain, facilitating the rapid movement of high-value, time-sensitive, or perishable products across international borders.

Key Market Trends & Insights

- The air freight market in Asia Pacific dominated the global industry in 2023 and accounted for a 45.8% share of the global revenue.

- The air freight market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.

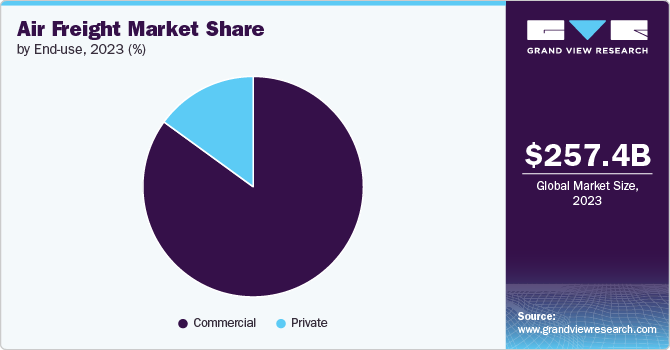

- According to end use, the commercial segment dominated the market in 2023.

- According to destination, the domestic air freight segment is expected to grow with the highest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 257.44 Billion

- 2030 Projected Market Size: USD 501.32 Billion

- CAGR (2024-2030): 10.3%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

The market comprises various stakeholders, including airlines, freight forwarders, cargo handling agents, customs brokers, and shippers. The air freight industry has experienced substantial growth in recent years, driven by a confluence of factors. The burgeoning e-commerce sector has significantly boosted demand for rapid, cross-border transportation. As consumers increasingly expect swift deliveries, air freight has become an indispensable Destination of the supply chain. Moreover, the COVID-19 pandemic exposed vulnerabilities in traditional logistics models, emphasizing the critical role of air freight in ensuring business continuity. Companies are now prioritizing supply chain resilience and diversification, leading to increased reliance on air cargo.

Technological advancements are revolutionizing the air freight industry. The integration of blockchain, artificial intelligence, and the Internet of Things (IoT) is enhancing supply chain visibility, optimizing operations, and improving security. These technologies enable real-time tracking of shipments, predictive maintenance of aircraft, and streamlined customs clearance processes. Additionally, growing environmental concerns have prompted industry to adopt sustainable practices. Airlines and cargo handlers are investing in fuel-efficient aircraft, exploring alternative fuels, and implementing carbon reduction initiatives to minimize their ecological footprint.

The air freight industry operates within a complex and intricate regulatory framework imposed by both national and international authorities. To ensure safety, security, and efficiency, a multitude of regulations govern various aspects of the industry. The International Air Transport Association (IATA) establishes global standards for cargo handling, security, and environmental protection. Complementing this, the International Civil Aviation Organization (ICAO) sets forth comprehensive regulations for civil aviation, encompassing airworthiness, air traffic management, and security measures.

Additionally, customs regulations, which vary significantly between countries, dictate the clearance and movement of goods across borders. Given the sensitive nature of air cargo, stringent security protocols, such as those implemented by the Transportation Security Administration (TSA) in the U.S., are essential to protect against threats. Adherence to this complex regulatory landscape is paramount for air freight operators to maintain compliance, mitigate risks, and ensure the seamless flow of goods across international borders.

The market is propelled by several key factors. Robust economic growth globally fuels increased trade, necessitating efficient transportation solutions, which air freight excels at providing. Industries reliant on timely delivery of critical goods, such as healthcare, high-tech, and fashion, heavily depend on air cargo. Additionally, the transportation of perishable items like fresh produce and pharmaceuticals demands the speed and reliability that air freight offers. In times of crisis, air freight plays a crucial role in delivering humanitarian aid and disaster relief supplies.

These factors present substantial opportunities for air freight companies. Expanding air cargo networks through new routes and increased capacity can capitalize on growing market demand. Diversifying service offerings beyond core transportation, such as customs brokerage, warehousing, and comprehensive supply chain management, can enhance revenue streams. Embracing technological advancements can streamline operations, reduce costs, and improve customer satisfaction. Finally, adopting sustainable practices aligns with increasing environmental consciousness, attracting eco-conscious customers and bolstering brand reputation.

Service Insights

The freight segment dominated the market in 2023 and accounted for more than 37% share of global revenue. Freight services dominate the air freight market due to their capacity to transport large volumes of goods efficiently. This segment is crucial for industries such as manufacturing, retail, and automotive, which require reliable and timely delivery of bulk shipments. The infrastructure supporting freight services at major airports worldwide enhances their effectiveness and reliability. The rise in globalization and e-commerce has further increased the demand for freight services, as businesses seek to quickly replenish inventory and meet consumer expectations.

The express segment is projected to expand at a faster growth rate during the forecast period 2024 to 2030. The surge in e-commerce and the need for rapid delivery solutions are propelling the market growth of the express services segment. Consumers and businesses demand shorter delivery times, pushing logistics providers to expand their express service offerings. Technological advancements, such as real-time tracking and improved logistics management, have made express services more efficient and reliable. As a result, express services are increasingly preferred for high-priority and time-sensitive shipments.

Destination Insights

The domestic air freight segment is expected to grow with the highest CAGR over the forecast period due to the high volume of goods transported within countries, driven by robust domestic trade and efficient national logistics networks. Major industries, including retail, manufacturing, and agriculture, rely heavily on domestic air freight for timely distribution. Well-developed infrastructure and streamlined customs processes within countries contribute to the efficiency of domestic air freight services. This segment's dominance is also supported by the need for rapid replenishment of goods in local markets.

The international segment is projected to witness a considerable growth rate from 2024 to 2030, propelled by increasing global trade and the expansion of international supply chains. Businesses are seeking faster and more reliable methods to transport goods across borders, enhancing the demand for international air freight services. Improvements in global logistics infrastructure and international trade agreements have facilitated smoother cross-border operations. As e-commerce continues to expand globally, the need for efficient international shipping solutions grows, driving the rapid growth of this segment.

End Use Insights

The commercial segment dominated the market in 2023, primarily due to the substantial demand from industries such as manufacturing, retail, and pharmaceuticals. These industries require consistent and reliable transportation of large quantities of goods to maintain their operations and supply chains. The scale and frequency of shipments in the commercial sector contributes significantly to the volume of air freight. Technological advancements and improved logistics efficiency have also bolstered the commercial segment's dominance.

The private segment is projected to grow at a faster CAGR during the forecast period 2024 to 2030. There is a rising demand for personalized and expedited shipping solutions for high-value and time-sensitive goods, such as luxury items, art, and personal belongings. The growth of e-commerce and the trend towards global living and working arrangements are also contributing factors. Private air freight services cater to these needs by offering tailored logistics solutions that emphasize speed and security.

Regional Insights

North America air freight market is expected to witness steady growth from 2024 to 2030, driven by a strong economy, advanced logistics infrastructure, and a booming e-commerce sector. The U.S. and Canada play pivotal roles, with their extensive networks of airports and sophisticated supply chain systems. The region's economic strength and high consumer demand for quick delivery of goods fuel the need for efficient air freight services. The rapid growth of e-commerce platforms like Amazon and the increasing prevalence of just-in-time delivery models are significant factors contributing to the market's expansion. North America's strategic trade relationships and agreements, such as the USMCA (United States-Mexico-Canada Agreement), further facilitate seamless cross-border air freight operations. Additionally, ongoing investments in technology and infrastructure are enhancing the efficiency and capacity of the region's air freight services, ensuring it remains the fastest-growing market globally.

U.S. Air Freight Market Trends

The air freight market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. Major airports like Memphis, Louisville, and Miami serve as key hubs for both domestic and international air freight, supporting efficient cargo handling and distribution. The country's large and diverse manufacturing base, coupled with high consumer demand for rapid delivery services, underpins the robust growth of the air freight sector. The rise of e-commerce giants such as Amazon and the increasing popularity of next-day and same-day delivery options are further boosting demand for air freight services. Additionally, the U.S. benefits from strategic trade relationships and a favorable business environment that supports the growth of air freight operations. Continued investments in airport infrastructure and advancements in logistics technology are expected to sustain the significant growth trajectory of the air freight market in the U.S.

Asia Pacific Air Freight Market Trends

The air freight market in Asia Pacificdominated the global industry in 2023 and accounted for a 45.8% share of the global revenue. The region dominates the air freight market due to its robust economic growth, expansive manufacturing base, and significant trade activities. Countries like China, Japan, and South Korea are major exporters of electronics, automotive parts, and industrial machinery, necessitating efficient air freight services. The region's dominance is further bolstered by its extensive logistics infrastructure, including world-class airports and advanced supply chain management systems. Additionally, the rise of e-commerce giants like Alibaba and JD.com has spurred demand for rapid and reliable air freight services to meet consumer expectations for fast delivery. Trade agreements and partnerships within the region, such as the Regional Comprehensive Economic Partnership (RCEP), also play a crucial role in facilitating smoother and more efficient air freight operations. As the region continues to industrialize and urbanize, the demand for air freight is expected to remain strong, ensuring its dominant position in the global market.

India air freight market is expected to grow at the fastest CAGR from 2024 to 2030. Rapid economic development, expanding manufacturing capabilities, and a burgeoning e-commerce sector are some of the factors propelling the market’s growth. The government's initiatives to improve infrastructure, such as the development of new airports and enhancement of existing facilities, are significantly boosting the country's air freight capacity. Additionally, the "Make in India" campaign is attracting foreign investments, leading to an increase in manufacturing activities and, consequently, the need for efficient logistics solutions. The rise of e-commerce platforms like Flipkart and Amazon has also fueled the demand for fast and reliable air freight services to ensure timely delivery across the country. India's strategic location and growing trade relationships with countries in Europe, North America, and Asia make it a pivotal player in the regional air freight market. With continued investments in infrastructure and technology, India is set to maintain its rapid growth trajectory in the air freight industry.

Europe Air Freight Market Trends

The air freight market in Europe is expected to grow at a significant CAGR from 2024 to 2030. Europe is witnessing significant growth in the air freight market, driven by its advanced industrial base, strong trade links, and extensive logistics networks. Major economies like Germany, the U.K., and the Netherlands play a crucial role, with their robust manufacturing sectors and high export volumes of goods such as machinery, automotive parts, and pharmaceuticals. The region's well-developed infrastructure, including major airports like Frankfurt, Amsterdam Schiphol, and London Heathrow, supports efficient air freight operations. The rise of e-commerce and increasing consumer demand for fast delivery services are also contributing to the market's growth. Moreover, the ongoing investments in technology and sustainability initiatives, such as reducing carbon emissions from air transport, are further enhancing the efficiency and competitiveness of the European air freight market.

France air freight market is expected to grow at a significant CAGR from 2024 to 2030, driven by its strategic geographic location, strong industrial base, and expanding e-commerce sector. Major airports like Paris Charles de Gaulle serve as critical hubs for international and regional air freight, facilitating efficient cargo handling and distribution. The French government's investments in infrastructure development and modernization of logistics facilities are enhancing the country's air freight capabilities. Additionally, France's role as a leading exporter of high-value goods, including aerospace components, luxury products, and pharmaceuticals, necessitates reliable and efficient air freight services. The growth of e-commerce platforms and increasing consumer demand for fast delivery are also contributing to the rapid expansion of the air freight market in France. With ongoing advancements in technology and logistics infrastructure, France is poised to continue its trajectory of robust growth in the air freight sector.

Key Air Freight Company Insights

The air freight industry is characterized by a complex competitive landscape. Traditional passenger airlines, leveraging belly space, once dominated the market. However, the rise of dedicated air cargo carriers and integrated logistics providers has reshaped the industry. Specialized air cargo carriers like Qatar Airways Cargo and Cathay Pacific Cargo focus on air freight exclusively, offering tailored services and often operating larger cargo aircraft. On the other hand, integrated logistics giants like DHL, FedEx, and UPS provide comprehensive supply chain solutions including air freight. Their global networks and diversified service offerings pose stiff competition.

The market also includes regional players and niche carriers catering to specific segments. This fragmented landscape is further intensified by technological advancements, which are driving operational efficiencies and customer expectations. To thrive, air freight companies must balance network strength, pricing strategies, service quality, and technological adoption.

Key Air Freight Companies:

The following are the leading companies in the air freight market. These companies collectively hold the largest market share and dictate industry trends.

- Air France-KLM S.A.

- AirFreight.com

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DB Schenker

- DHL International GmbH

- DIMOTRANS Group

- DSV

- FedEx

- GEODIS

- Kuehne+Nagel

- Nippon Express Co., Ltd.

- Rhenus Group

- United Parcel Service, Inc.

- Ziegler Group.

Recent Developments

-

In June 2024, ECU Worldwide, a subsidiary of Allcargo Logistics, formed a strategic partnership with ShipBob. This collaboration aims to enhance ShipBob's e-commerce inventory management by providing ocean and air freight services through ECU Worldwide's extensive global network. The partnership leverages ECU Worldwide's tech-driven platform, ECU360, to facilitate seamless freight operations and support ShipBob's clients across various markets.

-

In January 2023, Amazon expanded its logistics operations in India by launching Amazon Air. This dedicated air cargo service aims to accelerate delivery times for customers. By partnering with Quikjet Cargo Airlines and utilizing Boeing 737-800 aircraft, Amazon is building a robust air freight network across major Indian cities. This move is a significant step in Amazon's ongoing investment in India's e-commerce market.

-

In October 2022, A.P. Moller - Maersk expanded its air freight operations with the launch of a new service between the US and South Korea. This new route, operated by Maersk Air Cargo, signifies a strategic move to strengthen the company's integrated air cargo capabilities. By introducing its own fleet of Boeing 767-300 freighters, Maersk aims to provide customers with enhanced control and reliability in their supply chains.

Air Freight Market Report Scope

Attribute

Details

Market size value in 2024

USD 278.43 billion

Revenue forecast in 2030

USD 501.32 billion

Growth rate

CAGR of 10.3% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, destination, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, United Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA), South Africa

Key companies profiled

Air France-KLM S.A.; AirFreight.com; C.H. Robinson Worldwide, Inc.; CEVA Logistics; DB Schenker; DHL International GmbH; DIMOTRANS Group; DSV; FedEx; GEODIS; Kuehne+Nagel; Nippon Express Co., Ltd.; Rhenus Group; United Parcel Service, Inc.; Ziegler Group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Freight Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global air freight market report based on service, destination, end use, and region.

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Freight

-

Express

-

Mail

-

Other

-

-

Destination Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Private

-

Commercial

-

Retail and E-commerce

-

Manufacturing

-

Healthcare

-

Automotive

-

Perishable Goods

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global air freight market size was estimated at USD 257.44 billion in 2023 and is expected to reach USD 278.43 billion in 2024.

b. The global air freight market is expected to grow at a compound annual growth rate of 10.3% from 2024 to 2030, reaching USD 501.32 billion by 2030.

b. Asia Pacific dominated the air freight market in 2023 and accounted for a 45.8% share of the global revenue. The region dominates the air freight market due to its robust economic growth, expansive manufacturing base, and significant trade activities. Additionally, the rise of e-commerce giants like Alibaba and JD.com has spurred demand for rapid and reliable air freight services to meet consumer expectations for fast delivery.

b. Some key players operating in the air freight market include Air France-KLM S.A., AirFreight.com, C.H. Robinson Worldwide, Inc., CEVA Logistics, DB Schenker, DHL International GmbH, DIMOTRANS Group, DSV, FedEx, GEODIS, Kuehne+Nagel, Nippon Express Co., Ltd., Rhenus Group, United Parcel Service, Inc., and Ziegler Group.

b. The air freight market is propelled by several key factors. Robust economic growth globally fuels increased trade, necessitating efficient transportation solutions, which air freight excels at providing. Industries reliant on timely delivery of critical goods, such as healthcare, high-tech, and fashion, heavily depend on air cargo. Additionally, the transportation of perishable items like fresh produce and pharmaceuticals demands the speed and reliability that air freight offers. In times of crisis, air freight plays a crucial role in delivering humanitarian aid and disaster relief supplies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.